BTC holders proceed to look income on their investments.

This has remained regardless of the coin’s slender worth actions.

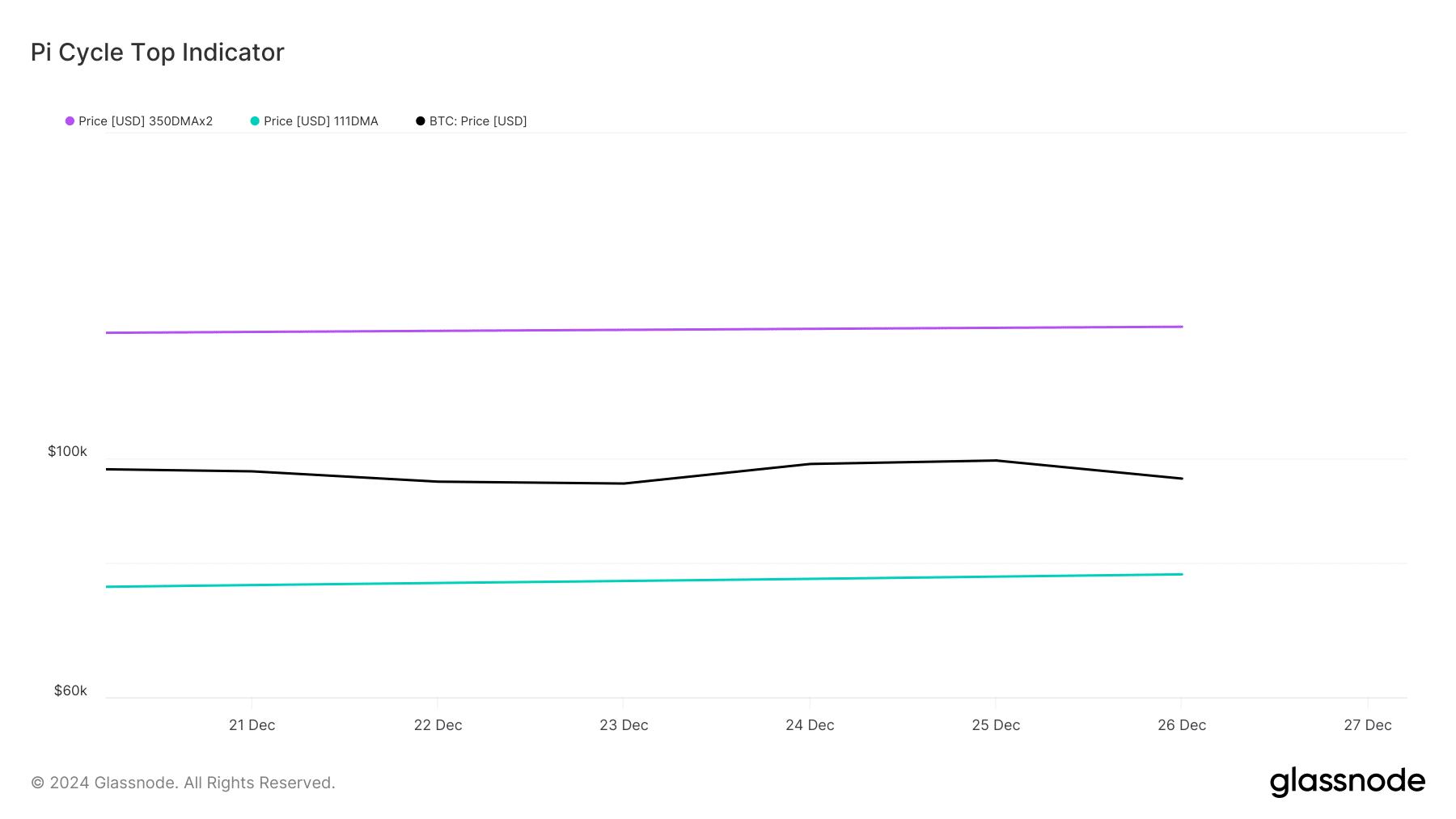

A brand new file via Glassnode discovered that Bitcoin [BTC] holders have persevered to carry unrealized income regardless of the main coin’s slender actions up to now few weeks.

At press time, BTC exchanged arms at $65,625. Trending inside of a horizontal channel, the coin has confronted resistance at $71,656 and has discovered make stronger at $64,825. On the other hand, regardless of this “sideways worth motion,” BTC’s “investor profitability stays powerful.”

Consistent with the on-chain information supplier:

“BTC costs are consolidating inside of a well-established industry vary. Traders stay in a typically favorable place, with over 87% of the circulating provide held in benefit, with a value foundation beneath the spot worth.”

