As GenAI continues to advance, considerations are mounting that many roles could also be in danger, as this modern generation provides a extra environment friendly and cost-effective solution to carry out duties historically treated through people.

Alternatively, one distinguished Wall Boulevard determine doesn’t percentage this gloomy outlook. Castle founder and CEO Ken Griffin stays skeptical that AI will outperform people in lots of spaces.

“Some are satisfied that inside 3 years virtually the whole thing we do as people shall be finished in a single shape or some other through LLMs and different AI gear,” stated Griffin, who boasts a internet price of $37.3 billion. “For numerous causes, I’m really not satisfied that those fashions will succeed in that form of leap forward within the close to long run.”

Sure eventualities are simply no longer appropriate for system studying fashions, says Griffin, corresponding to vehicles using throughout the snow or adjusting to a “global the place regimes shift.”

In the meantime, Griffin has additionally been taking a contrasting strategy to one of the crucial greatest names related to AI. Right through Q2, he determined to dump an enormous bite of his Nvidia (NASDAQ:NVDA) holdings, however on the similar time loaded up on Palantir (NASDAQ:PLTR) stocks.

So, let’s take a better have a look at those names and notice what’s in the back of Griffin’s newest strikes. With lend a hand from the TipRanks database, we will be able to additionally learn the way the Boulevard’s analyst group feels about his alternatives.

Nvidia

Communicate to any marketplace watcher in regards to the AI-fueled rally that has been using the present bull marketplace and the dialog will naturally flip to Nvidia. For an organization as soon as recognized basically because the maker of GPUs for players, in recent times the semi large has established itself because the undisputed AI chip king. And the cause of that may be a somewhat easy one: Nvidia’s chips are the most efficient in the market.

Such has been its luck, for a short lived duration previous this yr, Nvidia become probably the most treasured corporate on the earth. A have a look at its most up-to-date quarterly effects is symptomatic of a constant contemporary pattern of outperformance.

In its fiscal first quarter (April quarter), income climbed through 262.2% year-over-year to $26 billion, beating the Boulevard’s name through $1.45 billion. The ground-line efficiency used to be simply as spectacular, with adj. EPS of $6.12 coming in $0.54 forward of expectancies. And taking a look forward, as has turn out to be the norm for the chipmaker in recent years, the information exceeded expectancies once more, with Nvidia calling for FQ2 income of $28.0 billion, plus or minus 2%, vs. the Boulevard at $26.84 billion.

However Griffin doesn’t seem to be ready round to look if Nvidia delivers some other stellar document on the finish of the month (August 28). Right through Q2, he slashed his place through 80%, promoting 2,421,072 stocks.

Possibly Griffin’s transfer is a prescient one with the billionaire pondering the stocks have peaked and the street forward is probably not as easy as it’s been for the previous yr and a part. Actually, the corporate has encountered some problems not too long ago after the transport of its new Blackwell AI chip used to be behind schedule because of a design fault.

Buyers must control how this case develops, says D.A. Davidson analyst Gil Luria. “We imagine the reported delays in Blackwell deliveries usually are short-lived and feature restricted have an effect on, however they do upload a twist to the NVIDIA tale,” Luria defined. “Our way has been to be expecting report effects for the remainder of the yr given the considerable will increase communicated through mega cap consumers, with a extra wary strategy to next years, particularly CY26, the place consensus expectancies seem to suggest NVDIA’s mega cap consumers will perpetually forgo margin enlargement. The lengthen in Blackwell shipments would possibly create a shorter time period blip which we can have to scrupulously assess to be able to no longer mistake it for the inevitable cycle flip.”

Luria takes a wary way too, ranking NVDA stocks as Impartial, whilst his $90 worth goal implies the inventory will shed 27% of its price over the following yr. (To look at Luria’s monitor report, click on right here)

Griffin and Luria’s takes, on the other hand, aren’t ones shared through maximum at the Boulevard. The inventory claims a Robust Purchase consensus ranking, according to a mixture of 37 Buys vs. 4 Holds. At $144.17, the typical goal suggests stocks will climb some other 17% from right here. (See NVDA inventory forecast)

Palantir

From one giant AI title to some other. Palantir could also be a reputation related to the present scorching pattern and its inventory has benefited immensely from all of the hype – the stocks have greater than doubled in price during the last yr.

