The U.S. Treasury Division on Friday launched new figures associated with the 2023 funds that confirmed a troubling drop within the country’s tax earnings in comparison to GDP—a measure which fell to 16.5% regardless of a rising economic system—and an annual deficit building up that necessarily doubled from the former yr. “After file U.S. govt spending in 2020 and 2021” because of techniques associated with the commercial fallout from the Covid-19 disaster, the Washington Postreports, “the deficit dropped from with regards to $3 trillion to with regards to $1 trillion in 2022. However reasonably than proceed to fall to its pre-pandemic ranges, the deficit swiftly jumped this yr to more or less $2 trillion.”

Whilst a lot of the reporting at the Treasury figures painted an image of quite a lot of and overlapping dynamics to provide an explanation for the surge within the deficit—together with upper bills on debt because of rates of interest, tax submitting waivers associated with excessive climate occasions, the have an effect on of a pupil mortgage forgiveness program that used to be later rescinded, or a dip in capital beneficial properties receipts—revolutionary tax mavens say none of the ones complexities will have to act to defend what is on the center of the cheap that brings in lower than it spends: tax giveaways to the wealthy.

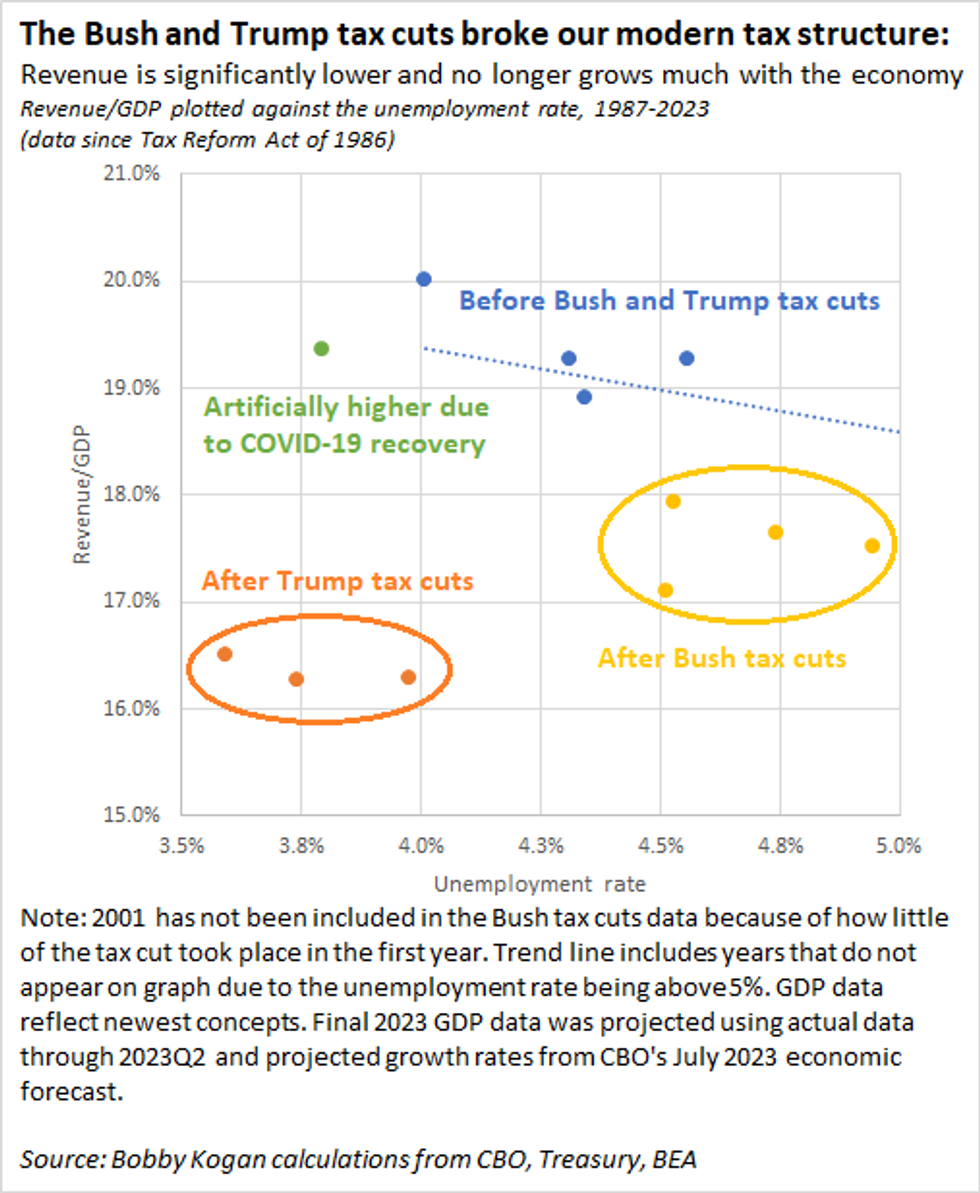

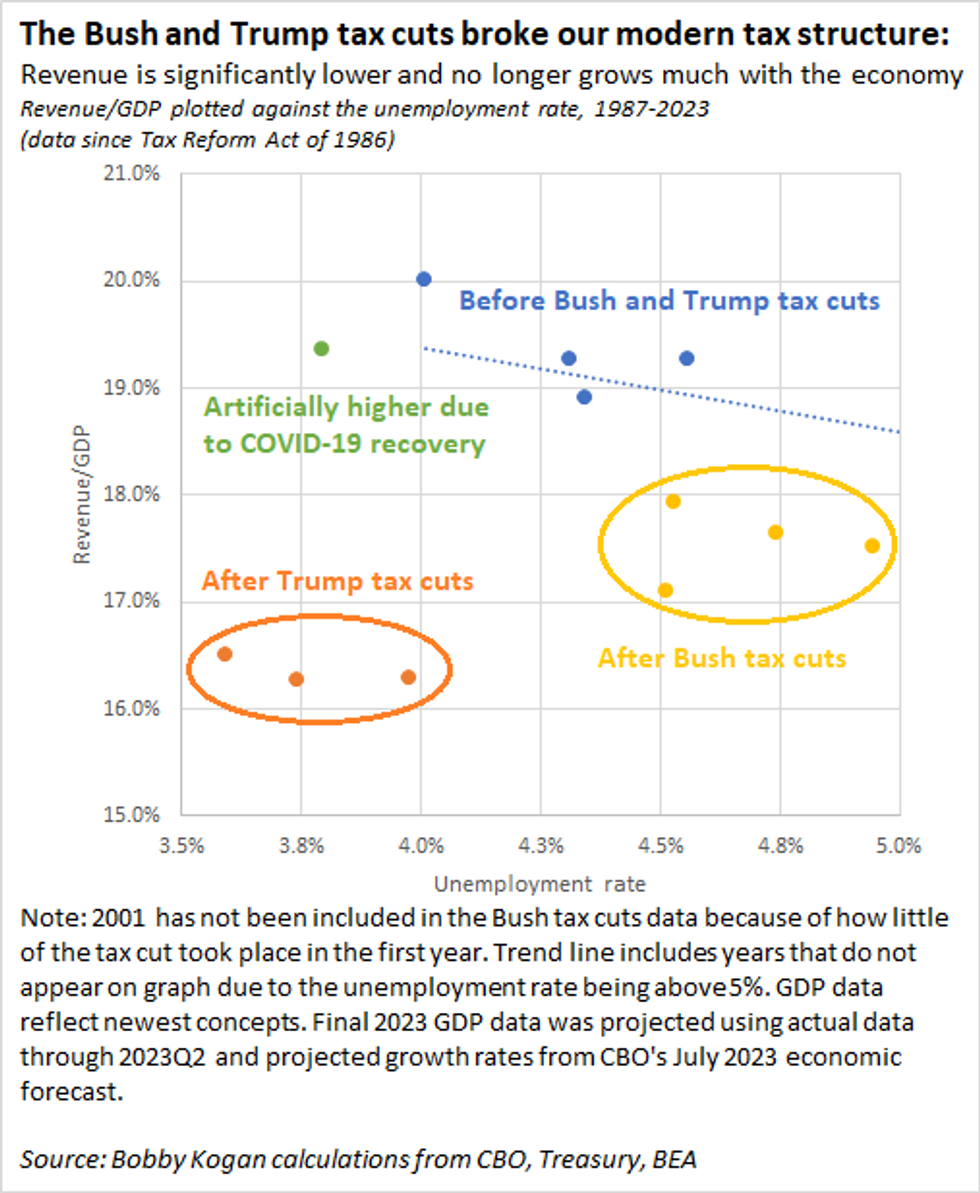

