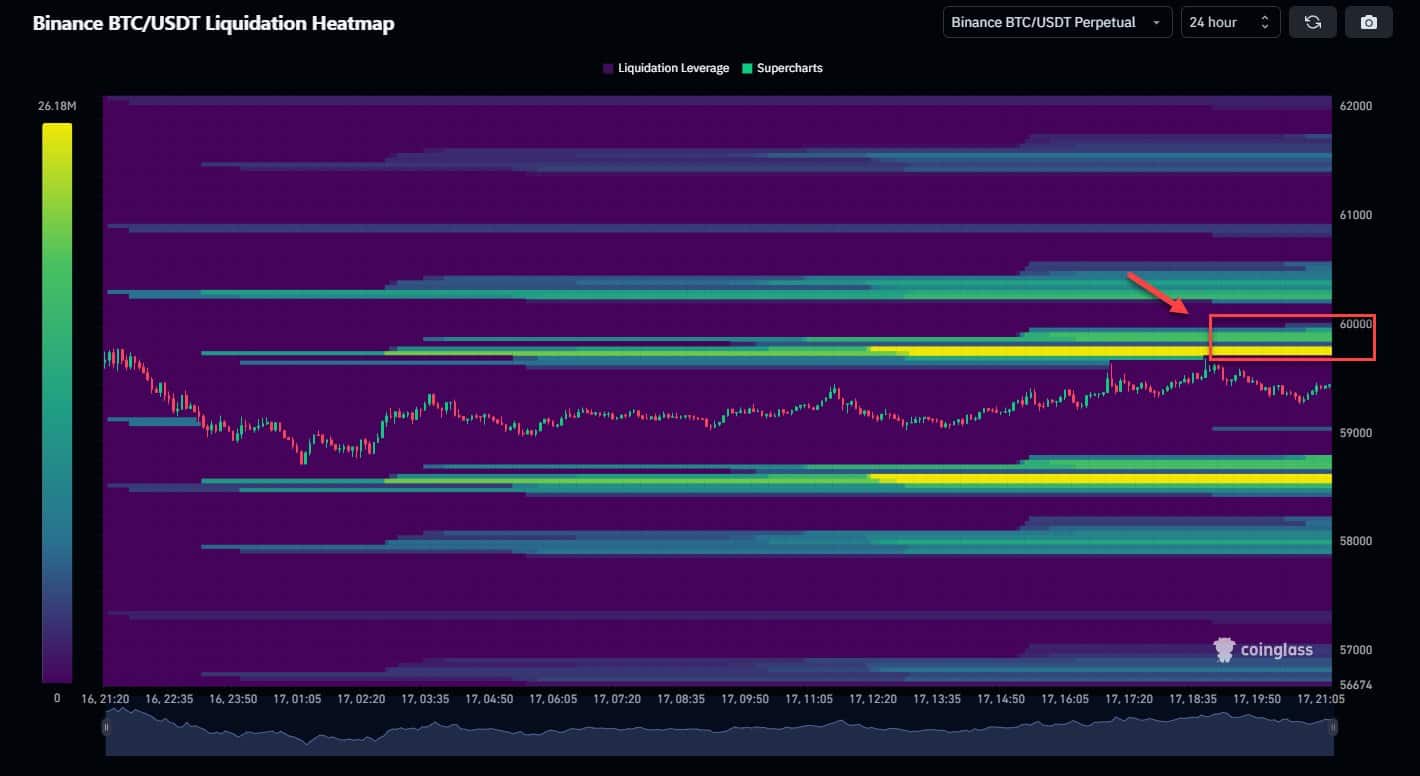

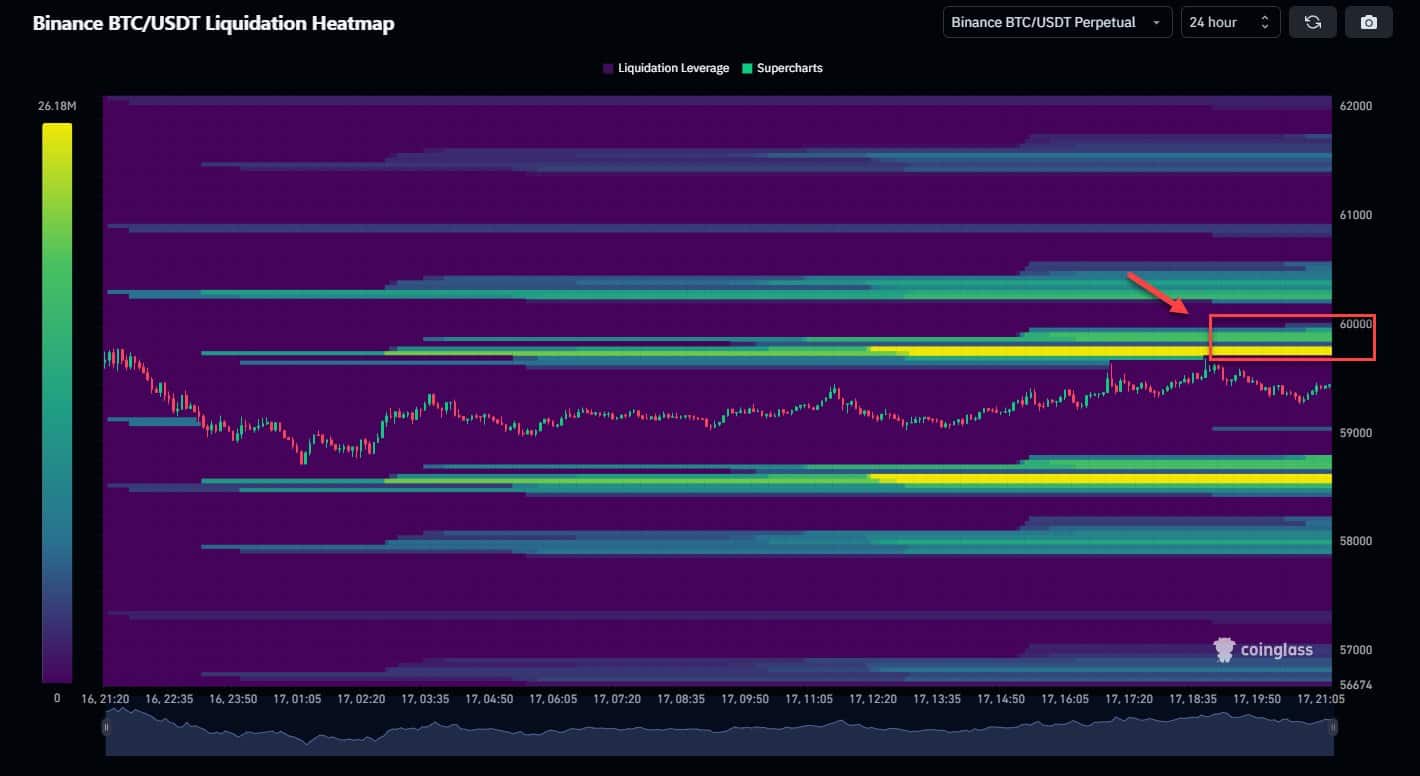

$244M Bitcoin in new shorts might be liquidated at $61K, and $9.17B Bitcoin at $68K.

Nonetheless, the learned worth, excessive whale ratio, and new ATH in cash provide recommend purchasing BTC.

The Bitcoin [BTC] marketplace is these days unsure, suffering to take care of a transparent upward trajectory after improving from the downturn at the fifth of August, led to via Japan shares crash.

As of time of press, BTC remained just below the $60K stage, however demanding situations remained. A cluster of four,000 new shorts lie in wait, with spot promote orders simply above $61K.

So, BTC may destroy the $60K worth stage in a single day, however stall at $61K. This was once the drawback as high-leverage lengthy liquidations loomed across the $58K worth mark.

