Bitcoin’s worth larger by means of greater than 3% within the closing 24 hours.

The German govt as soon as once more transferred BTC price tens of millions of bucks.

Bitcoin [BTC] in spite of everything confirmed indicators of restoration as, after weeks of declines, the king of cryptos’ day by day chart became inexperienced. Because of that, BTC’s worth broke above $57k.

Alternatively, now not the whole thing was once running in BTC’s choose, as a couple of primary avid gamers, just like the German govt, bought BTC whilst its worth surged.

Bitcoin turns bullish

CoinMarketCap’s knowledge published that Bitcoin’s worth had dropped by means of greater than 9% within the closing seven days.

However issues were given higher within the closing 24 hours because the king of cryptos’ worth larger by means of over 3%, which gave hope for an additional worth upward thrust.

On the time of writing, BTC was once buying and selling at $57,290.27 with a marketplace capitalization of over $1.129 trillion. Whilst BTC’s worth received bullish momentum, some of the most sensible avid gamers within the crypto house selected to promote their holdings.

Lookonchain’s contemporary tweet published that the German govt as soon as once more transferred 9,634 BTC, price over $551 million, to Kraken, FlowTraders, Coinbase, Bitstamp, Cumberland, and B2C2Group.

As in keeping with the tweet, the German govt has transferred 24,304 BTC, which was once price $1.44 billion for the reason that nineteenth of June, and nonetheless held 28,988 BTC at press time, valued at $1.66 billion.

Except for this, a whale additionally deposited quite a lot of BTC. Any other tweet from Lookonchain identified {that a} whale deposited 809 BTC, price $45.18 million, to Binance.

This build up in promoting power from a whale and the German govt may have a unfavorable affect at the coin’s worth motion and may lead to an finish to BTC’s newly introduced bull rally.

Will BTC’s bull rally finish quickly?

