XRP’s Futures Open Hobby has proven certain expansion of two.3% up to now 4 hours.

XRP’s OI-Weighted Investment Fee indicated that investors have been bullish, as lengthy positions have been paying brief positions.

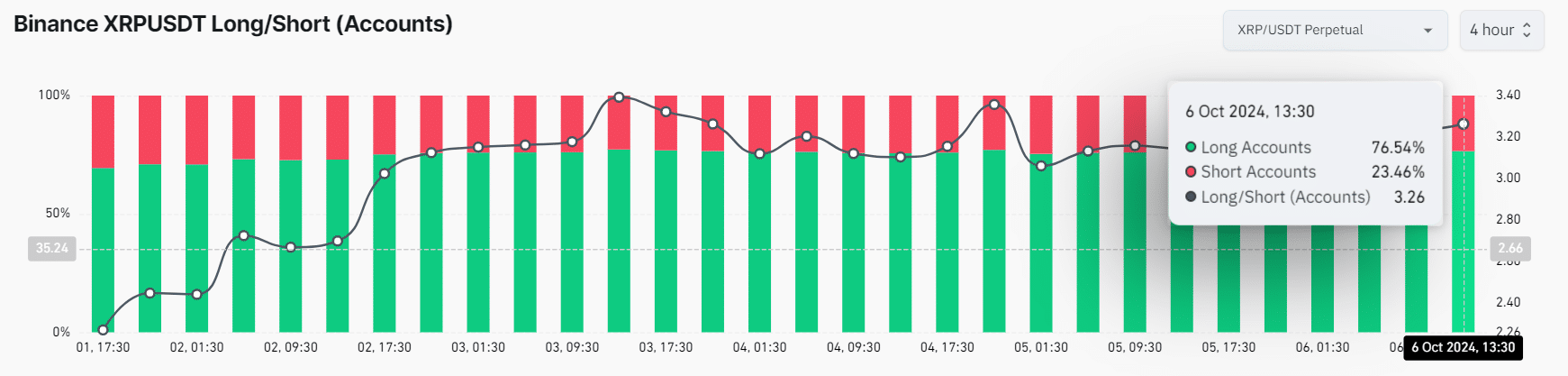

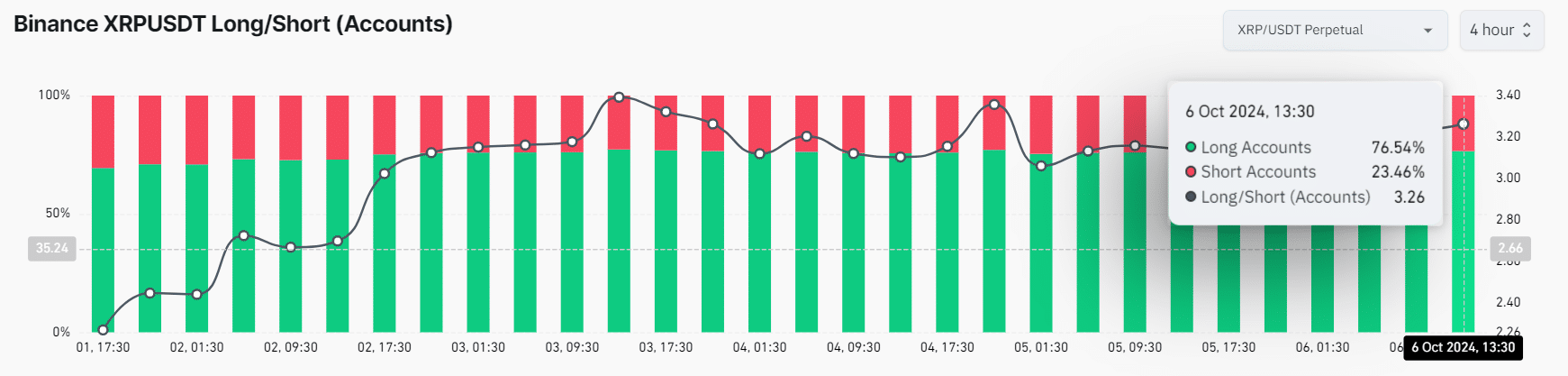

Within the ongoing sideways cryptocurrency marketplace, XRP investors on Binance gave the impression bullish as they considerably larger their lengthy positions over the last 4 hours till press time.

