AAVE has a bearish construction and impartial momentum.

Quick-term holders most probably added to the cost drop with profit-taking process, and accumulation has now not resumed but.

Aave [AAVE] used to be in a just right place within the DeFi sector and may just care for decentralized liquidations successfully. This earned a $6 million income in a single day.

The protocol additionally noticed milestones in July, such because the proposed creation of a “charge transfer.”

At the value entrance, AAVE gave the impression to be protecting sturdy regardless of market-wide losses previous this month. This concept used to be tossed out of the window all over the sell-off on Monday the fifth of August.

What are the potentialities for the token from right here on?

AAVE keeps bearish promise

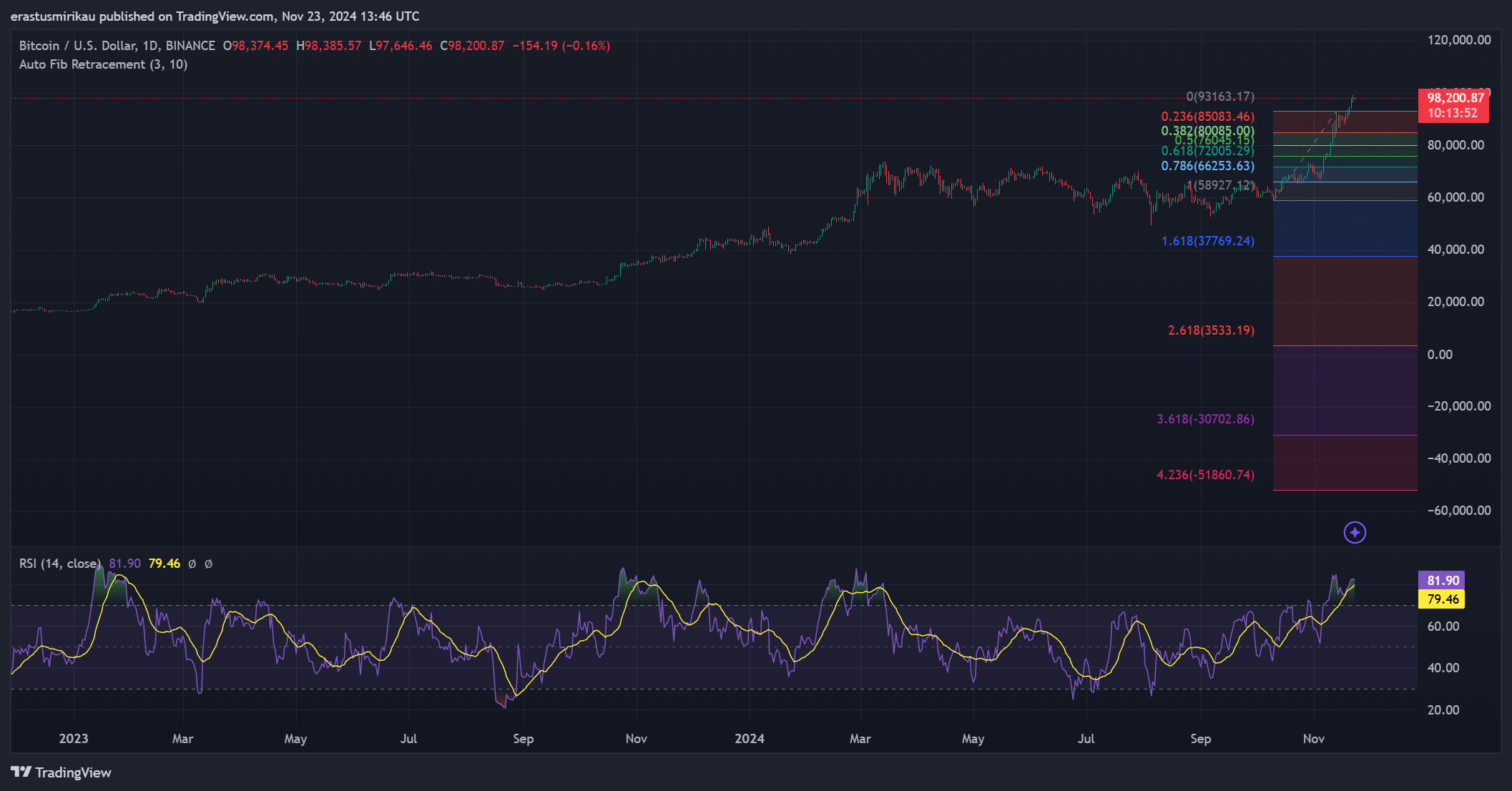

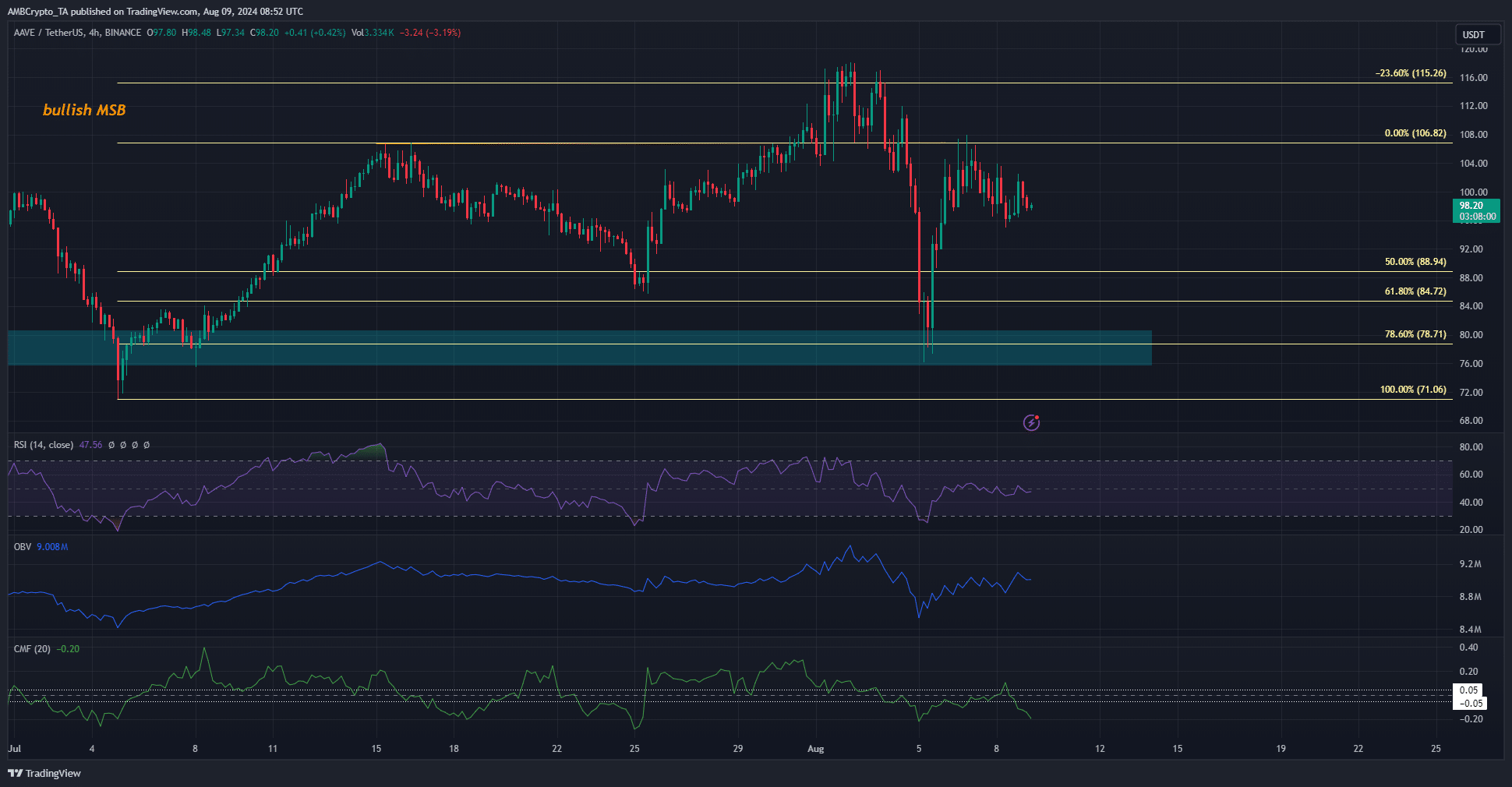

Supply: AAVE/USDT on TradingView

Supply: AAVE/USDT on TradingView

The marketplace construction of AAVE remained bearish at the 1-day chart. It fell to the 78.6% Fibonacci retracement degree at $78.71 and bounced to the $106 degree.

Then again, it might now not make a brand new top, and the rejection set a decrease top as a substitute.

The day by day RSI has meandered concerning the impartial 50 mark during the last few days, appearing the momentum didn’t choose the bulls but.

The OBV has trended upward for the reason that fifth of August, however the CMF fell to -0.2 to sign heavy capital go with the flow out of the marketplace.

