Ethereum lags at the back of Bitcoin when it comes to call for from institutional buyers

Ethereum maintains robust lead towards Bitcoin in a single key house despite the fact that

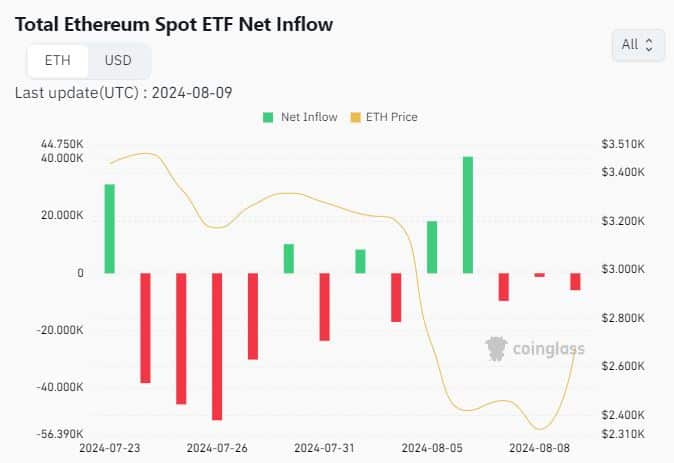

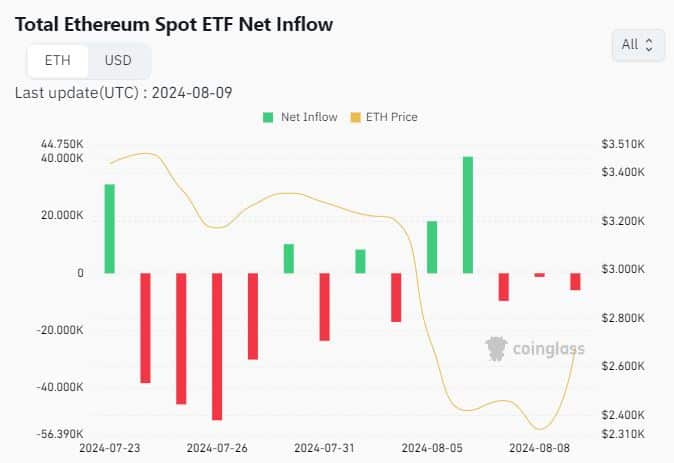

Spot Ethereum ETFs can have introduced some pleasure into the marketplace, however the hype has now not been any place close to what we now have noticed with Bitcoin. That is an consequence that aligns with a push for Bitcoin from political elites.

Whilst the remark underscores how Bitcoin overshadows Ethereum, may just the latter even have a downside when it comes to liquidity? Actually, a contemporary QCP research advised that Ethereum is also sidelined from the macro capital markets whilst the marketplace continues to choose Bitcoin.

Since each Bitcoin and Ethereum are to be had as Spot ETF belongings, a efficiency comparability would possibly supply a clearer image of efficiency variations.

Bitcoin ETFs netflows averaged nearly 300,000 BTC within the final 2 weeks, consistent with Coinglass. In the meantime, Ethereum had a complete spot ETF netflow of -114,350 ETH.

Supply: Coinglass

Supply: Coinglass

The knowledge disclosed more potent call for for Bitcoin, in comparison to ETH within the spot ETF section.

