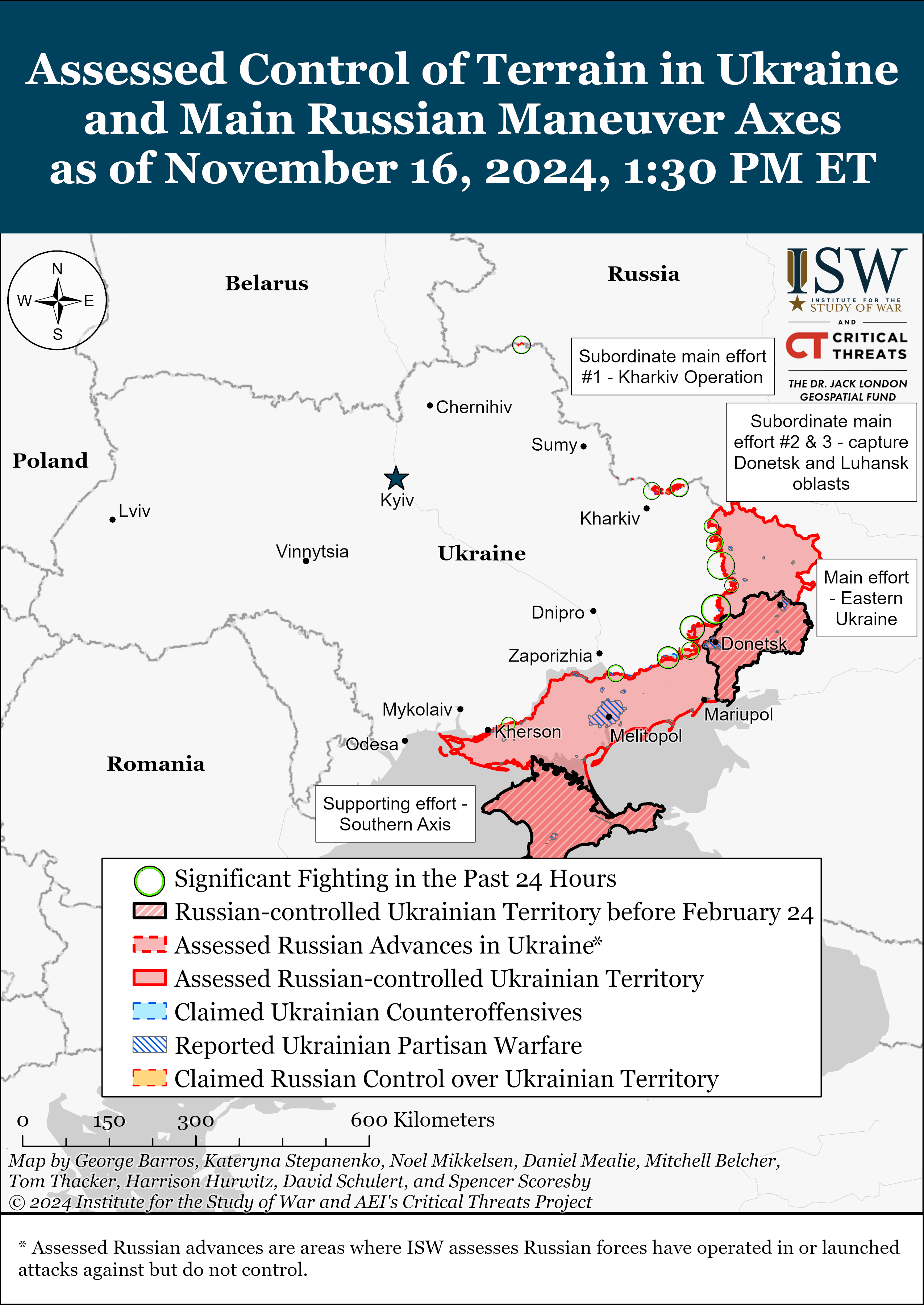

In spite of the large worth surge, BTC withdrawals from exchanges have been rather low.

