MATIC faces robust resistance, suffering to take care of ranges above $0.75.

Bearish sentiment prevails as MATIC traded beneath the Ichimoku cloud and all 3 transferring averages.

Polygon [MATIC] was once dealing with robust resistance at press time, with bearish sentiment successful over the marketplace bulls.

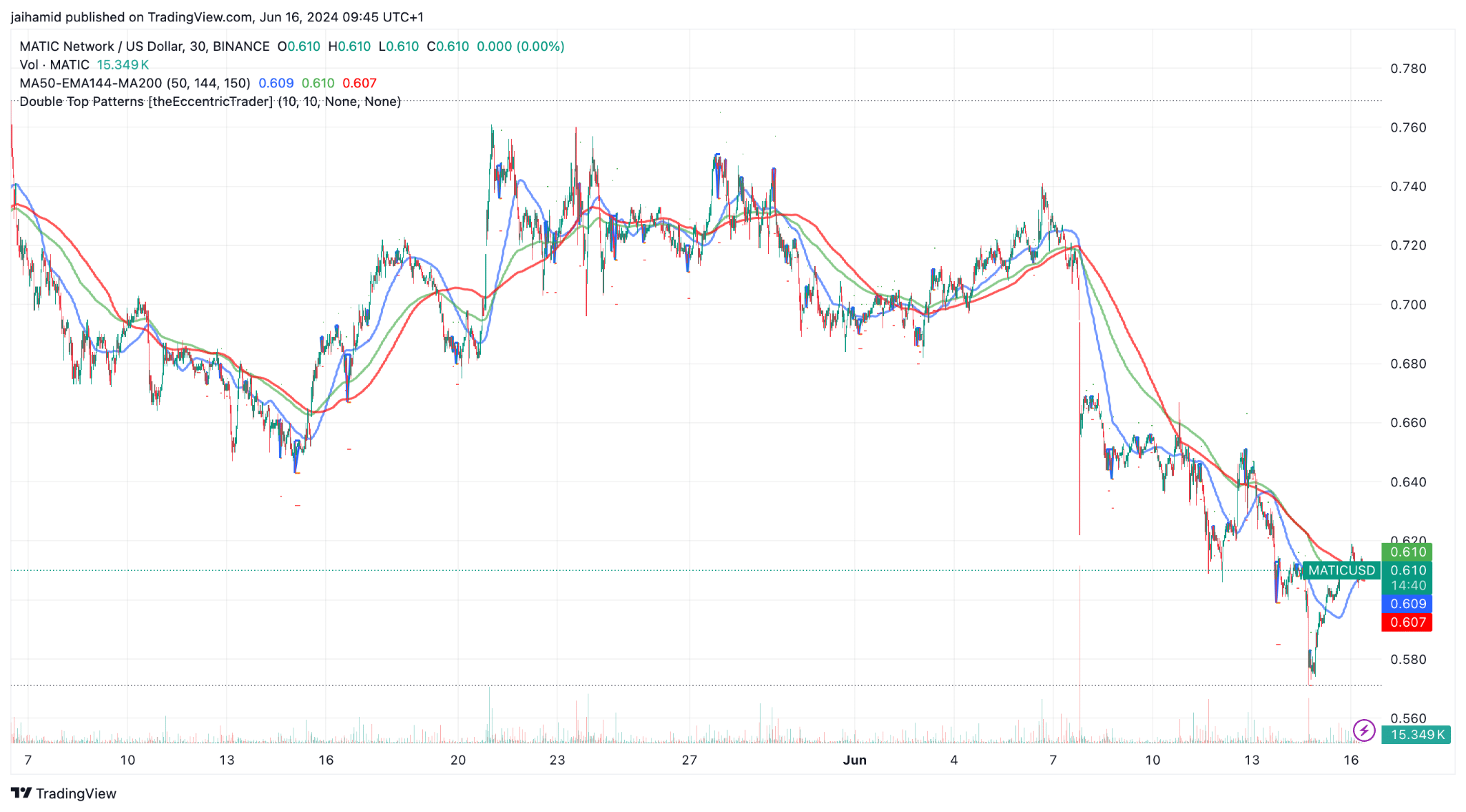

During the last 30 days, Polygon’s worth has struggled to stick above $0.75, experiencing a downtrend that has noticed its price drop to $0.61 at press time.

