USDT and USDC grew virtually $3 billion amidst crypto marketplace’s downturn

Tether’s USDT recorded $1.5 billion deposits whilst Circle’s USDC famous figures of $820 million

In spite of certain performances previous it, the bigger crypto marketplace crumbled on Monday. The beginning of this week noticed all cryptocurrencies decline amid a world inventory crash. Alternatively, stablecoins defied all marketplace odds all through the week.

Actually, the stablecoin sector grew in marketplace cap and provide, led via USDT and USDC.

USDT & USDC’s $3B provide in every week

Supply: X

Supply: X

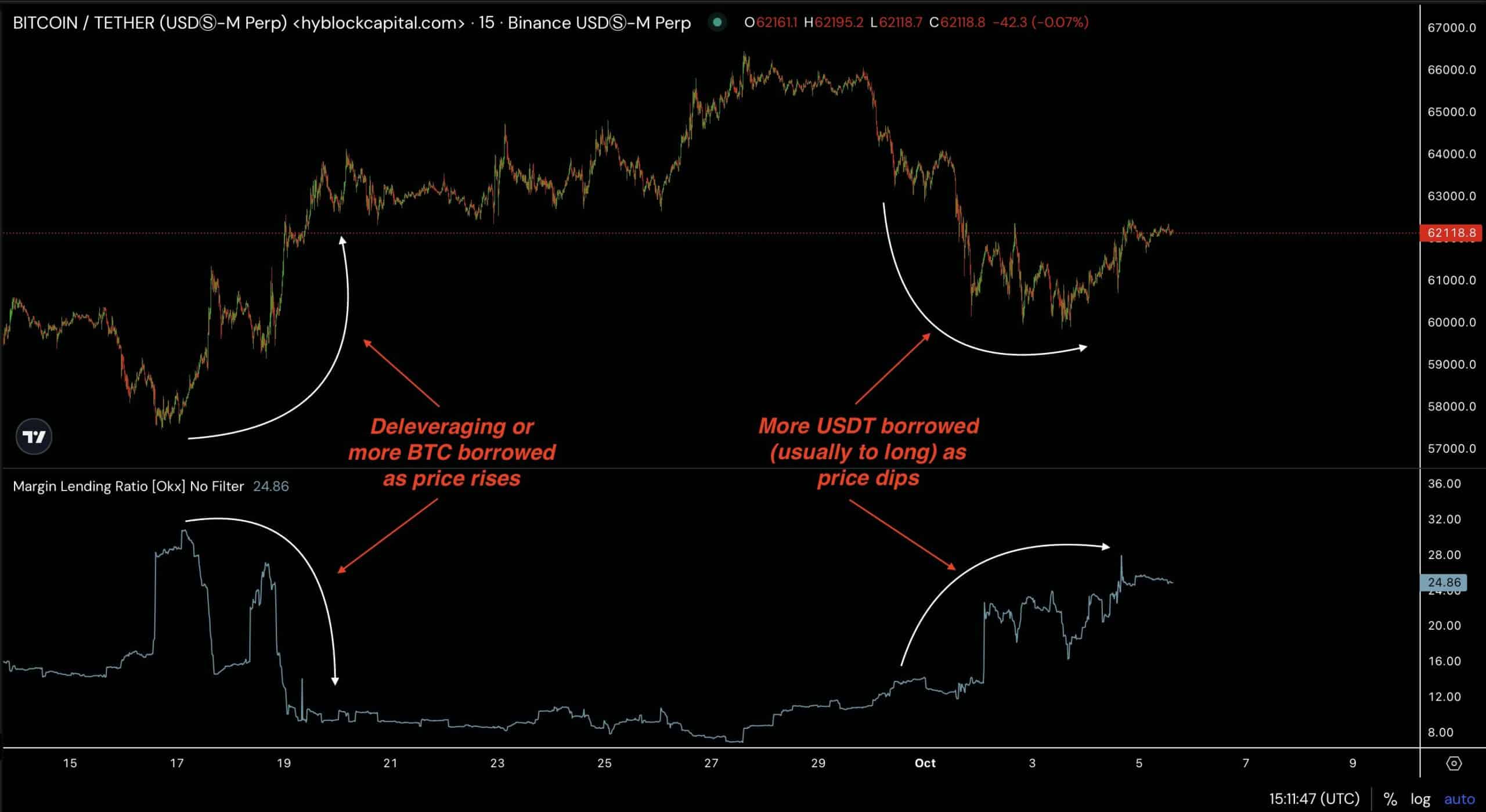

During the last week, the provision of Tether’s USDT and Circle’s USDC grew exponentially to $3 billion. Since crypto markets have been experiencing a sustained decline, the upward push in provide indicated a better wish to purchase the dip. Thus, maximum buyers rushed to shop for the dip as crypto costs declined.