AAVE metrics signaled volatility and distribution

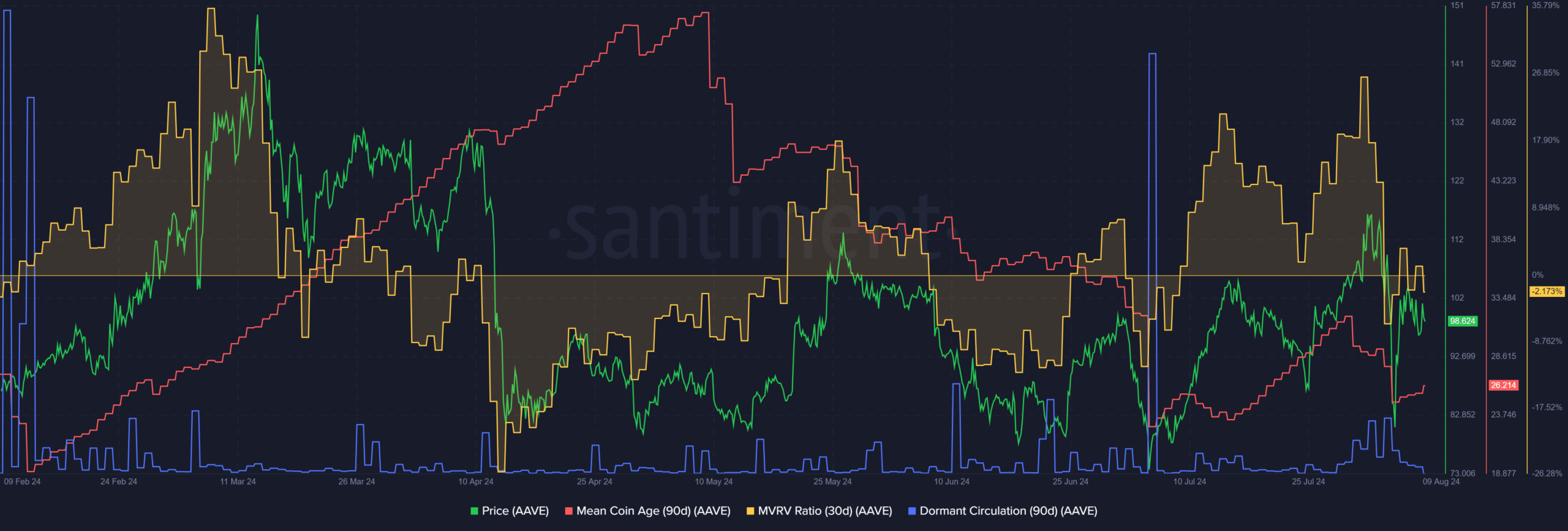

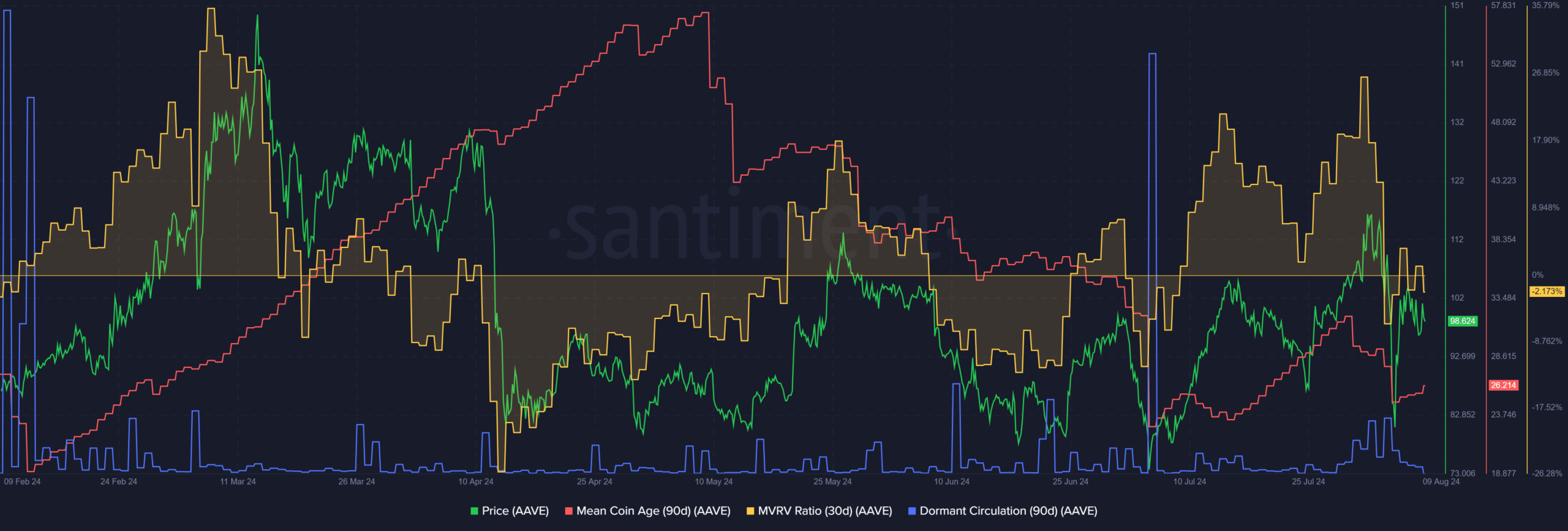

Supply: Santiment

Supply: Santiment

The MVRV ratio fell from just about 30% to -2%, appearing non permanent holders have been at a cash in prior to the cost crashed beneath $100. All through the cost drop, the dormant stream noticed an uptick.

In combination, it indicated holders cashed out and most probably took income. This concept used to be supported via the autumn within the imply coin age (MCA) too, which confirmed an AAVE distribution.

The MCA would want to development upper to sign patrons have been gathering the token.

