Palantir (NYSE:PLTR) has noticed its inventory climb by means of 225% during the last yr, surroundings lofty expectancies forward of its income free up the day before today. Even supposing the large information analytics corporate reported robust enlargement for Q1, it used to be no longer sufficient to satisfy those heightened investor expectancies. In consequence, stocks plummeted by means of 15% nowadays.

The corporate, recognized for its AI-driven answers adapted for governments and firms, completed a report benefit of $106 million in Q1 – its perfect so far. Earnings for the quarter rose 21% year-over-year to $643.3 million, surpassing Wall Side road forecasts of $615.3 million. EPS matched analyst expectancies at $0.08.

Coming off its rising revenues, Palantir additionally raised its steering for the remainder of 2024. General revenues for FY2024 are actually projected to vary between $2.667 billion and $2.689 billion. Alternatively, those numbers fell in need of the $2.71 billion the Side road used to be in search of.

Slowing world gross sales, which fell by means of 3% from the former quarter, additionally scared off traders. In particular, dim potentialities for enlargement in Europe, which accounts for 16% of the corporate’s trade, negatively impacted the numbers.

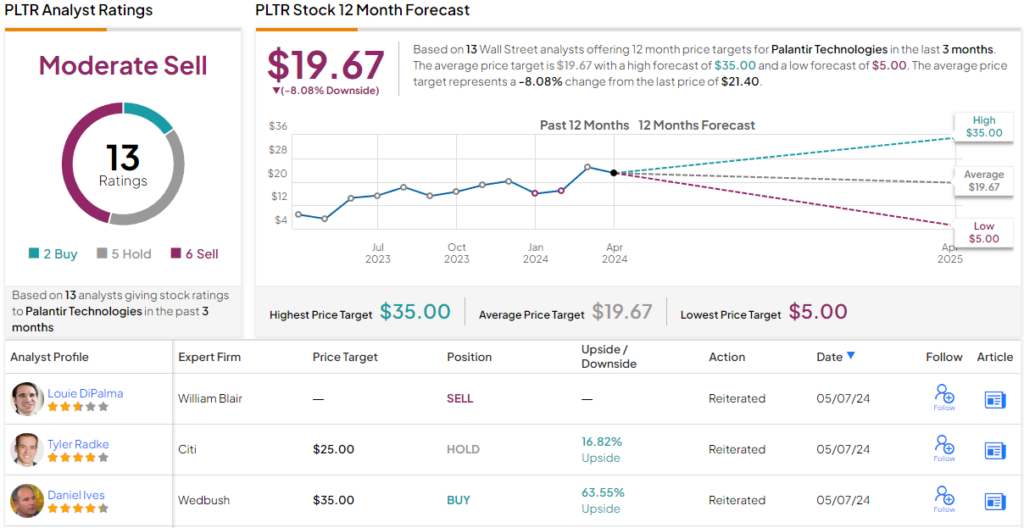

In gentle of those elements, what’s the next step for traders? Wedbush analyst Daniel Ives means that the new dip in inventory value would possibly provide a precious purchasing alternative for the ones having a look to put money into PLTR.

“We’re laser centered at the AI tale taking part in out with AIP (Synthetic Intelligence Platform) main the best way and Palantir delivered powerful numbers in this entrance once more,” writes Ives. In reality, the decrease inventory value items a “golden purchasing alternative for this natural play AI identify.”

Ives likes what he sees, particularly from Palantir’s rising cadre of shoppers and shortening gross sales cycles. With a complete buyer rely of 554 (up 42% year-on-year) and quicker conversion charges, the analyst positive concerning the corporate’s talent to maintain its enlargement trajectory.

“We proceed to look higher momentum within the PLTR enlargement tale with AIP main the fee in producing vital call for throughout each business and govt landscapes whilst wellpositioned to realize a bigger proportion of this $1 trillion alternative happening with AI use instances exploding globally,” Ives summed up.

No longer strangely, Ives charges PLTR stocks as an Outperform (i.e. Purchase), together with a $35 value goal, which represents ~64% upside doable for the following three hundred and sixty five days. (To look at Daniel Ives’ observe report, click on right here)

Alternatively, Ives’ colleagues aren’t fairly as upbeat. In line with 6 Sells, 5 Holds, and a couple of Buys, PLTR has a Reasonable Promote consensus score. At $19.67, the typical value goal implies an 8% problem from the present proportion value of $21.40. (See PLTR inventory forecast)

To search out excellent concepts for shares buying and selling at sexy valuations, discuss with TipRanks’ Perfect Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The evaluations expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions handiest. It is important to to do your individual research sooner than making any funding.