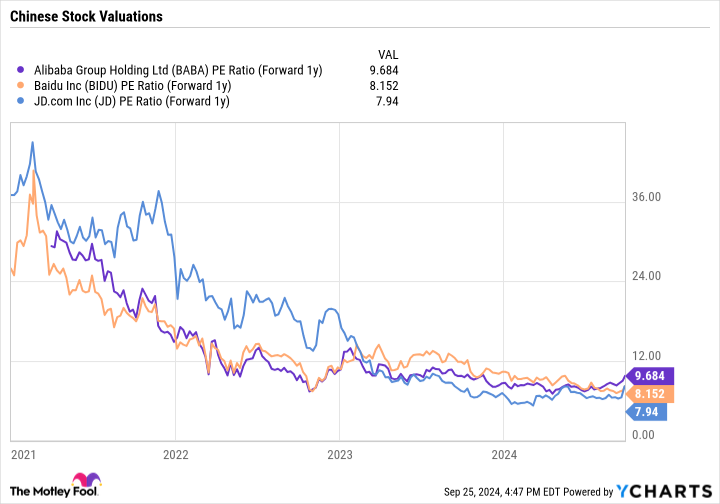

With its financial system floundering, the Chinese language executive just lately introduced quite a lot of measures to assist in giving it a boost. They come with reducing banks’ required reserve ratios, decreasing key rates of interest, and decreasing the specified downpayment proportion on 2nd properties.As well as, China will permit establishments, together with agents, finances, and insurance coverage corporations, to make use of financing from the central financial institution to buy shares. There could also be a plan to let corporations and big shareholders use executive financing to shop for again their stocks. By contrast backdrop, let us take a look at 3 Chinese language corporations that industry within the U.S. that would take pleasure in this stimulus plan.BaiduBaidu (NASDAQ: BIDU) is a Chinese language era conglomerate this is maximum similar to Alphabet within the U.S. It’s best identified for its seek engine, however like Alphabet, it additionally owns cloud computing and robotaxi companies. The corporate additionally owns stakes in publicly traded Chinese language commute corporate Go back and forth.com and video subscription carrier iQIYI.With the slow Chinese language financial system and lengthening festival for commercials, Baidu has noticed its inventory combat this 12 months, down about 20%. In the second one quarter, its general income used to be flattish, whilst its on-line advert income fell 2%. One space of energy used to be its cloud trade, which noticed income upward thrust 14%.Along with the affect of the susceptible macro setting and aggressive panorama, the corporate could also be within the technique of seeking to change into its seek revel in in the course of the integration of generative AI, which it says will supply extra correct and direct solutions. In August, about 18% of seek effects content material used to be created by way of generative AI, up from 11% in mid-Might.On the other hand, the corporate has mentioned this change is lately resulting in fewer advert impressions, which is hurting income within the close to time period. Long term, despite the fact that, the corporate thinks that is the appropriate technique and it’ll additionally discover different monetization fashions, equivalent to transferring from a cost-per-click type to a cost-per-sale type.Whilst Baidu is coping with near-term inside and exterior headwinds, an progressed Chinese language financial system and shopper may pass some distance towards serving to to strengthen its seek advert trade.AlibabaWile Baidu resembles Alphabet, Alibaba (NYSE: BABA) is very similar to Amazon within the U.S., with huge e-commerce, logistics, and cloud computing companies.Whilst Alibaba’s inventory has carried out smartly this 12 months, up greater than 20%, it is nonetheless down greater than 40% during the last 5 years. It too has struggled with greater festival and a susceptible Chinese language financial system. In Q2, its e-commerce income fell -1%, despite the fact that the corporate is making strides attracting extra shoppers, as its orders grew by way of double-digits and its gross products price (GMV) rose by way of top unmarried digits. Now that its Taobao and Tmall companies have stabilized, it’ll glance to extend monetization at the platforms.Tale continuesAnd very similar to Baidu, its cloud computing unit has just lately been a standout. Whilst its Q2 income best rose 6% ultimate quarter, the section’s adjusted EBITA (revenue prior to passion, taxes, and amortization) soared 155% because it shall we lower-margin shoppers roll off. The corporate additionally simply presented over 100 AI fashions to assist additional push expansion.Whilst Alibaba has been making strides in its turnaround efforts, an growth within the susceptible Chinese language financial system may pass some distance in serving to with the ones efforts.

3 Shares to Purchase After the Chinese language Stimulus Package deal