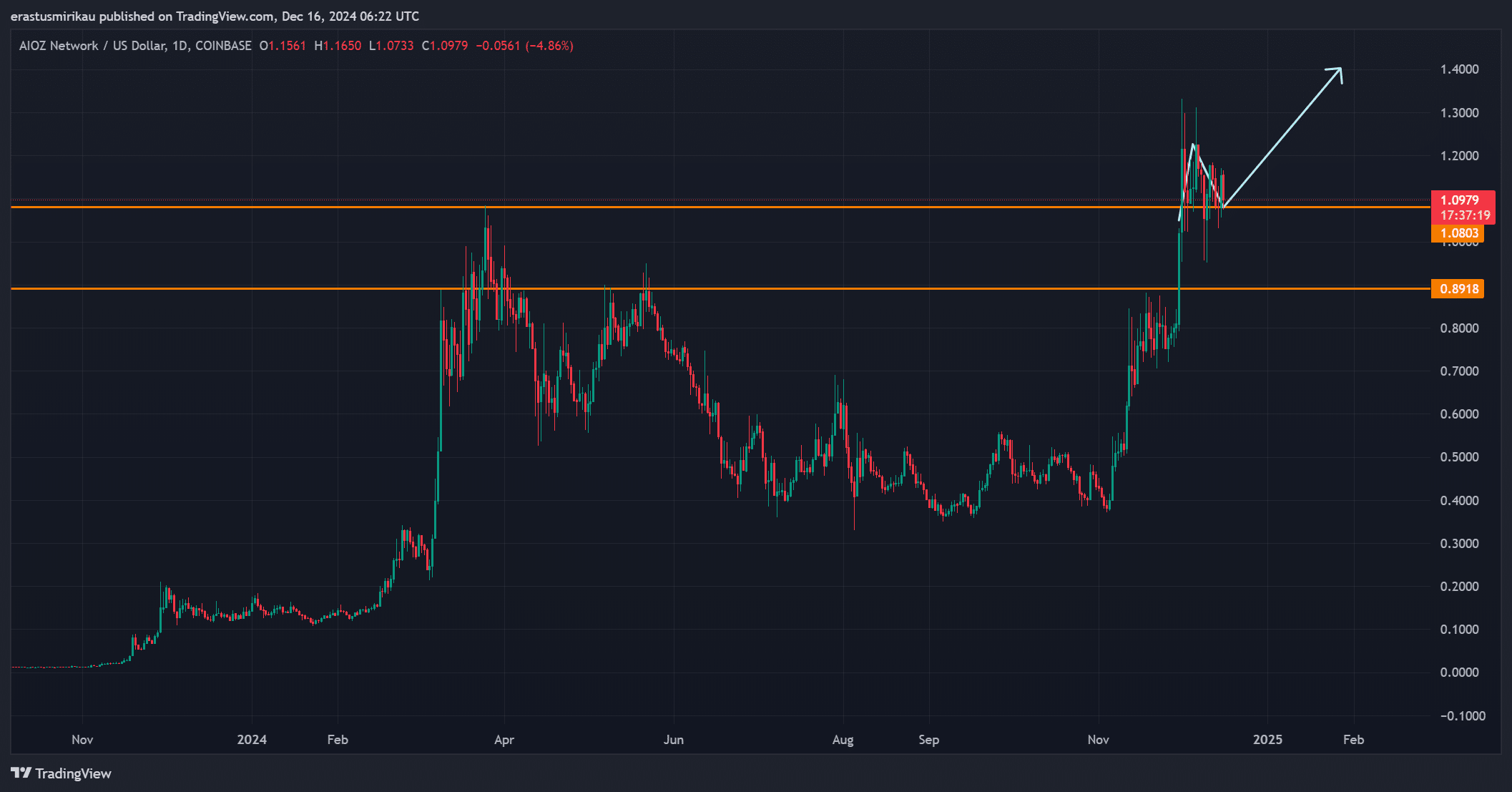

The chart beneath presentations more than one cases of MATIC making an attempt to breach resistance ranges marked at durations from $0.66 to $0.75.