Supply: Coinglass

Supply: Coinglass

Moreover, $9.17 billion in Bitcoin shorts might be liquidated if BTC reaches $68K, which additionally threatens its talent to succeed in new highs.

On the other hand, different knowledge helps BTC’s persisted restoration, probably attaining a brand new ATH via This fall 2024 or Q1 2025.

Bitcoin: Purchasing alternative forward?

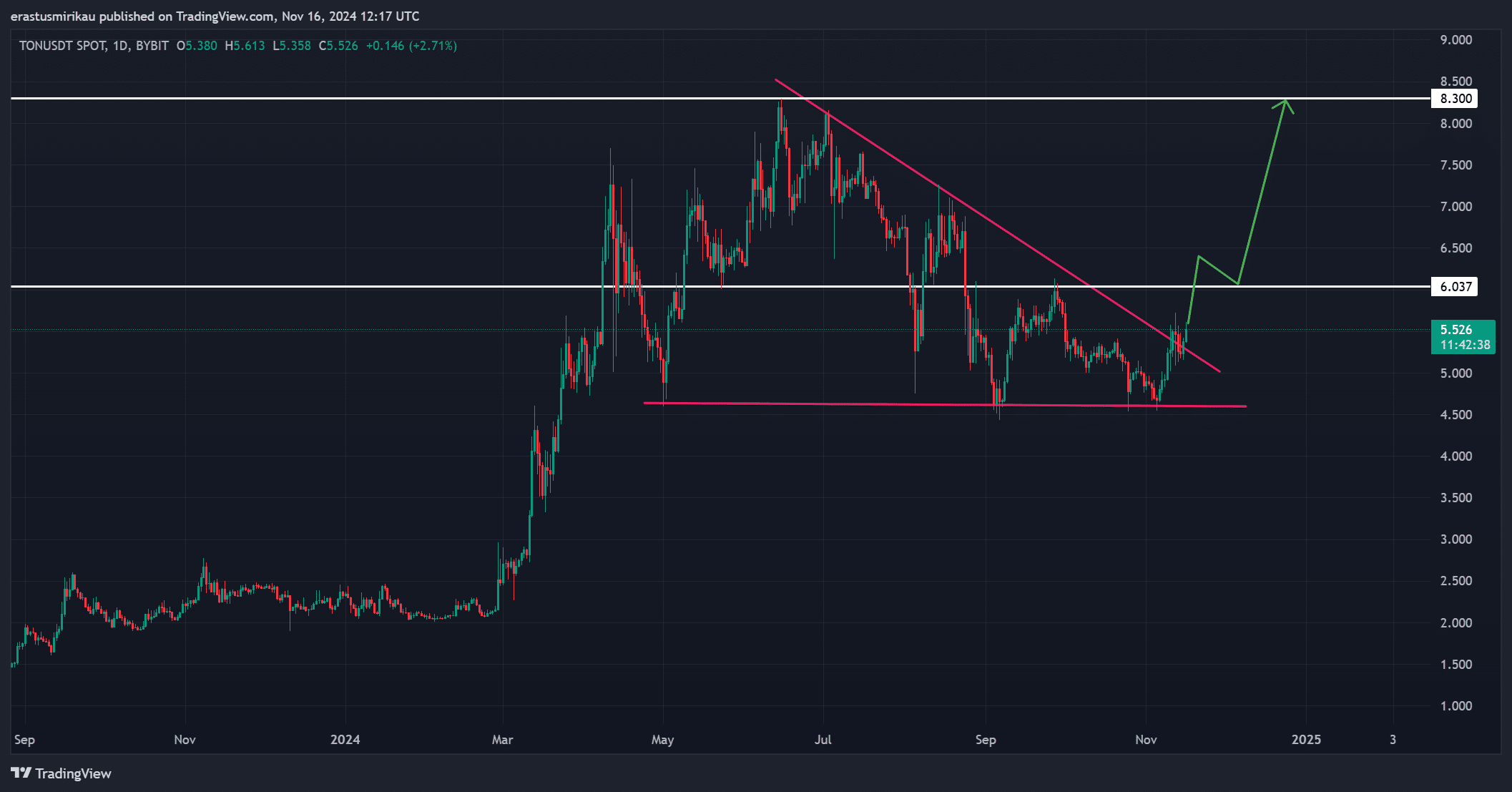

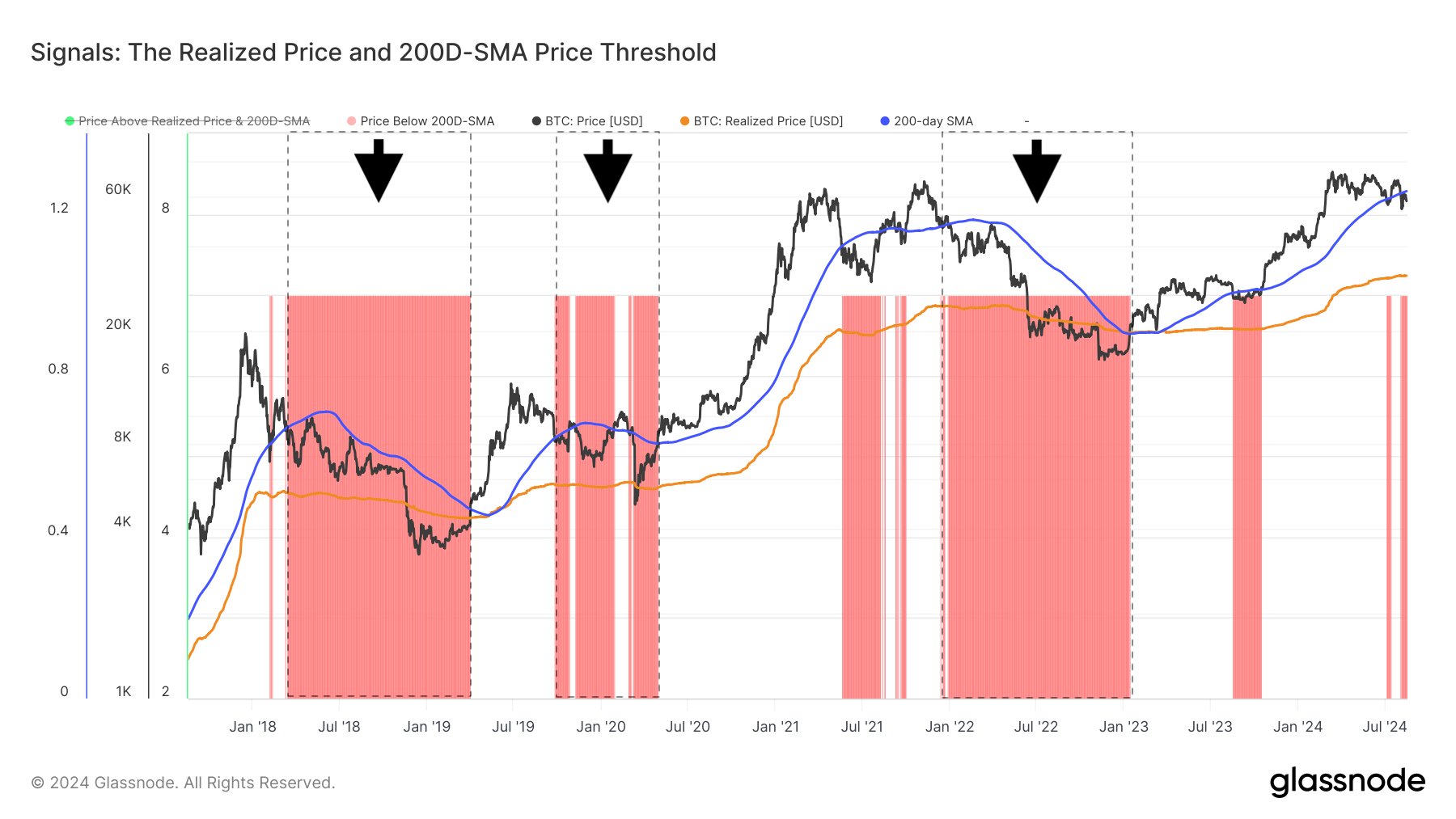