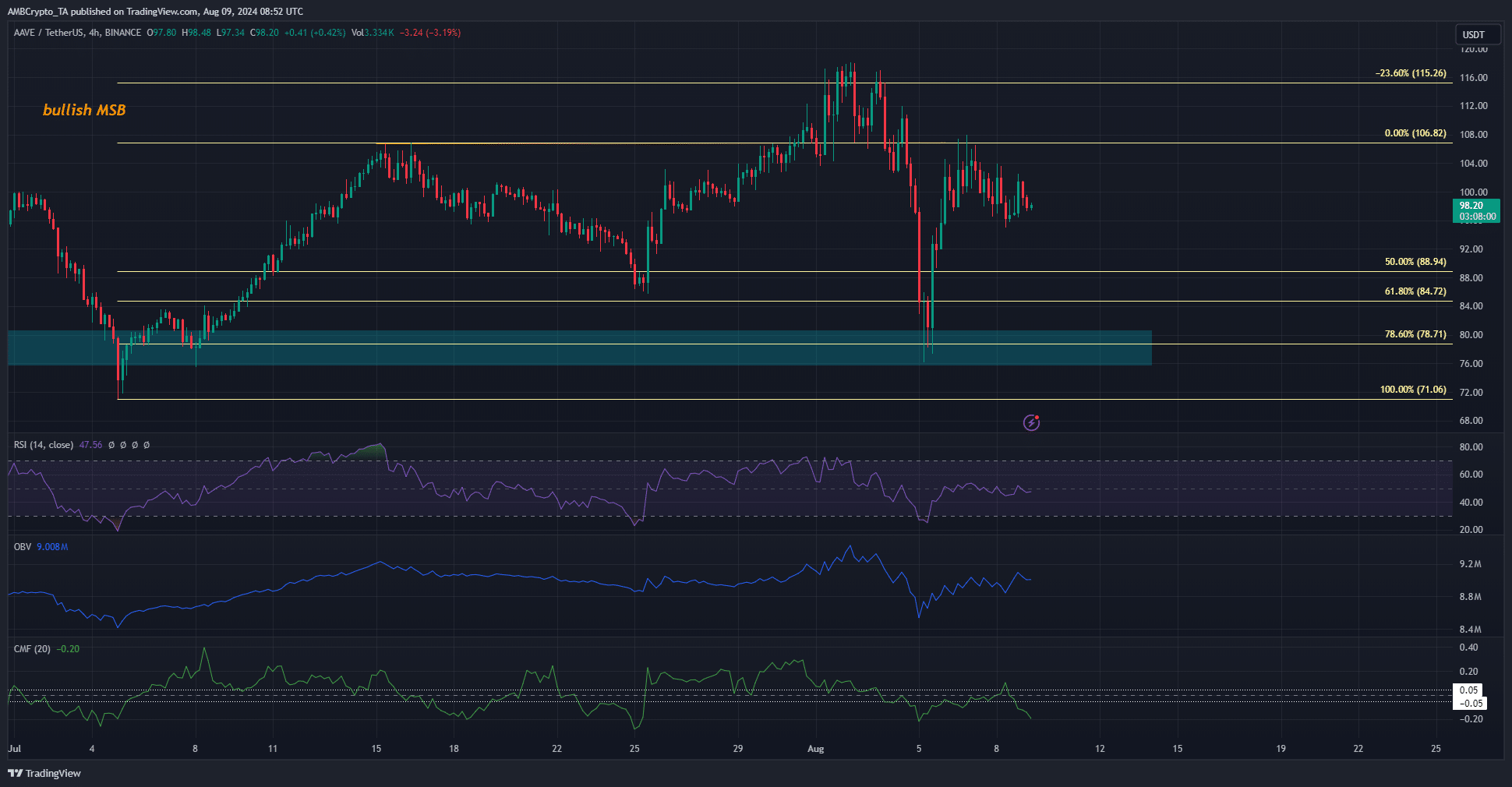

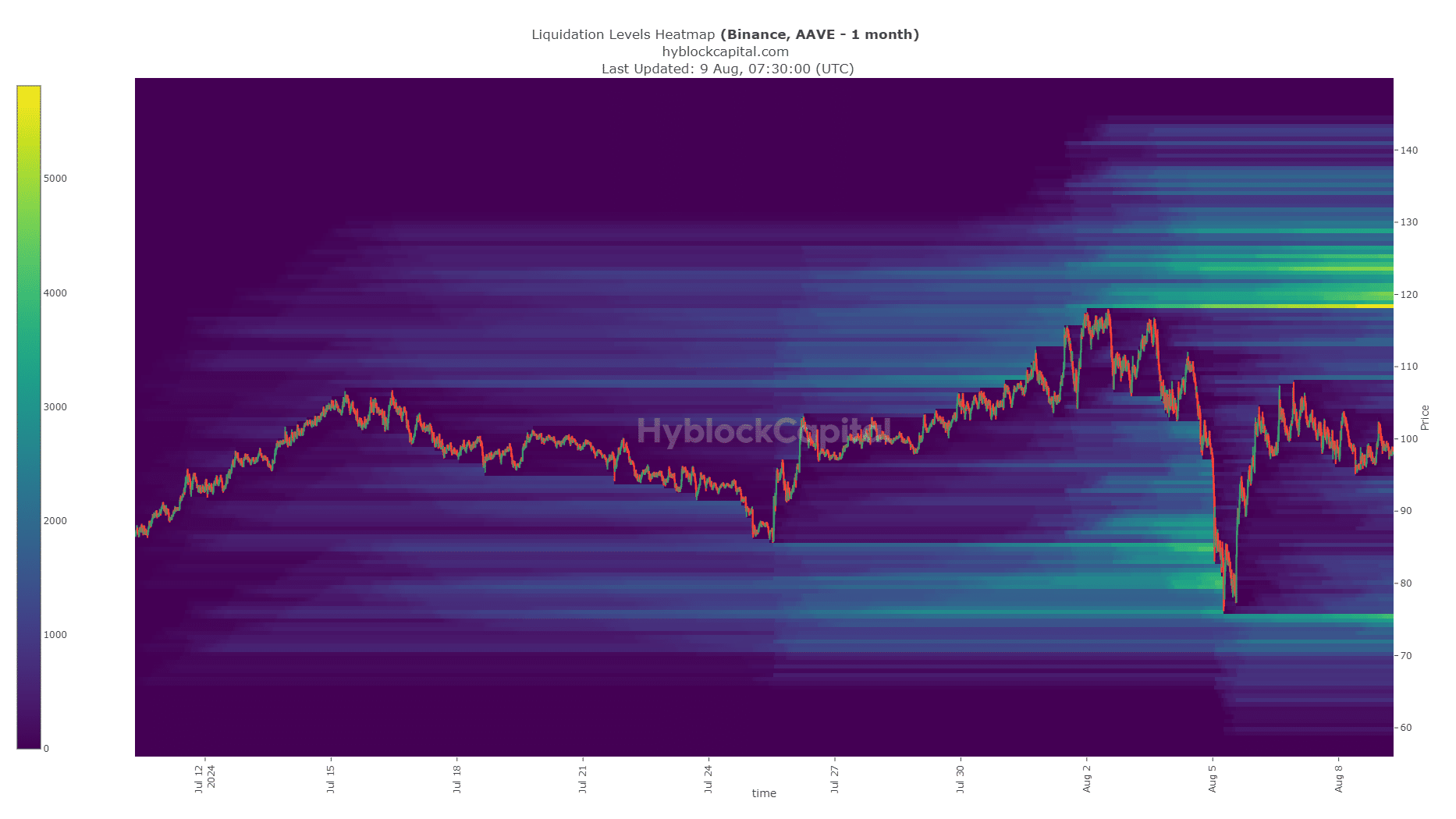

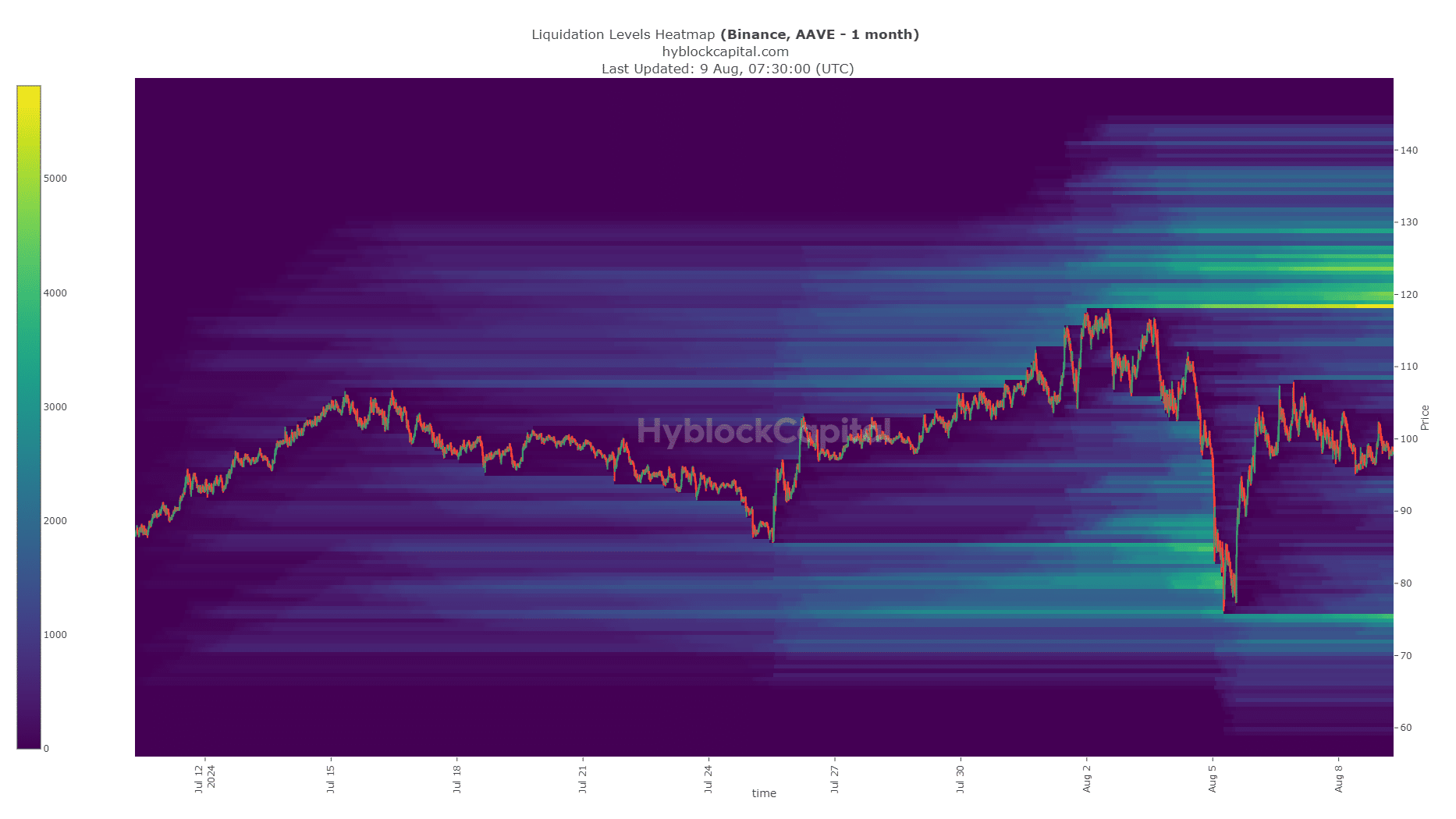

Supply: Hyblock

Supply: Hyblock

The liquidation heatmap underlined a non permanent goal at $108.5, and a miles more potent liquidity pool at $118-$120. This would function a near-term goal for the AAVE token prior to a pullback.

Lifelike or now not, right here’s AAVE’s marketplace cap in BTC’s phrases

Total, the display of relative power in opposition to Bitcoin [BTC] used to be briefly annihilated, which didn’t bolster investor self assurance.

But, the efficiency of the protocol all over this community pressure length used to be sure and may just replicate in AAVE costs as soon as the marketplace sentiment starts to shift.

Earlier: CBOE re-submits submitting for Spot Bitcoin ETF Choices to SEC – What subsequent?

Subsequent: XRP rallies post-SEC victory: Is that this the beginning of its bull run?