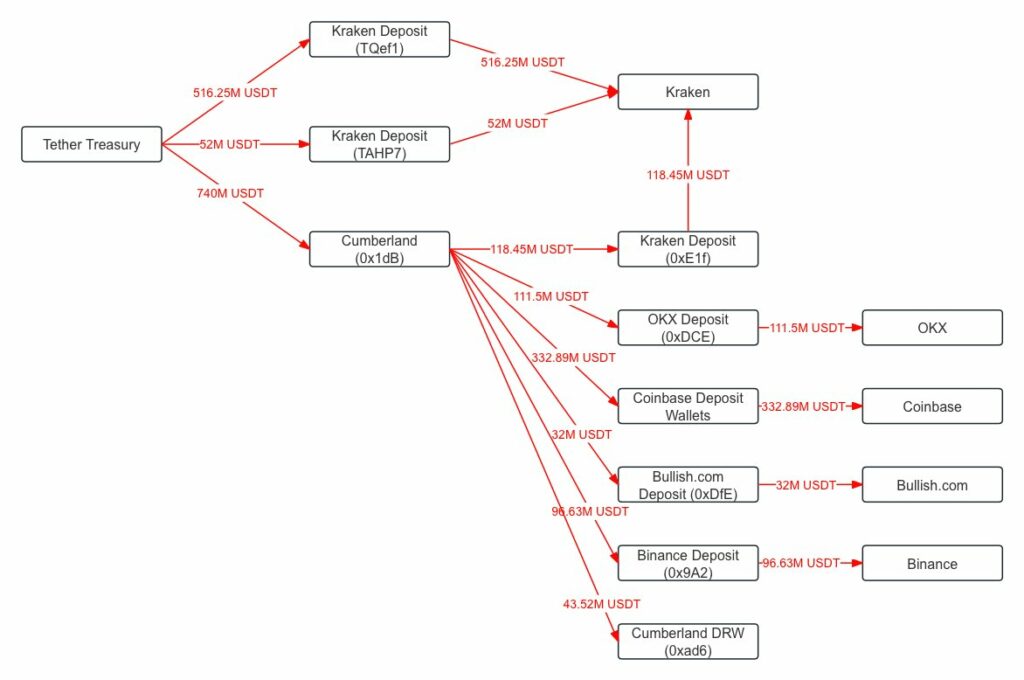

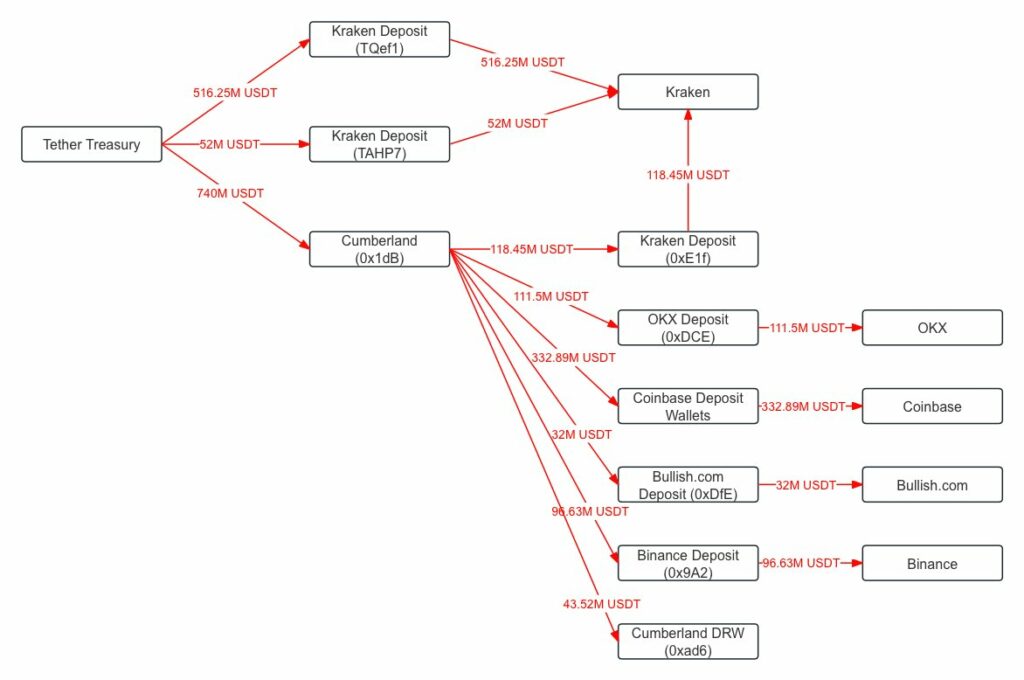

In step with information shared on X via Lookonchain, Tether transferred $1.3 billion to exchanges and marketplace markers because the Monday crash. Lookonchain famous,

” 1.3b of USDT has been transferred from Tether treasury to exchanges because the marketplace crash on Aug 5.”

