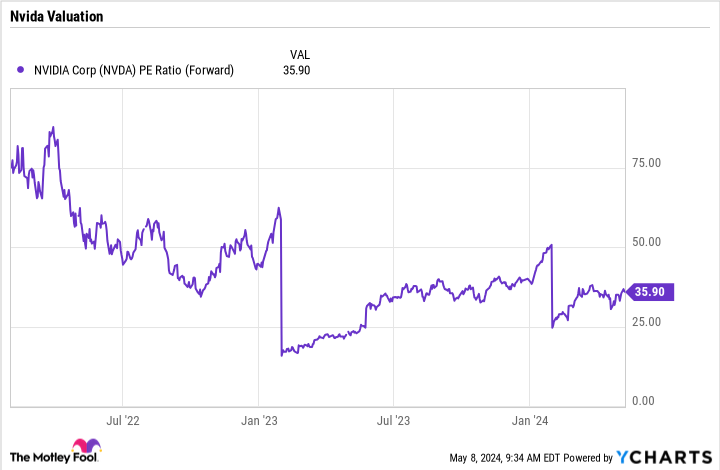

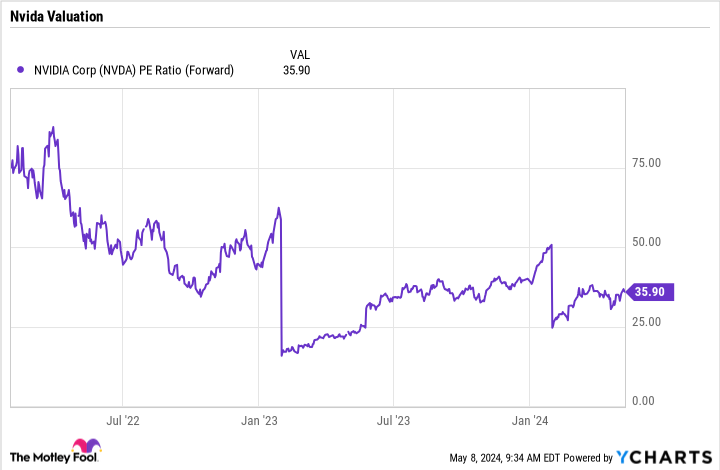

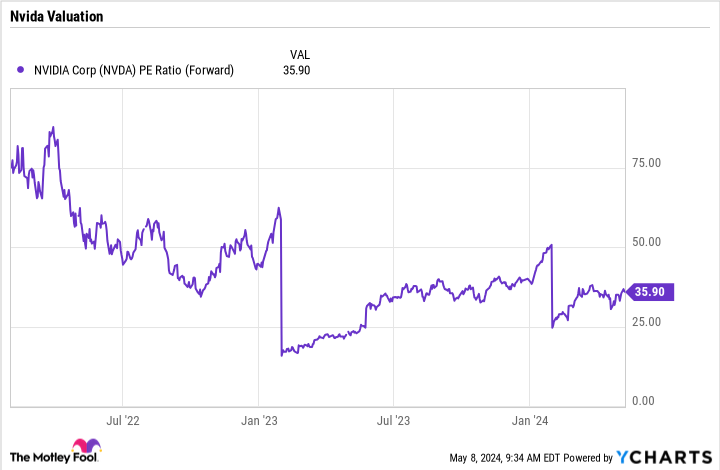

Synthetic intelligence (AI) has the possible to be one of the vital largest innovative developments in generation that the arena has ever noticed. Firms are simply beginning to embody the generation and what it may well do. On the other hand, the early effects are very promising, permitting organizations to develop into extra environment friendly and higher serve their shoppers.However make no mistake, synthetic intelligence remains to be in its early days, and there are numerous alternatives for buyers to make the most of firms serving to paved the way with AI. Let us take a look at probably the most absolute best shares to play the AI bull run.NvidiaNo corporate is reaping rewards extra from AI this present day than Nvidia (NASDAQ: NVDA). The maker of graphics processing unit (GPUs) has develop into the spine of the infrastructure had to energy AI programs in knowledge facilities. GPU chips are ready to do technical calculations sooner and with much less power than central processing devices (CPUs), which makes them splendid to be used in AI coaching and inference.Nvidia’s GPUs, in the meantime, have develop into the trade gold same old because of its CUDA tool platform, which permits its chips to be programmed immediately, saving shoppers money and time.Nvidia will proceed to be the go-to corporate for construction out the extra robust knowledge facilities had to energy AI programs. In the meantime, Nvidia is not a one-trick pony, and its networking industry may be very much taking advantage of AI.Nvidia has been striking up fantastic expansion, together with a greater than tripling of its earnings throughout its most up-to-date quarter. Regardless of that, the inventory is attractively valued at just a 36 ahead P/E, atmosphere it up for a bull run because the industry grows and buyers push up the inventory value.