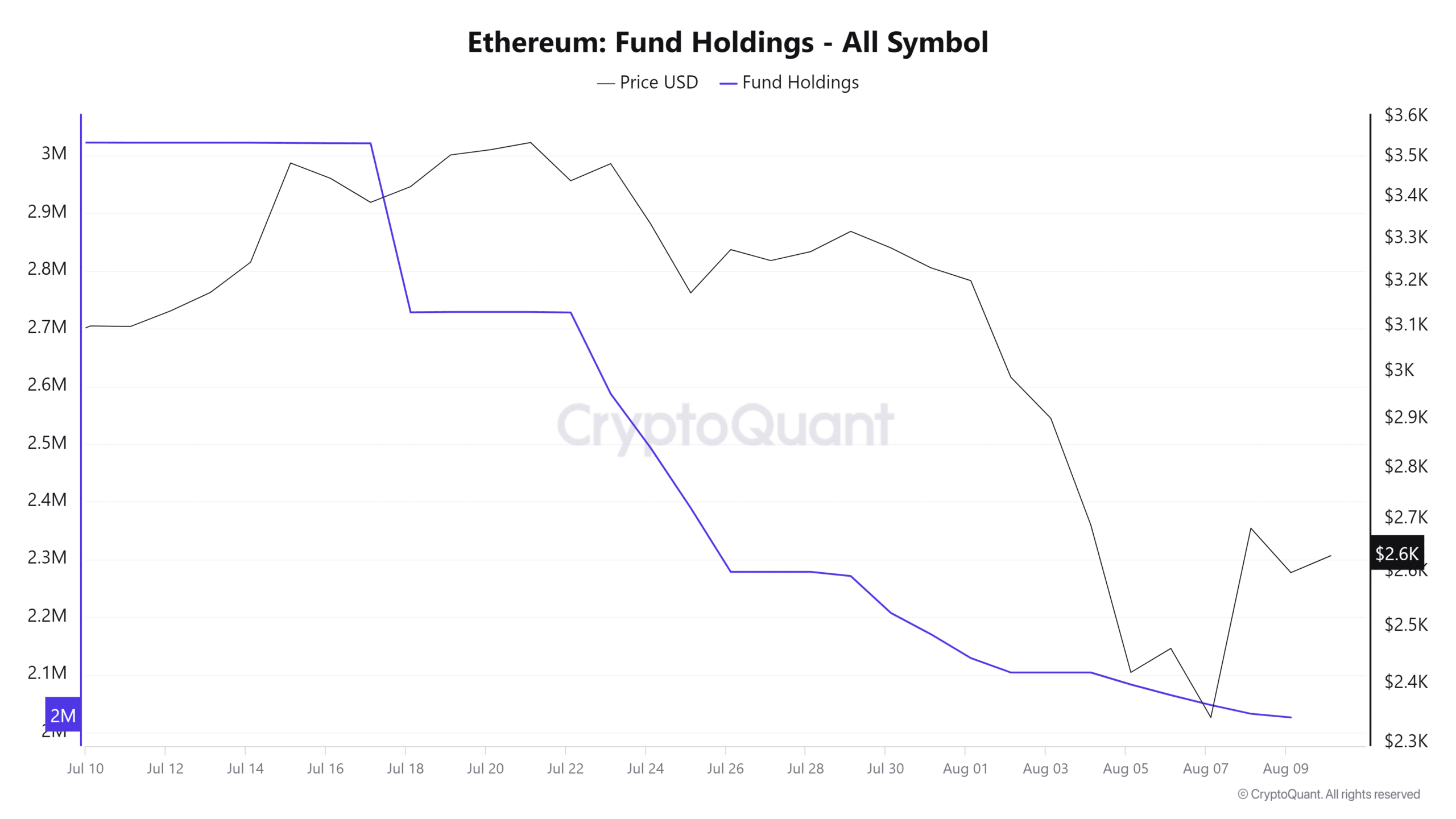

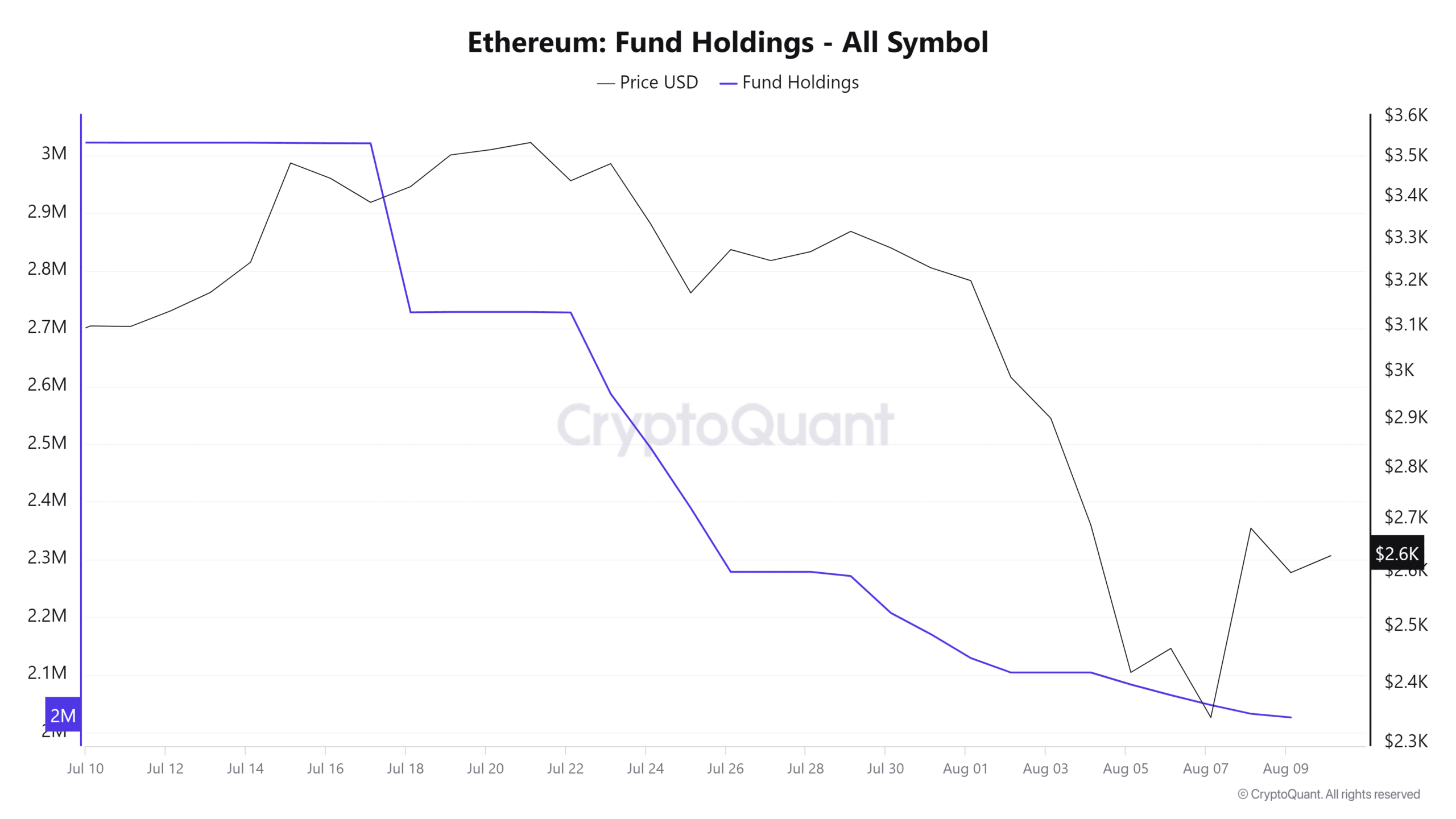

Our review additionally published the similar for fund holdings. In line with CryptoQuant, ETH fund holdings amounted to two,026,328.5 ETH, value $5.32 billion at ETH’s press time worth.

Supply: CryptoQuant

Supply: CryptoQuant

Right here, it’s also value noting that ETH fund holdings had been nonetheless on a downward trajectory on the time of writing, regardless of the marketplace’s restoration.

In the meantime, Bitcoin fund holdings amounted to 280,951.35 BTC, which at press time price had been value $17.07 billion – Slightly over thrice greater than ETH. This, regardless of BTC fund holdings additionally declining over the past 4 weeks.

An excellent comparability?

The aforementioned information showed that Bitcoin is extra preferable within the capital markets, in comparison to Ethereum.

