• Fed audio system and Nvidia profits will likely be in focal point this week. • Nvidia is a purchase with every other large beat-and-raise quarter on deck. • Goal is a promote amid declining gross sales, downbeat outlook anticipated. • On the lookout for extra actionable industry concepts? Subscribe right here for up 55% off as a part of our Early Chook Black Friday sale! U.S. shares completed decrease on Friday, with the S&P 500 and Nasdaq notching their largest one-day losses in two weeks, as a post-election rally ran out of steam and traders apprehensive over the trail of rates of interest. For the week, the S&P 500 fell 2.1%, whilst the tech-heavy Nasdaq Composite declined 3.1%. The blue-chip Dow Jones Business Reasonable misplaced 1.2% throughout the length. Supply: Making an investment.com The week forward is anticipated to be an eventful one as traders proceed to evaluate the outlook for the financial system, inflation, rates of interest and company profits. At the financial calendar, flash PMI readings on production and the products and services sector will take hold of consideration on Friday, in conjunction with updates at the housing marketplace. That will likely be accompanied by way of a heavy slate of Fed audio system, with the likes of district governors Jeffrey Schmid, Lisa Prepare dinner, Michelle Bowman, and Beth Hammack all set to make public appearances.

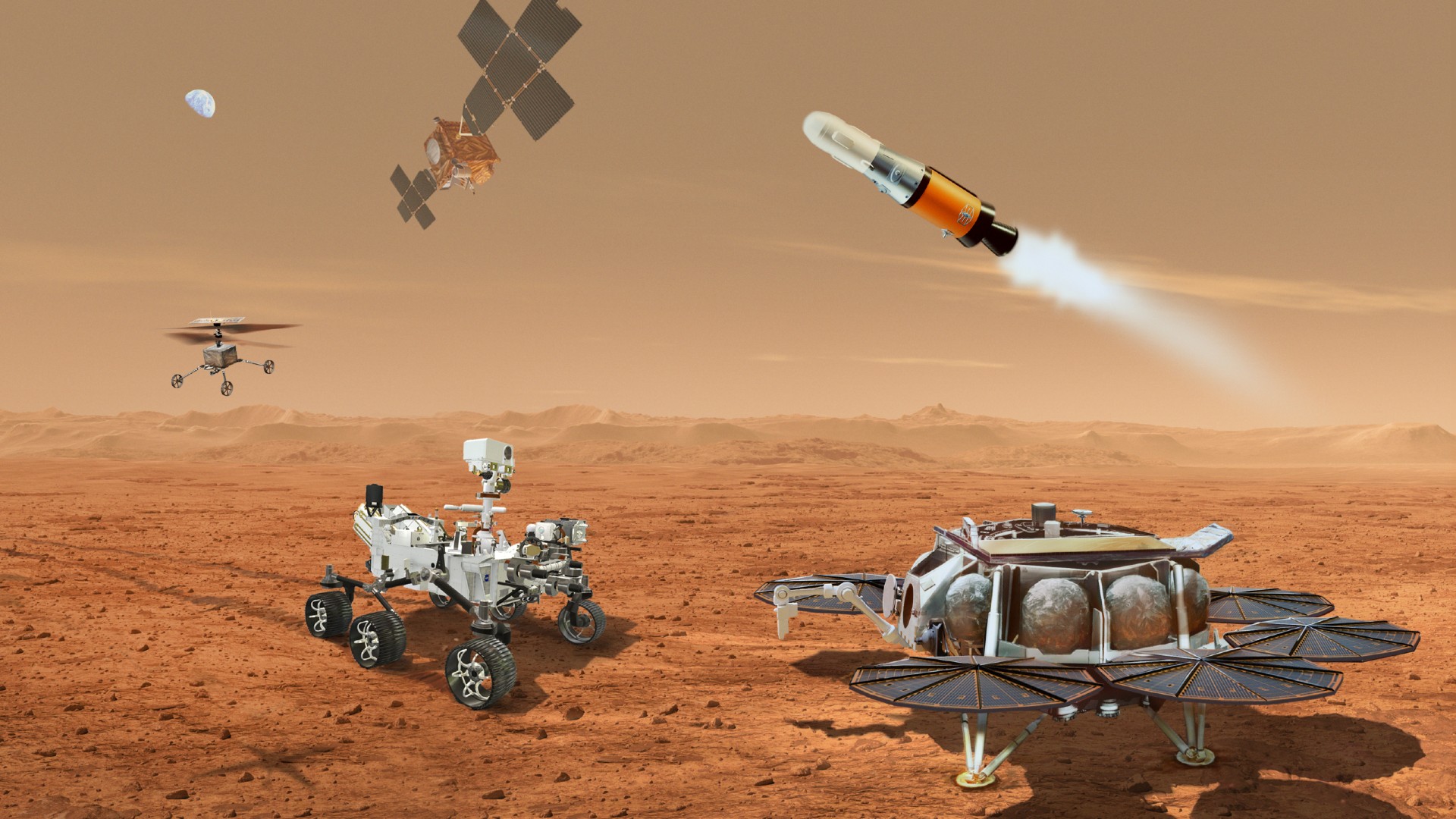

Weekly Financial Occasions Supply: Making an investment.com Expectancies for a 25-basis level fee reduce on the Fed’s December assembly stood at 63% on Sunday morning, consistent with the Making an investment.com Fed Track Instrument. Somewhere else, in company profits, Nvidia (NASDAQ:NVDA)’s effects would be the key replace of the week because the Q3 reporting season quiets down. Different notable names covered as much as document profits come with Walmart (NYSE:WMT), Goal (NYSE:TGT), TJX Firms (NYSE:TJX), Ross Retail outlets (NASDAQ:ROST), Lowe’s (NYSE:LOW), Palo Alto Networks (NASDAQ:PANW), and Snowflake (NYSE:SNOW). Without reference to which route the marketplace is going, underneath I spotlight one