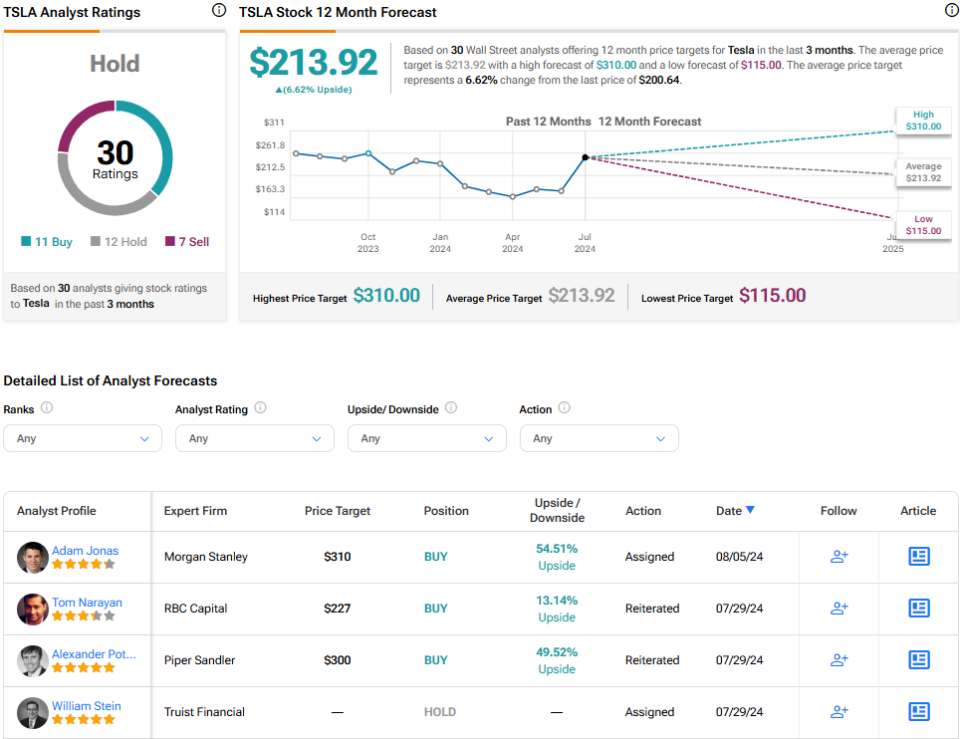

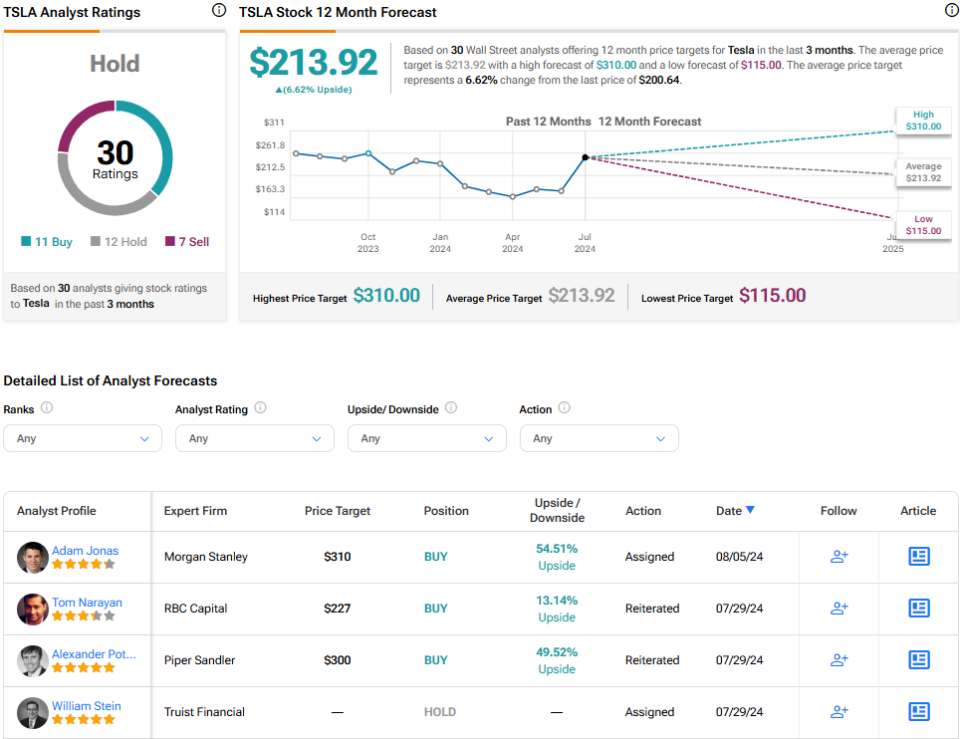

Tesla (TSLA), the main EV maker in america, has a blank power trade that would turn into the corporate’s secret enlargement device within the subsequent decade. Underneath this trade phase (referred to as Power Era and Garage), Tesla sells power garage merchandise and solar power techniques to consumers, capitalizing at the rising call for for renewable power merchandise.Since its founding in 2015, Tesla’s power trade has grown right into a $3 billion trade lately, and the corporate is aggressively increasing it in key international markets similar to China to realize long-term aggressive benefits on a world scale. I’m bullish at the outlook for Tesla as I imagine the corporate is well-positioned to develop within the subsequent decade.The Booming Power BusinessIn Q2, Tesla’s power garage deployments reached an all-time top of 9.4 GWh, a year-over-year (YoY) building up of 158%. At the again of report deployments, Power Era and Garage earnings reached a brand new top of $3 billion in comparison to simply $1.5 billion in Q2 2023. In the meantime, the core EV trade reported a earnings decline of seven% in Q2, which highlights the significance of the power trade at a time when macroeconomic pressures are restricting the expansion of the EV phase.The rising power trade is already serving to Tesla’s base line. In the second one quarter, the gross benefit margin of the power phase expanded by means of greater than 600 foundation issues YoY to 24.6%, whilst Automobile gross margins declined by means of 70 foundation issues to 18.5%. Even on an absolute foundation, power gross margins are manner forward of Automobile margins, which means the power trade is basically extra winning in comparison to Tesla’s core EV trade. Q2 was once probably the most winning quarter for the power trade since its inception.A 12 months in the past, the power trade handiest accounted for six% of overall gross income, however in Q2, the contribution from this phase rose to 16.3%. That is an encouraging signal, given the top profitability of this trade phase.Tesla is aggressively making an investment in its power trade to capitalize at the alternative in renewables. Throughout the Q2 profits name, CEO Elon Musk claimed that the corporate is making plans to ramp up manufacturing within the U.S. As well as, Tesla is construction a Megapack manufacturing unit in China to cater to the rising call for for power garage techniques. Consistent with corporate executives, Tesla is on tempo to a minimum of double the power garage capability within the foreseeable long term.The Giant Image Is PromisingAccording to BloombergNEF, the worldwide power garage marketplace tripled in 2023, with report international additions of 97 GWh in