Those cast dividend shares yielding as much as 6.3% will have to be a cast addition in your portfolio at this time.

The hot volatility within the S&P 500 compels me to reshare one in every of my core making an investment ideals: Dividend shares are not only for source of revenue traders.

Irrespective of the making an investment technique you observe, you’ll’t pass unsuitable proudly owning some dividend-paying shares that may earn you a gradual circulation of source of revenue even right through unstable instances. Over the years, shares that pay common dividends and develop their payouts constantly steadily additionally grow to be multibaggers. Listed here are two such dividend shares you would wish to double up on now.

Earn over 9% annualized returns with this dividend inventory

Brookfield Infrastructure (BIPC -1.83%) (BIP -2.21%) has gadgets of its partnership and company stocks indexed at the New York Inventory Change. Even if the 2 constitute the similar corporate, traders who wish to steer clear of tax headaches, equivalent to submitting Ok-1 federal paperwork, will have to purchase the company stocks.

The query, although, is why you will have to even purchase Brookfield Infrastructure inventory. If I needed to categorical that during one line, I would say Brookfield Infrastructure’s asset base, trade fashion, and dividend enlargement make it one of the vital compelling dividend shares to possess. With the company stocks yielding 4.7% (partnership gadgets yield 5.7%) and down virtually 15% in six months as of this writing, you would even wish to double up in this dividend inventory at this time.

Brookfield Infrastructure owns and operates massive and controlled belongings like utilities, herbal gasoline pipelines, rail and toll roads, knowledge facilities, and fiber-optic cable networks. 85% of its unfastened money flows, due to this fact, are regulated or gotten smaller, because of this money assists in keeping flowing in although the economic system slows. The corporate additionally sells belongings once they mature to reinvest the proceeds into probably higher-margin belongings, and the cycle repeats.

BIP knowledge by way of YCharts.

This trade fashion has helped Brookfield Infrastructure develop leaps and limits, with its finances from operations (FFO) in keeping with unit rising at a compound annual price of 15% and dividend (or distribution) in keeping with unit by way of 9% since 2009. The chart above displays how the inventory has fared since, with and with out reinvested dividends. Brookfield Infrastructure company inventory used to be indexed in 2021 and has doubled traders’ cash since then with reinvested dividends.

In the longer term, Brookfield Infrastructure is focused on over 10% FFO in keeping with unit enlargement and 5% to 9% annual dividend enlargement. Upload within the dividend yield, and that suggests doable annualized returns of a minimum of 9%. That is a cast funding for an source of revenue investor.