inventory prone to be in call for and every other which might see recent drawback. Consider even though, my time frame is only for the week forward, Monday, November 18 – Friday, November 22. Nvidia is poised for important features this week, because the tech large prepares to ship every other beat-and-raise quarterly profits document amid surging call for for its AI chips. The Santa Clara-based corporate is about to unencumber its Q3 profits after the marketplace closes on Wednesday at 4:20PM ET, with expectancies working top for every other record-breaking efficiency. A decision with CEO Jensen Huang is about for five:00PM ET. Marketplace individuals be expecting a large swing in NVDA stocks following the print, as in keeping with the choices marketplace, with a imaginable implied transfer of 9.8% in both route. Tale Continues

Nvidia Income Web page Supply: InvestingPro Investor sentiment is overwhelmingly bullish, as evidenced by way of 30 upward profits revisions previously 90 days, consistent with InvestingPro. Nvidia has constantly outperformed expectancies, changing into a bellwether for the tech sector as enlargement potentialities in synthetic intelligence stay robust. Consensus expectancies name for Nvidia to submit profits in keeping with proportion of $0.74, emerging 85% from EPS of $0.40 within the year-ago length. In the meantime, income is forecast to surge 82% yearly to $33.1 billion, underscoring the corporate’s unrivaled dominance within the AI chip marketplace. Of specific hobby will likely be steerage for the present quarter, marking the debut of Nvidia’s next-generation Blackwell AI processor. CEO Jensen Huang has described call for for Blackwell as “insane,” atmosphere the degree for better-than-expected forecasts. NVDA inventory ended Friday’s consultation at $141.98, slightly below its checklist top of $149.65 reached on November 12. Stocks have soared 186.7% in 2024, making Nvidia probably the most top-performing S&P 500 shares of the yr. At present ranges, Nvidia has a marketplace cap of $3.48 trillion, making it probably the most precious corporate buying and selling at the U.S. inventory change.

