The cost of Bitcoin has long gone up as regards to 5% for the reason that contemporary weekend.

There was once a purchase sign from on-chain metrics but additionally issues over “synthetic call for”.

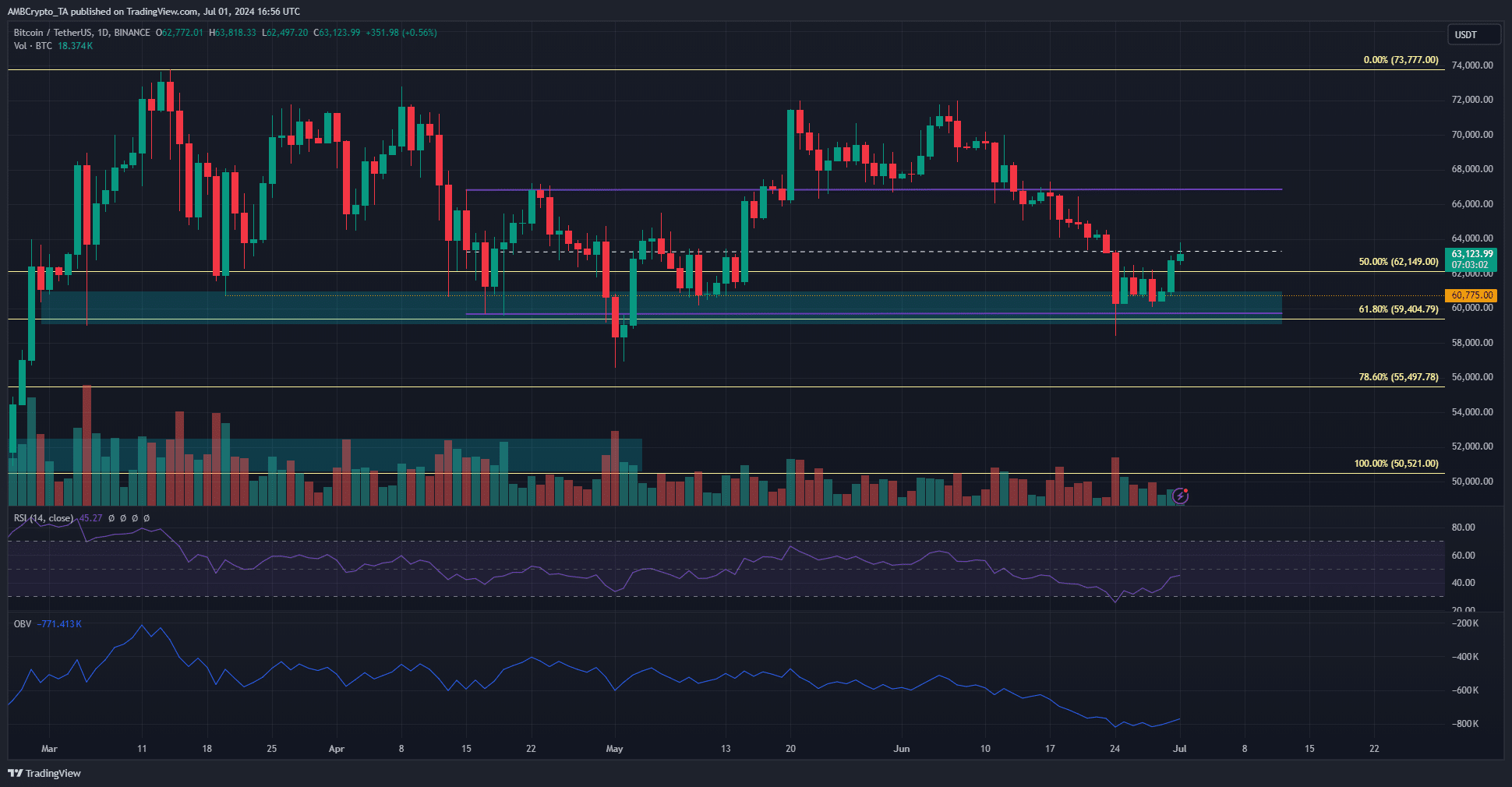

Bitcoin [BTC] has received 4.5% since Saturday, the twenty ninth of June. In doing so, the enhance zone that stretched again to the first of March was once retested and defended as enhance. Moreover, the variety lows of the previous 3 months’ worth motion had been additionally stored.