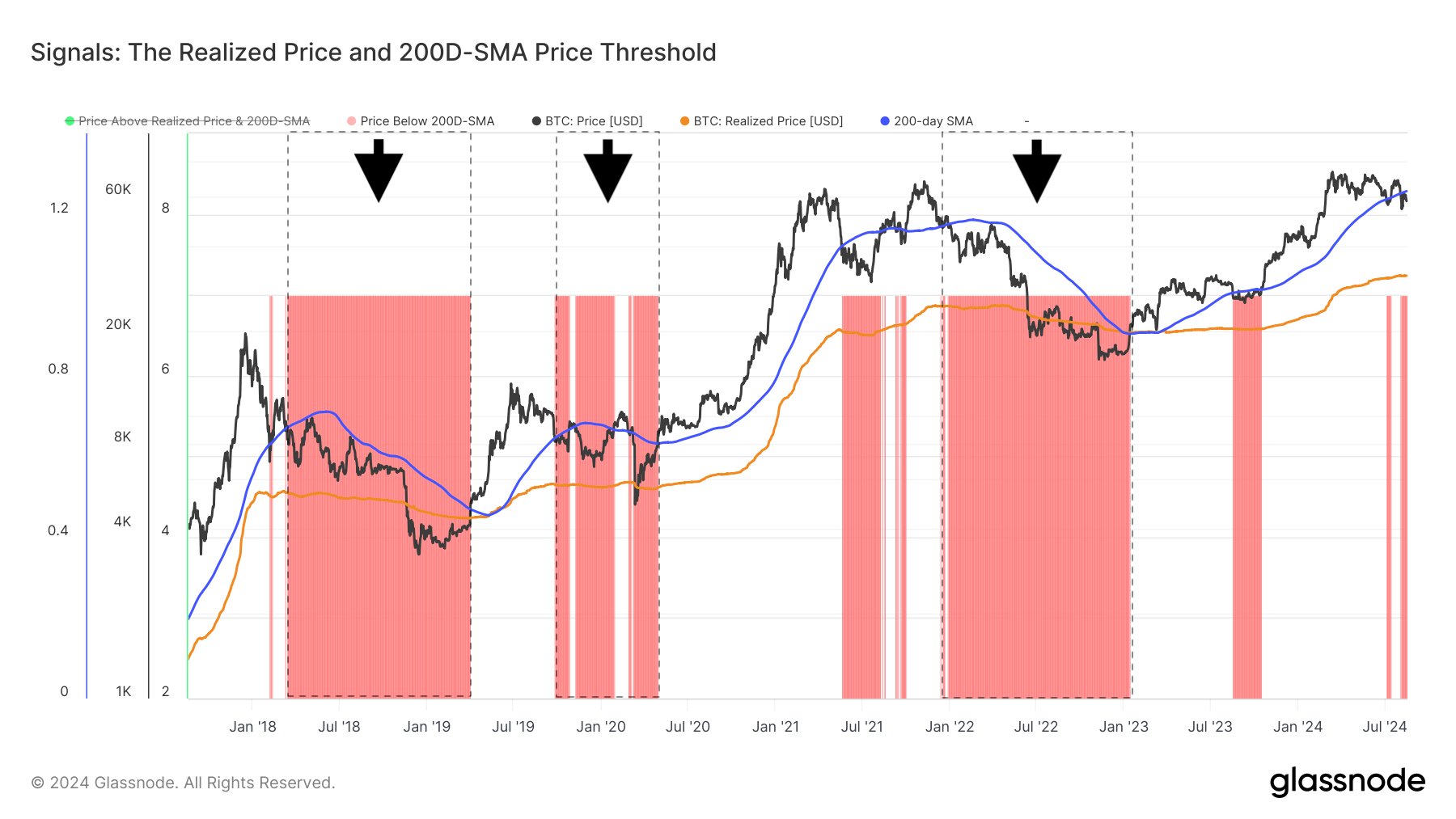

Bitcoin not too long ago dropped underneath the 200-day Easy Shifting Moderate however has double bottomed, a key indicator for long-term developments continuation.

