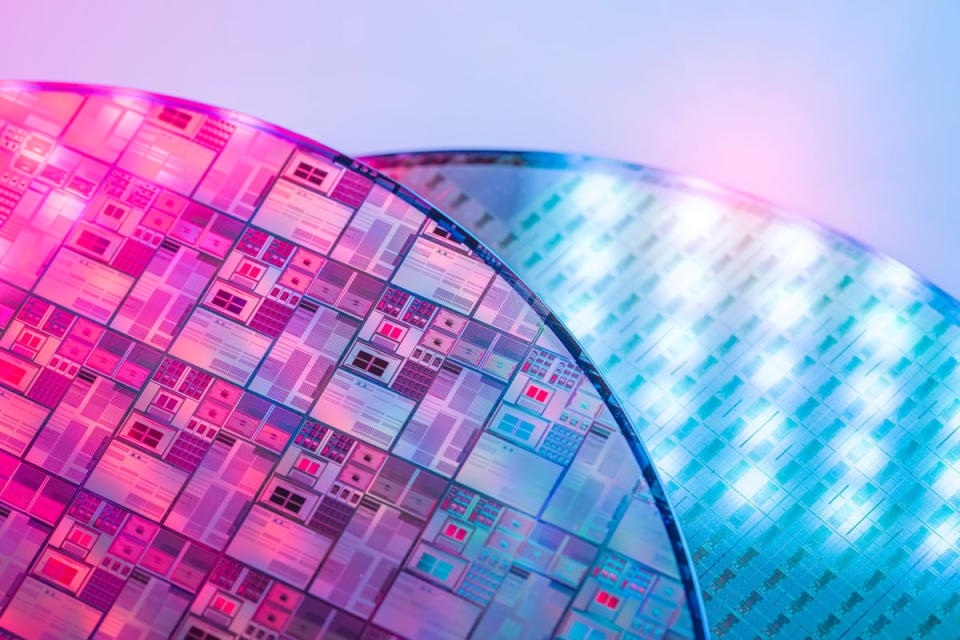

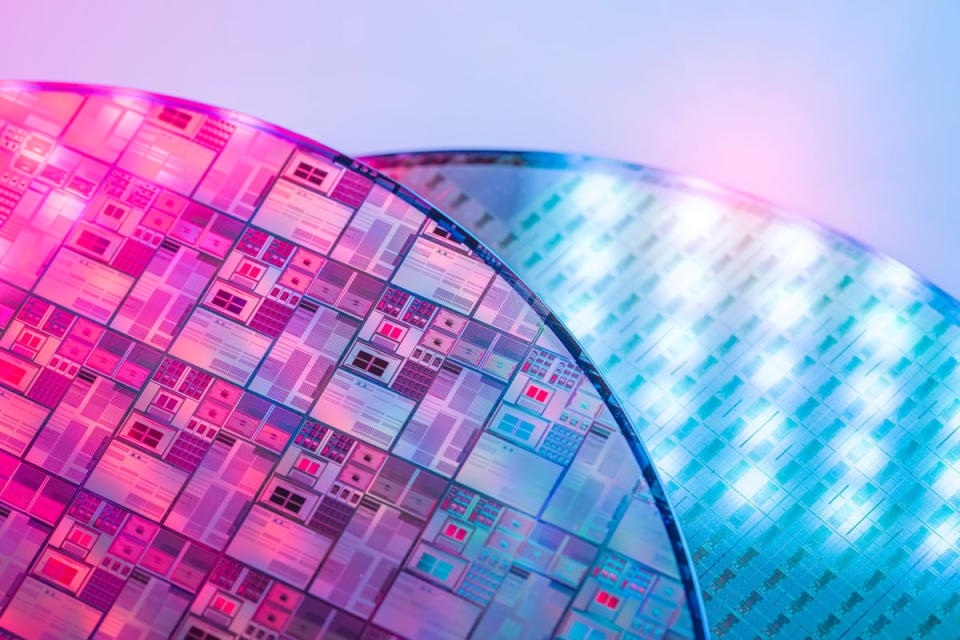

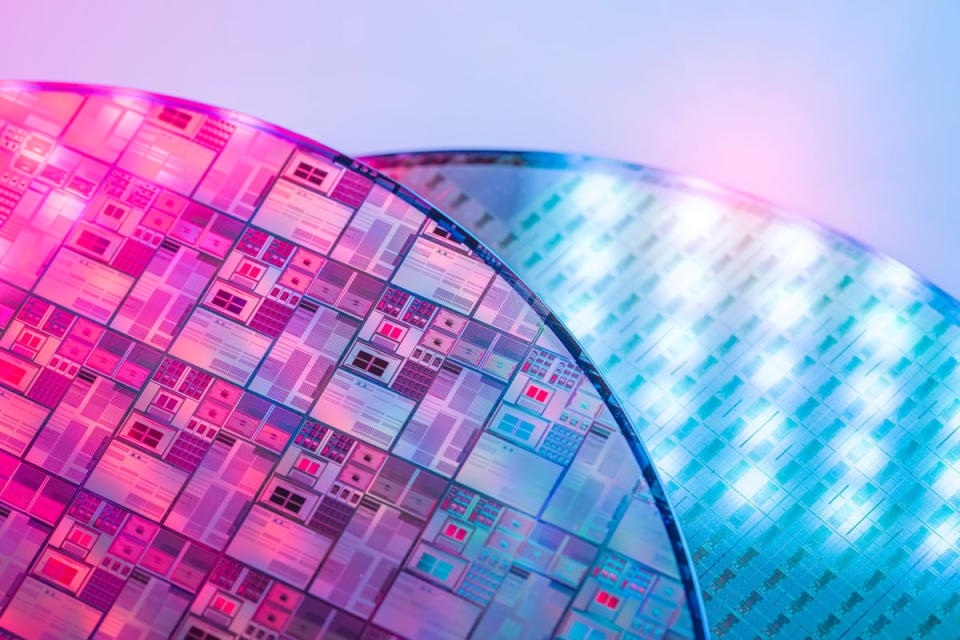

Apple (NASDAQ: AAPL) published its new intelligence referred to as “Apple Intelligence” at its International Builders Convention a couple of weeks in the past. Highlights come with developing notes and summaries of all apps, AI-powered photograph modifying features, and the sensible and strong Siri. It additionally contains third-party products and services reminiscent of ChatGPT for more info. What makes Apple Intelligence so compelling is the volume of AI processing it does at the instrument. As a substitute of taking your question, sending it to a server in conjunction with any related information, looking forward to the server to procedure your question, and downloading the effects in your instrument, it is all accomplished for your iPhone, Mac, or iPad. For complex queries that require a bigger model of the infrastructure, Apple makes use of its personal servers and machines referred to as Non-public Cloud Compute, which protects customers’ privateness. Since all of those inventions run on silicon made through Apple, chip foundry Taiwan Semiconductor Production Co. (NYSE: TSM) might see an building up in orders because of Apple Intelligence. As well as, as Apple leads the way in which within the construction of AI in gadgets, it’s going to push different instrument producers to shop for extra complex chips from TSMC.