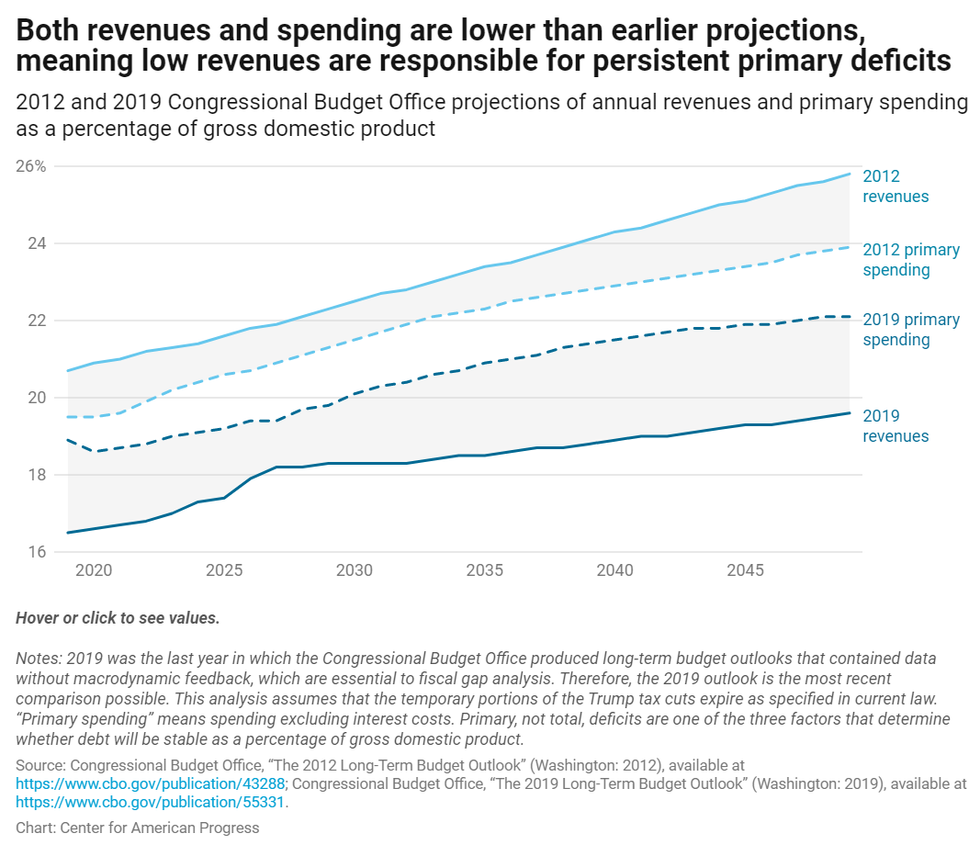

Bobby Kogan, senior director for federal funds coverage on the Heart for American Growth, has argued many times that rising deficits in recent times have a transparent and singular leader motive: Republican tax cuts that get advantages most commonly the rich and successful firms.In line with the Treasury figures launched Friday, Kogan stated that “more or less 75%” of the surge within the deficit and the debt ratio, the volume of federal debt relative to the full measurement of the economic system, used to be because of earnings decreases on account of GOP-approved tax cuts over contemporary many years. “Of the remainder 25%,” he stated, “greater than part” used to be upper pastime bills at the debt associated with Federal Reserve coverage. “We have now a earnings drawback, because of tax cuts,” stated Kogan, pointing to the foremost tax regulations enacted beneath the administrations of George W. Bush and Donald Trump. “The Bush and Trump tax cuts broke our fashionable tax construction. Income is considerably decrease and not grows a lot with the economic system.” And he presented this visualization a few rising debt ratio: “The purpose I wish to make time and again and once more is that, relative to the remaining time CBO used to be projecting solid debt/GDP, spending is down, no longer up,” Kogan stated in a tweet Friday evening. “It is decrease earnings that is 100% accountable for the alternate in debt projections. If you are taking away not anything else, depart with this level.”In his tweet, Kogan presented the next chart to turn contemporary and projected ranges of each federal earnings and spending relative to gross home product (GDP):

“The purpose I wish to make time and again and once more is that, relative to the remaining time CBO used to be projecting solid debt/GDP, spending is down, no longer up,” Kogan stated in a tweet Friday evening. “It is decrease earnings that is 100% accountable for the alternate in debt projections. If you are taking away not anything else, depart with this level.”In his tweet, Kogan presented the next chart to turn contemporary and projected ranges of each federal earnings and spending relative to gross home product (GDP): In an in depth research produced in March, Kogan defined that, “If no longer for the Bush tax cuts and their extensions—in addition to the Trump tax cuts—revenues could be on the right track to stay tempo with spending indefinitely, and the debt ratio (debt as a proportion of the economic system) could be declining. As a substitute, those tax cuts have added $10 trillion to the debt since their enactment and are accountable for 57 p.c of the rise within the debt ratio since 2001, and greater than 90 p.c of the rise within the debt ratio if the one-time prices of expenses responding to COVID-19 and the Nice Recession are excluded.”

