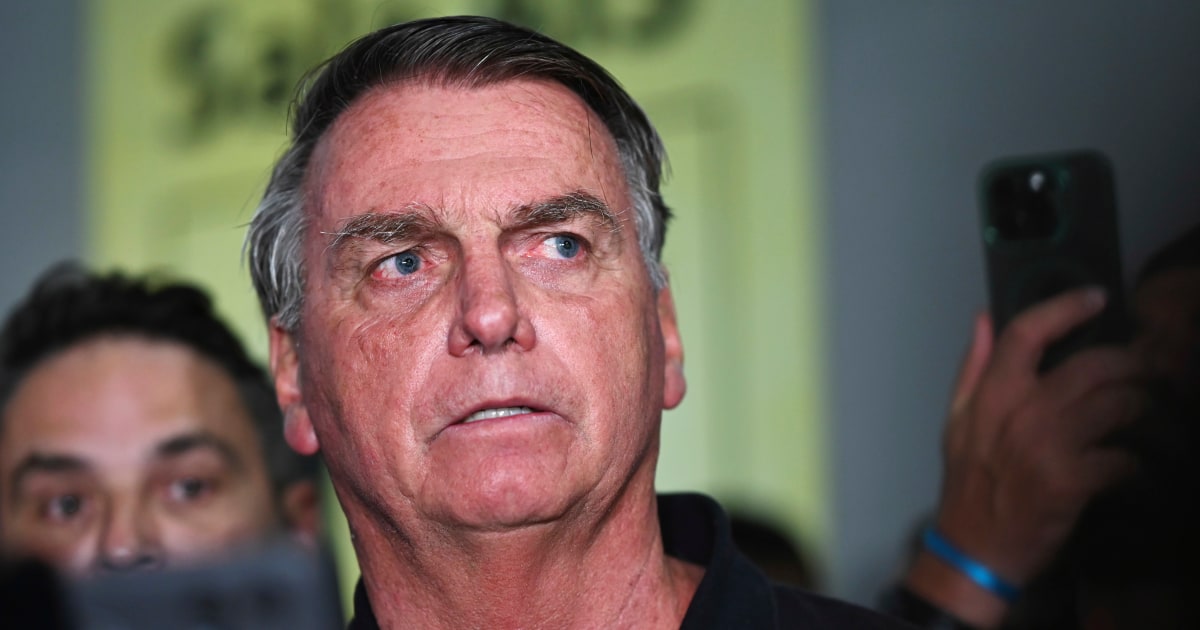

Through Theo LeggettBusiness correspondent, BBC News1 hour agoImage supply, Getty ImagesImage caption, Ultimate month Tesla needed to recall 1000’s of its Cybertrucks over protection considerations round their accelerator pedalsThere was once a time when it appeared Tesla may do no mistaken. In little greater than a decade, it went from generation upstart to mass-market carmaker, invested billions in its blank power trade, and noticed its price rocket.However now the corporate is suffering with falling automotive gross sales and intense pageant from Chinese language manufacturers, in addition to issues of its much-hyped Cybertruck.Decrease gross sales have hit its revenues, and harm its earnings. Its percentage worth has fallen through greater than 1 / 4 for the reason that get started of the 12 months. So is all of this only a bump within the highway, or are the wheels coming off the Tesla bandwagon?”It is about breaking a spell,” defined Elon Musk to a specifically invited target audience at Tesla’s California manufacturing facility again in June 2012.”The sector has been below the semblance that electrical vehicles cannot be as just right as fuel vehicles,” he stated.Musk was once talking on the release of the brand new Tesla Fashion S, a automotive he insisted would shatter that phantasm. It was once no empty promise. Symbol supply, Getty ImagesImage caption, Tesla’s 2012 free up of the Fashion S reworked the electrical automotive marketAt the time electrical vehicles had a long-standing popularity for being gradual, uninspiring and impractical, with very restricted vary.Even though new fashions such because the Nissan Leaf have been beginning to increase a distinct segment following, that they had but to make a lot of an have an effect on at the wider marketplace.The Fashion S was once robust, had sportscar efficiency, and may commute as much as 265 miles on a unmarried price. It wasn’t affordable, beginning at $57,000 (£47,000) in the USA for the bottom efficiency model, however it indisputably made some degree.Since then, Tesla has introduced 4 extra fashions, together with the Fashion X SUV, the “reasonably priced” Fashion 3 and Fashion Y, and the Cybertruck. It now has large, so-called gigafactories development vehicles in Shanghai and Berlin, along with its unique facility in Fremont, California, and numerous different US websites. Ultimate 12 months, it delivered 1.8 million vehicles, suggesting it has established itself firmly as a mass-market producer. However in line with Professor Peter Wells, director of Cardiff College’s Centre for Automobile Trade Analysis, that is a part of the issue. “When Tesla first emerged, it had an exhilarating new product, a charismatic CEO, and it got here throughout as actually pioneering,” he explains.Now although, the corporate “is not the entrepreneurial new entrant and upstart disrupter, however increasingly more an business incumbent with the entire demanding situations this brings when confronted with a rising array of competition in the similar marketplace area”.Different firms, like China’s Nio, are providing extra thrilling merchandise, says Prof Wells, whilst fellow Chinese language company BYD gives just right efficiency at decrease costs. “Mainly, the arena has stuck up with Tesla,” he says.Symbol supply, Getty ImagesImage caption, Chinese language electrical automotive emblem Nio is making vehicles with the wow factorThere is undoubtedly that there’s a lot extra pageant than there