Regardless of those efforts, each and every rally was once met with a pointy reversal, indicating robust bearish drive at those upper worth issues.

Supply: TradingView

Supply: TradingView

At the problem, MATIC has established transparent reinforce across the $0.57 and $0.61 marks. Those reinforce ranges are spaces the place consumers have traditionally stepped in, fighting additional declines.

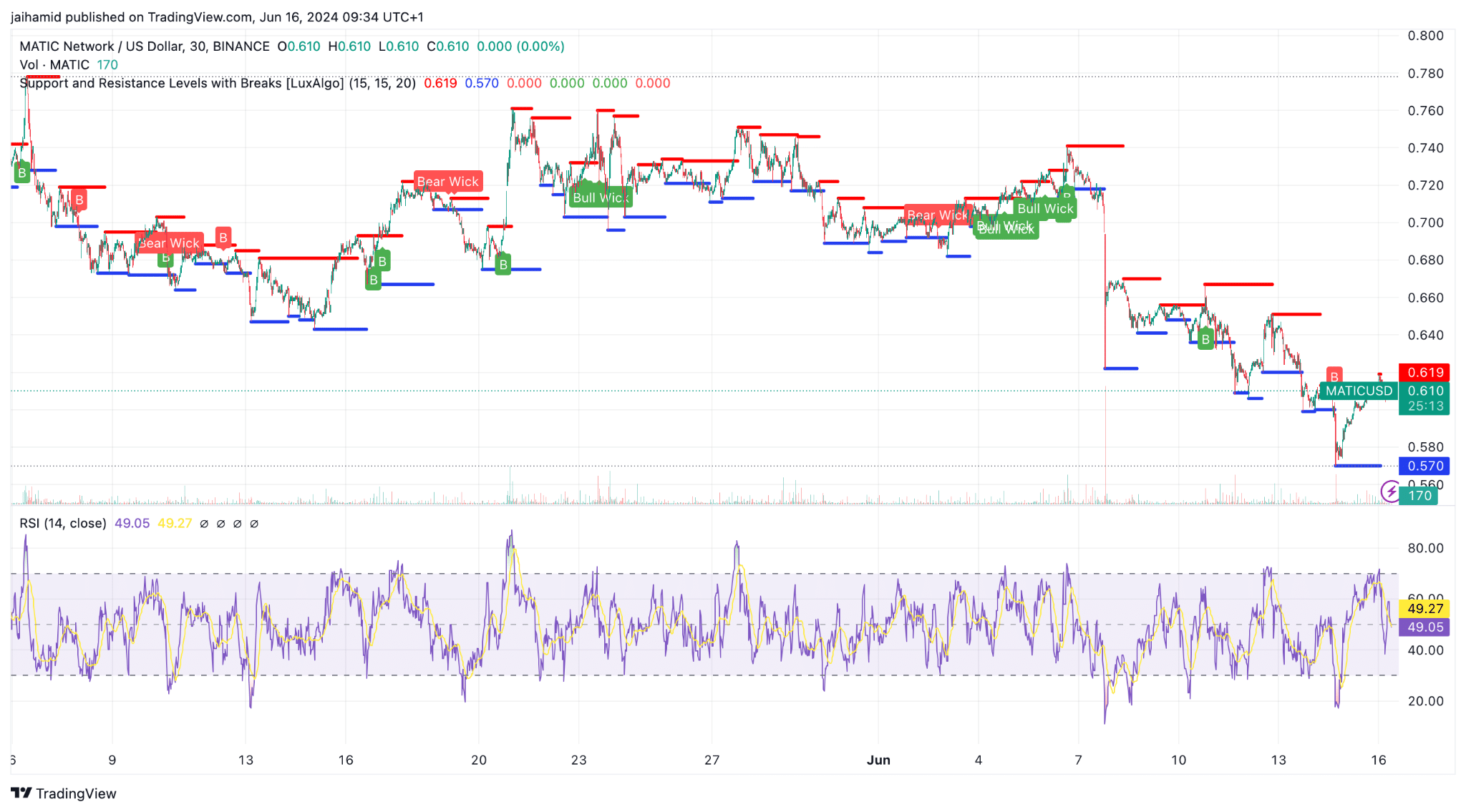

The RSI has fluctuated across the 50 mark, indicating a stability between purchasing and promoting pressures.

Then again, it hasn’t ventured into overbought territory (above 70), which aligns with the loss of sustained upward momentum in the associated fee.

