International achieve of BTC ETFs make bigger with the Australian Inventory Trade set for a brand new checklist on twentieth June.

It continues to be observed whether or not america spot ETH ETF approvals will building up call for for BTC ETFs.

Australian Inventory Trade (ASX), the most important trade in Australia, has joined the Bitcoin [BTC] ETF celebration through approving its first BTC ETF product from asset supervisor VanEck.

The product, VanEck Bitcoin ETF (VBTC), will probably be indexed on June twentieth, marking the historic debut of an ETF involving the most important virtual asset on ASX.

Andrew Campion, ASX’s normal supervisor of funding merchandise, instructed the Australian Monetary Overview (AFR) that the extend in approving BTC ETFs at the trade used to be because of the 2022 crypto wintry weather. Campion added,

“However with the restoration of cryptocurrency costs, we’ve had a good bit of pastime during the last 365 days, and that’s culminated within the approval.’

ASX signaled renewed pastime after US and Hong Kong spot BTC ETFs went reside.

Call for for Bitcoin ETF Australia

On his section, Arian Neiron, Asia Pacific managing director at VanEck, emphasised the rising investor call for for BTC.

‘Bitcoin has remained an rising asset magnificence that many advisers and buyers need”

The ASX’s checklist is a brilliant sign for Australian buyers in search of regulated avenues for buying and selling and making an investment in BTC.

An identical merchandise have additionally just lately been introduced on the second one biggest Australian trade, Cboe Australia, a key competitor to ASX.

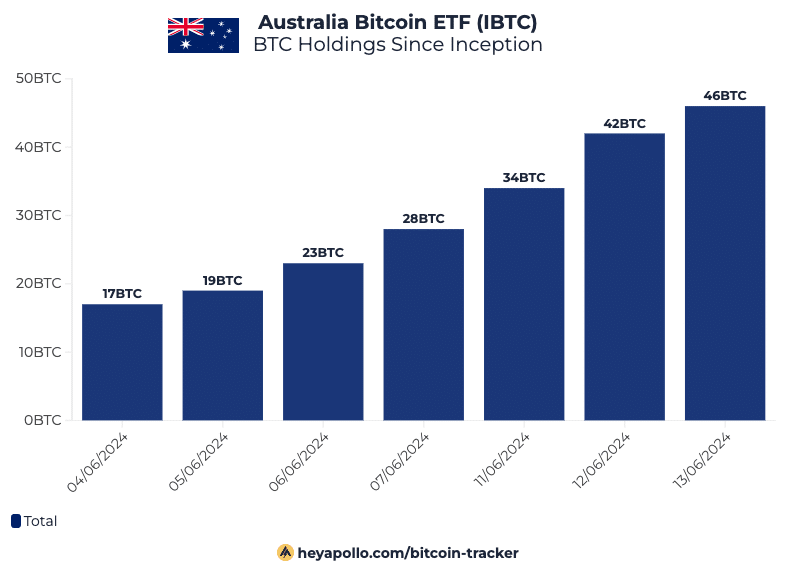

Significantly, Monochrome Bitcoin ETF (IBTC) debuted and began working on Cboe Australia on June third. As of June 14th, the product had gathered 46 BTC, Julian Farher, a Bitcoin analyst and investor, printed.

Supply: X/Julian_Farher

Supply: X/Julian_Farher

Apparently, the ASX’s checklist will get started buying and selling only some days prior to US spot Ethereum [ETH] ETF approval. Many analysts view it as a catalyst for the entire marketplace. Whether or not or no longer it’ll ramp up call for for the Australian BTC ETFs continues to be observed.

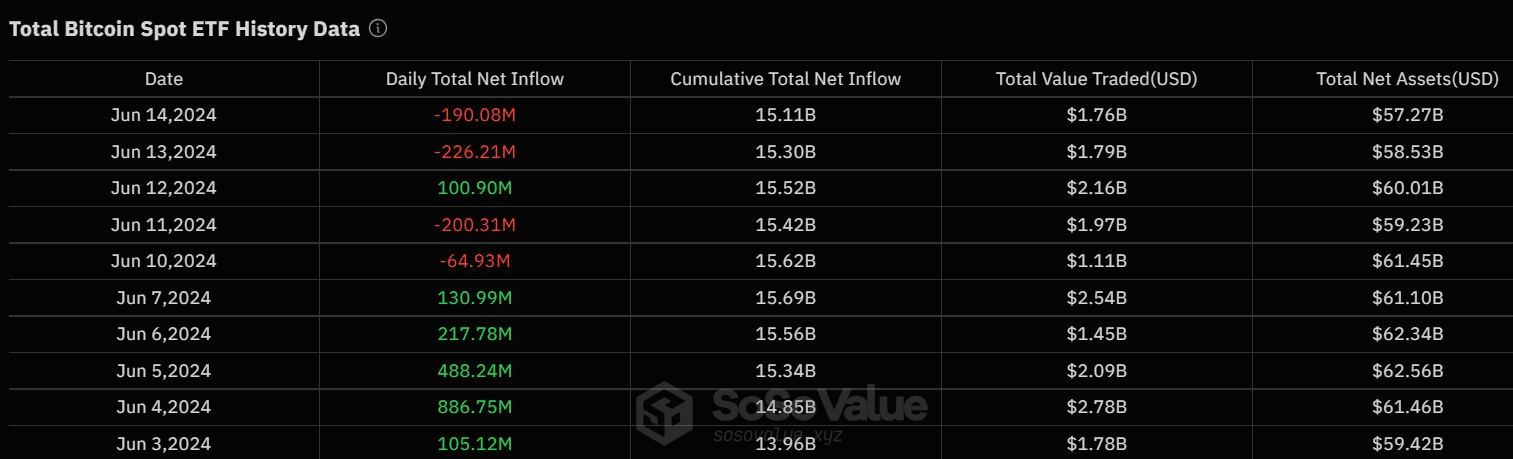

On the other hand, the spot US BTC ETFs recorded vital outflows remaining week as buyers de-risked prior to and after the Fed’s choice to stay rates of interest unchanged for the 7th time.

Supply: Soso Price

Supply: Soso Price

With the exception of 12 June, the remainder of remaining week noticed huge outflows value over $680 million, underscoring US buyers’ risk-off means.

As of press time, the king coin slipped under $66K. It would development decrease to the variability low if the bearish sentiment persists.

Moreover, in step with Coinglass information, the entire marketplace’s Open Pastime (OI) charges had been crimson as of press time, indicating low liquidity within the derivatives marketplace and reinforcing the bearish sentiment.