Nvidia (NASDAQ:NVDA) inventory stays on a outstanding upward trajectory, surging 151% year-to-date. Even the hot announcement of a design factor delaying the Blackwell B200 chip’s quantity shipments slightly slowed the momentum.

Certainly, in keeping with UBS’s Timothy Arcuri, an analyst ranked 4th amongst hundreds of Wall Boulevard inventory execs, traders have little to fret about.

Arcuri’s tests point out that the preliminary buyer shipments of the Blackwell chip could be not on time by way of as much as 4-6 weeks, doubtlessly extending to past due January 2025. Alternatively, the lengthen is predicted to be partially offset as many shoppers flip to the H200 because of its shorter lead instances. Main shoppers are more likely to have their first Blackwell gadgets up and operating round April 2025. In the meantime, AI labs are “upsizing and extending” their example commitments, whilst enterprises are hastily expanding their percentage of call for, either one of which might be “bullish signs.”

Given the 4-6 week lengthen from mid-December, Arcuri now anticipates just a minimum quantity of Blackwell gadgets shall be bought in FQ4 (January quarter). Alternatively, his forecast for Hopper gadgets is up by way of about 25%, because of shorter lead instances and indicators of higher capability procurement within the provide chain.

Consequently, Arcuri has decreased his FQ4 earnings estimate by way of about $500 million, aligning it extra carefully with basic Boulevard expectancies. The lengthen additionally reduces his FQ1 earnings estimate by way of about $500 million, even though his forecast nonetheless stays $3.5-4 billion above Wall Boulevard estimates.

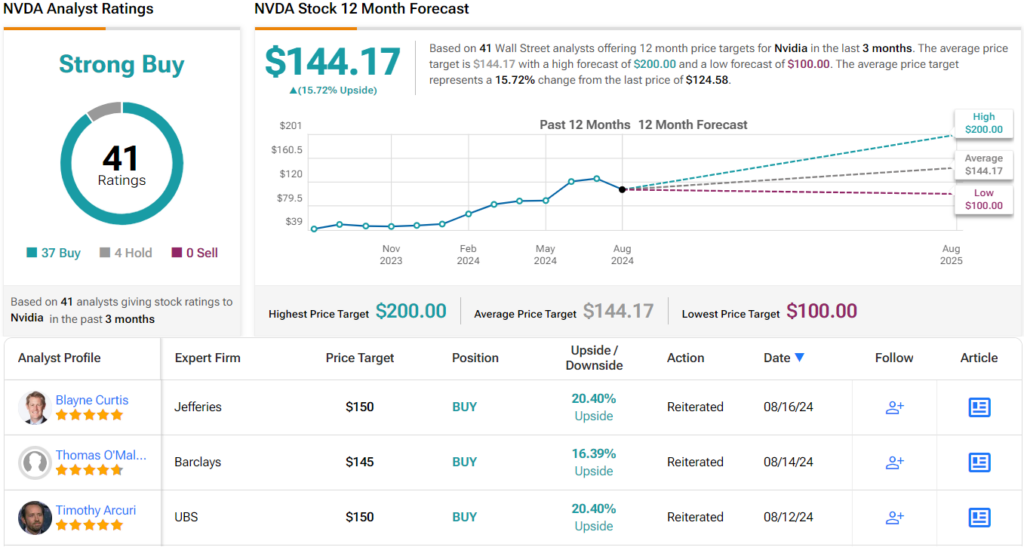

Regardless of those changes, Arcuri hasn’t modified his $150 worth goal for NVDA stocks, suggesting a 20% upside over the following 12 months. It’s no marvel that he charges the inventory a Purchase. (To look at Arcuri’s observe report, click on right here)

Arcuri’s outlook is echoed by way of lots of his colleagues. With 37 Buys outgunning 4 Holds, the consensus amongst analysts is that Nvidia is a Robust Purchase. Going by way of the $144.17 reasonable goal, a 12 months from now the stocks shall be converting fingers for a ~16% top class. (See Nvidia inventory forecast)

To seek out excellent concepts for shares buying and selling at sexy valuations, talk over with TipRanks’ Perfect Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The critiques expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions simplest. You will need to to do your personal research prior to making any funding.