The tech-heavy Nasdaq Composite (^IXIC) and benchmark S&P 500 (^GSPC) rose on Monday, with US shares eyeing an upbeat begin to June as hopes for charge cuts revive and the meme-stock mania roars again.The Nasdaq and S&P rose about 0.8% and zero.4%, respectively, as Nvidia (NVDA) stocks popped at the heels of an AI chip replace. The Dow Jones Commercial Moderate (^DJI) hovered across the flatline.A surge in GameStop (GME) stocks grabbed the highlight, firing up hypothesis once more of a go back to a 2021-style meme rally. The inventory skyrocketed over 100% at one level in early buying and selling after a Reddit put up it sounds as if via Keith Gill — AKA “Roaring Kitty” — confirmed a large wager via the influential dealer. Fellow meme darling AMC’s (AMC) stocks shot up up to 27% along the transfer.Stocks of GME, which have been in short halted for volatility, pared beneficial properties to about 50% in a while after the outlet bell.Total, shares are on the right track to construct on their robust efficiency in Would possibly, which noticed all 3 main gauges smash data all through the month. The temper has became extra certain after PCE information gave hope that inflation has became a nook, prompting optimism that the Federal Reserve will glance extra kindly on a reduce to borrowing prices.Learn extra: How does the exertions marketplace have an effect on inflation?For the reason that, the Would possibly jobs record and different exertions prints later this week will check investor sentiment at the Fed’s trail. Buyers have stepped up bets on a Fed reduce in September when put next with per week in the past, in keeping with the CME FedWatch instrument.In the meantime, beneficial properties for Nvidia at a comeback for the AI enthusiasm that has lifted techs. Stocks rose about 4% in a while after the open after the chipmaker unveiled a brand new AI platform and promised to boost up the tempo of fashion upgrades. Rival AMD’s (AMD) inventory additionally tipped upper along the discharge of its personal new AI line-up and construction plans.Live7 updates Mon, June 3, 2024 at 7:07 AM PDTISM record displays additional contracting in production activityFresh information out Monday confirmed a combined studying on job within the production sector in Would possibly.The Institute for Provide Control’s production PMI indicated the producing sector moved additional into contraction in Would possibly, whilst a measure from S&P International confirmed production job higher greater than first of all idea in Would possibly.The ISM’s production PMI registered a studying of 48.7 in Would possibly, down from a studying of 49.2 and less than the 49.5 economists anticipated, in keeping with Bloomberg information.”US production job persisted in contraction after rising in March, the primary growth for the sphere since September 2022,” Timothy Fiore, chair of the ISM’s production trade survey committee, stated within the corporate’s liberate. “Call for used to be comfortable once more, output used to be solid, and inputs stayed accommodative.”Fiore added: “Call for stays elusive as corporations exhibit an unwillingness to take a position because of present financial coverage and different stipulations.”S&P International’s personal production PMI studying out Monday confirmed US production job hit a studying of 51.3, up from a previous studying of fifty.9 whilst new orders within the sector returned to enlargement.

Mon, June 3, 2024 at 7:07 AM PDTISM record displays additional contracting in production activityFresh information out Monday confirmed a combined studying on job within the production sector in Would possibly.The Institute for Provide Control’s production PMI indicated the producing sector moved additional into contraction in Would possibly, whilst a measure from S&P International confirmed production job higher greater than first of all idea in Would possibly.The ISM’s production PMI registered a studying of 48.7 in Would possibly, down from a studying of 49.2 and less than the 49.5 economists anticipated, in keeping with Bloomberg information.”US production job persisted in contraction after rising in March, the primary growth for the sphere since September 2022,” Timothy Fiore, chair of the ISM’s production trade survey committee, stated within the corporate’s liberate. “Call for used to be comfortable once more, output used to be solid, and inputs stayed accommodative.”Fiore added: “Call for stays elusive as corporations exhibit an unwillingness to take a position because of present financial coverage and different stipulations.”S&P International’s personal production PMI studying out Monday confirmed US production job hit a studying of 51.3, up from a previous studying of fifty.9 whilst new orders within the sector returned to enlargement. Mon, June 3, 2024 at 6:32 AM PDTNasdaq, S&P 500 upward push on the open Markets opened most commonly upper on Monday to kick off the primary buying and selling day of June.The tech-heavy Nasdaq Composite (^IXIC) and benchmark S&P 500 (^GSPC) rose about 0.8% and zero.4%, respectively, whilst the Dow Jones Commercial Moderate (^DJI) hovered across the flatline.A surge in GameStop (GME) stocks grabbed the highlight, firing up hypothesis once more of a go back to a 2021-style meme rally. Stocks of GME have been halted for volatility after mountaineering about 64% upper in a while after the outlet bell.