Supply: TradingView

Supply: TradingView

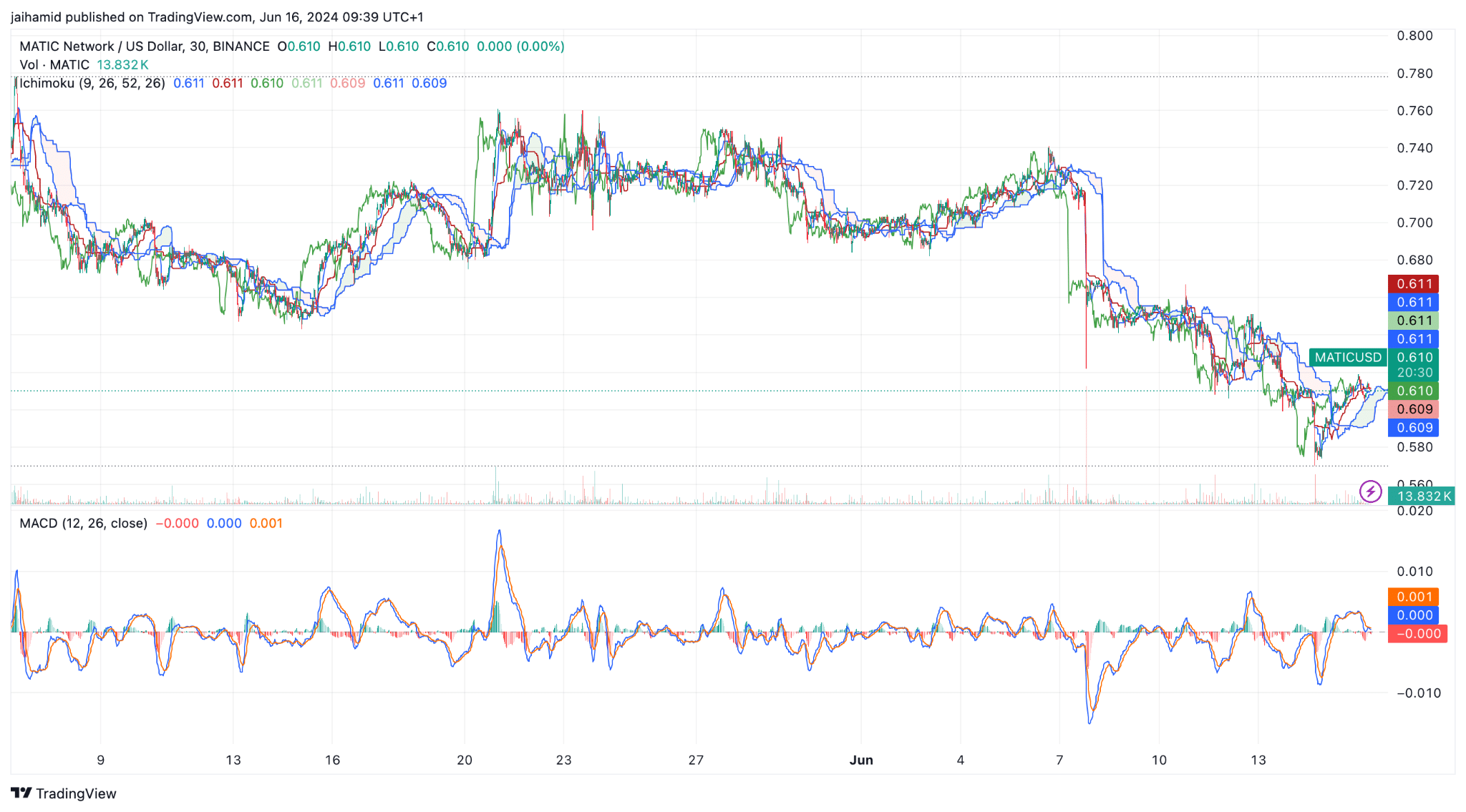

The Ichimoku cloud, visual at the chart, advised a bearish outlook as the associated fee moved underneath the cloud at press time.

The chart above published a sequence of decrease highs and decrease lows, a vintage indication of a bearish pattern.

The MACD line was once just about the sign line and soaring across the 0 line, which supposed that there’s a loss of robust momentum from both the bulls or the bears.

Supply: TradingView

Supply: TradingView

MATIC has additionally noticed many double-top formations all through the previous 30 days.