Supply: BTC/USDT on TradingView

Supply: BTC/USDT on TradingView

At press time, the mid-range mark at $63.3k served as resistance. The technical signs confirmed {that a} bullish reversal at the upper timeframes was once now not but in sight.

Then again, within the decrease timeframes, the bearish sentiment of the previous week and the lopsided futures marketplace supposed that liquidation ranges to the north may well be hunted.

The query of why Bitcoin goes up is partly spoke back there, however there are different components at play too. Will the bulls power costs upper?

The metrics point out a network-wide accumulation but additionally trace at bother

Supply: Santiment

Supply: Santiment

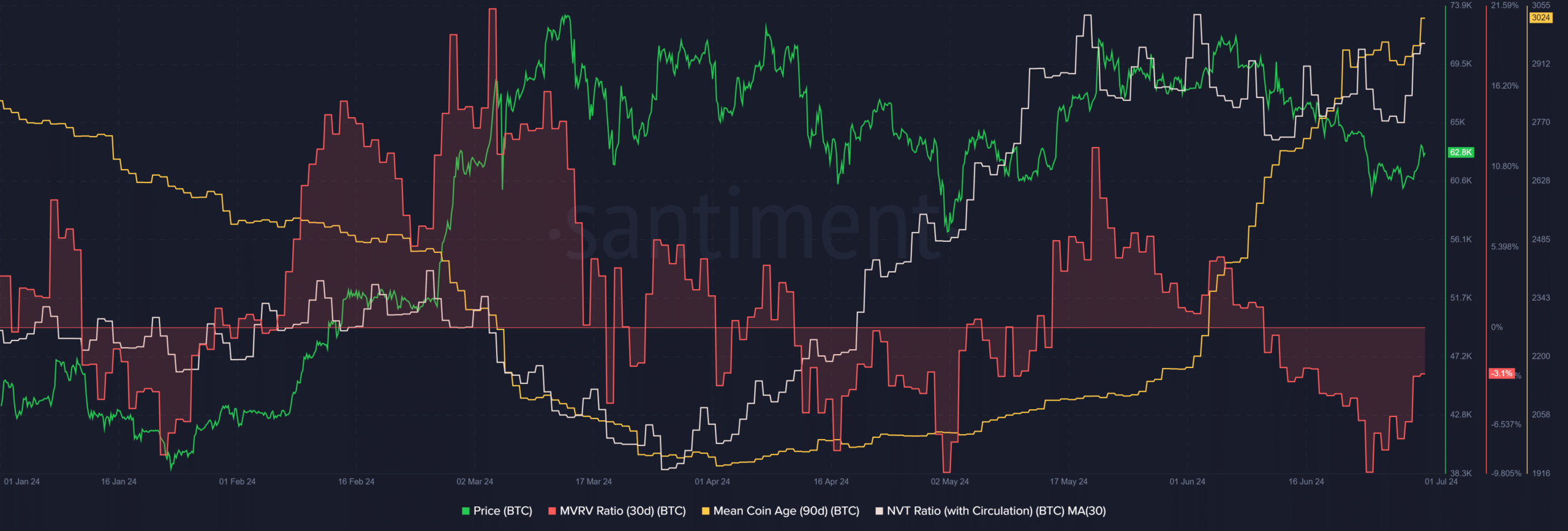

The 30-day MVRV ratio was once adverse, that means that temporary holders had been out of the cash. Then again, previously six weeks, the imply coin age has firmly trended upper. This was once a favorable aggregate.

It indicated accumulation among holders whilst additionally signaling an undervalued asset. In combination, it marks a temporary purchasing alternative. This would arrange a rally for the king of crypto.

Then again, the Community Worth to Transactions Ratio, calculated right here in keeping with flow, confirmed that Bitcoin was once overrated when in comparison to the volume of BTC transacted on-chain day-to-day.

This would impede the bulls however is overshadowed by way of the MVRV and imply coin age aggregate.