Mon, June 3, 2024 at 6:32 AM PDTNasdaq, S&P 500 upward push on the open Markets opened most commonly upper on Monday to kick off the primary buying and selling day of June.The tech-heavy Nasdaq Composite (^IXIC) and benchmark S&P 500 (^GSPC) rose about 0.8% and zero.4%, respectively, whilst the Dow Jones Commercial Moderate (^DJI) hovered across the flatline.A surge in GameStop (GME) stocks grabbed the highlight, firing up hypothesis once more of a go back to a 2021-style meme rally. Stocks of GME have been halted for volatility after mountaineering about 64% upper in a while after the outlet bell. Mon, June 3, 2024 at 4:52 AM PDTFord CEO to Yahoo Finance on EV profitsFord (F) CEO Jim Farley informed me in a brand new episode of Yahoo Finance’s ‘Opening Bid’ podcast that he has a date in thoughts when Ford will earn cash from EVs.However he did not need to percentage it with me all through a sit-down in Detroit! Ford is slated to lose about $5 billion in its EV department this yr.I did admire although that Farley is enthusiastic about working a winning EV trade, and that comes with streamlining prices and pulling again on competitive EV plant buildout timelines.You’ll be able to watch the total episode under, or concentrate in in all main podcast platforms equivalent to Spotify, Apple, Amazon, Pandora and iHeartmedia.

Mon, June 3, 2024 at 4:52 AM PDTFord CEO to Yahoo Finance on EV profitsFord (F) CEO Jim Farley informed me in a brand new episode of Yahoo Finance’s ‘Opening Bid’ podcast that he has a date in thoughts when Ford will earn cash from EVs.However he did not need to percentage it with me all through a sit-down in Detroit! Ford is slated to lose about $5 billion in its EV department this yr.I did admire although that Farley is enthusiastic about working a winning EV trade, and that comes with streamlining prices and pulling again on competitive EV plant buildout timelines.You’ll be able to watch the total episode under, or concentrate in in all main podcast platforms equivalent to Spotify, Apple, Amazon, Pandora and iHeartmedia. Mon, June 3, 2024 at 2:42 AM PDTNvidia helps to keep on rolling sentiment wiseNvidia (NVDA) stocks are getting a three% pop pre-market after any other well-received presentation from founder Jensen Huang, this time at Computex in Taipei.An important factor used to be Nvidia unveiling its subsequent era of AI chips dubbed Rubin. That is spectacular stuff, as Nvidia simply introduced new AI chips in March.”Internet-net, we view all 4 bulletins as nice depiction of Nvidia’s efforts to lean on its present AI accelerator dominance to ascertain a powerful presence in what’s for the corporate a most commonly untapped blended speeded up computing general addressable marketplace of $1 trillion plus going from AI networking to the in large part CPU-centered server marketplace,” Citi analyst Atik Malik stated in a consumer notice.Unsurprisingly, Malik maintained a purchase score on Nvidia stocks.Atone for Nvidia by the use of Yahoo Finance’s contemporary unique interview with Huang.

