Lido and Rocket Pool’s staking tokens were given categorized as securities by way of the SEC

LDO’s value plummeted at the charts, whilst RPL’s value remained slightly solid

United States’ SEC (Securities and Exchanges Committee) is within the information once more for all of the wring causes. This time, it’s for labelling the likes of Lido [LDO] and Rocket Pool [RPL] as securities.

SEC moves once more

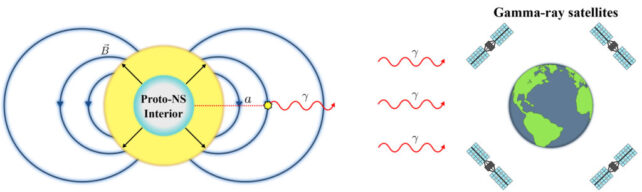

The SEC considers Lido and Rocket Pool’s staking systems to be securities as a result of they serve as in a similar way to funding contracts. Traders give a contribution their ETH to a shared pool, with the expectancy of making money in accordance with the efforts of this system’s managers, moderately than their very own movements.

The SEC classifying Lido and Rocket Pool’s staking systems as securities could have a number of adverse penalties. Registering and complying with securities rules may also be dear and time-consuming. Lido and Rocket Pool may face vital hurdles in assembly those necessities.

The lawsuit has fueled worry out there, doubtlessly resulting in a decline in consumer participation and a drop within the price in their tokens (stETH & rETH).

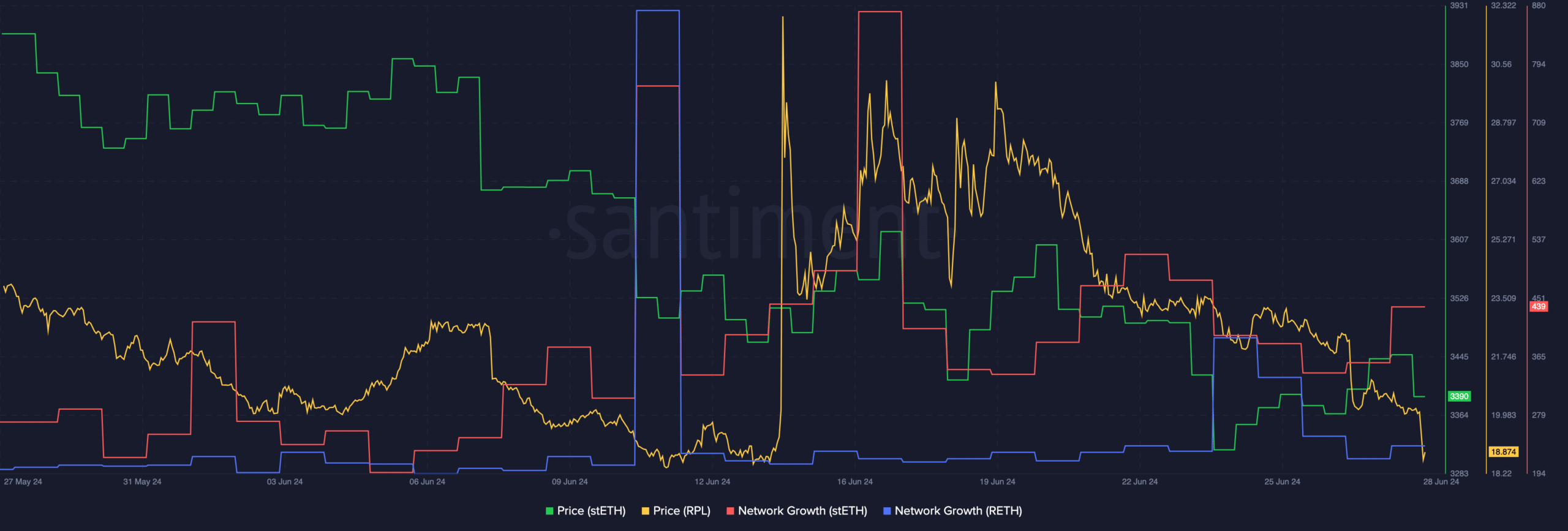

In reality, information from Santiment published that the community enlargement related to each stETH and rETH fell materially during the last few weeks. This urged that the collection of new addresses curious about each those staking tokens declined considerably.

If new customers proceed to become bored in them, each those protocols may just endure.

Supply: Santiment

Supply: Santiment

Moreover, working as a safety may limit Lido and Rocket Pool’s skill to supply their services and products freely. They may face obstacles on who they may be able to be offering their services and products to or how they construction their systems.

Deja Vu

The SEC’s lawsuit in opposition to Ripple Labs supplies treasured insights into the possible penalties Lido and Rocket Pool may face. If that’s the case, the lawsuit precipitated an important drop in XRP’s value as exchanges delisted it because of uncertainty over its felony standing. In reality, LDO and RPL have already recorded value drops following the SEC’s announcement. And, an extra decline isn’t precisely out of the query.

On the time of writing, LDO was once down by way of 18.17% within the ultimate 24 hours. RPL, then again, fell by way of 1.08%.

Sensible or no longer, right here’s LDO’s marketplace cap in BTC’s phrases

Alternatively, it is usually necessary to peer that the SEC’s core argument within the Ripple case was once that XRP itself was once a safety bought via an unregistered providing.

Lido and Rocket Pool’s case is quite other. The SEC perspectives their staking systems as funding contracts, no longer the tokens themselves, which might imply dangerous information for stETH and rETH. Thus, the affect on LDO and RPL will stay in large part unsure for a while.