Referred to as a large information analytics company, Palantir supplies instrument platforms to lend a hand organizations combine, organize, and analyze huge quantities of information. Since being based in 2003, Palantir’s merchandise were basically utilized by executive businesses, together with intelligence and protection, however the corporate has been seeking to make a concerted push into the industrial sector.

And that is the place AI enters the sport. Remaining yr, Palantir introduced its Synthetic Intelligence Platform (AIP), a collection of gear and applied sciences designed to streamline the advance, deployment, and control of AI fashions and packages. It integrates quite a lot of AI functionalities, corresponding to system studying, herbal language processing, and knowledge research, right into a platform that permits organizations to successfully harness AI functions.

And the product has been gaining traction, as used to be obvious in its contemporary Q2 document. With US industrial income notching 55% YoY expansion, smartly forward of its 45% information, overall income reached $678.13 million, amounting to general expansion of 27.2% and outpacing expectancies through $25.71 million. On the different finish of the size, adj. EPS of $0.09 edged forward of the analysts’ forecast through $0.01. Shifting ahead, for Q3, the corporate expects income within the vary between $697 – $701 million, above the $680.2 million consensus estimate.

Griffin should have preferred all of that. In Q2, he bought 5,680,767 PLTR stocks. Those are recently price greater than $176.1 million.

The corporate additionally has a large fan in Wedbush analyst Daniel Ives, who applauds the most recent set of effects. He says, “Whilst the corporate has observed many skeptics from the Boulevard, this used to be a ‘turn out me’ quarter to turn out its increasing spouse ecosystem as extra use circumstances for its merchandise result in emerging call for around the panorama for enterprise-scale generative AI answers whilst gaining percentage with the AI Revolution now hitting the 2d/third/4th derivatives. This used to be a significant validation quarter/outlook for Palantir and the wider AI Revolution thesis.”

Actually, Ives is the Boulevard’s maximum distinguished PLTR bull, ranking the inventory as Outperform (i.e., Purchase), whilst his $38 worth goal implies stocks will recognize through ~22% over the following twelve months. (To look at Ives’ monitor report, click on right here)

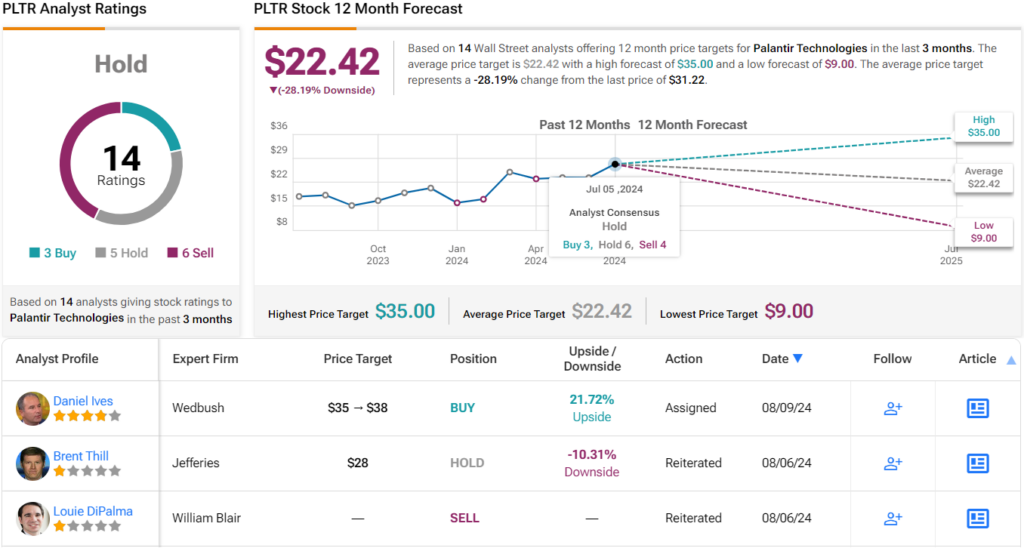

Griffin and Ives, on the other hand, are within the minority right here. The inventory best claims a Dangle consensus ranking, according to a mixture of 5 Holds, 6 Sells and three Buys. Additionally, the $22.42 reasonable goal readies buyers for a 28% decline within the yr forward. (See PLTR inventory forecast)

To seek out excellent concepts for shares buying and selling at sexy valuations, discuss with TipRanks’ Absolute best Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The critiques expressed on this article are only the ones of the featured analysts. The content material is meant for use for informational functions best. You will need to to do your individual research ahead of making any funding.