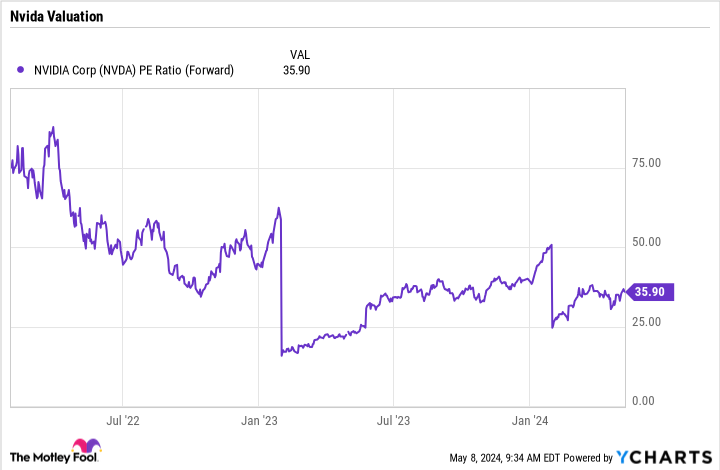

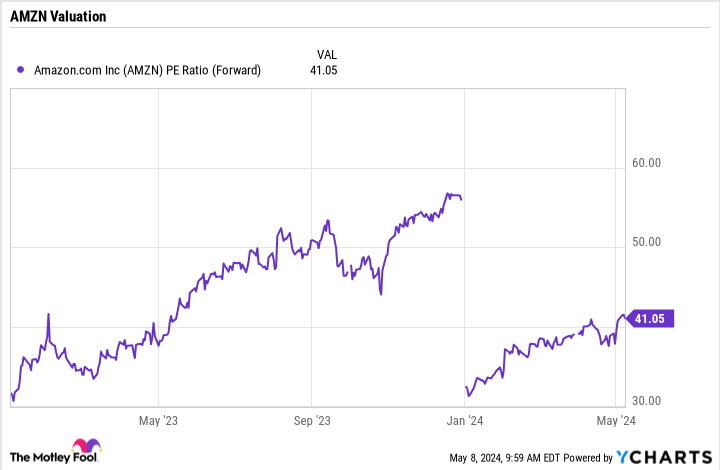

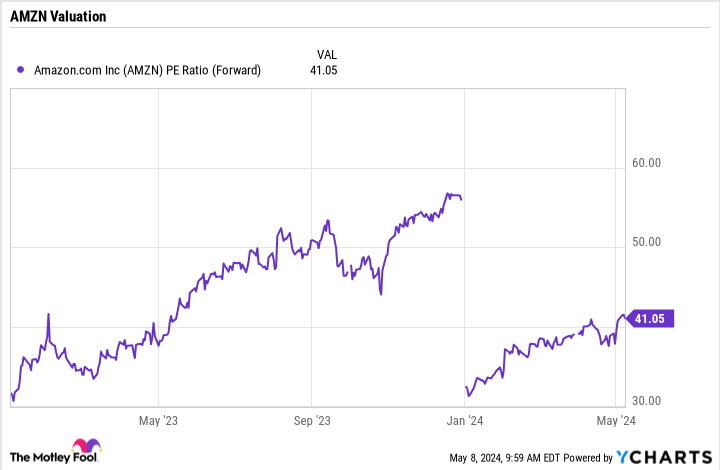

NVDA PE Ratio (Ahead) ChartAmazonWhen it involves AI, Amazon (NASDAQ: AMZN) might not be the primary inventory that involves thoughts. On the other hand, the e-commerce large has been closely making an investment within the generation.The corporate owns the biggest cloud industry, Amazon Internet Products and services or AWS, which is taking advantage of the proliferation of AI. It has additionally evolved two chips, Trainium and Inferentia, for use particularly for AI programs.At the tool facet, the corporate has evolved platforms to assist shoppers construct their very own AI fashions and programs. Its SageMaker platform is helping shoppers construct, educate, and deploy gadget studying fashions, whilst its Bedrock platform offers shoppers high-performing fashions from Amazon and different main AI firms thru a unmarried API to assist them construct AI programs.Amazon has additionally constructed out its personal AI-powered assistant for tool builders, Amazon Q. The AI assistant can write, take a look at, and debug code. It may well additionally resolution questions on corporate insurance policies, merchandise, and different subjects.Tale continuesAmazon has proven previously that it’s prepared to spend large to in the end win large, and AI seems to be no exception. Buying and selling at a ahead P/E of round 41, the inventory has room to run given the AI expansion alternatives in entrance of the corporate.