In a bull marketplace, this dip can provide a purchasing alternative, suggesting a possible rebound.

On the other hand, if Bitcoin’s worth stays underneath the 200-day SMA for a longer time period, it will sign the start of a undergo marketplace.

Supply: Glassnode

Supply: Glassnode

Regardless of this chance, analysts consider that Bitcoin is not going to go into a protracted downturn at this level.

The present state of affairs suggests a brief dip somewhat than the beginning of a bearish section, with a robust chance for restoration and persisted expansion.

Whale gather as world liquidity surges

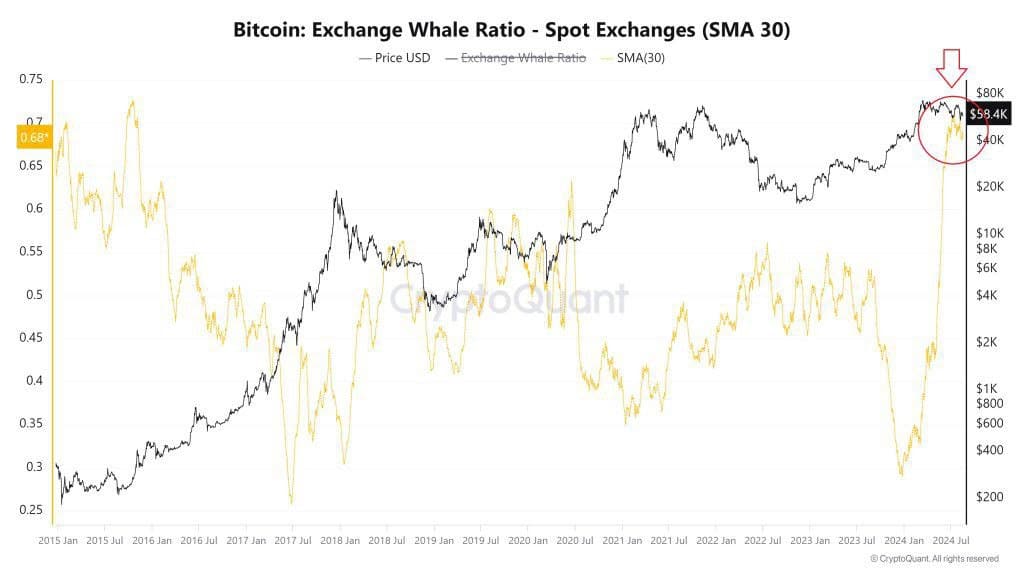

Bitcoin whales also are expanding their holdings, indicating a possible worth upward push. Analysts be aware that enormous buyers and buyers are purchasing throughout the associated fee dips, a trend that ceaselessly ends up in worth spikes.

This development, coupled with contemporary halving occasions and rising institutional hobby thru Bitcoin ETFs, means that Bitcoin’s costs might upward push quickly.