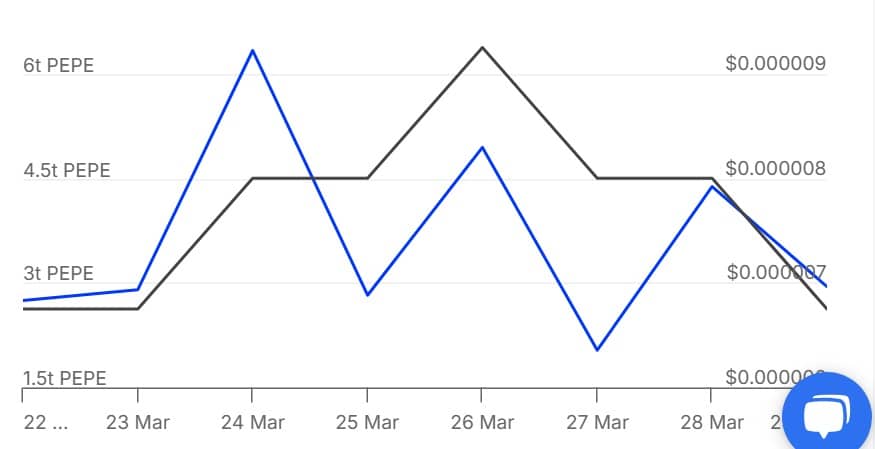

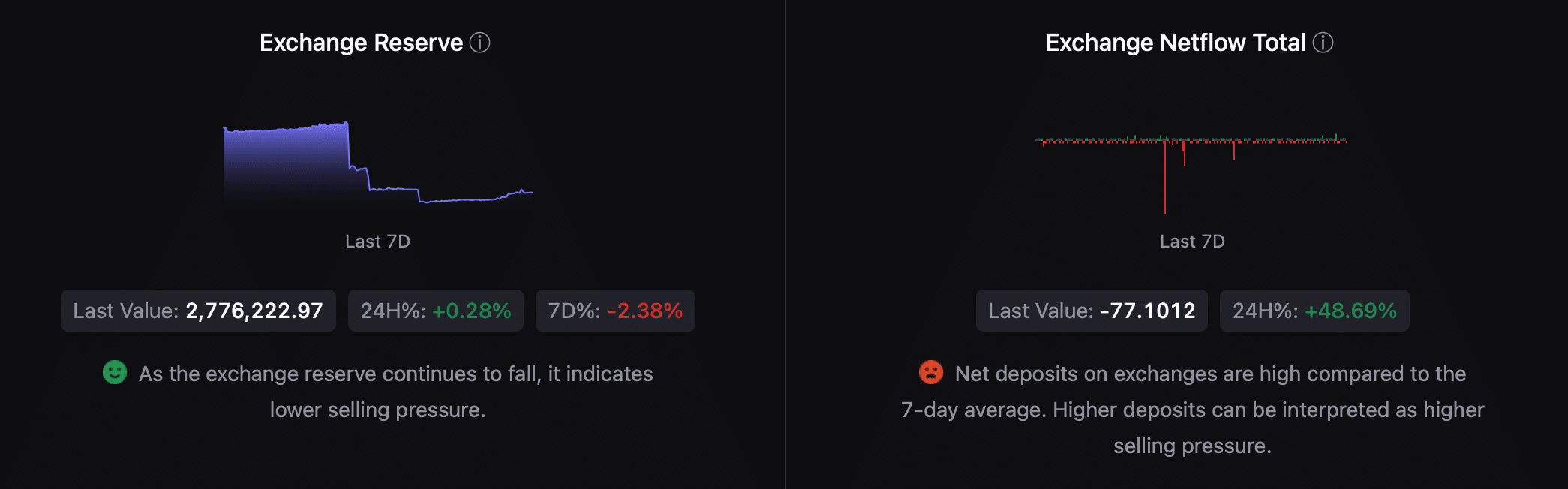

Since some of the avid gamers have been exerting promoting power, AMBCrypto checked CryptoQuant’s knowledge to raised perceive the whole marketplace situation.

We discovered that BTC’s Change Reserve was once lowering, indicating vulnerable promoting power.

Alternatively, BTC’s web deposit on exchanges was once top in comparison to the closing seven-day reasonable, which means that promoting power was once emerging.

Moreover, promoting sentiment was once additionally dominant amongst U.S. traders, which was once obtrusive from its pink Coinbase top rate.

Supply: CryptoQuant

Supply: CryptoQuant

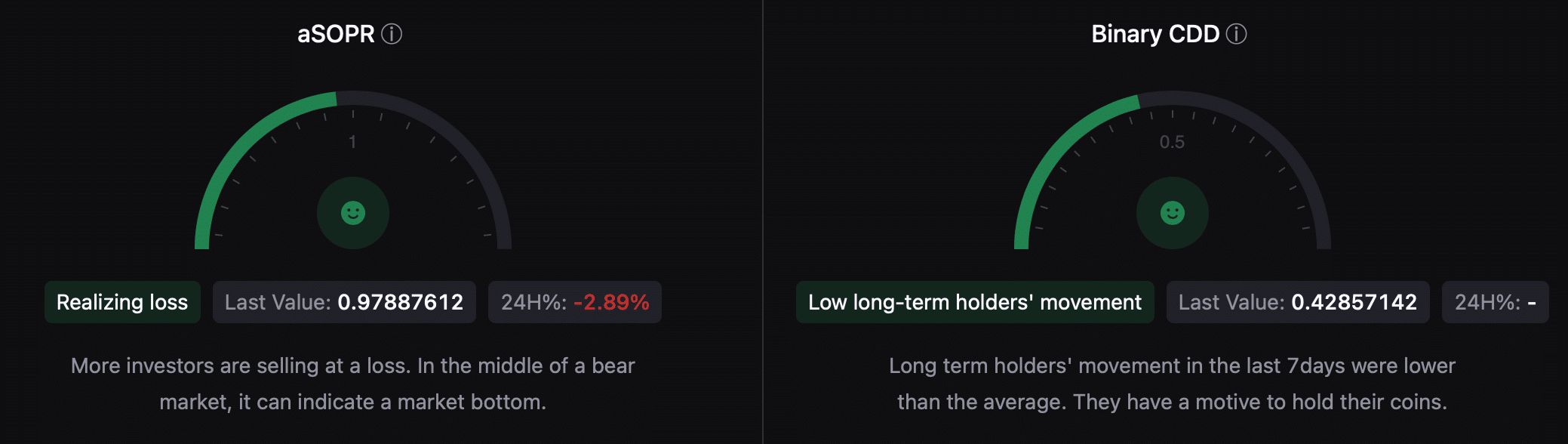

Nevertheless, a couple of different metrics seemed bullish. As an example, BTC’s aSORP published that extra traders have been promoting at a loss. In the midst of a endure marketplace, it could actually point out a marketplace backside.