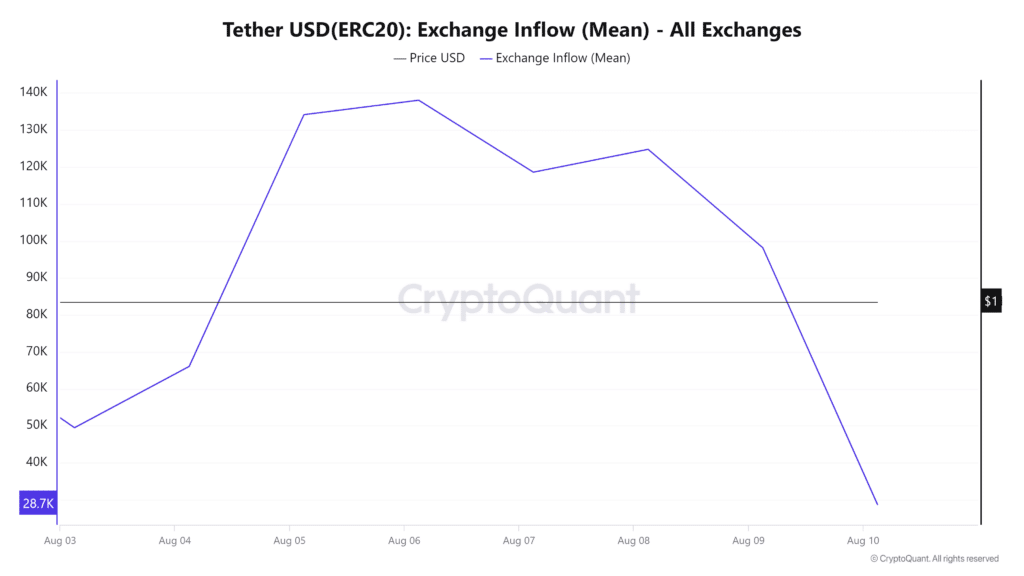

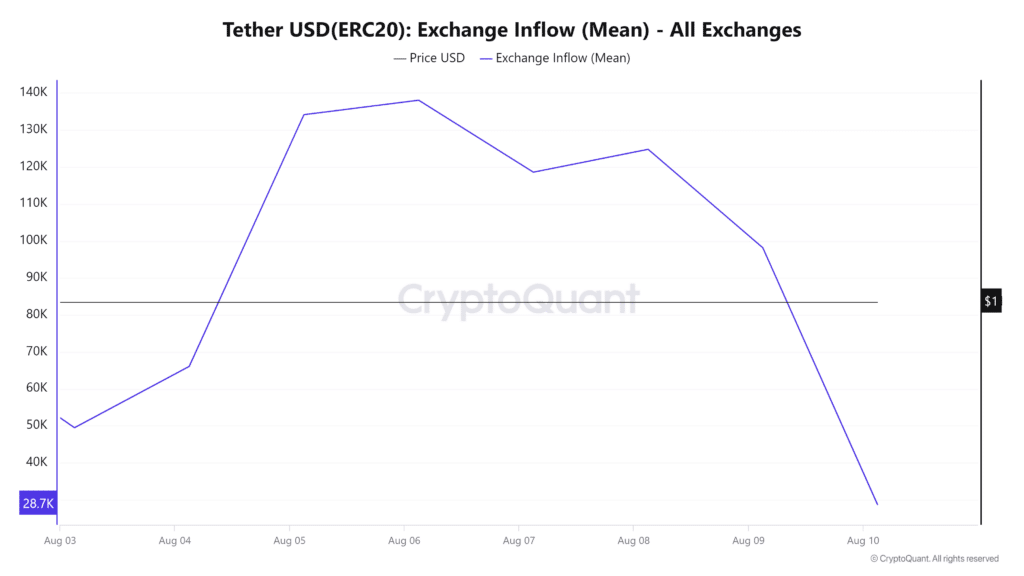

The unexpected surge in stablecoins has risen because the get started of the crypto marketplace tumble, which resulted from investors’ transfers to exchanges. Actually, Cryptoquant’s information published that USDT inflows into exchanges spiked via 181% between 3 August and six August right through the marketplace crash.

Supply: CryptoQuant

Supply: CryptoQuant

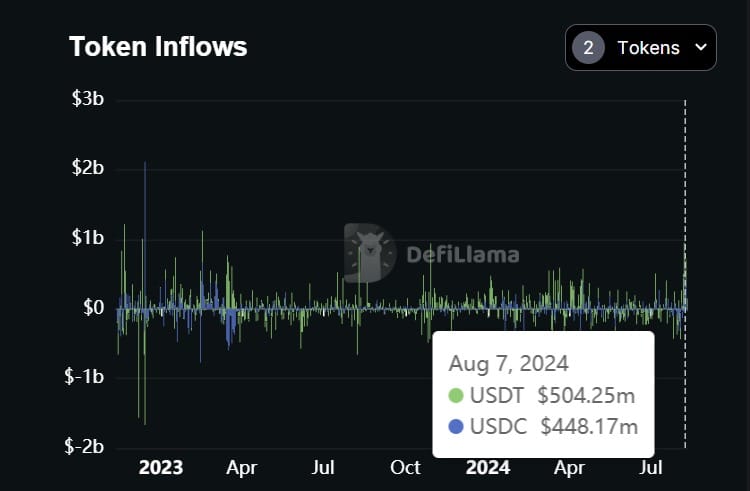

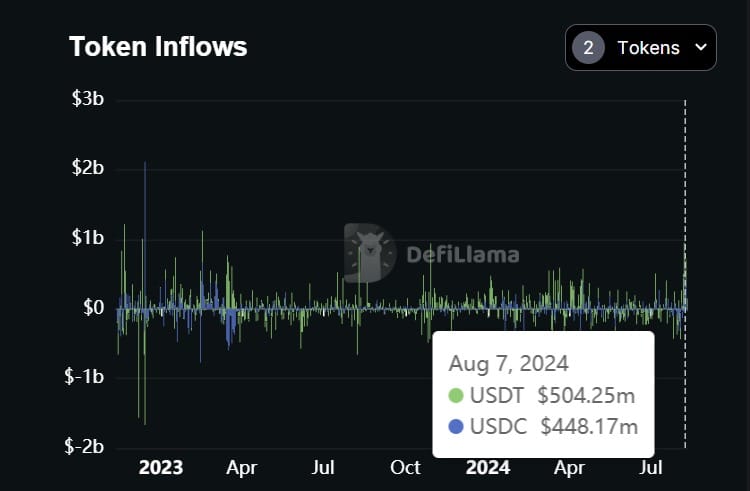

Similarly, information from defiLlama recommended that Binance registered exponential expansion in USDT deposits hitting $1.5 billion.

Moreover, USDC deposits into Binance hit a document of $820 million inside of simply 3 days.

Supply: Defillama

Supply: Defillama

Merely put, the knowledge presentations that the new marketplace downturn offered a purchasing alternative with all stakeholders changing into web patrons.

The larger purchasing force’s have an effect on was once witnessed after 48 hours when markets began to recuperate with important positive aspects around the board.

Marketplace Cap expansion to document top

The marketplace cap additionally surged as the provision grew right through the marketplace downturn. Tether’s USDT marketplace cap grew to a document top of $115.4 billion after experiencing sustained expansion over the past 3 months. Similarly, USDC has maintained its expansion since Circle complied with MICA. During the last week, USDC larger its numbers via $1.6 billion to $34.48 billion.