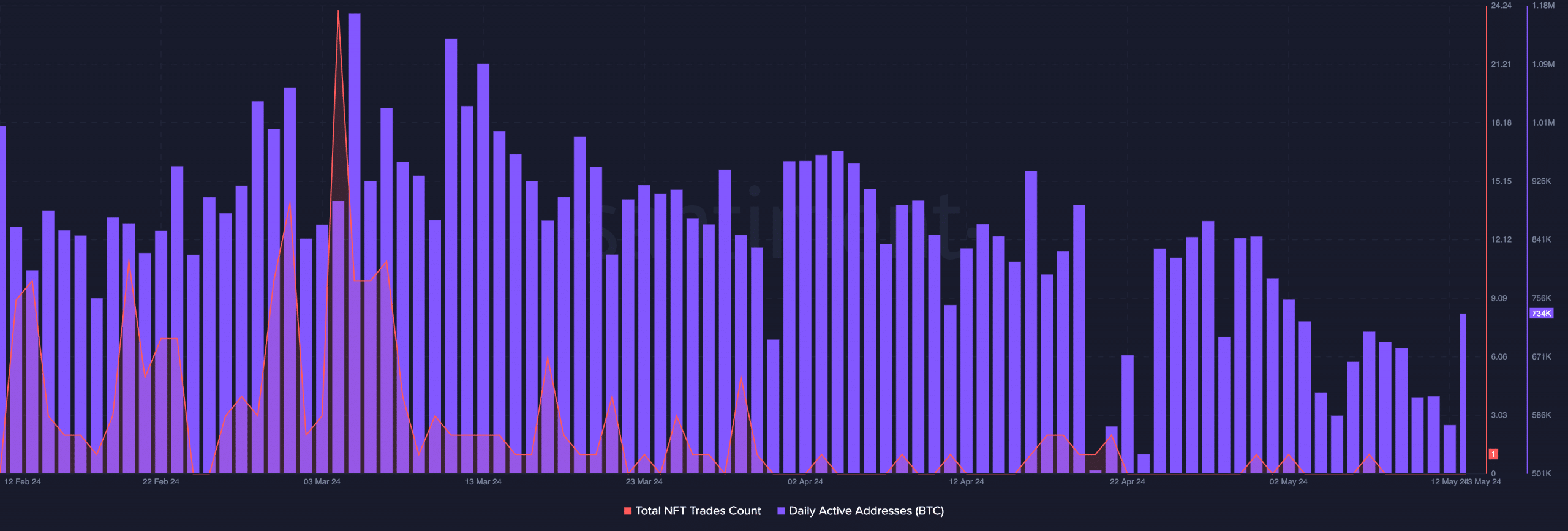

Task at the Bitcoin ecosystem persevered to say no.

Bitcoin [BTC] has observed an surprising surge in worth over the previous few days, which has impressed hope among buyers and holders. Because of the surge in optimism, addresses had been retaining on in your BTC.

Withdrawals decline

A minor withdrawal of Bitcoin came about the day prior to this, with 10,000 BTC leaving alternate wallets. The entire worth of the withdrawn Bitcoin is estimated to be round $630 million.

This sturdy call for for Bitcoin suggests a possible resurgence of passion within the cryptocurrency marketplace.

Analysts observe that the extent of constant call for for Bitcoin hasn’t been this prime since overdue 2020, marking an important shift in investor sentiment.

Supply: X

Supply: X

At press time, BTC was once buying and selling at $67,049.74 and its worth had declined by means of 0.74% within the remaining 24 hours. Maximum holders of BTC have been winning, as BTC was once simply $6,000 bucks clear of its all-time prime.

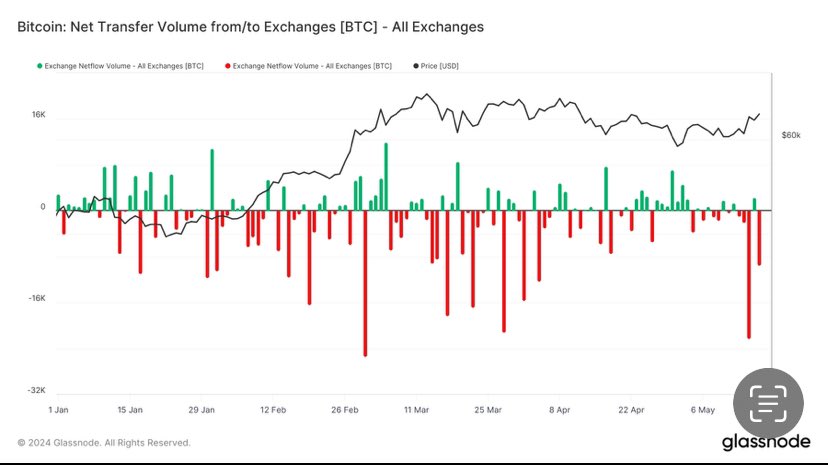

The speed at which BTC was once buying and selling at had declined. This supposed that the frequency at which BTC was once buying and selling at had declined.

Even if this will also be perceived as a unfavourable signal for BTC, a declining speed additionally supposed that a large number of addresses have been retaining onto their Bitcoin and have been refusing to promote.

Moreover, the full selection of holders of BTC has additionally surged, indicating that numerous addresses have accrued vital quantities of BTC.

Coupled with the emerging selection of holders, there was once an reverse development observed in miner holdings. AMBCrypto’s research of Santiment’s knowledge printed that the availability held by means of miners had considerably fallen.

This would turn out to be certain for BTC ultimately. If miners fail to generate prime quantities of charges, it turns into tough for them to stay winning.

To stay their trade sustainable, they from time to time hotel to promoting their holdings, which finally ends up including promoting power to BTC.

A decrease provide of BTC held by means of miners implies that those sections of holders would have much less of an affect on the cost of BTC going ahead.

Supply: Santiment

Supply: Santiment

Is your portfolio inexperienced? Take a look at the BTC Benefit Calculator

Task at the decline

One of the vital explanation why miners fail to generate charges is because of inactiveness at the community. Over the previous few weeks, the selection of day-to-day lively addresses at the Bitcoin community had fallen.

Coupled with that, the selection of NFTs being traded at the community additionally declined. This steered a waning passion in Bitcoin’s ecosystem.

Supply: Santiment

Supply: Santiment