NVDA PE Ratio (Ahead) ChartAmazonWhen it involves AI, Amazon (NASDAQ: AMZN) might not be the primary inventory that involves thoughts. On the other hand, the e-commerce large has been closely making an investment within the generation.The corporate owns the biggest cloud industry, Amazon Internet Products and services or AWS, which is taking advantage of the proliferation of AI. It has additionally evolved two chips, Trainium and Inferentia, for use particularly for AI programs.At the tool facet, the corporate has evolved platforms to assist shoppers construct their very own AI fashions and programs. Its SageMaker platform is helping shoppers construct, educate, and deploy gadget studying fashions, whilst its Bedrock platform offers shoppers high-performing fashions from Amazon and different main AI firms thru a unmarried API to assist them construct AI programs.Amazon has additionally constructed out its personal AI-powered assistant for tool builders, Amazon Q. The AI assistant can write, take a look at, and debug code. It may well additionally resolution questions on corporate insurance policies, merchandise, and different subjects.Tale continuesAmazon has proven previously that it’s prepared to spend large to in the end win large, and AI seems to be no exception. Buying and selling at a ahead P/E of round 41, the inventory has room to run given the AI expansion alternatives in entrance of the corporate.

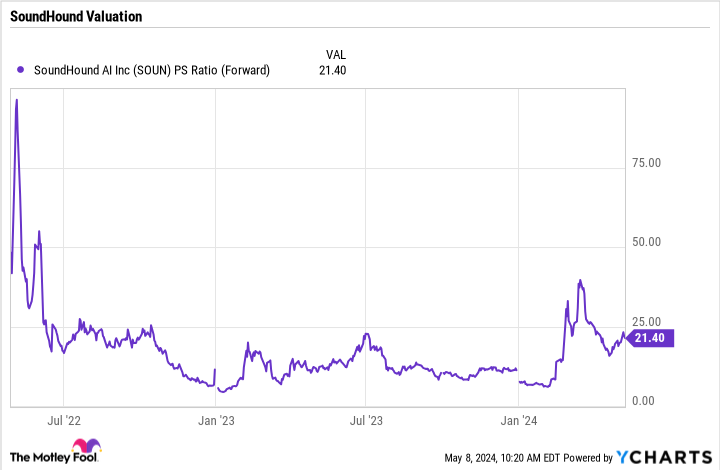

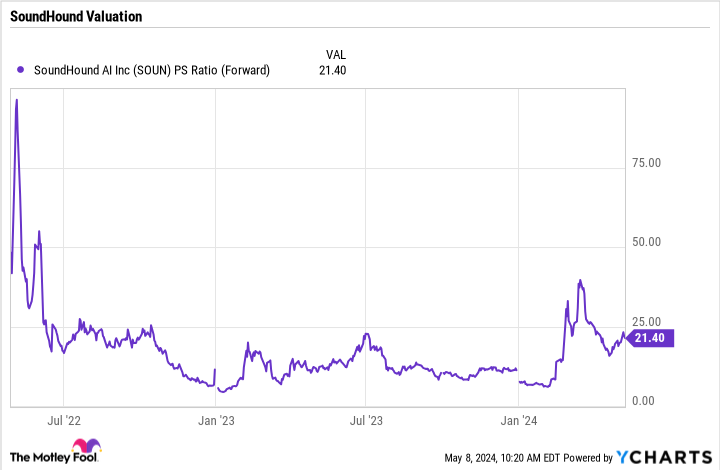

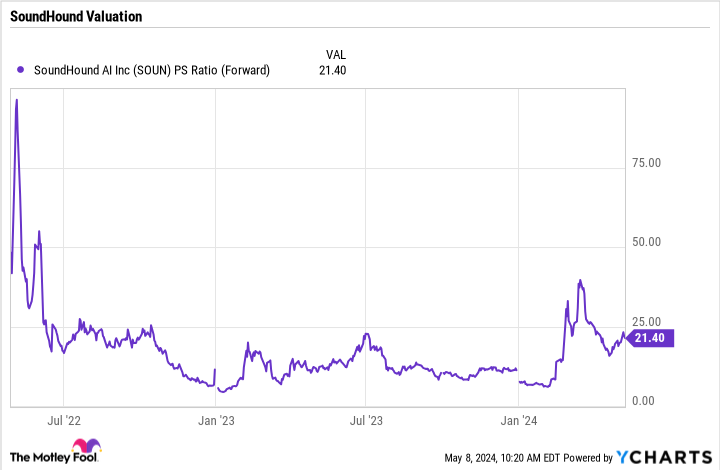

AMZN PE Ratio (Ahead) ChartSoundHound AIShares of SoundHound AI (NASDAQ: SOUN) skyrocketed previous this 12 months on information that Nvidia had made an funding within the AI-powered voice assistant corporate. On the other hand, extra just lately, the inventory has come go into reverse to a extra affordable degree.Soundhound’s generation is helping voice assistants and people have interaction extra naturally, permitting customers to invite extra advanced questions whilst getting higher solutions. The corporate has made robust inroads within the automotive trade and is making just right development within the eating place area as neatly. On the other hand, the programs of its generation must extend a long way past those two trade verticals.The corporate has a fantastic habitual earnings industry style wherein it will get royalty bills in keeping with quantity, utilization, or the lifetime of the product. For programs the place no product is concerned, comparable to with its eating place providing, it makes use of a subscription style.

