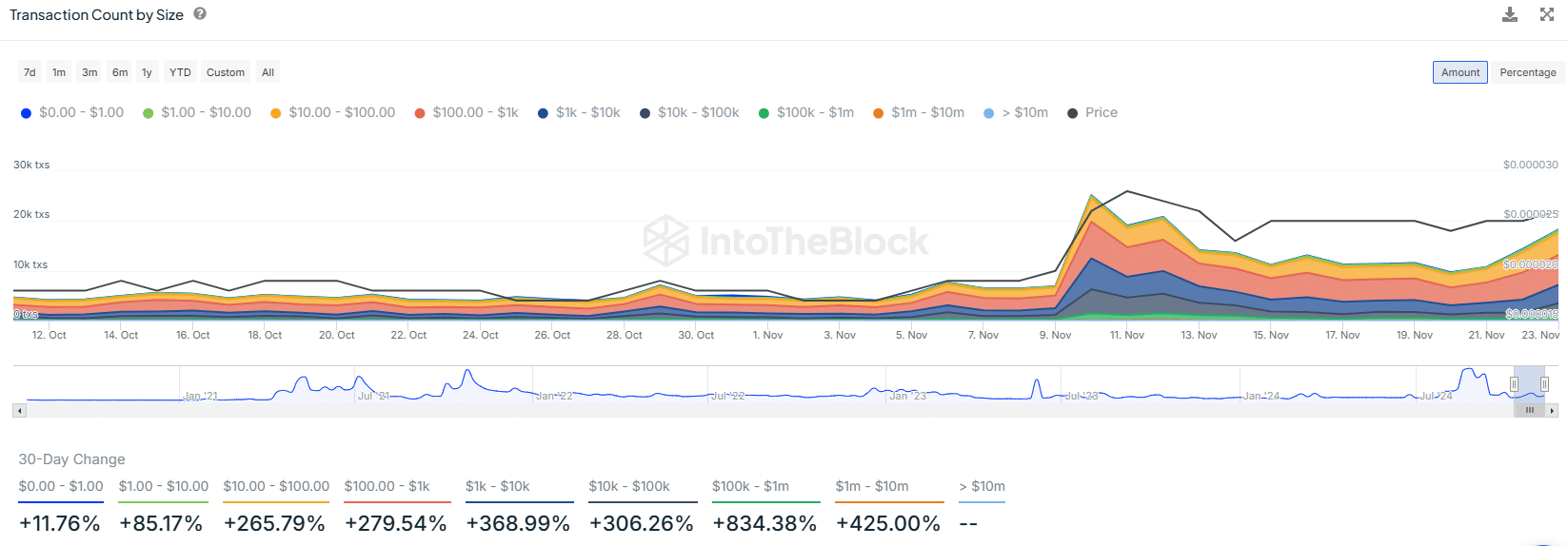

(Bloomberg) — Shares rebounded after their worst week since April as traders seemed past Joe Biden finishing his reelection marketing campaign to concentrate on the beginning of the tech profits season.Maximum Learn from BloombergThe megacap house rallied, with the Nasdaq 100 up 1.5%. In spite of the new hunch that had some on Wall Boulevard bracing for a summer time correction, respondents to Bloomberg’s Markets Are living Pulse survey be expecting profits to reinvigorate the S&P 500. With effects from Tesla Inc. and Alphabet Inc. on deck Tuesday, just about two-thirds of the 463 respondents to the questionnaire be expecting company earnings to spice up US equities.Learn: Biden Go out Sounds Alarm on Trump Trades Riven With ContradictionSky-high valuations and seasonal weak spot have incited some pullback warnings, with buyers additionally going through political uncertainties. But the marketplace response to Biden’s resolution to give up the race and endorse Kamala Harris has thus far been relatively muted, with the USA greenback little modified and Treasuries marginally upper.“This political shake up shouldn’t materially regulate the path of the markets,” stated Tom Essaye at The Sevens Record. “Without equal path of the S&P 500 will nonetheless be made up our minds by way of financial expansion.”The S&P 500 rose to five,550. A Bloomberg gauge of the “Magnificent Seven” megacaps climbed 2.5%. Tesla Inc. and Nvidia Corp. each and every added 4%. CrowdStrike Holdings Inc. tumbled 11% amid the continuing fallout from a erroneous device replace from the cybersecurity company. The Russell 2000 of smaller companies fell 0.1% after ultimate week’s surge.Treasury 10-year yields slid two foundation issues to 4.22%. Buyers can be targeted this week on US financial system readings, particularly the Federal Reserve’s most popular inflation gauge for clues on whether or not the central financial institution will have the ability to slash charges in September.After using the rally in US shares for lots of the 12 months, Giant Tech slammed right into a wall ultimate week. Buyers turned around from high-flying megacap stocks to riskier, lagging portions of the marketplace, spurred by way of bets on Fed price cuts and the specter of extra business restrictions on chipmakers.Nonetheless, the new outperformance of US small caps is going through technical resistance and lacks basic drivers to hold on for an extended time frame, consistent with Morgan Stanley’s leader US fairness strategist Mike Wilson.Tale continues“Whilst we’re respectful of nonetheless gentle sentiment/positioning in small caps, we see restricted basic and macro justification for small cap outperformance proceeding in a sturdy method,” Wilson and his group stated in a notice to purchasers.Hedge price range aggressively minimize chance throughout their lengthy and quick books and on the quickest tempo since January 2021, consistent with a notice by way of Goldman Sachs Team Inc.’s high brokerage table.From a internet waft point of view, ultimate week’s notional internet promoting in US unmarried shares used to be the biggest since March 2022. 9 out of eleven sectors have been internet offered — led by way of knowledge era, well being care, financials and effort.Potentialities of a Republican win in November’s presidential election would possibly invoke small-cap “animal spirits,” however this is more likely to be quick lived, consistent with Morgan Stanley’s Lisa Shalett.