Supply: CryptoQuant

Supply: CryptoQuant

Is your portfolio inexperienced? Take a look at the BTC Benefit Calculator

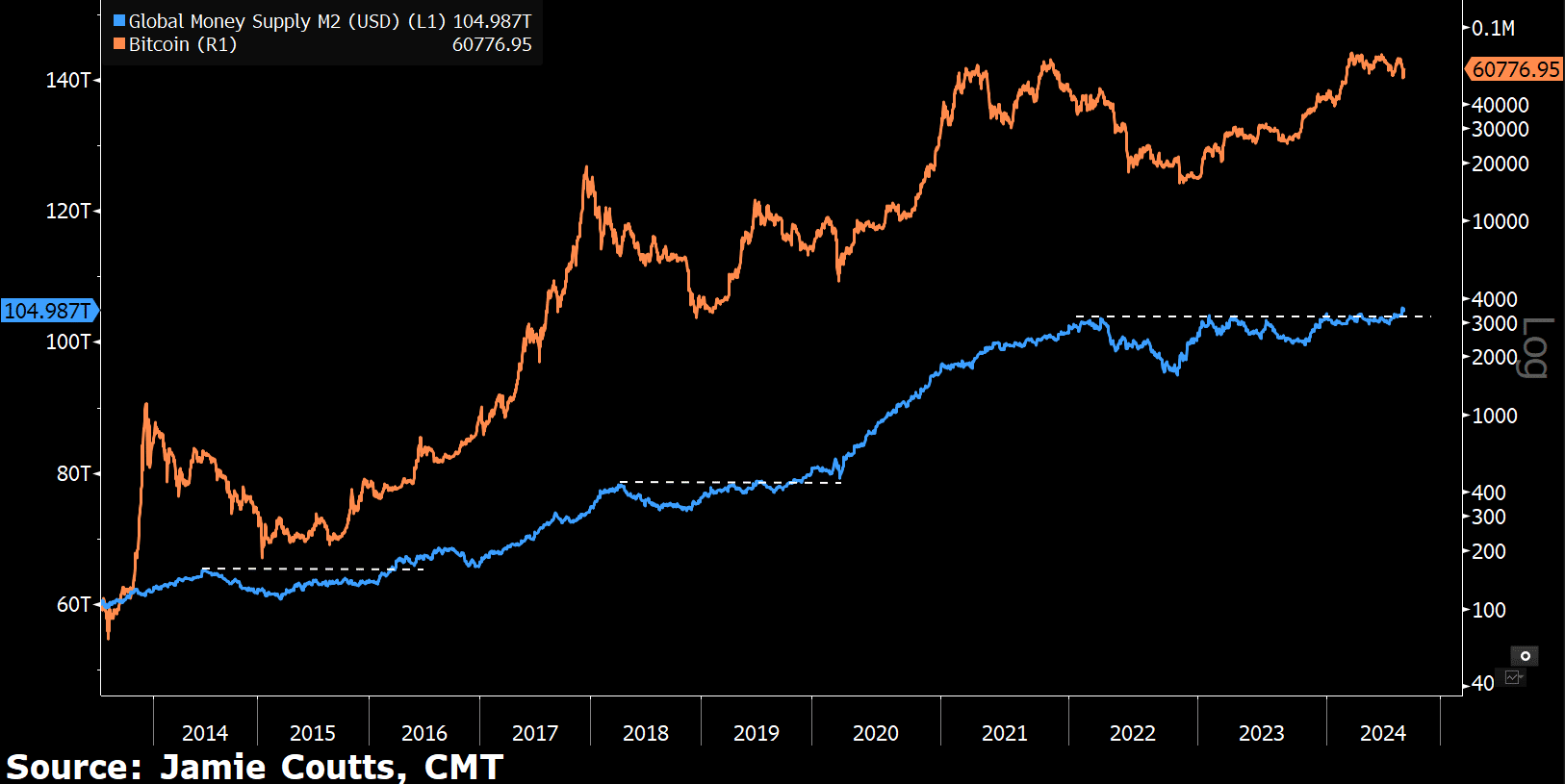

The worldwide cash provide has additionally reached a brand new all-time excessive, boosting purchasing energy and most probably expanding Bitcoin’s worth.

With more cash in flow, purchasing force rises, making Bitcoin a robust long-term funding. The continual building up in cash provide helps Bitcoin’s attainable for long term good points.

Supply: Jamie Coutts, CMT

Supply: Jamie Coutts, CMT

Earlier: Dogecoin’s huge transactions surge 35%: What’s subsequent for DOGE?

Subsequent: Whales assist Litecoin surge 10.32% – Will LTC rally every other 40%?