garage capability. This 12 months, international power garage additions are anticipated to hit 100 GWh, construction at the certain momentum from ultimate 12 months. BloombergNEF tasks the worldwide power garage marketplace to develop at a CAGR of 21% to 442 GWh by means of 2030. Endured adoption of renewable power is on the heart of those expectancies.Power garage techniques play a a very powerful function in supporting the transition from fossil fuels to renewable power. They assist stability the intermittent nature of renewable power assets by means of serving to customers and effort manufacturers retailer extra power to be applied when manufacturing falls beneath call for.Analysts Are Having a bet Giant at the Power BusinessWall Boulevard stays desirous about Tesla’s enlargement potentialities amid the slowdown in international EV gross sales, however some mavens are banking at the power phase to ship oversized returns. For example, Nancy Tengler, CEO and CIO of Laffer Tengler Investments, believes the power phase will force sturdy profits enlargement for Tesla within the coming years. She even in comparison the power phase to Amazon Internet Products and services, which has been the important thing profits driving force for Amazon (AMZN) in recent times.Moreover, Morgan Stanley (MS) analyst Adam Jonas, after digesting Q2 profits, raised Tesla’s value goal to $310, assigning the power trade a worth of $50 in step with percentage, up from his previous estimate of $36 in step with percentage. After boosting his estimates, the analyst commented that the power trade is a “display stealer.”Cantor Fitzgerald analysts additionally raised their full-year earnings estimates for Tesla at the again of the bettering outlook for the power trade. Cantor analysts now be expecting power garage deployments of 29 GWh in 2024, up considerably from the former estimates of 16.3 GWh. Power phase earnings is predicted to hit $9.6 billion this 12 months in opposition to earlier expectancies of $6.6 billion. Stifel and Baird analysts additionally commented definitely at the outlook for Tesla’s power trade following the sturdy second-quarter efficiency.Is Tesla Inventory a Purchase, Consistent with Analysts?Tesla inventory has declined greater than 16% this 12 months amid EV value cuts, intensifying festival, increased rates of interest, inflationary pressures, and regulatory demanding situations. This lackluster marketplace efficiency has introduced Tesla’s valuation to extra cheap grounds. Nonetheless, in keeping with the scores of 30 Wall Boulevard analysts, Tesla inventory earns a Cling consensus score. The common Tesla inventory value goal is $213.92, which means upside possible of 6.6% from the present marketplace value.

Tesla Inventory (NASDAQ:TSLA): Right here’s Its Secret Expansion System