This 6.3%-yielding inventory may just pay you even larger dividends

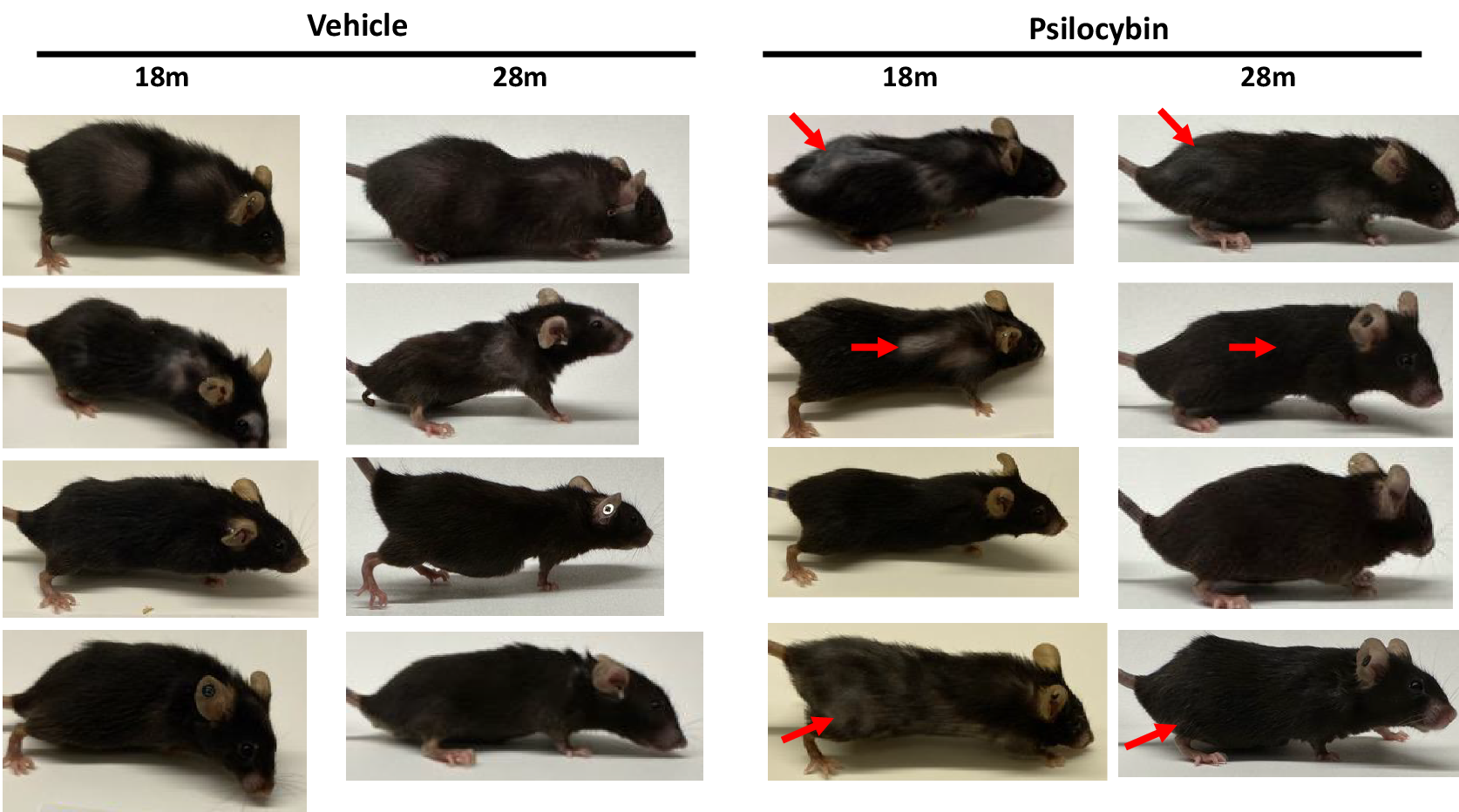

Endeavor Merchandise Companions (EPD 0.46%) has already confirmed its mettle as a dividend inventory. It has greater its dividend for greater than 25 consecutive years now, and that dividend enlargement has vastly added to the inventory’s returns. Up to now 5 years by myself, traders in Endeavor Merchandise have earned greater than 250% returns with reinvested dividends. However there is a explanation why I’m in particular bullish about this dividend inventory now.

EPD knowledge by way of YCharts.

Endeavor Merchandise is a midstream power corporate with an enormous pipeline community that transports herbal gasoline, crude oil, herbal gasoline liquids, petrochemicals, and delicate merchandise. It has spent billions of greenbacks on growth lately and is nearing the finishing touch of maximum of its initiatives. To place some numbers to that, $6 billion of the $7.6 billion of primary initiatives beneath development are slated to enter carrier this 12 months. Initiatives come with a number of gasoline processing crops within the Permian Basin and a herbal gasoline liquids pipeline recently beneath growth.

I be expecting those initiatives to start out contributing to Endeavor Merchandise’ money flows later this 12 months. In the meantime, with the corporate’s enlargement capital expenditures anticipated to taper from $4 billion-$4.5 billion in 2025 to $2 billion-$2.5 billion in 2026, Endeavor Merchandise will have to have more money to be had for distribution to its shareholders within the type of dividends and percentage buybacks. With the inventory additionally yielding 6.3%, it is an opportune time to double up in this dividend enlargement inventory.

Neha Chamaria has no place in any of the shares discussed. The Motley Idiot recommends Brookfield Infrastructure Companions and Endeavor Merchandise Companions. The Motley Idiot has a disclosure coverage.