Nvidia Chart Supply: Making an investment.com It’s value bringing up that InvestingPro’s AI-powered quantitative fashions fee Nvidia with a forged ‘Monetary Well being Ranking’ of three.7 out of five.0, highlighting its forged profitability and promising enlargement trajectory. Be certain that to try InvestingPro to stick in sync with the marketplace pattern and what it approach on your buying and selling. Subscribe now and rise up to 55% off and place your portfolio one step forward of everybody else! In stark distinction, Goal is dealing with a a lot more difficult outlook. The large-box store is grappling with top running prices, shrinking margins, and stiff pageant from opponents like Walmart. Risky site visitors developments, seasonal climate demanding situations, and election affect uncertainties compound the retail large’s struggles. Goal – which is the 7th greatest brick-and-mortar store within the U.S. – is scheduled to unencumber its third-quarter profits document forward of the hole bell on Wednesday at 6:30AM ET. Consistent with the choices marketplace, investors are pricing in a swing of round 9% in both route for TGT inventory following the print.

Goal Income Web page Supply: InvestingPro Wall Boulevard initiatives profits of $2.30 in keeping with proportion, marking a 9.5% build up from $2.10 a yr previous. Income is expected to develop marginally by way of 2% to $25.9 billion, highlighting susceptible shopper call for for discretionary items like house furniture and attire. Taking a look forward, CEO Brian Cornell is prone to ship wary steerage for the all-important vacation quarter because of a hard running surroundings, aggressive panorama, and ongoing discounting process. Exterior headwinds, corresponding to climate disruptions and broader financial uncertainty, have additional difficult the outlook. With disappointing Q3 effects and a wary vacation outlook at the horizon, the inventory’s drawback dangers outweigh attainable rewards. Buyers will have to steer clear of Goal amid this difficult retail panorama. TGT inventory closed at $152.13 on Friday. Stocks have underperformed the S&P 500 by way of a large margin this yr, gaining 6.8%. At present valuations, the Minneapolis-based store has a marketplace cap of $70 billion.

Goal Chart Supply: Making an investment.com It will have to be famous that Goal recently has a underneath moderate InvestingPro ‘Monetary Well being Ranking’ of two.6 out of five.0 because of lingering considerations over weakening benefit margins and spotty gross sales enlargement. Whether or not you are a newbie investor or a seasoned dealer, leveraging InvestingPro can unencumber a global of funding alternatives whilst minimizing dangers amid the difficult marketplace backdrop. Subscribe now to rise up to 55% off all Professional plans and immediately unencumber get entry to to a number of market-beating options, together with: • ProPicks AI: AI-selected inventory winners with confirmed monitor checklist. • InvestingPro Honest Price: Right away in finding out if a inventory is underpriced or hyped up. • Complicated Inventory Screener: Seek for the most efficient shares in response to masses of chosen filters, and standards. • Best Concepts: See what shares billionaire traders corresponding to Warren Buffett, Michael Burry, and George Soros are purchasing.

Early Chook Black Friday Deal Disclosure: On the time of writing, I’m lengthy at the S&P 500, and the Nasdaq 100 by means of the SPDR® S&P 500 ETF, and the Invesco QQQ Believe ETF. I’m additionally lengthy at the Era Make a selection Sector SPDR ETF (NYSE:XLK). I frequently rebalance my portfolio of person shares and ETFs in response to ongoing possibility evaluate of each the macroeconomic surroundings and corporations’ financials. The perspectives mentioned on this article are only the opinion of the creator and will have to no longer be taken as funding recommendation. Observe Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory marketplace research and perception. Comparable Articles 1 Inventory to Purchase, 1 Inventory to Promote This Week: Nvidia, Goal The way to Use This Robust Momentum Gauge to Spot Pattern Shifts and Organize Possibility Occidental Petroleum Hits New Low: Will Buffett Take the Bait?

1 Inventory to Purchase, 1 Inventory to Promote This Week: Nvidia, Goal