Quick-term holders started to amass huge quantities of BTC.

Whale accumulation of BTC bogged down.

Bitcoin [BTC] witnessed a large bump in value over the previous few days, inflicting a surge in optimism among investors. Nevertheless it wasn’t simply investors that had been appearing optimism round BTC.

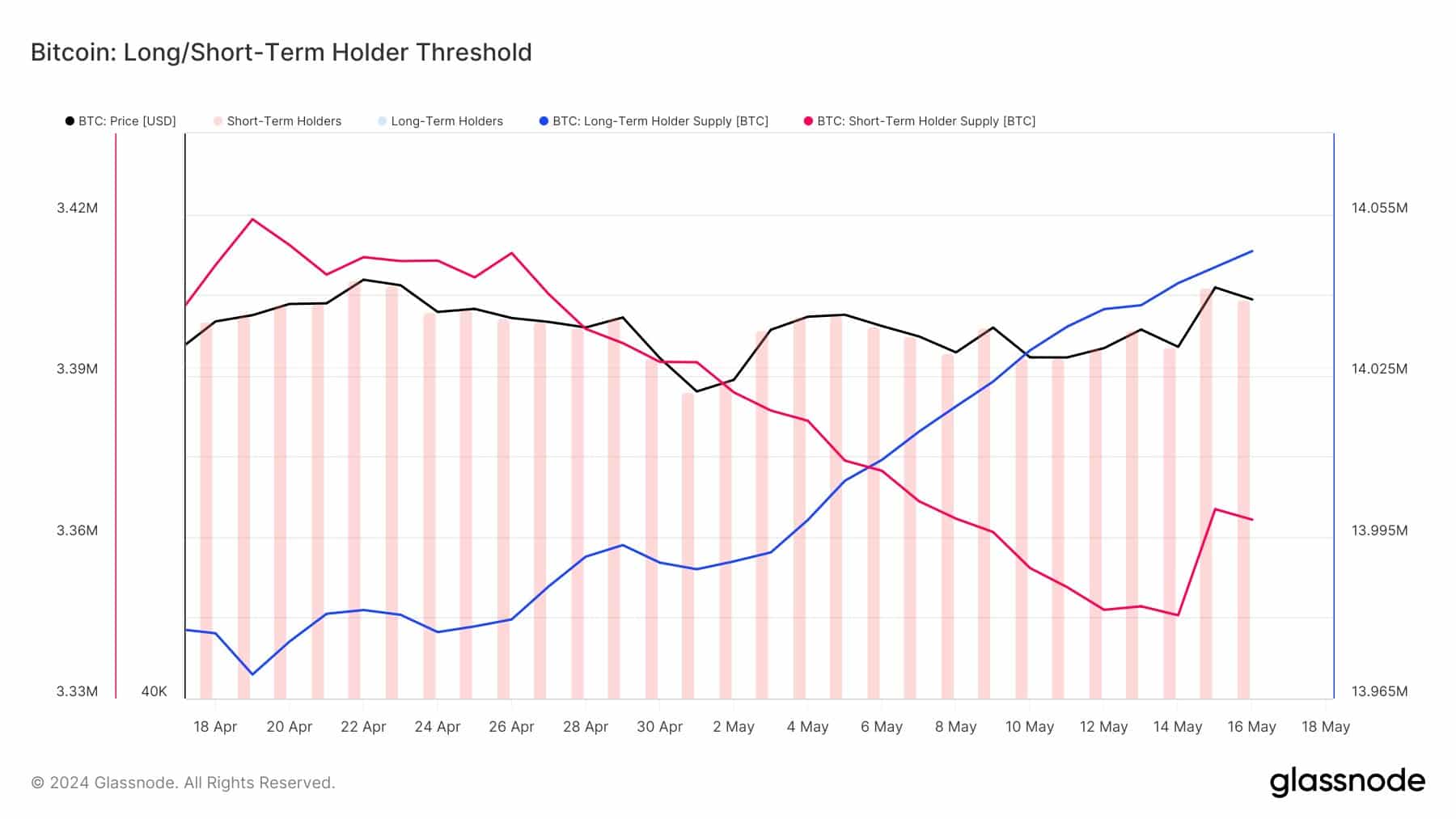

Quick time period holders transfer in

In the previous few days, the Quick Time period Holders (STH) provide noticed a internet build up of over 20,000 Bitcoin.

