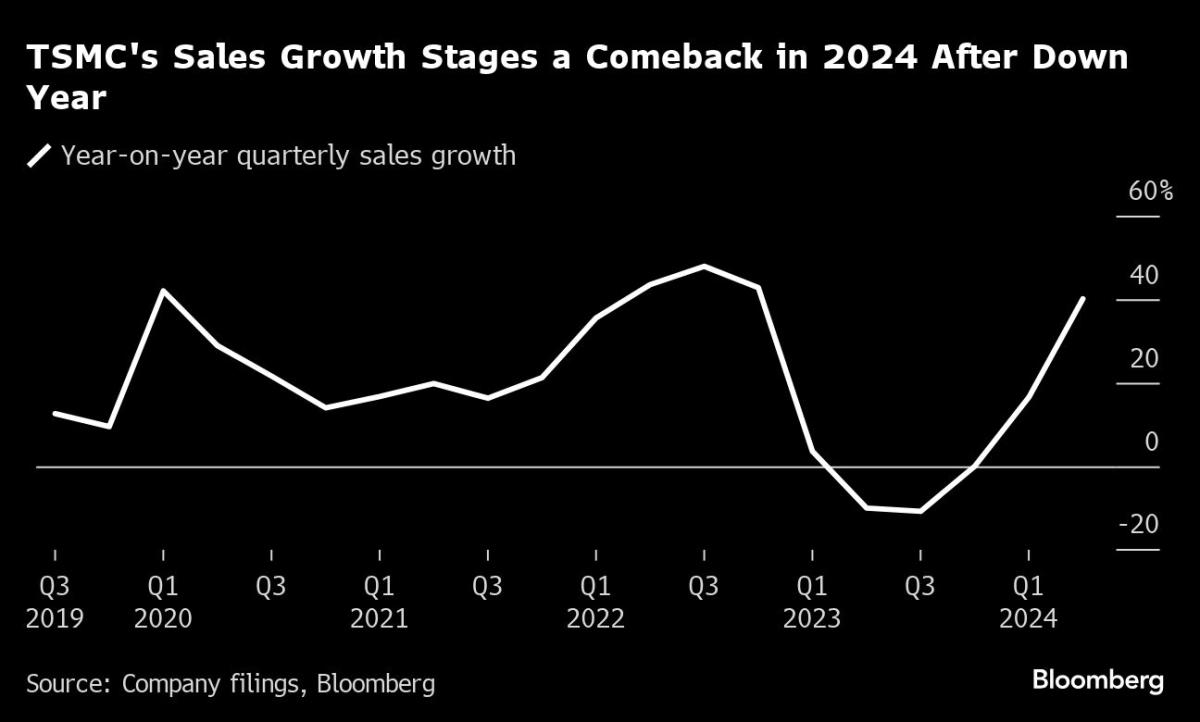

(Bloomberg) — Taiwan Semiconductor Production Co.’s income rose 45% in July, accelerating its tempo of enlargement from the June quarter and bolstering hopes for sustained sturdy call for for synthetic intelligence chips from the likes of Nvidia Corp.Maximum Learn from BloombergSales for the month reached NT$256.95 billion ($7.9 billion). For the 3rd quarter, analysts venture TSMC income will have to develop 37% to NT$747.4 billion, with the July consequence suggesting TSMC would possibly surpass the ones expectancies.Taiwan’s largest corporate is among the key bellwethers for AI call for, because the go-to chipmaker for main accelerator makers Nvidia and Complicated Micro Gadgets Inc. It’s additionally the only real provider of processors for Apple Inc.’s iPhones, at a time the cellular software marketplace is appearing indicators of bouncing off post-Covid generation lows. Closing month, the sector’s biggest contract chipmaker raised its full-year enlargement outlook to past the utmost mid-20% it had guided towards prior to now.TSMC introduced an upbeat overview of its industry and potentialities when it ultimate reported profits, with Leader Government Officer C.C. Wei signaling the corporate could have room to lift costs as extra of its consumers transition to its maximum complicated generation and need to compete for restricted capability. Prime-performance computing, led through AI, contributed 52% of TSMC’s income ultimate quarter, the primary time it has accounted for greater than part.Nonetheless, buyers have began to query whether or not the billions of greenbacks Large Tech companies have invested within the infrastructure to toughen the AI growth will lead to really extensive returns, whilst a possible lengthen in Nvidia’s building of a brand new era of AI chips is spurring issues over the development of the rising generation.Worries concerning the world financial outlook over the last week interrupted the AI rally that had noticed key avid gamers like TSMC features billions in marketplace price. Traders opted to money out of one of the crucial 12 months’s largest gainers, pushing TSMC’s stocks down 10% in an afternoon, even though the corporate recovered a lot of that during next days as cash managers noticed a excellent purchasing alternative.–With the help of Vlad Savov.(Updates with further main points from TSMC’s newest profits document)Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

TSMC Gross sales Develop 45% in July on Sturdy AI Chip Call for