Mon, June 3, 2024 at 2:42 AM PDTNvidia helps to keep on rolling sentiment wiseNvidia (NVDA) stocks are getting a three% pop pre-market after any other well-received presentation from founder Jensen Huang, this time at Computex in Taipei.An important factor used to be Nvidia unveiling its subsequent era of AI chips dubbed Rubin. That is spectacular stuff, as Nvidia simply introduced new AI chips in March.”Internet-net, we view all 4 bulletins as nice depiction of Nvidia’s efforts to lean on its present AI accelerator dominance to ascertain a powerful presence in what’s for the corporate a most commonly untapped blended speeded up computing general addressable marketplace of $1 trillion plus going from AI networking to the in large part CPU-centered server marketplace,” Citi analyst Atik Malik stated in a consumer notice.Unsurprisingly, Malik maintained a purchase score on Nvidia stocks.Atone for Nvidia by the use of Yahoo Finance’s contemporary unique interview with Huang. Mon, June 3, 2024 at 2:33 AM PDTThe vibe round device shares after Salesforce shockerSalesforce (CRM) profits ultimate week actually left a foul style within the mouth of tech bulls.Such a lot so that they voiced their issues at a intently watched Jefferies tech convention in Newport Seashore past due ultimate week.Listed below are a pair key takeaways from Jefferies tech analyst Brent Thill:”Macro headwinds persist. Investor sentiment within the device house stays unfavourable as corporations name out the harsh macro atmosphere. The weak point used to be broad-based throughout front-office, back-office, huge enterprises, and small companies. Workday (WDAY) and Salesforce each highlighted susceptible enlargement in EMEA.””AI crowding out. In spite of the long-term trade tailwinds surrounding AI, investor issues surrounded near-term funds shifts clear of device as corporations center of attention on semis and {hardware}.”