In keeping with the on-chain analytics company Coinglass, 76.54% of Binance investors went lengthy at the XRPUSDT pair, whilst 23.46% most well-liked brief positions.

Binance investors move lengthy on XRP

This important lengthy place on Binance advised that investors have been positive about XRP’s worth expanding within the coming days.

Alternatively, this wager at the notable lengthy place befell when XRP was once suffering to realize momentum close to the robust strengthen stage of $0.52.

Supply: Coinglass

Supply: Coinglass

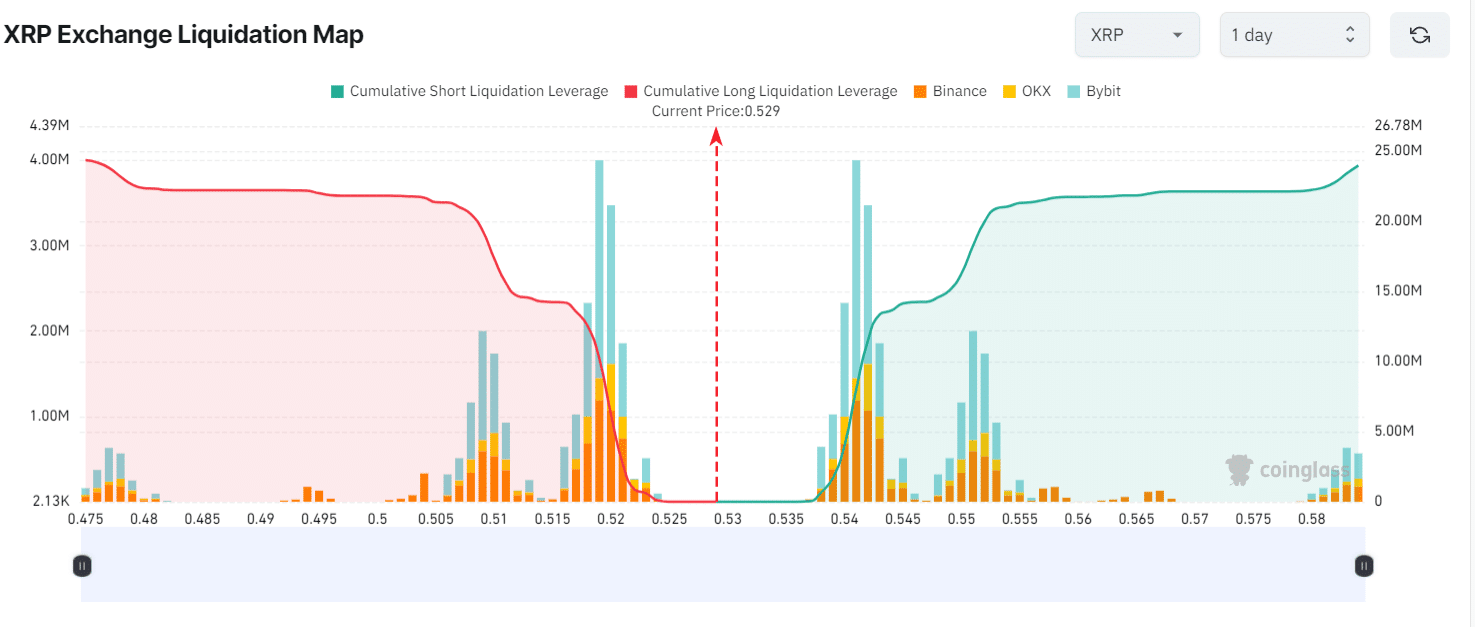

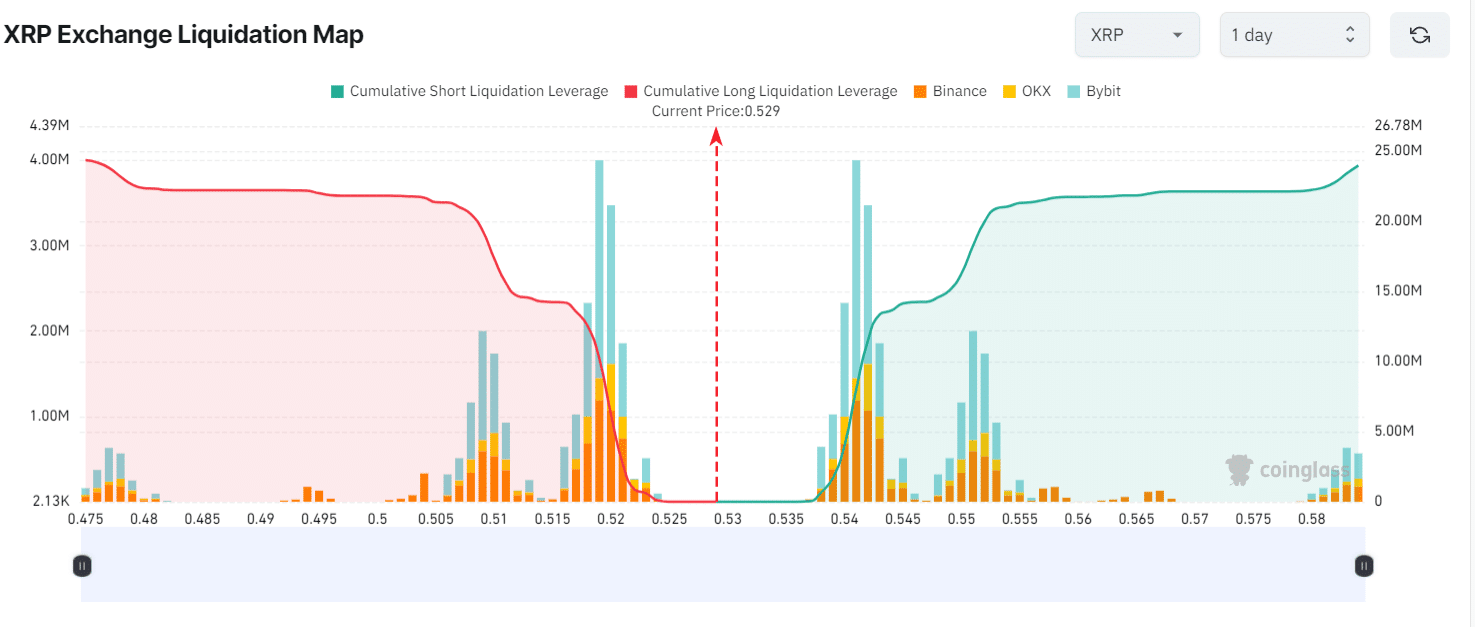

At press time, XRP was once buying and selling close to $0.529 and has skilled a value decline of 0.65% over the last 24 hours.

In the meantime, investors and buyers remained hesitant to take part, as its buying and selling quantity has dropped through 50% in comparison to the day before today.

XRP’s bullish on-chain metrics

In spite of the worry available in the market, XRP’s Futures Open Hobby has proven certain expansion of two.3% up to now 4 hours. This indicated that investors’ bets are expanding, which can be a bullish sign for XRP holders.

As of now, the key liquidation ranges have been $0.519 at the decrease aspect and $0.541 at the higher aspect, with investors being over-leveraged at those ranges, consistent with Coinglass information.

Supply: Coinglass

Supply: Coinglass

If the marketplace sentiment shifts to adverse and the cost of XRP falls beneath the $0.519 stage, just about $10.21 million value of lengthy positions might be liquidated.

Conversely, if sentiment improves and the fee soars to the $0.541 stage, roughly $8 million value of brief positions might be liquidated.

Alternatively, some other on-chain metrics supporting this bullish outlook was once XRP’s Open Hobby (OI)-Weighted Investment Fee, which was once at +0.0097% at press time.

A good Investment Fee indicated that investors have been bullish, as lengthy positions are paying brief positions.