Symbol: Getty Pictures or your laptop).As a way to clear up AI questions about gadgets, the gadgets will have to be succesful. Which means that gadgets which are only some years previous can not take care of the calls for of AI and the most recent gadgets, if in any respect imaginable. Apple, as an example, is proscribing the Apple Intelligence characteristic to the iPhone 15 Professional, iPhone 15 Professional Max, and upcoming iPhone 16 gadgets. (Notice that the limitation this is the volume of momentary reminiscence, or RAM, at the instrument, now not simply the processors. )In consequence, Apple has noticed an enormous call for for customers who wish to improve their telephones over the following couple of years. Apple Intelligence is to be had international. And extra iPhone gross sales imply extra call for for TSMC chips. However TSMC does not simply provide Apple chips. It produces essentially the most chips on the earth, accounting for greater than 60% of the marketplace. This scale offers smaller startups a aggressive benefit, as they may be able to make investments extra in R&D to increase extra complex tactics to print extra robust and energy-efficient chips. This guarantees that it keeps current shoppers like Apple who’re searching for complex chips, and draws extra in their trade. It additionally is helping TSMC to draw new shoppers as pioneers reminiscent of front-line AI corporations push new machines. The tale continues Apple’s cloud is simply beginning to beef up different sorts of main languages (LLMs) and its personal high-end LLM, Apple has created. Non-public Cloud Computing (PCC). The device makes use of Apple’s servers that still deploy the tech titan’s designs. It’s price noting that Apple does now not use the platform to coach AI fashions. It’s the usage of PCC to procedure information with algorithms that can require extra computing energy than is to be had on shopper gadgets. The primary implementation is to ship knowledge to ChatGPT. There’s a nice possible for Apple to enlarge its information heart capability as it really works with many companies and producers who wish to combine their AI products and services with the Apple platform. When the corporate introduced its partnership with OpenAI’s ChatGPT, it mentioned it was once running to deliver extra companions to the platform later this 12 months. If Apple pushes builders to make use of PCC, it might building up Apple’s call for for TSMC products and services. It additionally supplies differently for Apple to get cash from builders. Simply consider the improbable expansion of the App Retailer during the last 15 years. A an identical construction could be really helpful for each Apple and TSMC. Making $ 1 trillion semiconductor companyTSMC already has a marketplace of $ 900 billion. Even so, the inventory appears undervalued at these days’s payment because of expansion fueled through endured call for for AI chips. Stocks are buying and selling at about 27x ahead revenue estimates, which is a top rate over the price-to-earnings ratio. It must develop its earnings briefly to justify the fee because the call for for high-end chips helps its top-line expansion and improves its working margins. Analysts be expecting revenue to extend through greater than 25% subsequent 12 months. Robust enhancements to the iPhone over the following couple of years, higher call for from Apple’s new information facilities, and a push into computer systems fueled TSMC’s expansion. Its aggressive benefit in generating top quality, robust, and energy-efficient gadgets will lend a hand in the following couple of years. The corporate is simply shy of $1 trillion in earnings. Must you make investments $1,000 in Taiwan Semiconductor Production at this time? Before you purchase stocks in Taiwan Semiconductor Production, believe this: The Motley Idiot Inventory Marketing consultant analysis group simply recognized what they imagine are the ten highest shares buyers can purchase at this time… and Taiwan Semiconductor Production was once now not considered one of them. The ten shares that had been minimize may result in monster returns within the coming years. Suppose again to when Nvidia made this record on April 15, 2005… when you invested $1,000 all over our promotion, you can have $751,670! * Inventory Marketing consultant supplies buyers with an easy-to-follow plan for luck, together with a information to development portfolios, common updates from mavens, and two new choices each month. The Inventory Marketing consultant provider has quadrupled the go back of the S&P 500 since 2002*.See 10 shares »*Inventory Marketing consultant returns as of July 2, 2024Adam Levy holds positions at Apple and Taiwan Semiconductor Production. The Motley Idiot owns and endorses Apple and Taiwan Semiconductor Production. The Motley Idiot has some extent to expose. Information about Apple’s New Synthetic Intelligence (AI) May Push This Semiconductor Corporate to a $1 Trillion Valuation was once firstly revealed through The Motley Idiot.

