TAMPA, Fla. (WFLA) — Two Florida insurance coverage firms need to elevate their charges by means of greater than 50%.

Fortress Key Indemnity Corporate, which is owned by means of Allstate, covers apartment house owners. The corporate has proposed its fee to leap by means of 53.5% for patrons.

Document unearths Florida second-most dear state for automobile insurance coverage

Amica Mutual Insurance coverage, which covers houses like holiday houses, has proposed a 54.1% building up.

“Extra common, serious climate, upper restore prices and increased reinsurance premiums have brought about charges to upward thrust in lots of states, together with Florida,” a spokesperson for Allstate mentioned in a remark.

Allstate mentioned the velocity building up for Fortress Key was once filed with the Florida Administrative center of Insurance coverage Legislation just about a yr in the past and started rolling out to consumers in Would possibly 2023. The corporate mentioned this isn’t a brand new proposal to extend apartment charges.

In a remark in regards to the Fortress Key building up, a spokesperson mentioned: “The price of offering dependable coverage for Florida houses has risen dramatically, and we’re taking movements to make sure we will be able to give protection to consumers over the lengthy haul.”

House insurance coverage disaster: What’s the standing of Florida’s marketplace 1 yr after insolvencies?

Mark Friedlander, who’s the Florida spokesperson for the Insurance coverage Knowledge Institute, mentioned Fortress Key handiest writes insurance policies for roughly 150,000 Florida householders.

Friedlander mentioned one of the most value building up is as a result of the tragedy that took place in Surfside with a cave in of a apartment there. Then again, he mentioned the insurance coverage scenario is making improvements to in Florida.

“If truth be told, seven new firms had been licensed to jot down new trade in 2024 and that’s an ideal results of the legislature as a result of for a few years, firms had been pulling again on Florida,” he mentioned.

“It’s essential to in reality now start to store your protection and get aggressive quotes,” he mentioned. “So, should you’ve noticed a vital building up, it doesn’t matter what form of belongings insurance coverage you may have, it could be time to name your agent.”

‘It’s simply no longer inexpensive’: Some Florida householders ditch insurance coverage because of value

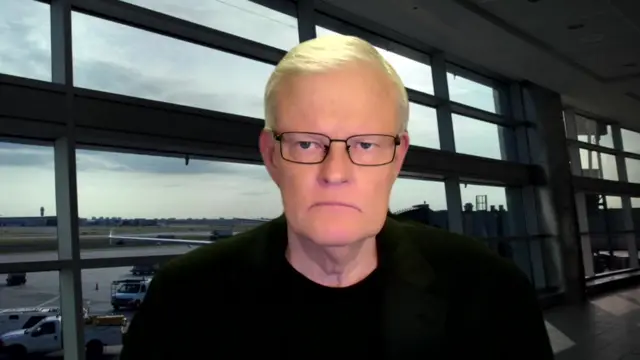

Former State Sen. Jeff Brandes mentioned 3 primary elements are using up the price of householders insurance coverage in Florida.

“Litigation was once using, was once actually using up the price,” Brandes mentioned. “The problem now we have now’s, inflation is right here and inflation wasn’t a large deal two or 3 years in the past. It’s undoubtedly a big factor these days and the reinsurance costs have persisted to be upper all the way through the rustic.

Brandes mentioned the legislature must do extra paintings to support the home-owner insurance coverage scenario in Florida.

“I feel there are answers in the market,” he mentioned. “I feel the legislature must get a hold of a longer term technique for tips on how to maintain belongings insurance coverage within the state. So far, they haven’t carried out that.”