Despite the fact that previous inflows had been value billions, the ETF registered a web outflow at the tenth of June.

Lengthy-term holders had been cashing out, suggesting an extra decline for BTC.

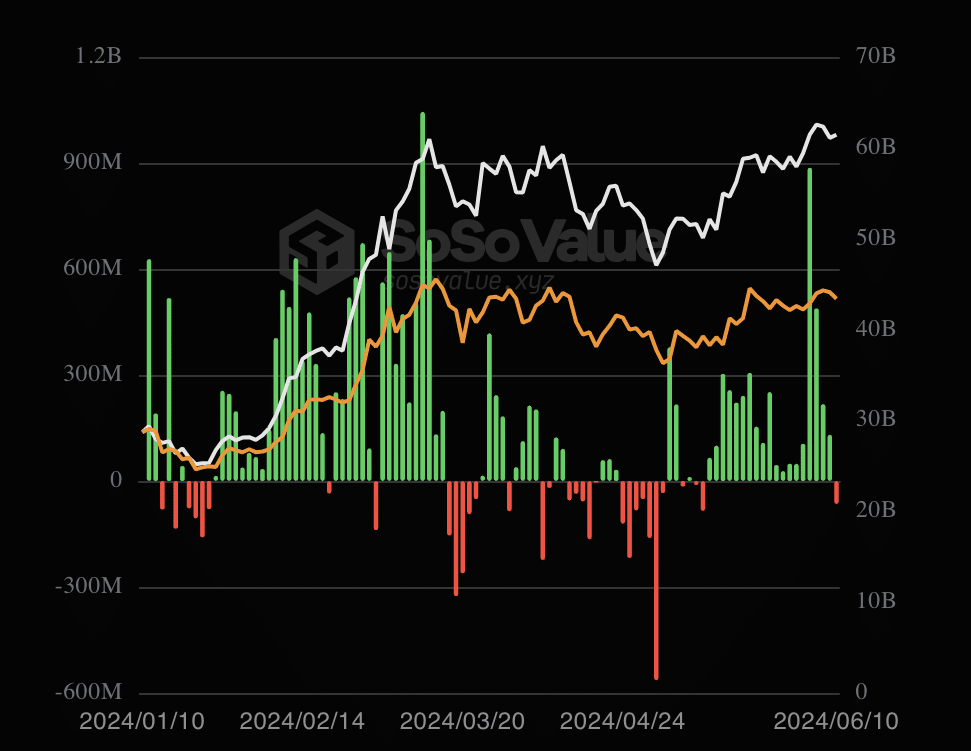

Bitcoin [BTC] ETFs have registered 19 consecutive days of inflows after enduring outflows for an extended duration. Led via BlackRock Bitcoin ETF, the inflows were value nearly $3 billion in the previous couple of weeks.

As an example, at the tenth of June, BlackRock recorded an influx of $6.34 million. Bitwise’s IBIT had $7.59 million. On the other hand, the tides appear to have modified as Grayscale’s GBTC had the next outflow at$39.53 million.

On account of GBTC’s report, the full outflow was once upper than the influx. For the unaccustomed, a Bitcoin ETF isn’t the similar as BTC, the cryptocurrency.

Supply: Soso Worth

Supply: Soso Worth

The outflows are taking the highest spot

For Bitcoin ETFs, you don’t want to personal Bitcoin. As an alternative, you simplest want to have publicity to the cryptocurrency as the cost have an effect on the Internet Asset Worth of the ETF.

Within the first quarter (Q1) of 2024, the property, led via BlackRock Bitcoin ETF, recorded billions of greenbacks in inflows on a number of days. On account of this, the cost of the coin rallied to a brand new all-time prime in March.

In a while, the cash stopped coming in, thereby, main Bitcoin to slide beneath $60,000 at one level. However the resurgence in the previous couple of weeks ensured that BTC’s correction bogged down.

Additionally, it was once throughout the similar duration that BlackRock Bitcoin ETF hit $20 billion in AUM. AUM stands for Property Beneath Control. The AUM displays the influx and outflow of a fund, and the cost efficiency of the property.