Symbol: Getty Pictures or your laptop).As a way to clear up AI questions about gadgets, the gadgets will have to be succesful. Which means that gadgets which are only some years previous can not take care of the calls for of AI and the most recent gadgets, if in any respect imaginable. Apple, as an example, is proscribing the Apple Intelligence characteristic to the iPhone 15 Professional, iPhone 15 Professional Max, and upcoming iPhone 16 gadgets. (Notice that the limitation this is the volume of momentary reminiscence, or RAM, at the instrument, now not simply the processors. )In consequence, Apple has noticed an enormous call for for customers who wish to improve their telephones over the following couple of years. Apple Intelligence is to be had international. And extra iPhone gross sales imply extra call for for TSMC chips. However TSMC does not simply provide Apple chips. It produces essentially the most chips on the earth, accounting for greater than 60% of the marketplace. This scale offers smaller startups a aggressive benefit, as they may be able to make investments extra in R&D to increase extra complex tactics to print extra robust and energy-efficient chips. This guarantees that it keeps current shoppers like Apple who’re searching for complex chips, and draws extra in their trade. It additionally is helping TSMC to draw new shoppers as pioneers reminiscent of front-line AI corporations push new machines. The tale continues Apple’s cloud is simply beginning to beef up different sorts of main languages (LLMs) and its personal high-end LLM, Apple has created. Non-public Cloud Computing (PCC). The device makes use of Apple’s servers that still deploy the tech titan’s designs. It’s price noting that Apple does now not use the platform to coach AI fashions. It’s the usage of PCC to procedure information with algorithms that can require extra computing energy than is to be had on shopper gadgets. The primary implementation is to ship knowledge to ChatGPT. There’s a nice possible for Apple to enlarge its information heart capability as it really works with many companies and producers who wish to combine their AI products and services with the Apple platform. When the corporate introduced its partnership with OpenAI’s ChatGPT, it mentioned it was once running to deliver extra companions to the platform later this 12 months. If Apple pushes builders to make use of PCC, it might building up Apple’s call for for TSMC products and services. It additionally supplies differently for Apple to get cash from builders. Simply consider the improbable expansion of the App Retailer during the last 15 years. A an identical construction could be really helpful for each Apple and TSMC. Making $ 1 trillion semiconductor companyTSMC already has a marketplace of $ 900 billion. Even so, the inventory appears undervalued at these days’s payment because of expansion fueled through endured call for for AI chips. Stocks are buying and selling at about 27x ahead revenue estimates, which is a top rate over the price-to-earnings ratio. It must develop its earnings briefly to justify the fee because the call for for high-end chips helps its top-line expansion and improves its working margins. Analysts be expecting revenue to extend through greater than 25% subsequent 12 months. Robust enhancements to the iPhone over the following couple of years, higher call for from Apple’s new information facilities, and a push into computer systems fueled TSMC’s expansion. Its aggressive benefit in generating top quality, robust, and energy-efficient gadgets will lend a hand in the following couple of years. The corporate is simply shy of $1 trillion in earnings. Must you make investments $1,000 in Taiwan Semiconductor Production at this time? Before you purchase stocks in Taiwan Semiconductor Production, believe this: The Motley Idiot Inventory Marketing consultant analysis group simply recognized what they imagine are the ten highest shares buyers can purchase at this time… and Taiwan Semiconductor Production was once now not considered one of them. The ten shares that had been minimize may result in monster returns within the coming years. Suppose again to when Nvidia made this record on April 15, 2005… when you invested $1,000 all over our promotion, you can have $751,670! * Inventory Marketing consultant supplies buyers with an easy-to-follow plan for luck, together with a information to development portfolios, common updates from mavens, and two new choices each month. The Inventory Marketing consultant provider has quadrupled the go back of the S&P 500 since 2002*.See 10 shares »*Inventory Marketing consultant returns as of July 2, 2024Adam Levy holds positions at Apple and Taiwan Semiconductor Production. The Motley Idiot owns and endorses Apple and Taiwan Semiconductor Production. The Motley Idiot has some extent to expose. Information about Apple’s New Synthetic Intelligence (AI) May Push This Semiconductor Corporate to a $1 Trillion Valuation was once firstly revealed through The Motley Idiot.