The associated fee was once beneath all 3 transferring averages, reinforcing the bearish outlook via suggesting that the whole pattern was once closely pushed via the bears.

Supply: Coinglass

Supply: Coinglass

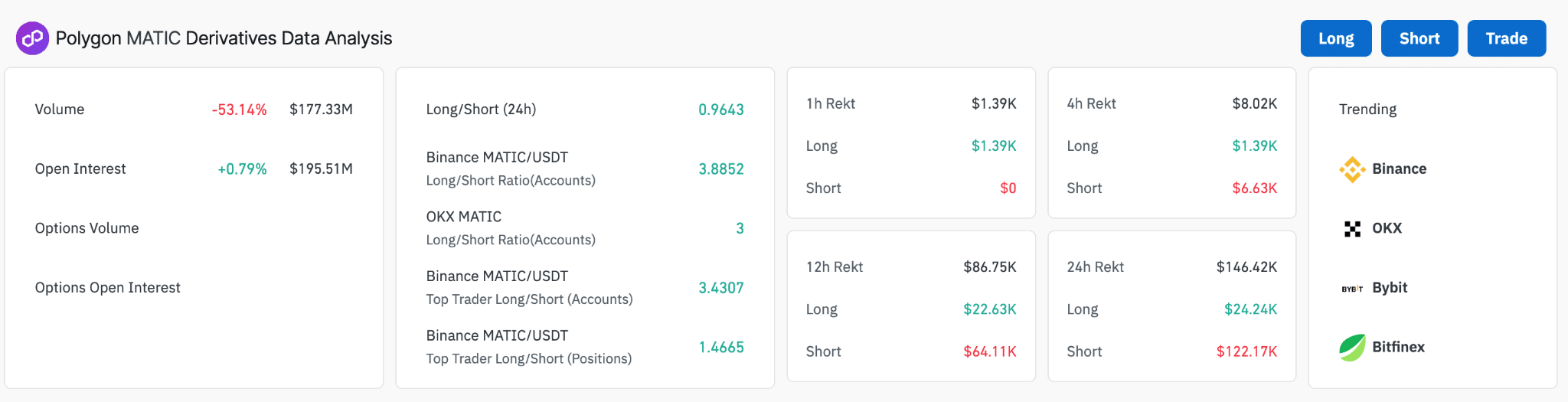

MATIC’s derivatives buying and selling quantity has declined considerably via 53.14%.

Sensible or now not, right here’s MATIC’s marketplace cap in ETH’s phrases

The lengthy/quick ratio on Binance [BNB] for MATIC/USDT stood at 3.8852 for accounts at press time, suggesting that extra buyers held lengthy positions than shorts.

So, extra buyers appeared to imagine in MATIC’s attainable to realize i9n the long run.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)