On the other hand, with the new build up in outflows, Bitcoin’s worth may well be heading for a decline. At press time, BTC modified palms at $67,539. This represents a 2.63% lower within the final 24 hours.

Will BTC slip beneath $67,000?

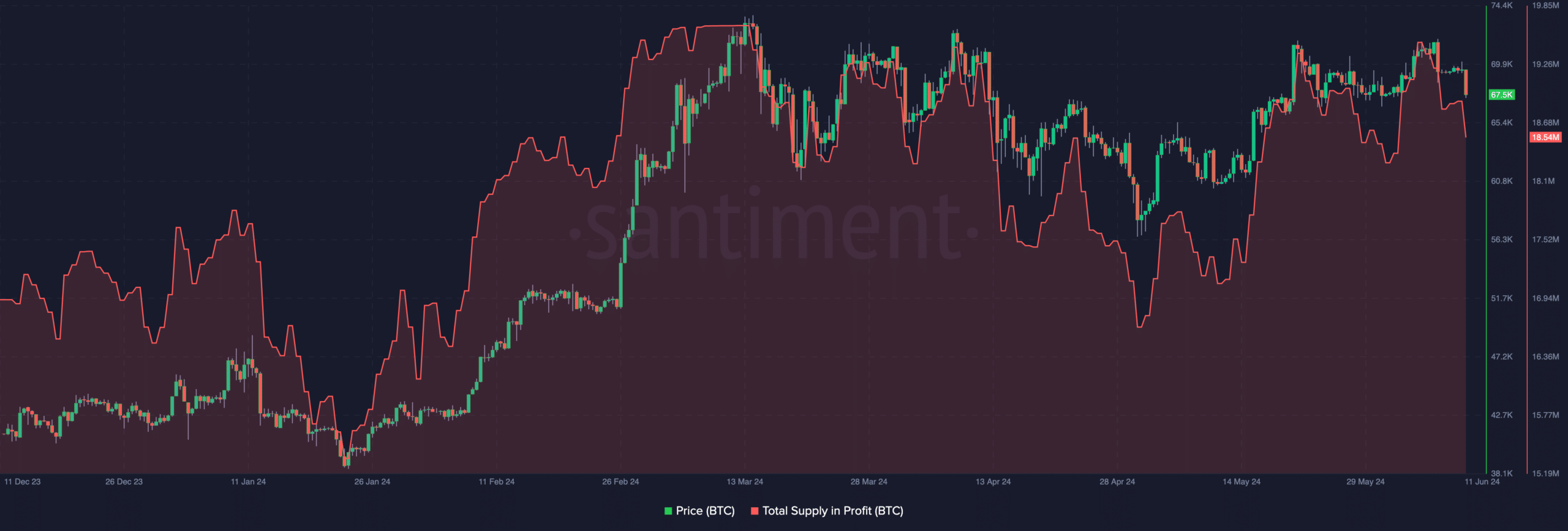

On account of this, the full provide in benefit dropped. In step with Santiment, Bitcoin’s general provide in benefit has declined to 18.54 million from a ceiling of nineteen.64 million.

Will have to Bitcoin worth proceed to drop, the provision in benefit may also head downwards. On the other hand, a decrease benefit provide generally is a likelihood for marketplace individuals to shop for the coin at a cut price.

Supply: Santiment

Supply: Santiment

If this purchase sign seems, Bitcoin would possibly rebound towards $70,000 within the quick time period. On the other hand, if promoting force continues, the cost of BTC may just lower to $65,000.

