OM has surged by means of 8354.87% during the last 12 months, outpacing different cash available in the market

Marketplace signs urged Mantra’s marketplace is also overheated now and may decline

During the last 12 months, Mantra [OM] has recorded an explosive surge at the charts, outperforming all cryptocurrencies. In reality, in 2024, Mantra surged from a low of $0.043 to a brand new all-time prime of $4.6, recorded 2 weeks in the past.

Since then, it has registered a slight pullback at the charts. On the time of writing, OM was once buying and selling at $3.65. This marked 8354.87% hike during the last 12 months. This parabolic annually rally has left Mantra because the best-performing crypto of the 12 months.

MANTRA – The altcoin that ruled 2024 with +8354% Expansion

In line with Aphractal, OM has outperformed all main cash during the last 12 months. For example, the altcoin has outperformed Ethereum [ETH] by means of 196.5 occasions and Bitcoin [BTC] by means of 67 occasions.

![2024 noticed OM [Mantra] outperform the remaining, will 2025 be any other? 2024 noticed OM [Mantra] outperform the remaining, will 2025 be any other?](https://ambcrypto.com/wp-content/uploads/2024/12/om-2024.jpeg) Supply: Alphractal

Supply: Alphractal

This expansion is important for Mantra because it displays no longer handiest the energy of the Mantra ecosystem, but additionally the emerging call for for its blockchain.

This is also proof that markets are warming as much as blockchains that cater to real-world asset integration and are compliant with regulatory government. Subsequently, with sturdy metrics and a singular imaginative and prescient, OM has established itself as essentially the most impactful altcoin of the 12 months.

What lies forward for OM ?

All over 2024, Mantra has made really extensive strides in opposition to marketplace adoption, particularly because it creates a reputation in a extremely aggressive marketplace. With this in thoughts, it’s crucial to invite ourselves what lies forward for OM and whether or not it may possibly maintain those positive factors.