Now, USDC is at its every year top because the cave in of SVB in 2023.

This surge was once additional famous via different crypto analysts, with David Alexander sharing his research on X via mentioning,

“Fascinating $USDC actions this week as general circulating provide has larger via $1.56B (4.8%) after experiencing a pointy decline forward of broader marketplace headwinds. A lot of those inflows took place on Ethereum ($1.34B) and Solana ($356M).”

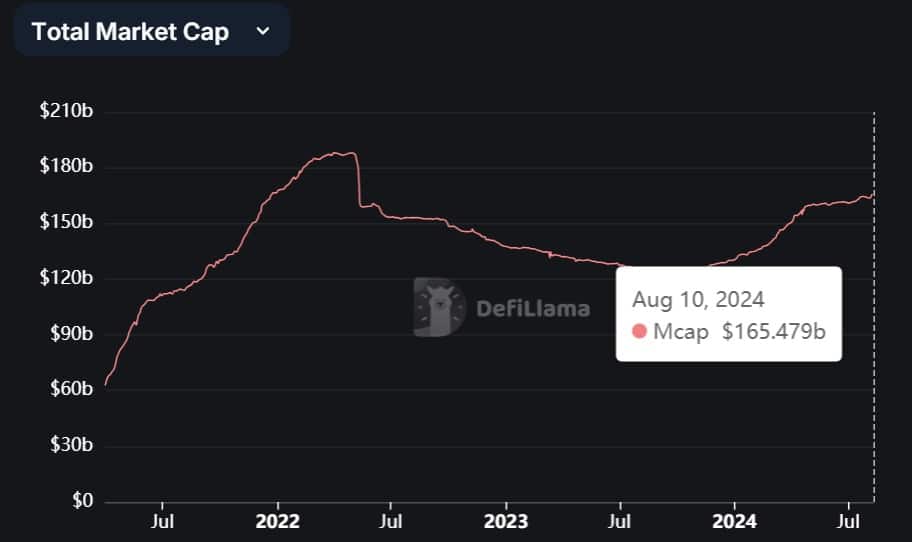

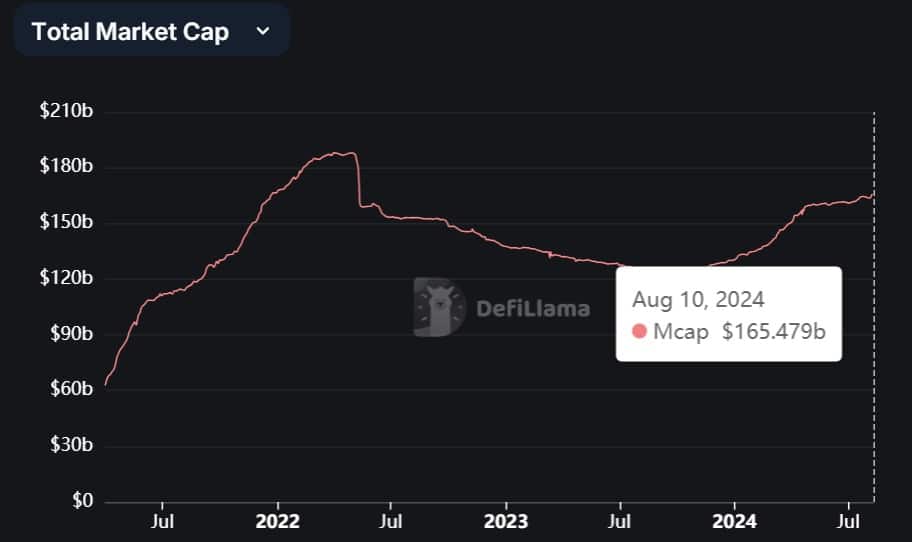

Supply: Defillama

Supply: Defillama

During the last yr, stablecoins have noticed constant expansion from $124.6 billion on 10 August 2023 to $165.4 billion, at press time. This will also be noticed as an indication of better adoption, hobby, and utilization, translating into USDT’s and USDC’s expansion.

Subsequent: XRP marketplace watch – Did Ripple’s stablecoin checking out transfer the altcoin?