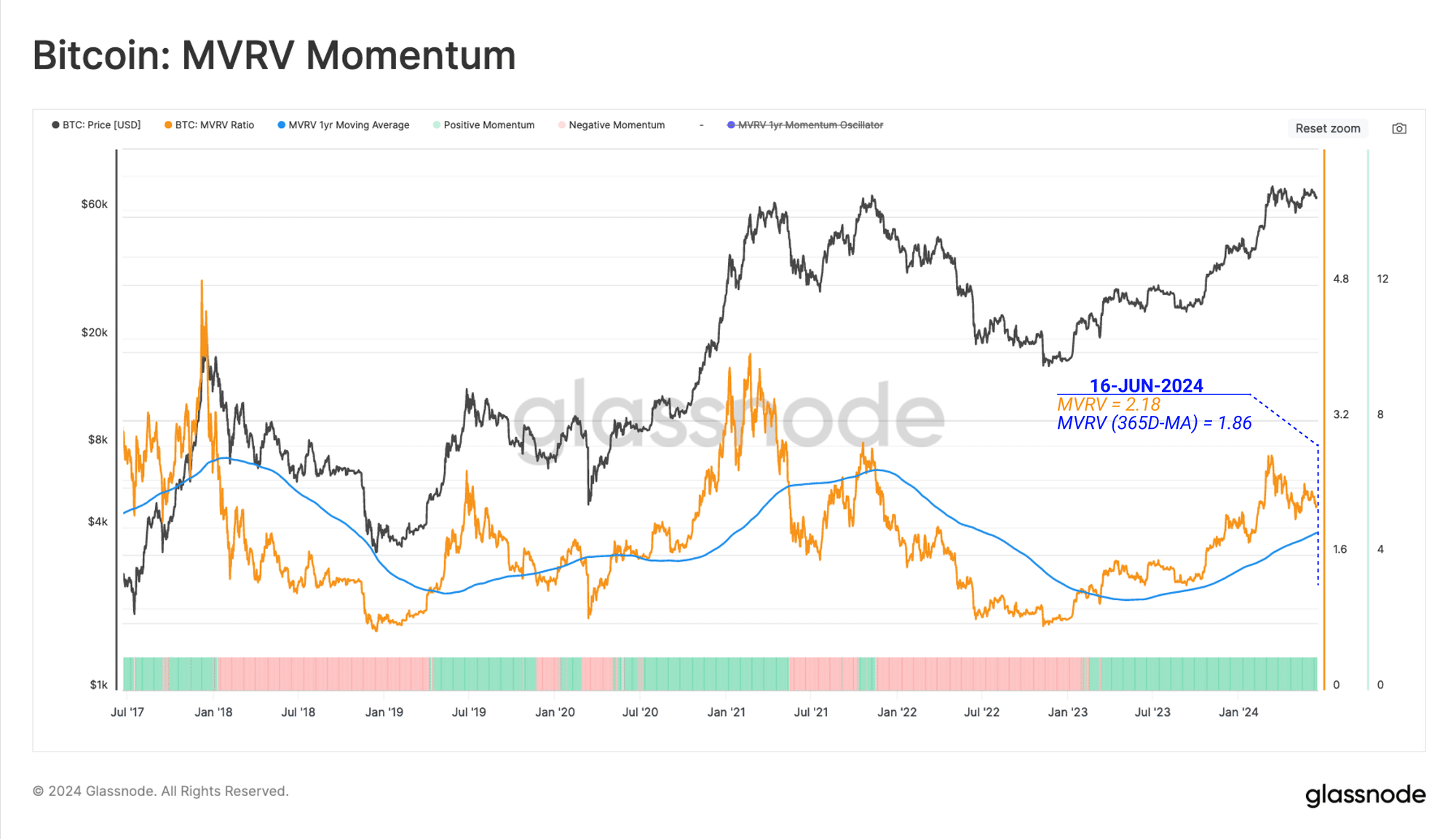

Glassnode assessed the coin’s Marketplace Price to Learned Price (MVRV) ratio and located that the typical BTC coin in stream holds an unrealized benefit of over 120%.

Supply: Glassnode

Supply: Glassnode

Apparently, regardless of how winning BTC holders are, the amount of cash being processed and transferred at the Bitcoin Community since March’s all-time top (ATH) has declined considerably,

Glassnode famous that this decline “underscores a discounted urge for food for hypothesis and heightened indecision available in the market.”

Low alternate process

BTC’s worth consolidation has additionally resulted in a decline in BTC alternate flows. Glassnode discovered that BTC’s momentary holders (STHs) lately ship roughly 17,400 BTC (valued at $1.13 billion at present marketplace costs) to exchanges day-to-day.

Those buyers have held their cash for a somewhat quick length, most often lower than 155 days.

Their present alternate inflows constitute a 68% decline from 55,000 BTC despatched to exchanges via this cohort of buyers when the coin climbed to an all-time top of $73,000 in March.

