When the S&P 500 is up giant at the yr, it is simple to leave out the price of dependable dividend shares. In the end, what just right is a three% yield if the marketplace is up just about 20%?

However the price of high quality dividend shares is not how they carry out all the way through a robust marketplace — it is that they ship common quarterly bills it doesn’t matter what the marketplace is doing. The most productive dividend-paying corporations take it a step additional by means of elevating their dividends once a year, even all the way through recessions. That approach, buyers can rely on a rising source of revenue flow when they want it maximum.

Coca-Cola (KO -0.74%), Clorox (CLX -0.19%), and Goal (TGT -1.96%) have raised their dividends once a year for many years. This is why each and every inventory is value purchasing ahead of the tip of the yr.

Symbol supply: Getty Pictures.

Coca-Cola’s moat used to be placed on show this yr

Relying on whom you ask, Coca-Cola inventory can have a good looking or mediocre recognition. The very best grievance is that Coke is a low-growth, market-underperforming inventory that’s not value proudly owning. However proponents of Coca-Cola will argue that the corporate’s monitor document of dividend raises and buybacks, in addition to its large moat, make it value proudly owning.

Coke’s 10-year chart is unquestionably disappointing. Its trailing-12-month earnings is in reality decrease these days than it used to be a decade in the past. In the meantime, web source of revenue is up simply 26% in 10 years and the inventory is up simply 43% in comparison to a 150% acquire within the S&P 500. Alternatively, the patron staples sector has a tendency to underperform robust bull markets. Coca-Cola’s underperformance is not so unhealthy while you examine it to the sphere as a substitute of the S&P 500.

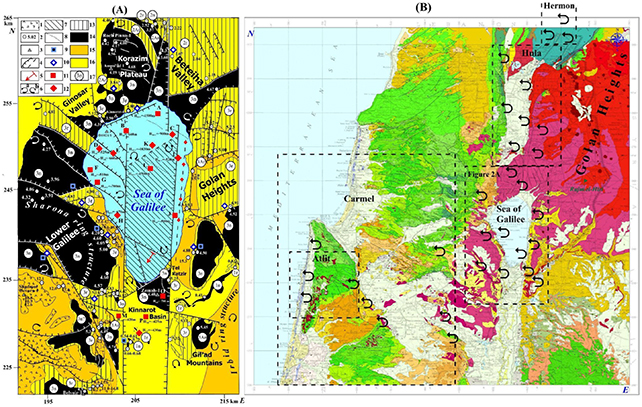

KO knowledge by means of YCharts

Coke’s redeeming high quality is its historical past of dividend raises. Coke is among the longest-tenured Dividend Kings, having paid and raised its dividend for 61 consecutive years. The dividend has greater by means of over 50% within the ultimate decade by myself. And over the last yr, Coke has accomplished robust bottom-line progress thank you to worth will increase, proving its emblem’s energy and skill to fight inflation.

Traders who care extra about capital preservation than capital appreciation will almost definitely gravitate towards Coke’s professionals outweighing the cons. The trick is to get the inventory at a just right charge. Coke’s 24 price-to-earnings (P/E) ratio is cheap relative to the S&P 500. With a three.1% dividend yield, now is a superb time to shop for Coke if it aligns together with your monetary targets.

Time to begin valuing Clorox typically once more

Previous q4, Clorox inventory underwent a swift and brutal sell-off, in large part because of a cyberattack. The inventory has lately been convalescing is now up 22% from its 52-week low. However zoom out, and the inventory is largely flat yr so far.

Like Coke, Clorox has a portfolio of sturdy manufacturers that make stronger strong dividend will increase. Along with the flagship Clorox emblem, Clorox owns Burt’s Bees, Satisfied trash baggage, Brita water filters, Kingsford charcoal, and extra. There is a bit extra doable progress with Clorox than with Coke, given the product classes Clorox is in and the truth that Clorox’s marketplace capitalization is some distance smaller than Coke’s. However Clorox remains to be essentially a dividend inventory. And the inventory is just now not as overwhelmed down because it used to be all the way through the worst of the cyberattack scare.

Nonetheless, Clorox is a superb price. It includes a 3.4% dividend yield. And despite the fact that its P/E ratio is prime presently, it has made significant price cuts and value will increase that set the degree for robust bottom-line effects as soon as Clorox has totally recovered from the cyberattack.

Goal is simply too reasonable to forget about

Like Clorox, Goal suffered a large sell-off that noticed the inventory business as little as round $103 a percentage. Since Nov. 1, Goal is up 24.9%. However it’s nonetheless down in 2023 and down over 20% within the ultimate 3 years.

Goal has been coping with inflationary pressures, vulnerable shopper spending on discretionary items, stock demanding situations, and robbery. The previous couple of years had been an especially difficult duration for predicting purchaser conduct, which has long gone from a wave of pleasure all the way through the pandemic to extra reserved these days. Prime rates of interest make borrowing cash dearer and drive customers to spend inside their manner.

Sadly for Goal, that suggests a probably subdued vacation season, which is why Goal has selected to stay a lean stock as a substitute of risking being over-optimistic after which having to put in force steep reductions after the vacations simply to transport merchandise off cabinets.

Even after the inventory’s fresh partial rebound, it nonetheless yields 3.2%. Like Coke, this is a Dividend King with over 50 consecutive years of dividend will increase. Goal additionally has extra progress doable than Coke or Clorox. It has performed a very good activity leaning into its rewards program, curbside pickup, and e-commerce. Its margins are appearing indicators of development, with ultimate quarter’s running margin coming in at 5.2%, which is a large development over ultimate yr’s epic margin cave in.

TGT Working Margin (Quarterly) knowledge by means of YCharts

Goal unquestionably is not out of the woods but. And it’s going to take some time ahead of it totally recovers. However the inventory remains to be reasonable, buying and selling at a 17.4 P/E ratio. That is just too low for a corporation with Goal’s emblem energy and dividend monitor document.

Corporations you’ll be able to rely on in 2024

Coke, Clorox, and Goal are 3 shares preferably fitted to buyers whose monetary targets come with producing a gentle flow of passive source of revenue. Every inventory yields over 3%, which is with regards to the risk-free 10-year Treasury Charge of four.2%. Most effective with shares, you get the prospective praise (and take at the threat) that includes making an investment.

Top of the range dividend shares like Coke, Clorox, and Goal must turn out to be a profitable funding that blends dividend source of revenue and capital positive aspects over the years.