Bitcoin’s marketplace construction printed it used to be just about a re-accumulation zone.

A leap to $65,065 might be BTC’s goal as soon as the coin recovers.

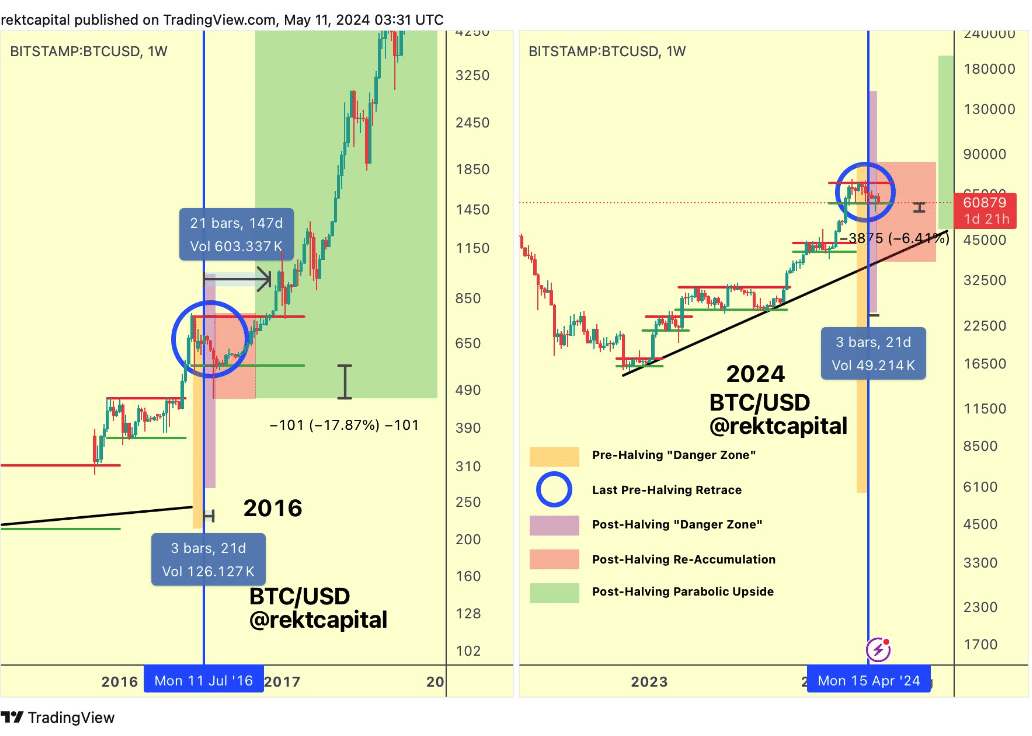

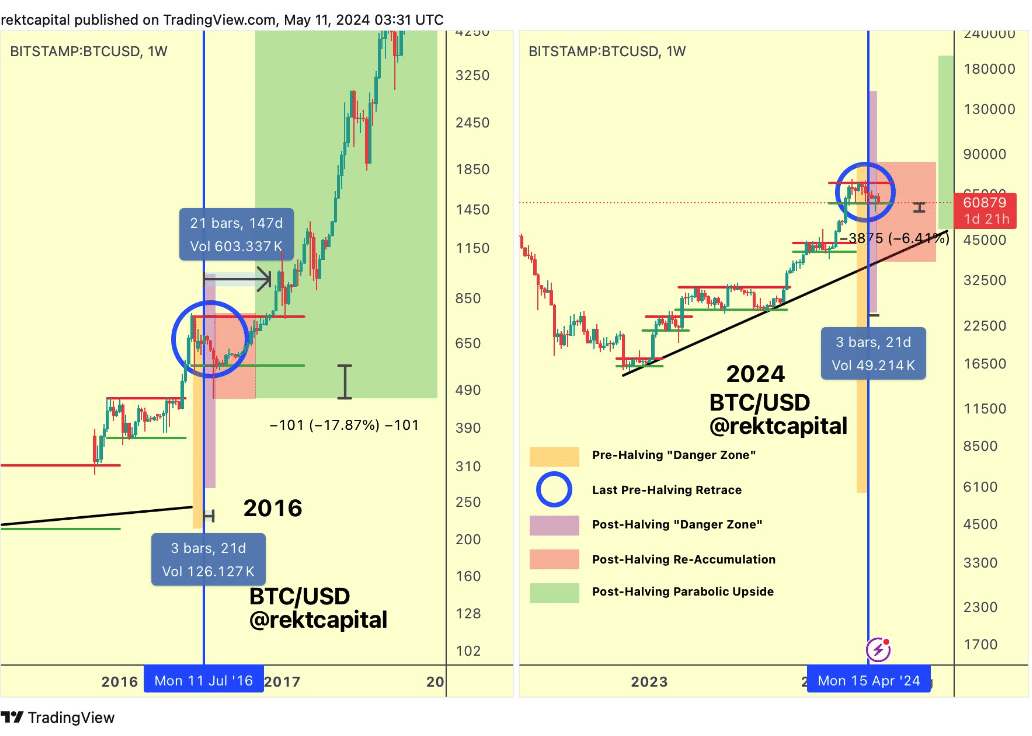

Consistent with crypto dealer Rekt Capital, Bitcoin [BTC] has left the chance zone and has reached the re-accumulation space. The analyst discussed this in a put up on X (previously Twitter) at the eleventh of Would possibly.

From the chart Rekt Capital shared, he defined how the coin has happy the post-halving correction, and in two days, Bitcoin may have left the chance space totally.

The purple days are nearly over

To again up his rationale, he referred to the 2016 post-having cycle. At the moment, 3 bearish engulfing candlesticks gave the impression inside of 21 days. In a while, BTC surged previous $4,250 inside of some months.

At the 2024 chart, any other set of purple candlesticks gave the impression, suggesting that Bitcoin’s correction might be just about its finish. At press time, Bitcoin’s value used to be $60,509.

Supply: Rekt Capital/X

Supply: Rekt Capital/X

This used to be a 5.61% lower within the closing seven days. Because of this plunge, many BTC contracts out there have been liquidated.

The use of information from Hyblock, AMBCrypto spotted that there used to be a magnetic zone round liquidation ranges. This indicator displays value ranges the place buyers possibility being liquidated.

The magnetic zone (blue) signifies a prime degree of liquidity and signifies that the cost may transfer in that route. For Bitcoin, the cost may transfer towards $65,065 within the quick time period.