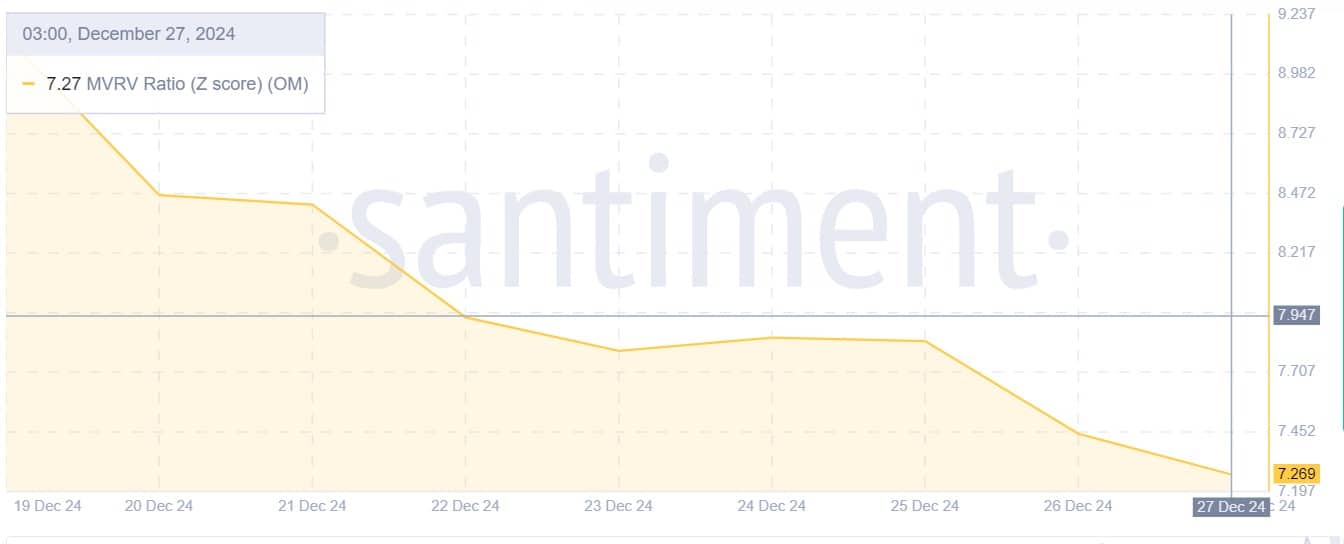

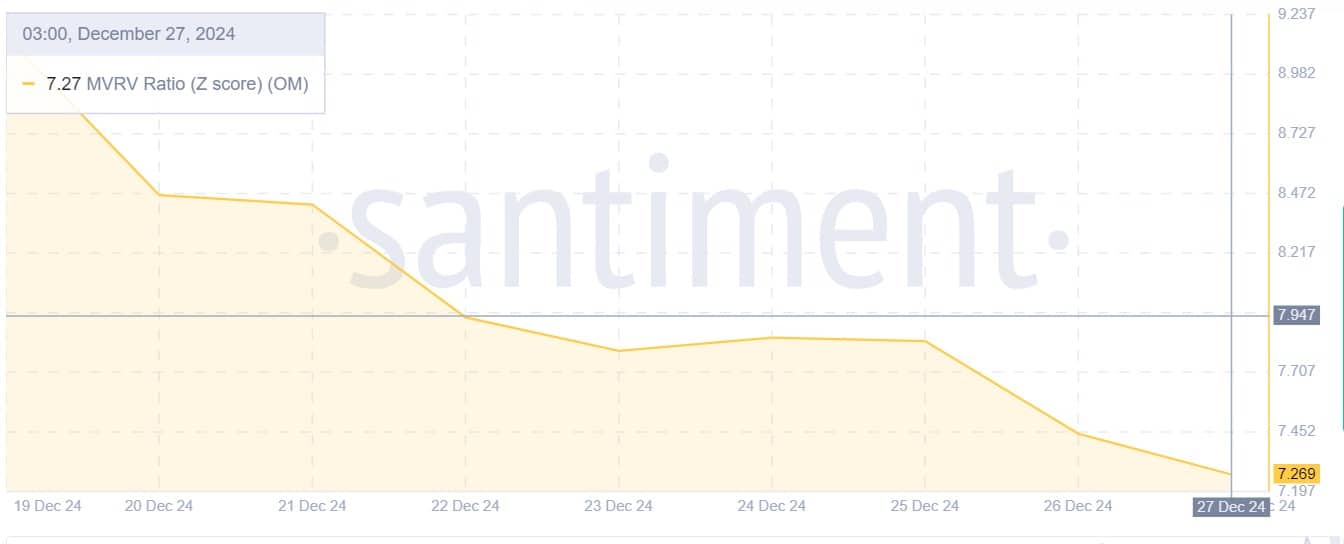

In line with AMBCrypto’s research, Mantra’s marketplace is recently overheated and the altcoin would possibly quickly be getting into a corrective section.

Supply: Santiment

Supply: Santiment

For starters, we will see this overheated sign thru its MVRV Ratio Z rating. Whilst it declined from 9 to 7.2 during the last week, indicating the beginning of the marketplace cooling down, it nonetheless stays within the increased zone.

In most cases, a rating above 3.7 alerts that marketplace price is considerably above the discovered price, which incessantly precedes marketplace correction or drops. Subsequently, the fee is in all probability to say no for markets to go into a wholesome state.

Supply: Tradingview

Supply: Tradingview

Moreover, this shift to a correction section may also be additional evidenced by means of a bearish crossover from two fronts. As such, a bearish crossover gave the impression on Stoch RSI and RVGI. When this crossover seems on Stoch, it means that upward momentum has weakened and the fee would possibly decline.

This bearishness may also be additional showed by means of the bearish crossover at the Relative Vigor Index (RVGI).

In conclusion, bears are getting into the marketplace and looking to take over. If their makes an attempt prevail, OM may see losses on its value charts. If the seen bearish development persists, OM may drop to $3.4. Alternatively, if the annual development holds its may, the altcoin will reclaim the $4.0 resistance.

Earlier: FLOKI surges 22% in every week – Is a memecoin supercycle coming?

Subsequent: Exploring Bitcoin’s function in evading sanctions as Putin follows Trump’s lead – Will it paintings?