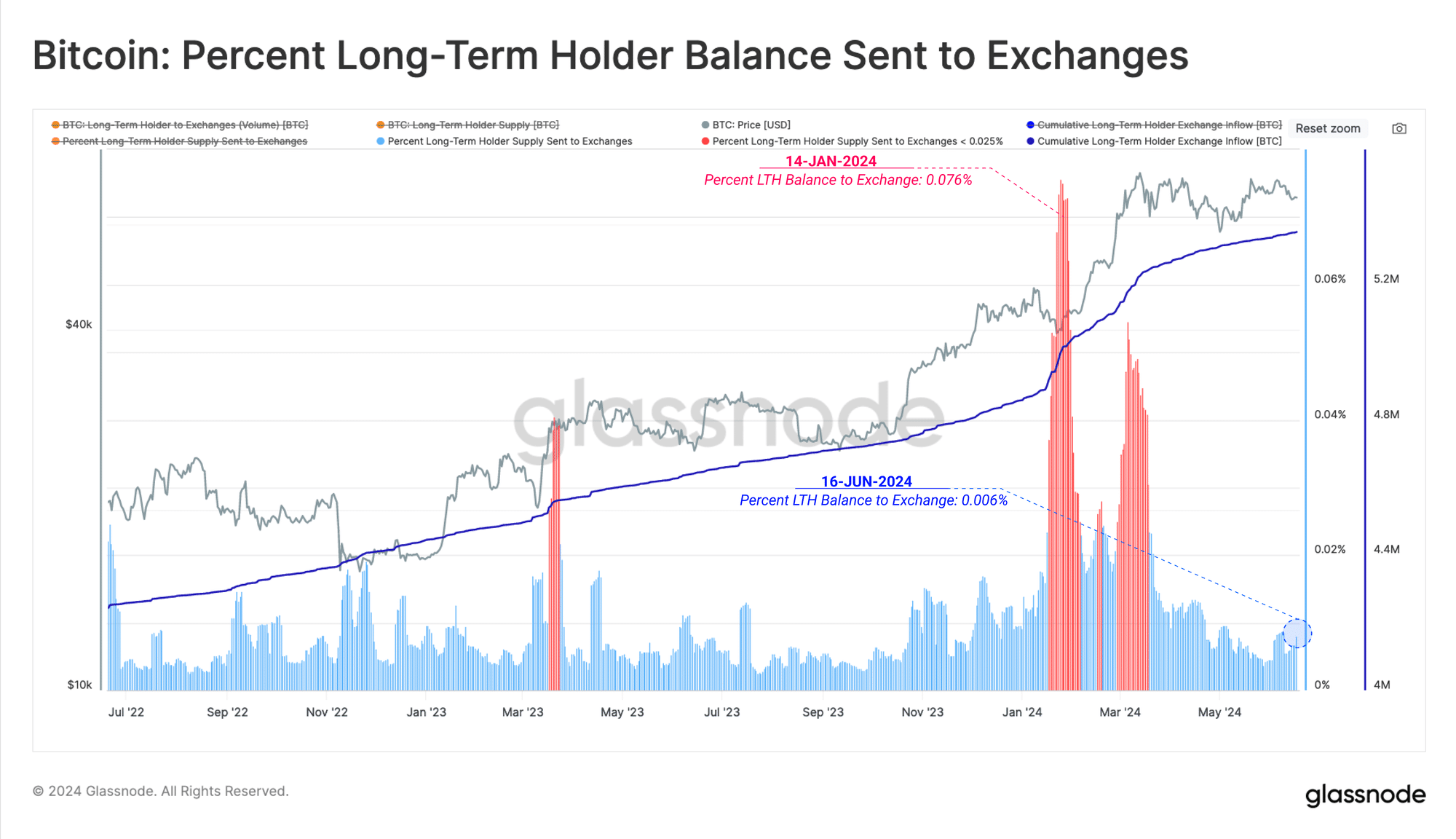

As for long-term holders (LTHs), their “distribution into exchanges is somewhat low, with just a marginal 1k+ BTC/day in inflows lately.”

Supply: Glassnode

Supply: Glassnode

Glassnode stated:

“LTHs are sending lower than 0.006% in their general holdings into exchanges, suggesting that this cohort has reached equilibrium and that upper or decrease costs are required to stimulate additional motion.”

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The common BTC despatched to exchanges generates a benefit of round $5,500. This has triggered some buyers who’ve held for lengthy to promote for benefit.

Because the marketplace anticipates a rally to the $73,750 ATH, there may be sufficient call for to take in the marketing force. On the other hand, it’s “now not big enough to push marketplace costs upper.”

![2024 noticed OM [Mantra] outperform the remaining, will 2025 be any other? 2024 noticed OM [Mantra] outperform the remaining, will 2025 be any other?](https://ambcrypto.com/wp-content/uploads/2024/12/om-2024.jpeg)