was once. Following the diesel emissions scandal that engulfed it in 2015, Volkswagen started ploughing cash into electrical cars. And as governments world wide started taking a look severely at eventual bans at the sale of latest petrol and diesel fashions, different established producers quickly adopted. Shoppers searching for an electrical automotive with respectable vary and function now have a variety of choices to make a choice from. In China, in the meantime, policymakers have for years noticed the advance of electrical cars (EVs) as a possibility to take a vital percentage of the worldwide marketplace, and promoted their building. The outcome has been the fast expansion of manufacturers comparable to BYD – which overtook Tesla to grow to be the arena’s largest producer of electrical vehicles on the finish of final 12 months. On the identical time, because the EV marketplace has grow to be extra established, in lots of portions of the arena subsidies to lend a hand shoppers purchase them were reined in. That can be one explanation why the rampant expansion in EV gross sales lately has eased off – and why the producers themselves are having to drop their costs.In keeping with impartial auto analyst Matthias Schmidt, this has indisputably had an have an effect on on Tesla.”Finance ministers who have been up to now glad to provide sexy incentives for the acquisition of a battery electrical car in a marketplace atmosphere that seemed bare-shelved, with necessarily a Tesla or a Tesla on be offering, at the moment are slamming their handbags close,” he says. One marketplace through which this seems to have had a profound impact is Germany. A subsidy scheme providing 1000’s of euros off the price of a brand new electrical car was once rapidly led to December. EV gross sales there fell sharply within the first 3 months of this 12 months, with Tesla struggling a 36% drop in comparison to the similar duration in 2023.The query now’s whether or not Tesla can regain misplaced momentum. Its maverick leader govt, Elon Musk seems to be pinning his hopes at the corporate turning into a pacesetter in car autonomy – a supplier of driverless robotic taxis.Ultimate month, on his social media web page X, he wrote: “No longer reasonably making a bet the corporate, however going balls to the wall for autonomy is a blindingly evident transfer. The entirety else is like permutations on a horse carriage”.Symbol supply, Getty ImagesImage caption, Elon Musk is making a bet on Tesla being the chief in driverless carsYet Musk has been speaking up the chance of complete autonomy a long time. In 2019, for instance, he promised that inside of a 12 months there could be 1,000,000 Teslas at the highway able to performing as robotaxis.The truth, thus far, is moderately other. Tesla’s “Complete Self Using” package deal stays moderately lower than its name suggests – it’s nonetheless a “arms on” device that calls for the motive force to be paying consideration all the time.The search for complete autonomy does have compatibility with Tesla’s id as a generation trade, moderately than a conventional carmaker. However Musk’s critics consider it’s merely a smokescreen to distract from different issues.In the meantime, Tesla has been slicing costs to spice up gross sales, and slicing prices and lowering headcount to support its margins. A lot as every other automotive corporate would possibly do.

Have the wheels come off for Tesla? – BBC Information

/cdn.vox-cdn.com/uploads/chorus_asset/file/25758299/2023738908.jpg)