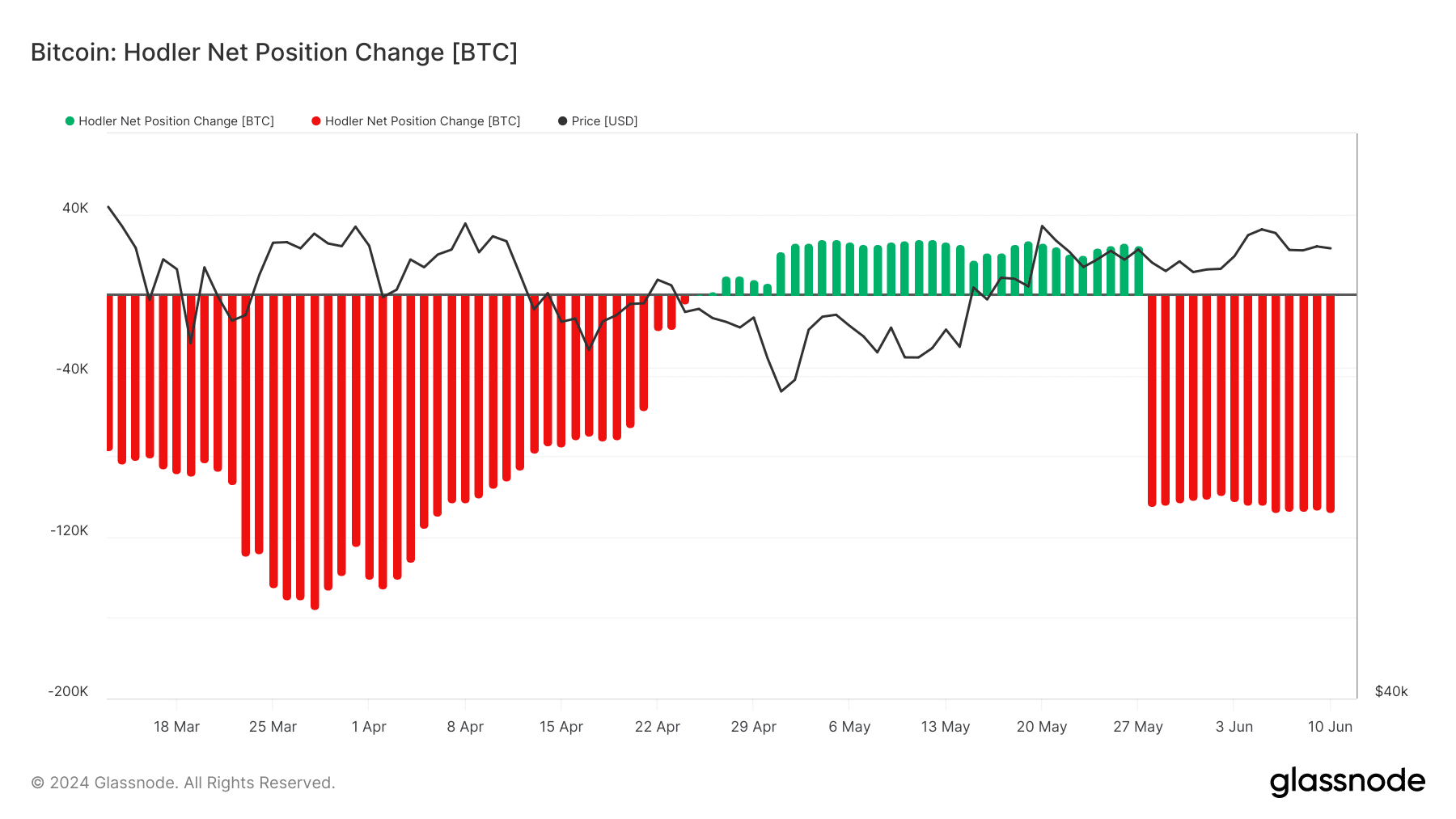

With the exception of BlackRock Bitcoin ETF and the metric above, AMBCrypto checked out a a very powerful indicator. The metric thought to be was once the Hodler Internet Place Trade.

A good studying of this indicator recommend that long-term holders are gathering. However, a detrimental worth implies an build up in Bitcoin cashed out.

Supply: Glassnode

Supply: Glassnode

Is your portfolio inexperienced? Test the Bitcoin Benefit Calculator

In step with Glassnode, Bitcoin’s Hodler Internet Place Trade was once -107.211 BTC. This means that HODLers were reserving earnings.

As such, Bitcoin’s worth may just lower somewhat than rebound. On the other hand, the bearish bias might be invalidated if accumulation begins to return in huge numbers.