Seems, cave in of the forex is the fee Japan is now paying for years of crazed financial insurance policies.

Through Wolf Richter for WOLF STREET.

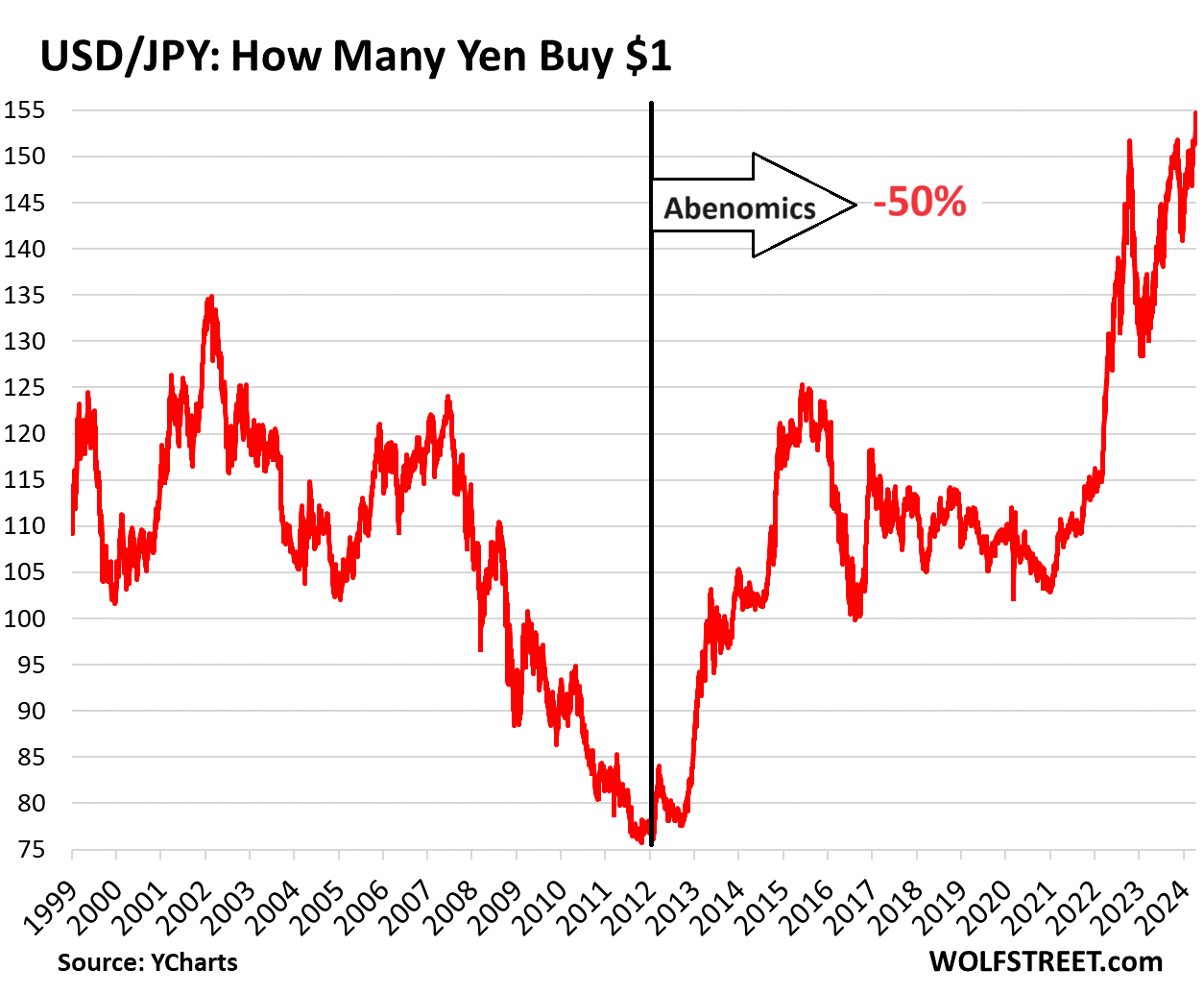

These days, the yen dropped to ¥154.7 to the USD, a 34-year low, regardless of unending copy-and-paste jawboning by means of Jap government and a few marketplace intervention – promoting hard earned greenbacks to shop for again yen that the BOJ had created in such reckless abandon – to prop up the yen.

The yen has plunged by means of 32% towards the USD since 2021 when different central banks began shifting clear of QE and nil% or unfavorable coverage charges; and it has collapsed by means of 50% since 2012 when newly elected high minister Shinzo Abe carried out his financial insurance policies (“Abenomics”) of fiscal profligacy funded by means of cash printing, massive quantities of cash printing that used to be bolstered in 2016 by means of the establishment of Yield Curve Regulate, which saved the 10-year yield close to 0%.

The Financial institution of Japan has taught world central banks an enormous lesson over the last dozen years: You’ll be able to break out with unending quantities of cash printing, no drawback – see how we’re doing it? – necessarily purchasing over part of the nationwide debt with freshly created yen, plus a host of alternative securities, and there received’t be any dangerous penalties. Now that lesson has grew to become out to be pretend. The yen is collapsing. There’s a worth to pay in any case: the destruction of the forex:

The one factor this is superb is how lengthy some of these crazed financial insurance policies may also be maintained ahead of one thing breaks, however then one thing does smash, one thing giant, like a forex. And the free-lunch idea that had pushed all this seems to had been pretend.

The BOJ has began to react in tiny child steps, however there’s not anything in those tiny child steps that will forestall the destruction of the yen – it’s nonetheless destroying the yen, however in relatively smaller increments.

The method began in December 2022, through which time different central banks have been mountain climbing their coverage charges in giant increments and had grew to become to QT. That used to be when the BOJ “stunned” markets by means of lifting the ceiling of the 10-year JGB yield band to 0.5%. In 2023, it lifted the ceiling to one%. And in October 2023, it discarded that particular ceiling. Then on the coverage assembly in March, the BOJ:

Maintained QE, stated it might “proceed its JGB purchases with extensively an identical quantity as ahead of,” about ¥6 trillion monthly ($40 billion), in keeping with marketplace prerequisites.

Scrapped its unfavorable interest-rate insurance policies by means of lifting the momentary price by means of a wide ranging 10 foundation issues, OMG, from -0.1% to 0.0%, its first price hike since 2007.

More or less ended yield-curve keep an eye on however with out throwing it out totally.

Formally ended purchases of fairness ETFs and J-REITs, despite the fact that it had stopped purchasing them in 2023.

Slowed however didn’t forestall the purchases of company paper and company bonds and stated it might finish them altogether in a few yr.

So the BOJ has accomplished just a few micro-steps to transport clear of its crazed financial insurance policies, but it surely’s nonetheless in large part caught in those insurance policies, it’s nonetheless pursuing them, simply at a slower tempo. Forex destruction at paintings.

Experience studying WOLF STREET and wish to fortify it? You’ll be able to donate. I respect it immensely. Click on at the beer and iced-tea mug to learn how:

Do you want to be notified by means of e mail when WOLF STREET publishes a brand new article? Join right here.

![]()