Maximum buyers are choosing for bullish bets in spite of the coin’s motion

DOGE’s hike to $0.29 now stalled due to the marketplace’s correction

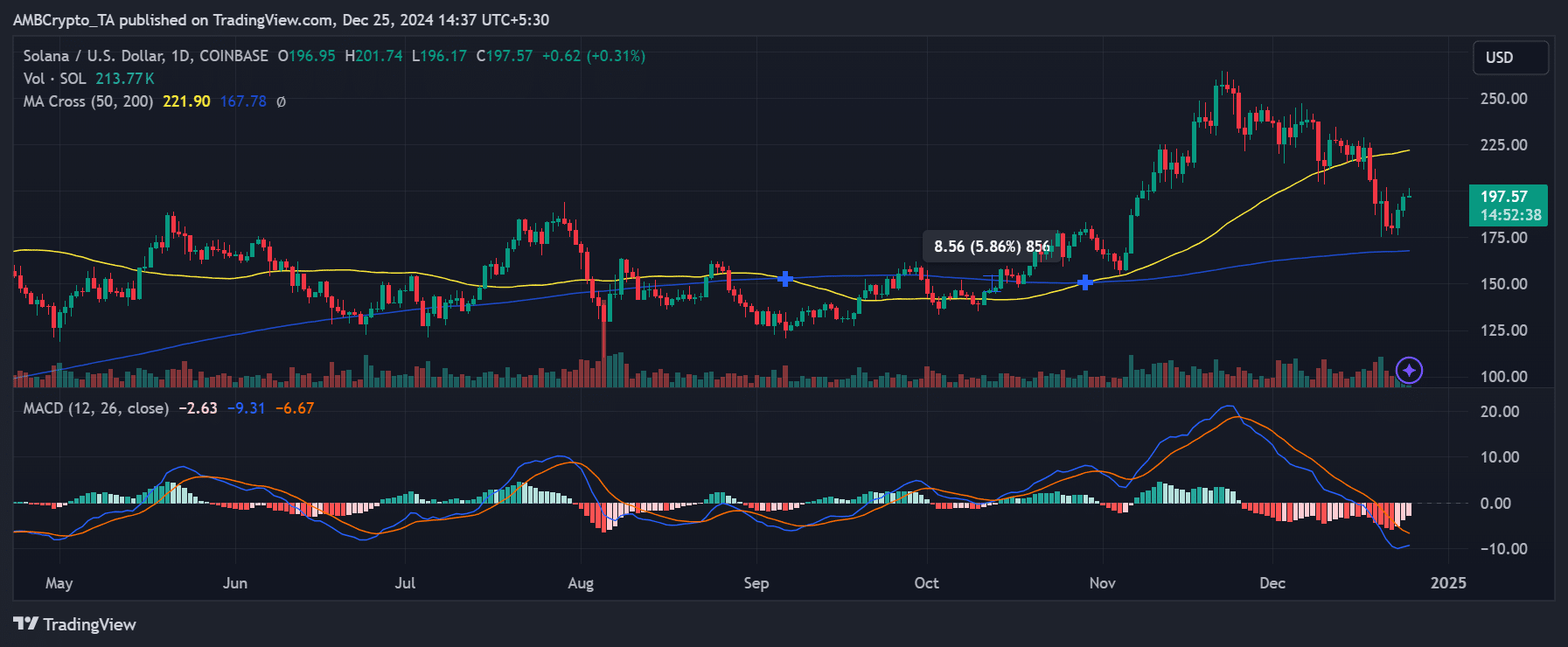

AMBCrypto’s research of the marketplace published that buyers were bullish on Dogecoin [DOGE], in spite of its contemporary struggles. In the past, DOGE seemed find it irresistible was once heading to $0.30. On the other hand, for some weeks, the cost has been caught between $0.18 and $0.22. On the time of writing, it was once right down to $0.17 after a 13% fall owing to Bitcoin shedding over 5% of its price within the final 12 hours.