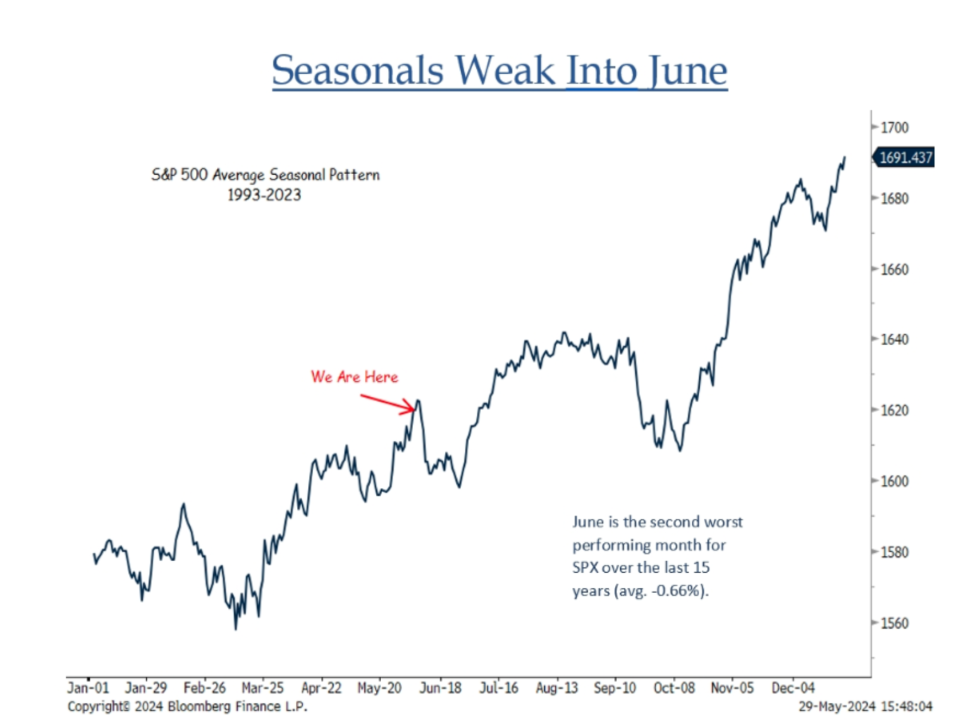

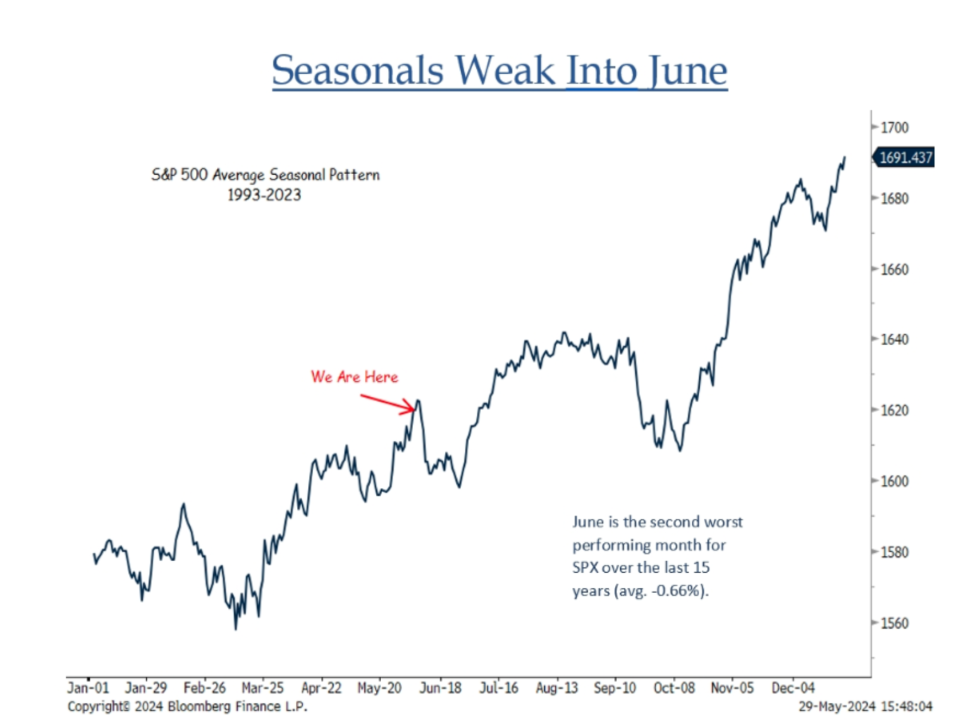

Mon, June 3, 2024 at 2:33 AM PDTThe vibe round device shares after Salesforce shockerSalesforce (CRM) profits ultimate week actually left a foul style within the mouth of tech bulls.Such a lot so that they voiced their issues at a intently watched Jefferies tech convention in Newport Seashore past due ultimate week.Listed below are a pair key takeaways from Jefferies tech analyst Brent Thill:”Macro headwinds persist. Investor sentiment within the device house stays unfavourable as corporations name out the harsh macro atmosphere. The weak point used to be broad-based throughout front-office, back-office, huge enterprises, and small companies. Workday (WDAY) and Salesforce each highlighted susceptible enlargement in EMEA.””AI crowding out. In spite of the long-term trade tailwinds surrounding AI, investor issues surrounded near-term funds shifts clear of device as corporations center of attention on semis and {hardware}.” Mon, June 3, 2024 at 2:25 AM PDTReminder on June for stocksJune is the second one worst-performing month of the yr for the S&P 500 the ultimate 15-years.Useful chart from BTIG this morning.

Mon, June 3, 2024 at 2:25 AM PDTReminder on June for stocksJune is the second one worst-performing month of the yr for the S&P 500 the ultimate 15-years.Useful chart from BTIG this morning.

June is incessantly a difficult length for markets. (BTIG)

June is incessantly a difficult length for markets. (BTIG) Mon, June 3, 2024 at 2:21 AM PDTGameStop explodesAnd so begins the week….GameStop (GME) stocks are up 85% pre-market (have been up up to 103%) as meme overlord Keith Gill perceived to divulge a $116 million place within the online game store on Reddit. It used to be his first put up in 3 years.Notice the put up could not be verified, very similar to one constructed from his X account a pair weeks in the past.All I will be able to say is watch out with this one!If the rest, the actual play is to do a little analysis on is Reddit (RDDT) given the heightened job at the platform. Get started your fact-finding undertaking right here.

Mon, June 3, 2024 at 2:21 AM PDTGameStop explodesAnd so begins the week….GameStop (GME) stocks are up 85% pre-market (have been up up to 103%) as meme overlord Keith Gill perceived to divulge a $116 million place within the online game store on Reddit. It used to be his first put up in 3 years.Notice the put up could not be verified, very similar to one constructed from his X account a pair weeks in the past.All I will be able to say is watch out with this one!If the rest, the actual play is to do a little analysis on is Reddit (RDDT) given the heightened job at the platform. Get started your fact-finding undertaking right here.

June is incessantly a difficult length for markets. (BTIG)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25752946/1183652392.jpg)