The liquidity cluster beckons BTC upward

Supply: Hyblock

Supply: Hyblock

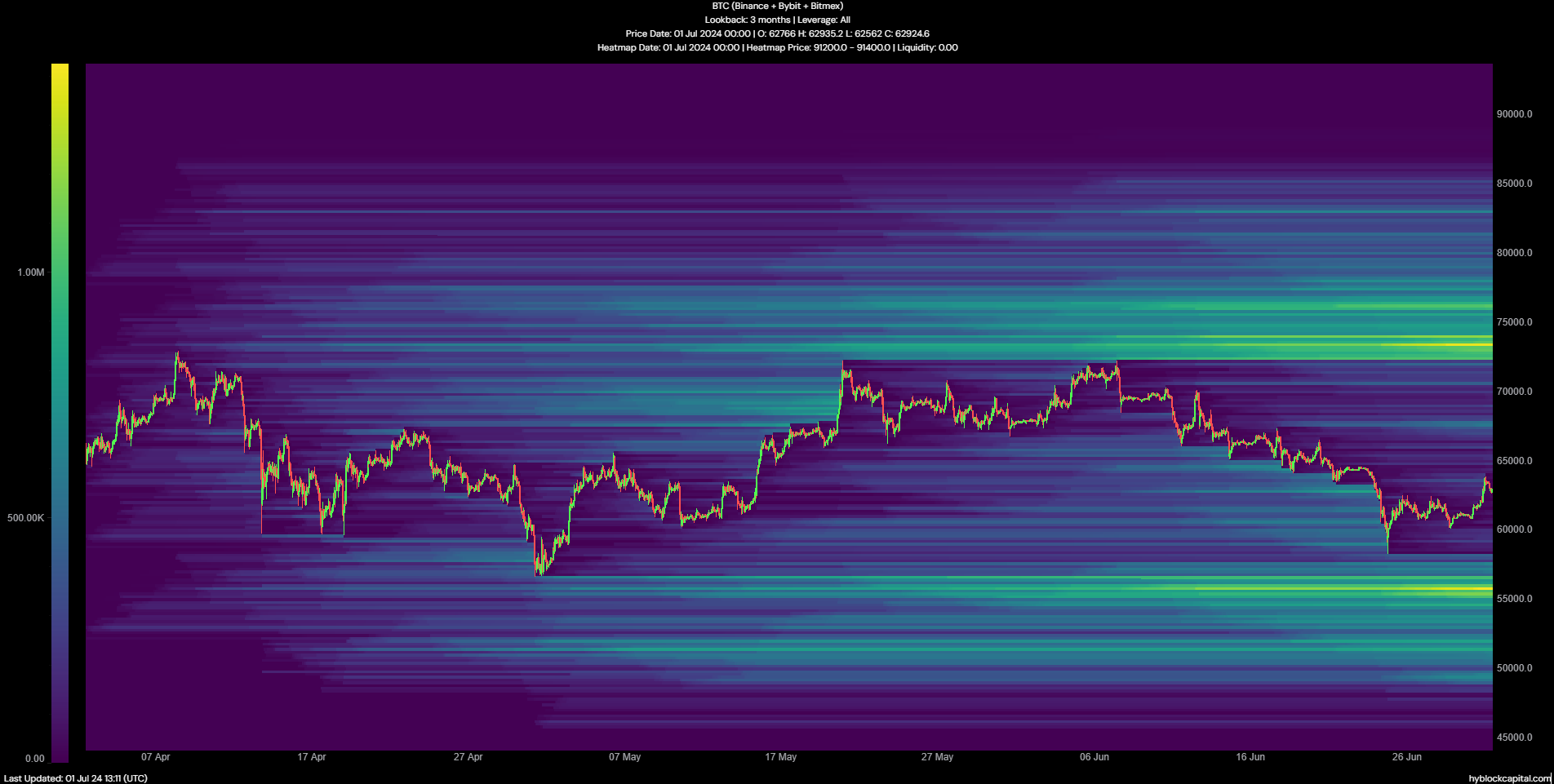

The $55k liquidation cluster was once now not examined because the bulls halted the fee from falling beneath the $60k mental enhance. No longer each zone of top liquidity must be examined. If the fee continues to climb upper, the $73k zone is the following house of pastime for investors.

The trail ahead isn’t simple for the bulls. A tweet from Head of Analysis at CryptoQuant, Julio Moreno, highlighted that Bitcoin miner capitulation was once handy and costs may have shaped an area backside.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Some other crypto analyst, Axel Adler, noticed that it was once the crypto exchanges that had been in large part snapping up the Bitcoin being bought in contemporary weeks and now not the broader marketplace.

Whilst it isn’t inherently adverse, the analyst believed that different cohorts of holders had been promoting and that this synthetic call for will not be wholesome in the longer term.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25755281/2181413178.jpg)