U.S. ETFs amassed 11,000 Bitcoin all the way through the similar duration, even if making an allowance for outflows from the Hong Kong ETFs. This urged vital call for from different assets, as mirrored in the fee motion.

This higher call for from STHs creates a good comments loop. As extra other people purchase in, the fee is going up, attracting much more patrons. It will boost up value will increase.

Alternatively, it’s necessary to keep in mind that STHs are usually much more likely to promote temporarily on value dips, doubtlessly main to raised volatility.

So, whilst STH accumulation is a good signal for Bitcoin’s momentary momentum, it would impact BTC’s longer term enlargement.

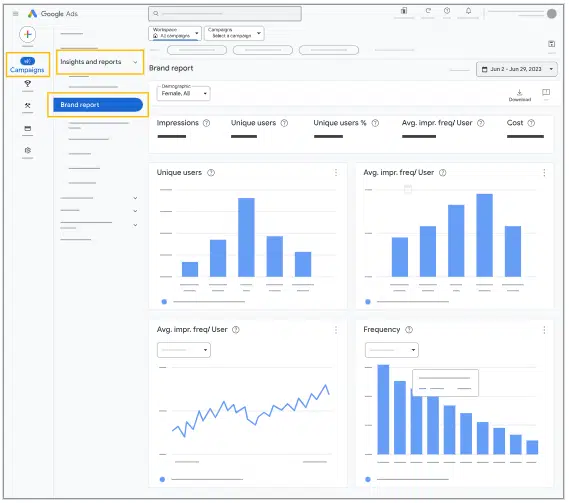

Supply: glassnode

Supply: glassnode

What are holders as much as?

Any other indicator of the emerging choice of Quick Time period Holders will be the declining Lengthy/Quick ratio. A falling lengthy/brief ratio urged that the choice of long-term holders amassing BTC had been declining.

Those long-term holders are much more likely to stay their holdings all the way through violent value fluctuations, which might additionally affect BTC negatively in the end.