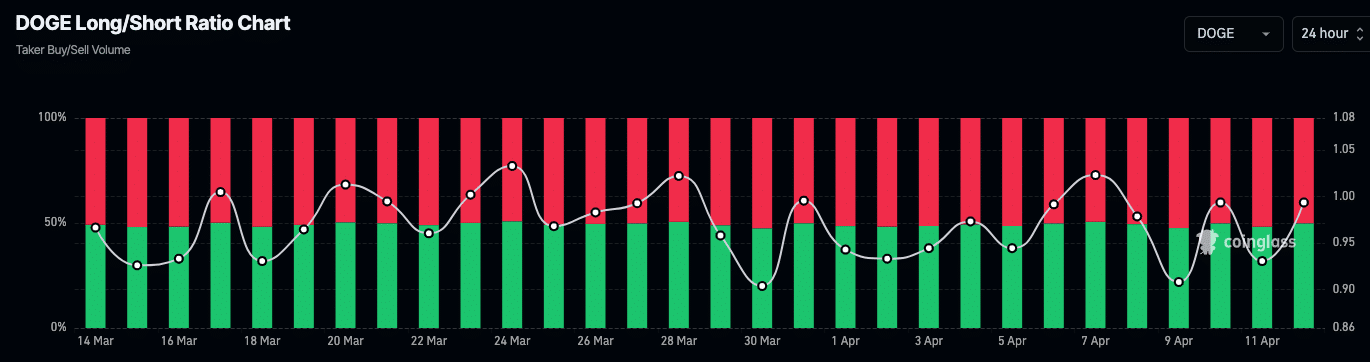

On the other hand, knowledge got from the Lengthy/Quick ratio published that buyers have been unfazed by way of the efficiency. In truth, in step with Coinglass’ information, Dogecoin’s 24-hour Lengthy/Quick ratio was once 1.02.

The Lengthy/Quick ratio is an important metric used to test the sentiment of Futures buyers. A studying underneath 1 displays the dominance of shorts. However, values above 1 point out bullish sentiment and extra lengthy positions.

Supply: Coinglass

Supply: Coinglass

DOGE isn’t able but

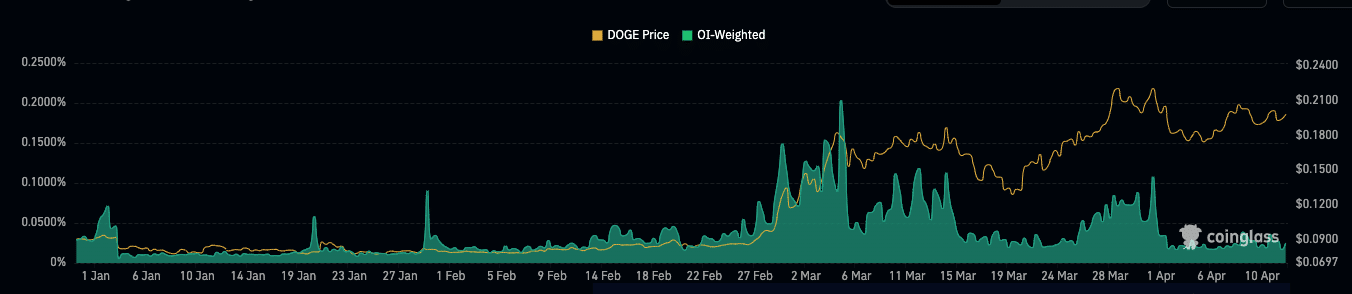

Alas, sentiment on my own received’t take DOGE out of its tight-trading vary. This was once why AMBCrypto thought to be different signs. Open Passion (OI) was once one of the vital signs we evaluated.

OI screens details about liquidity and passion in explicit contracts out there. This is helping buyers perceive traits and possible actions. An build up in OI signifies that marketplace individuals are expanding their internet positions.

On this case, patrons were extra competitive than dealers. To the contrary, when the OI decreases, it’s the wrong way round.

At press time, Dogecoin’s OI was once $1.29 billion, in spite of the most recent marketplace correction. It is a signal that internet positioning by way of buyers has been moderately solid, in spite of the marketplace’s volatility.

Subsequently, the impact at the value, outdoor of exterior parts, could be minimum. If the OI holds and the marketplace steadies itself, DOGE can resume its uptrend once more and possibly, try to climb previous $020 and later, $0.25.

Supply: Coinglass

Supply: Coinglass

However, an enormous closure in internet positions would possibly invalidate this prediction, and DOGE would possibly drop additional at the charts.

Calm prior to chaos?

From a technical perspective, the DOGE/USD chart published that the coin’s momentum had turn out to be susceptible, particularly after the most recent market-wide correction. In truth, the crypto’s Relative Power Index (RSI) had fallen underneath midpoint at 0.50.

In a similar fashion, the Parabolic SAR’s dotted markers switched place to above the cost candles – A beautiful bearish signal.

Is your portfolio inexperienced? Test the Dogecoin Benefit Calculator

If the marketplace stabilizes itself, DOGE has the prospective to arrest its downtrend and escape from its consolidation section. On the other hand, the altcoin is prone to proceed buying and selling inside of its current value vary over the following few days.

Bullish sentiment out there and a surge in capital drift would possibly cause the hike. A tweet from Elon Musk would possibly do the trick too.