“We want the resilience of enormous caps to small caps — final analysis,” she wrote.The S&P 500 simply exited what’s traditionally been its best possible two-week stretch of the 12 months within the first part of July, and is coming near its maximum difficult stretch in August and September.Benefit estimates for the S&P 500 in the second one quarter haven’t been minimize up to they usually have, consistent with JPMorgan Chase & Co. strategists, an indication that there’s little room for sadness this profits season. A group lead by way of Mislav Matejka stated typically projections fall by way of 5% within the 3 months earlier than effects, however this time it’s been about 1%.The “marketplace is buying and selling close to highs, with complete positioning and excessive focus, suggesting that there’s now not a lot scope to take in any disappointments,” they wrote.The 5 greatest US era firms are going through tricky comparisons with the stellar profits cycles of the previous 12 months. Earnings for the gang are projected to upward thrust 29% in the second one quarter from the similar length a 12 months previous, knowledge compiled by way of Bloomberg Intelligence display.Whilst nonetheless robust, that’s down from the previous 3 quarters, when expansion for the gang ranged from 44% to 49%. The whole message from Wall Boulevard: Be expecting effects to turn the firms are nonetheless booming, however to not the level observed ultimate 12 months.Company Highlights:Verizon Communications Inc. reported working income that overlooked analysts’ estimates as fewer other folks upgraded wi-fi apparatus.The majority of McDonald’s Corp. US eating places will lengthen the burger chain’s $5 meal deal in a bid to draw budget-strapped diners.Delta Air Traces Inc. apologized for canceling hundreds of flights right through the busiest shuttle weekend of the summer time as a lot of its techniques failed following a catastrophic CrowdStrike Holdings Inc. IT outage.Ryanair Holdings Plc minimize its outlook for price ticket costs within the a very powerful summer time shuttle length and stated fares will probably be “materially decrease” as customers develop extra wary, including to pessimism that the post-pandemic rebound in flying is fizzling.Berkshire Hathaway Inc. has offered off some other block of BYD Co. stocks, taking its stake in one of the vital global’s greatest carmakers to underneath 5% from greater than 20% two years in the past.Key occasions this week:Eurozone shopper self assurance, TuesdayUS current house gross sales, TuesdayAlphabet, Tesla, LVMH profits, TuesdayCanada price resolution, WednesdayUS new house gross sales, S&P World PMI, WednesdayIBM, Deutsche Financial institution profits, WednesdayGermany IFO industry local weather, ThursdayUS GDP, preliminary jobless claims, sturdy items, ThursdayUS non-public source of revenue, PCE value index, College of Michigan shopper sentiment, FridaySome of the principle strikes in markets:StocksThe S&P 500 rose 1% as of 10:48 a.m. New York timeThe Nasdaq 100 rose 1.5p.cThe Dow Jones Commercial Reasonable rose 0.4p.cThe Stoxx Europe 600 rose 1.1p.cThe MSCI International Index rose 0.8p.cThe Russell 2000 Index rose 0.1p.cCurrenciesThe Bloomberg Buck Spot Index used to be little changedThe euro used to be little modified at $1.0881The British pound used to be little modified at $1.2913The Eastern yen rose 0.4% to 156.91 according to dollarCryptocurrenciesBitcoin fell 1.2% to $66,899.79Ether fell 1.4% to $3,450.55BondsThe yield on 10-year Treasuries declined two foundation issues to 4.22p.cGermany’s 10-year yield used to be little modified at 2.47p.cBritain’s 10-year yield used to be little modified at 4.13p.cCommoditiesWest Texas Intermediate crude fell 0.3% to $79.85 a barrelSpot gold fell 0.6% to $2,386.29 an ounceThis tale used to be produced with the help of Bloomberg Automation.–With the aid of John Viljoen, Sujata Rao, Matthew Burgess, Alexandra Semenova and Kasia Klimasinska.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Tech Storms Again After Rout With Income in Focal point: Markets Wrap