Combining the knowledge from the Lengthy/Quick Ratio, Futures Open Hobby, liquidation ranges, and Investment Fee, it gave the impression that bulls have been lately dominating the asset, with expectancies that costs will upward thrust.

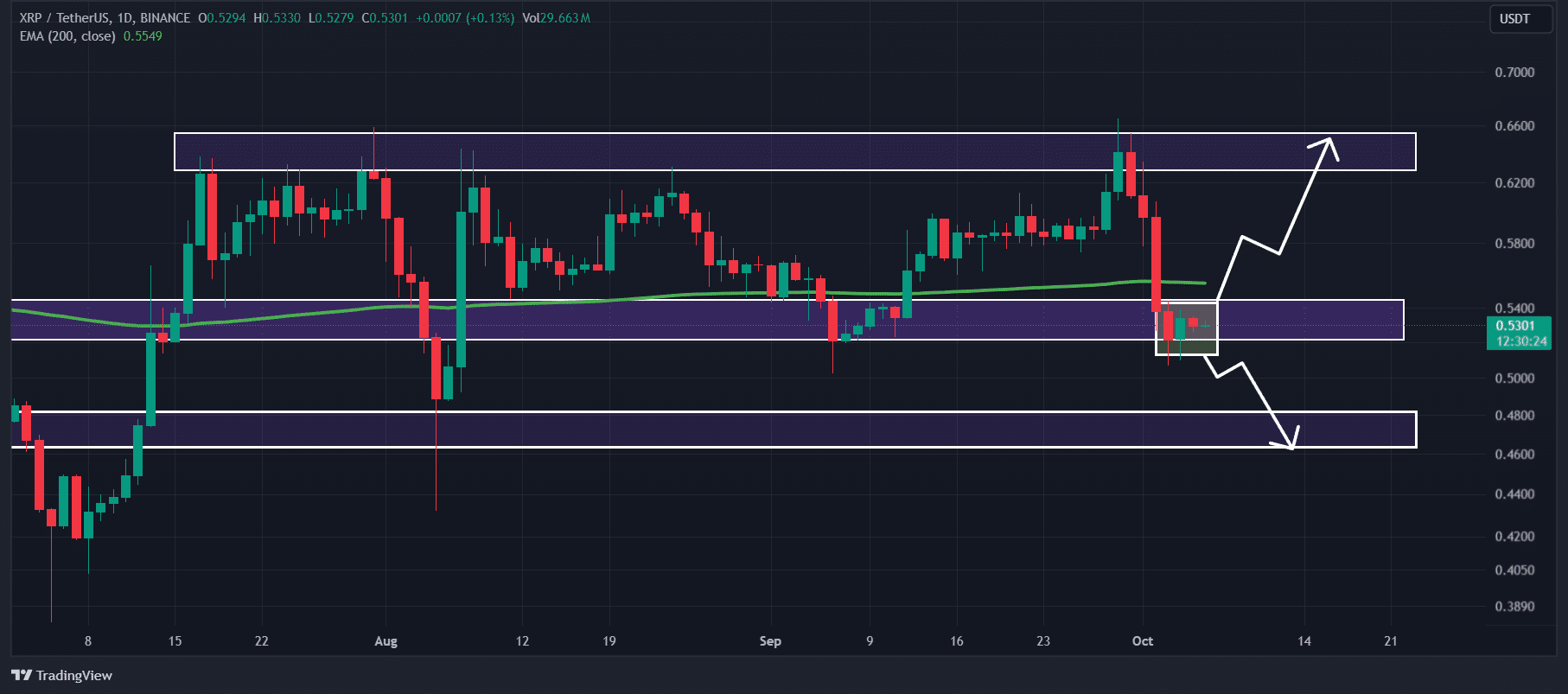

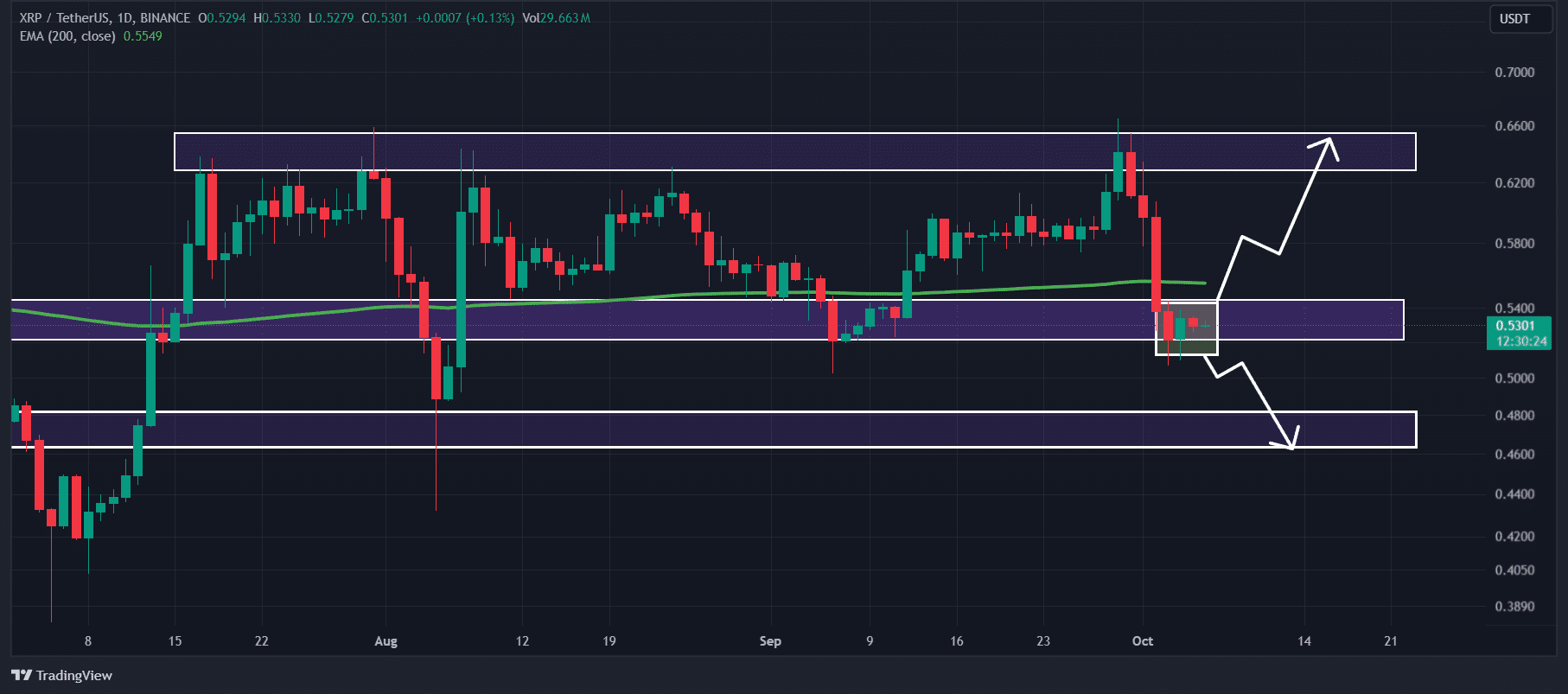

XRP technical research and key ranges

In keeping with AMBCrypto’s technical research, XRP has been consolidating inside of a decent vary between $0.518 and $0.545 for the previous 3 days, close to the the most important strengthen stage of $0.52.

Alternatively, a breakout from this consolidation zone will resolve the following motion in XRP’s worth.

Supply: TradingView

Supply: TradingView

Learn XRP’s Value Prediction 2024–2025

According to the ancient worth momentum, if XRP breaches the zone and closes a day-to-day candle above the $0.545 stage, there’s a robust risk that it will bounce through 17% to succeed in the $0.65 stage.

Conversely, if XRP breaches the decrease boundary of the consolidation zone and closes a day-to-day candle beneath $0.515, it will decline through 12% to $0.455 within the coming days.

Subsequent: AVAX breaks this bearish trend – What’s subsequent for worth?