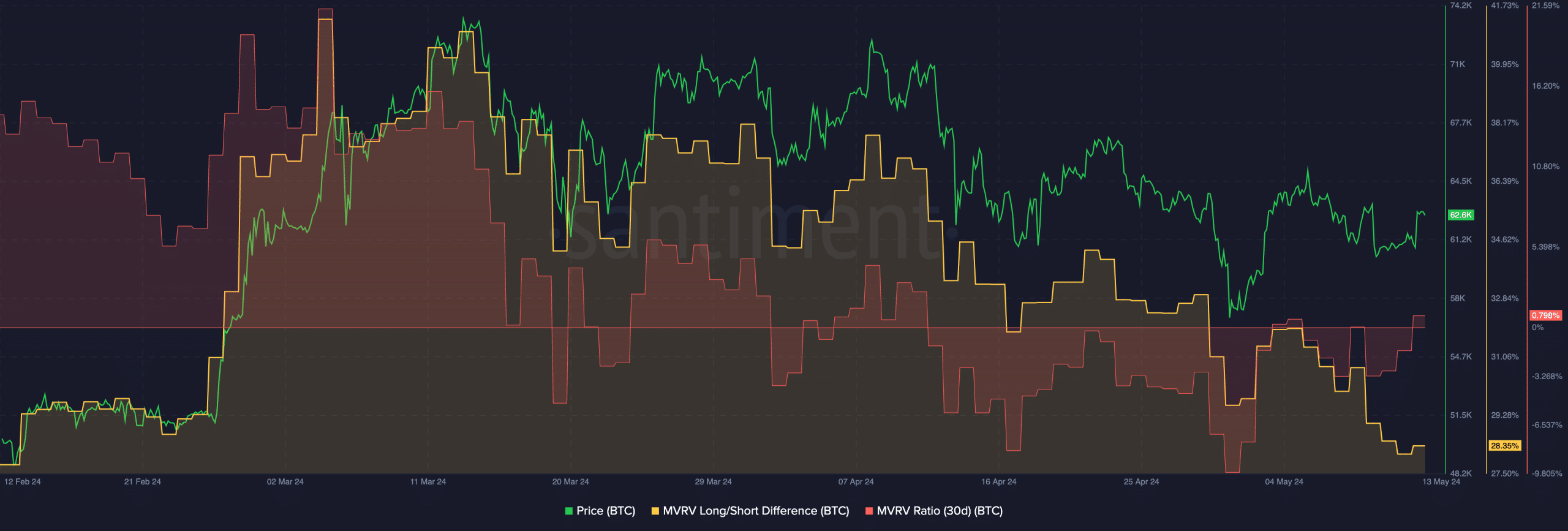

The MVRV ratio for BTC had surged in the previous few days, indicating that numerous addresses retaining BTC had grew to become successful.

This would upload promoting force on BTC, as STHs could also be incentivized to promote their holdings for benefit.

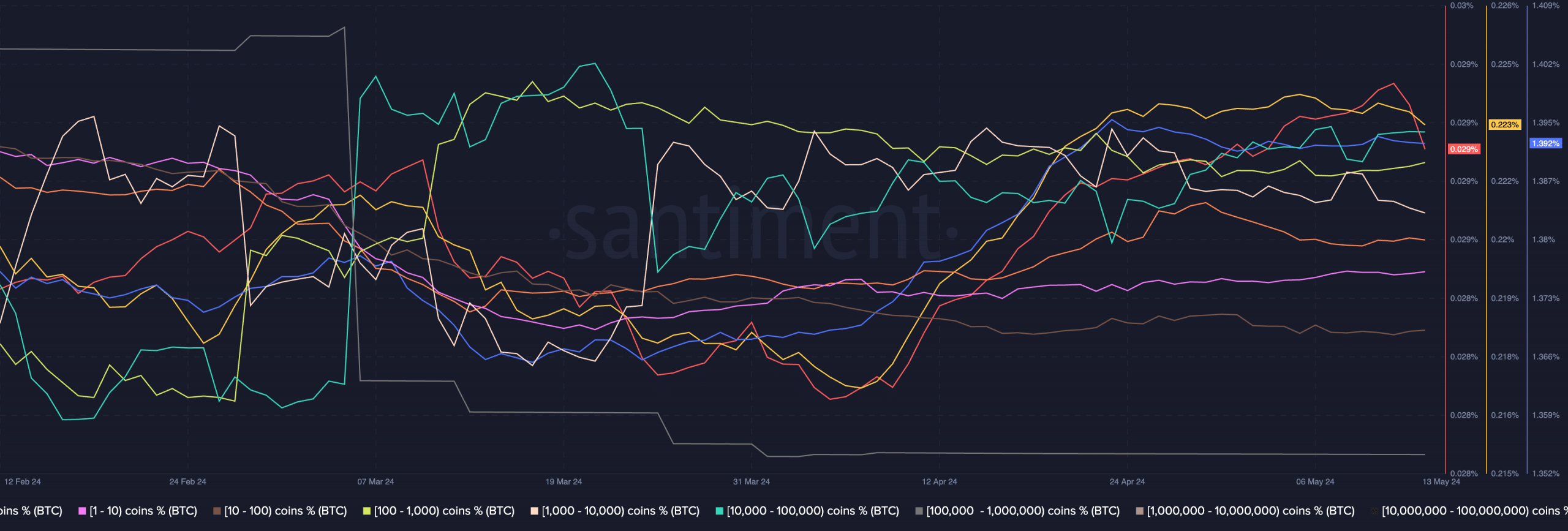

Supply: Santiment

Supply: Santiment

Whale habits would additionally play a really perfect function in figuring out the cost of BTC at some point. In the previous few days, whales were stagnant in the case of accumulation of BTC.

They’ve now not bought any in their holdings, however have proven no real interest in amassing BTC at this value degree.

Is your portfolio inexperienced? Take a look at the BTC Benefit Calculator

Retail investors, alternatively, were seen to shopping for Bitcoin en masse, which can have additionally contributed to the hot surge in BTC’s value.

On the time of writing, BTC was once buying and selling at $67,110.39 and its value had grown through 1.17% within the remaining 24 hours.

Supply: Santiment

Supply: Santiment