In an in depth research produced in March, Kogan defined that, “If no longer for the Bush tax cuts and their extensions—in addition to the Trump tax cuts—revenues could be on the right track to stay tempo with spending indefinitely, and the debt ratio (debt as a proportion of the economic system) could be declining. As a substitute, those tax cuts have added $10 trillion to the debt since their enactment and are accountable for 57 p.c of the rise within the debt ratio since 2001, and greater than 90 p.c of the rise within the debt ratio if the one-time prices of expenses responding to COVID-19 and the Nice Recession are excluded.”

On Friday, the place of job of Sen. Sheldon Whitehouse (D-R.I.) cited those self same numbers in a press unencumber responding to the Treasury’s new record.”Tax giveaways for the rich are proceeding to starve the government of wanted earnings: the ones handed by means of former Presidents Trump and Bush have added $10 trillion to the debt and account for 57 p.c of the rise within the debt-to-GDP ratio since 2001,” learn the remark. “If no longer for the ones tax cuts, U.S. debt could be declining as a percentage of the economic system.”Whitehouse, who chairs the Senate Finances Committee, stated the dip in federal earnings and enlargement within the total deficit each have the similar number one motive: GOP fealty to the rich people and robust firms that bankroll their campaigns.”Of their blind loyalty to their mega-donors, Republicans’ fixation on massive tax cuts for billionaires has created a earnings drawback this is using up our nationwide debt,” Whitehouse stated Friday evening. “Whilst federal spending fell during the last yr relative to the dimensions of the economic system, the deficit higher as a result of Republicans have rigged the tax code in order that giant firms and the rich can steer clear of paying their fair proportion.”Providing an answer, Whitehouse stated, “Solving our corrupted tax code and cracking down on rich tax cheats would assist deliver down the deficit. It will additionally make sure lecturers and firefighters do not pay upper tax charges than billionaires, degree the taking part in box for small companies, and advertise a more potent economic system for all.”None of the most recent figures—the ones appearing that tax cuts have injured revenues and due to this fact spiked deficits and higher debt—will have to be a wonder.In 2018, in a while after the Trump tax cuts have been signed into regulation, a Congressional Finances Workplace (CBo) record predicted exactly this end result: that revenues would plummet; annual deficits would develop; and no longer even the promise of financial enlargement made by means of Republicans to justify the giveaway could be sufficient to make up the variation within the funds.”The CBO’s newest record exposes the rip-off in the back of the rosy rhetoric from Republicans that their tax invoice would pay for itself,” Sen. Chuck Schumer (D-N.Y.), and now Senate Majority Chief, stated on the time.”Republicans racked up the nationwide debt by means of giving tax breaks to their billionaire friends, and now they would like everybody else to pay for them.”In its 2018 record, the CBO predicted the deficit would upward push to $804 billion by means of the top of that fiscal yr. Now, for the entire empty guarantees and howling from the GOP and their allied deficit hawks, the commercial prescription they pressured via Congress has led to an annual deficit of greater than double that, all whilst not easy the country’s poorest and maximum inclined pay the cost by means of not easy key social techniques—together with meals support, schooling budgets, unemployment advantages, and housing help—be slashed.In the meantime, the GOP majority within the U.S. Area—without or with a Speaker these days maintaining the gavel—nonetheless has plans to increase the Trump tax cuts if given part an opportunity. In Might, a CBO research of that pending regulation discovered that such an extension would upload an extra $3.5 trillion to the nationwide debt.

“Republicans racked up the nationwide debt by means of giving tax breaks to their billionaire friends, and now they would like everybody else to pay for them,” Sen. Whitehouse stated on the time. “It’s one among lifestyles’s nice enigmas that Republicans can stay a directly face whilst they concurrently cite the deficit to extort huge spending cuts to vital techniques and reinforce a invoice that may blow up deficits to increase trillions in tax cuts for the individuals who want them the least.”

$10 Trillion in Added US Debt Since 2001 Displays ‘Bush and Trump Tax Cuts Broke Our Trendy Tax Construction’