This may occur provided that BTC bounces. Failure to opposite upwards may motive an additional value lower. Additionally, the CLLD, which is the Cumulative Liquidation Degree Delta (CLLD) used to be damaging.

Unfavorable values of the CLLD point out that quick are beginning to really feel extra of the liquidations. If sustained, this might be bullish for Bitcoin’s value.

Supply: Hyblock

Supply: Hyblock

HODLers are in at the go out

We additionally discovered proof of the prospective value build up from any other metric on Glassnode. The metric in query used to be the Hodler Internet Place Alternate.

Hodler Internet Place Alternate tracks the per month web place of long-term buyers. If the worth is damaging, it signifies that Bitcoin holders are figuring out beneficial properties, or cashing out on their property.

On the other hand, a good studying of the Hodler Internet Place Alternate implies accumulation. Up till the closing week of April, the metric used to be damaging, indicating that buyers have been reserving earnings.

However because the first week in Would possibly, that has modified. Particularly, long-term holders purchased 26,990 BTC at the tenth of Would possibly. Because it stands, this accumulation may proceed.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Maintaining this momentum may make sure that Bitcoin trades above $60,000 within the coming days. For the longer term, this might be instrumental for the parabolic upside.

Supply: Hyblock

Supply: Hyblock

On the other hand, buyers may wish to be cautious as BTC may drop additional. As Rekt Capital opined, Bitcoin may nonetheless have two extra days of problem ahead of the cost may start to upward thrust slowly.

Subsequent: XRP: Deciphering what’s subsequent – Do bulls nonetheless stand a possibility?