AMZN PE Ratio (Ahead) ChartSoundHound AIShares of SoundHound AI (NASDAQ: SOUN) skyrocketed previous this 12 months on information that Nvidia had made an funding within the AI-powered voice assistant corporate. On the other hand, extra just lately, the inventory has come go into reverse to a extra affordable degree.Soundhound’s generation is helping voice assistants and people have interaction extra naturally, permitting customers to invite extra advanced questions whilst getting higher solutions. The corporate has made robust inroads within the automotive trade and is making just right development within the eating place area as neatly. On the other hand, the programs of its generation must extend a long way past those two trade verticals.The corporate has a fantastic habitual earnings industry style wherein it will get royalty bills in keeping with quantity, utilization, or the lifetime of the product. For programs the place no product is concerned, comparable to with its eating place providing, it makes use of a subscription style.

Symbol supply: Getty Pictures.SoundHound remains to be rather small, producing simplest $46 million in earnings closing 12 months. On the other hand, it has a big reserving backlog of $661 million, which if venerated will develop into earnings over the following a number of years. The weighted moderate period of its contracts is set six and a part years, with extra earnings backend loaded. A lot of the corporate’s backlog comes from its relationships with about 20 auto manufacturers and having its generation constructed into new fashions in their cars.Buying and selling at over 21 occasions ahead gross sales, SoundHound inventory isn’t reasonable. On the other hand, its valuation has come down so much in fresh months, and it has numerous possible to develop if it may well proceed to transport its generation into extra merchandise. Coming into smartphones, as an example, could be a recreation changer for the corporate and the inventory.

Symbol supply: Getty Pictures.SoundHound remains to be rather small, producing simplest $46 million in earnings closing 12 months. On the other hand, it has a big reserving backlog of $661 million, which if venerated will develop into earnings over the following a number of years. The weighted moderate period of its contracts is set six and a part years, with extra earnings backend loaded. A lot of the corporate’s backlog comes from its relationships with about 20 auto manufacturers and having its generation constructed into new fashions in their cars.Buying and selling at over 21 occasions ahead gross sales, SoundHound inventory isn’t reasonable. On the other hand, its valuation has come down so much in fresh months, and it has numerous possible to develop if it may well proceed to transport its generation into extra merchandise. Coming into smartphones, as an example, could be a recreation changer for the corporate and the inventory.

SOUN PS Ratio (Ahead) ChartShould you make investments $1,000 in Nvidia at the moment?Before you purchase inventory in Nvidia, believe this:The Motley Idiot Inventory Consultant analyst group simply known what they consider are the 10 absolute best shares for buyers to shop for now… and Nvidia wasn’t considered one of them. The ten shares that made the lower may just produce monster returns within the coming years.Imagine when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $550,688!*Inventory Consultant supplies buyers with an easy-to-follow blueprint for luck, together with steering on construction a portfolio, common updates from analysts, and two new inventory selections each and every month. The Inventory Consultant provider has greater than quadrupled the go back of S&P 500 since 2002*.See the ten shares »*Inventory Consultant returns as of Might 6, 2024John Mackey, former CEO of Complete Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Amazon and Nvidia. The Motley Idiot has a disclosure coverage.3 Best AI Shares Able for a Bull Run used to be at the start printed via The Motley Idiot

SOUN PS Ratio (Ahead) ChartShould you make investments $1,000 in Nvidia at the moment?Before you purchase inventory in Nvidia, believe this:The Motley Idiot Inventory Consultant analyst group simply known what they consider are the 10 absolute best shares for buyers to shop for now… and Nvidia wasn’t considered one of them. The ten shares that made the lower may just produce monster returns within the coming years.Imagine when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $550,688!*Inventory Consultant supplies buyers with an easy-to-follow blueprint for luck, together with steering on construction a portfolio, common updates from analysts, and two new inventory selections each and every month. The Inventory Consultant provider has greater than quadrupled the go back of S&P 500 since 2002*.See the ten shares »*Inventory Consultant returns as of Might 6, 2024John Mackey, former CEO of Complete Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Amazon and Nvidia. The Motley Idiot has a disclosure coverage.3 Best AI Shares Able for a Bull Run used to be at the start printed via The Motley Idiot

:max_bytes(150000):strip_icc()/GettyImages-2223947511-bd7ac55530344660aafc4d7ddf0c261b.jpg)