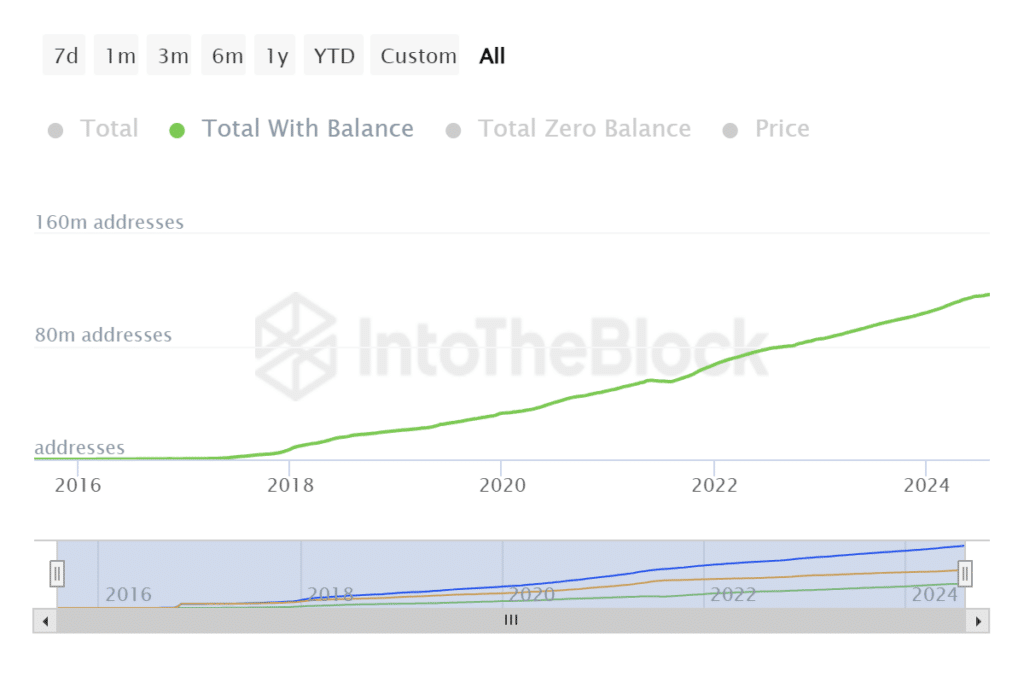

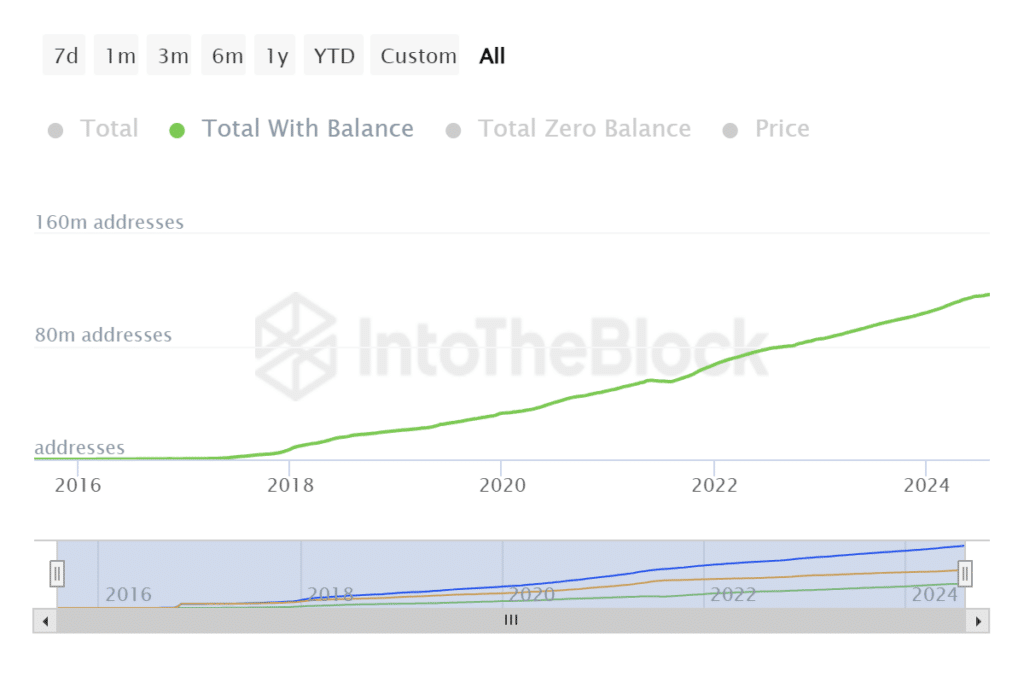

This may occasionally give an explanation for why finances cling extra in Bitcoin than Ethereum. Alternatively, Ethereum additionally wins in different key spaces too. As an example, it has a miles upper overall deal with depend with stability at 116.97 million.

Supply: IntoTheBlock

Supply: IntoTheBlock

Compared, Bitcoin had a complete of “simply” 52.67 million overall addresses with stability – Lower than part of the full Ethereum addresses.

This highlighted one in all Ethereum’s strengths as an increasing ecosystem. In all probability one of the most greatest the explanation why Ethereum just lately won Spot ETF approvals.

There’s unquestionably that Bitcoin’s early lead towards Ethereum provides a transparent merit. Alternatively, Ethereum additionally items a chance that the institutional elegance of buyers are beginning to embody. But even so, Ethereum ETFs are just a few weeks previous, whilst Bitcoin ETFs were round for months.

The rest months of 2024 will have to supply a clearer image of the way Ethereum will fare within the macro capital marketplace. However, the findings ascertain that Ethereum is at slightly of an obstacle towards Bitcoin when it comes to securing institutional liquidity.

It’ll give an explanation for the variations between BTC and ETH’s worth motion too.

Subsequent: USDT fuels Bitcoin’s ’thirteenth biggest’ restoration – The whole thing you wish to have to grasp