Its Binary CDD was once additionally inexperienced, which means that long-term holders’ actions within the closing seven days have been less than reasonable. They’ve a purpose to carry their cash.

Supply: CryptoQuant

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

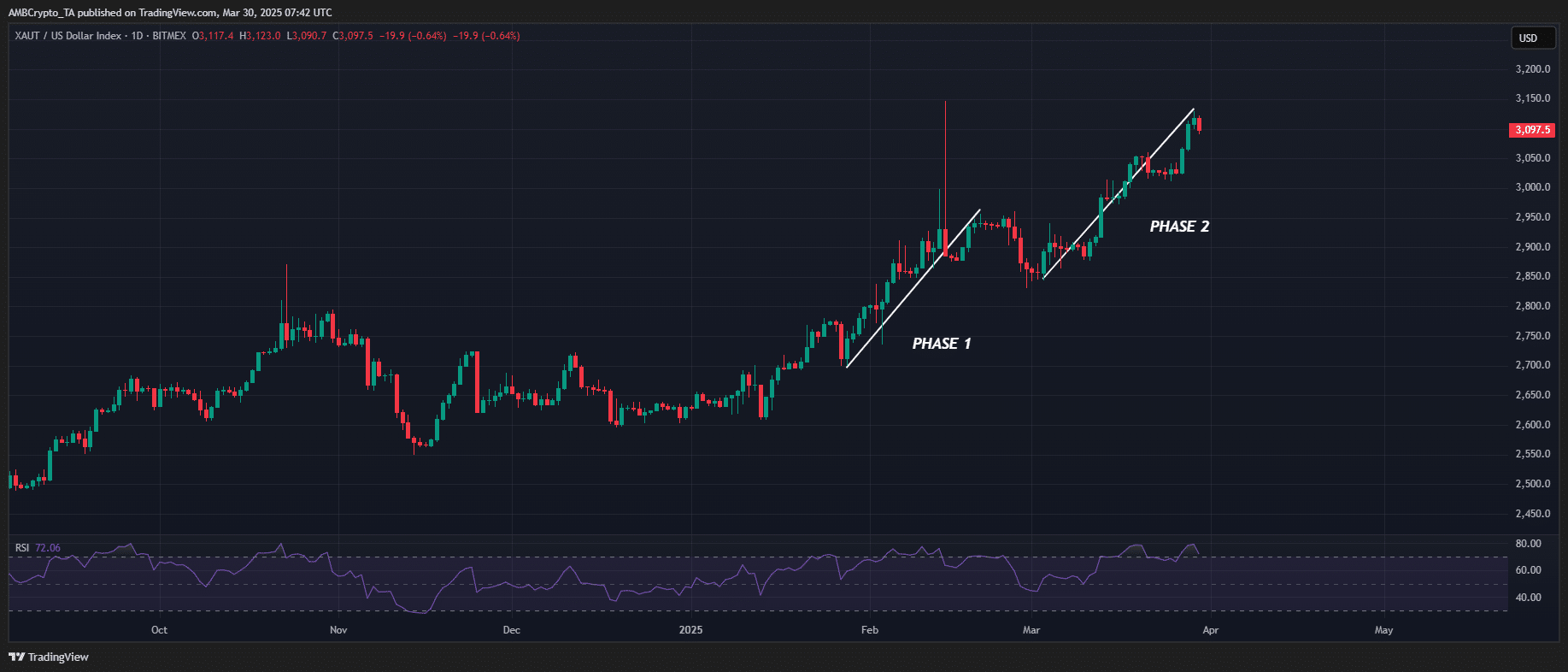

We then took a have a look at BTC’s day by day chart to look whether or not signs trace at a endured bull rally. The technical indicator Chaikin Cash Glide (CMF) registered an uptick, hinting at a endured worth upward thrust.

However the Cash Glide Index (MFI) seemed bearish because it moved southward. This is able to, with the newest switch from the German govt, may put an finish to Bitcoin’s bull rally.

Supply: TradingView

Supply: TradingView