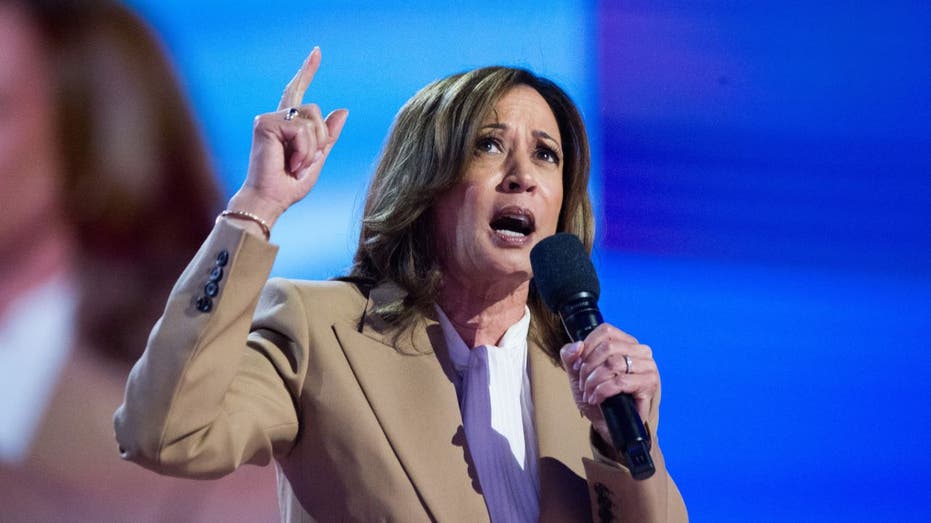

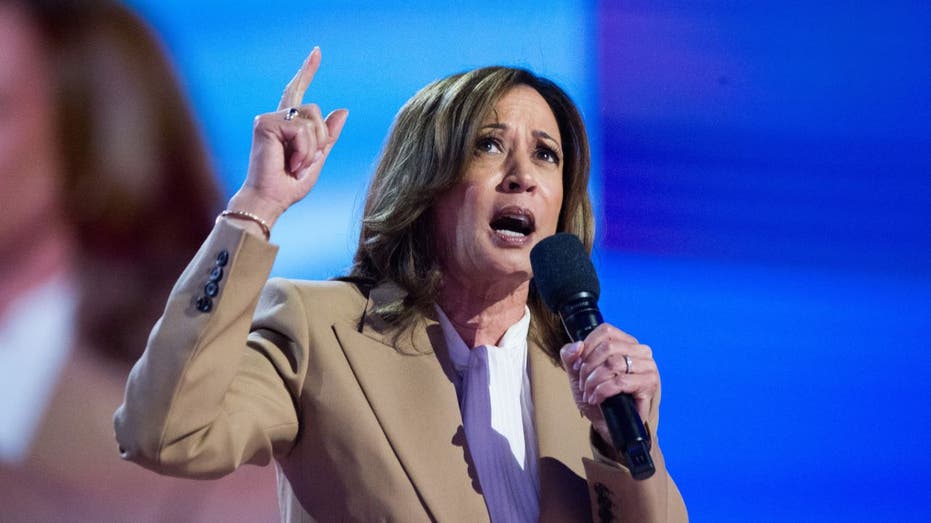

FOX Trade correspondent Lydia Hu has the newest at the deal supporters imagine will make the metal trade more potent and extra aggressive on ‘The Backside Line.” Vice President Harris’ perspectives at the pending merger of U.S. Metal and Nippon Metal stay unclear. The Democratic Celebration’s nominee has but to weigh in at the proposed deal that has attracted bipartisan political scrutiny in spite of shareholders vote casting decisively in want of the deal. The deal, which might have Nippon Metal achieve U.S. Metal for $14.9 billion, is present process a evaluation by means of the Committee on International Funding within the U.S. and has drawn complaint from some unionized employees and likely politicians in each the Democratic and Republican events.Whilst President Biden stated in March he opposes the deal, Harris has but to publicly articulate her place at the merger and whether or not she would observe Biden in making an attempt to dam it must she win the election. FOX Trade reached out to the Harris marketing campaign relating to her perspectives at the U.S. Metal-Nippon Metal merger and didn’t obtain a reaction ahead of e-newsletter. POTENTIAL DEM VP PICK SAYS HE CAN’T SUPPORT US STEEL-NIPPON STEEL MERGER  Vice President Kamala Harris hasn’t weighed in on the united statesSteel-Nippon Metal merger. (Jacek Boczarski/Anadolu by the use of Getty Pictures / Getty Pictures)Pennsylvania Gov. Josh Shapiro, a Democrat who was once one of the crucial main contenders to grow to be Harris’ working mate, stated in past due July that “if the U.S. steelworkers are not proud of this deal, which they aren’t, I am not proud of this deal.”Ticker Safety Final Alternate Alternate % X UNITED STATES STEEL CORP. 37.95 -1.34

Vice President Kamala Harris hasn’t weighed in on the united statesSteel-Nippon Metal merger. (Jacek Boczarski/Anadolu by the use of Getty Pictures / Getty Pictures)Pennsylvania Gov. Josh Shapiro, a Democrat who was once one of the crucial main contenders to grow to be Harris’ working mate, stated in past due July that “if the U.S. steelworkers are not proud of this deal, which they aren’t, I am not proud of this deal.”Ticker Safety Final Alternate Alternate % X UNITED STATES STEEL CORP. 37.95 -1.34

-3.41%

NPSCY NIPPON STEEL CORP. 7.55 +0.07

+0.94%

Former President Trump, who’s now Harris’ major rival for the presidency, expressed opposition to the deal in February and reiterated that view Monday.”I can forestall Japan from purchasing United States Metal,” Trump stated at an tournament in Pennsylvania. “They should not be allowed to shop for it.”NIPPON STEEL SAYS US STEEL ACQUISITION WOULDN’T CAUSE LAYOFFS, PLANT CLOSURES  U.S. Metal has stated its maintain Nippon Metal would toughen the American metal trade and get advantages employees in addition to provide chains. (Justin Merriman/Bloomberg by the use of Getty Pictures / Getty Pictures)Nippon Metal, which is based totally in Japan however isn’t a state-owned endeavor, has labored with U.S. Metal as a way to assuage the worries concerning the merger raised by means of politicians and hard work teams. The corporate up to now stated it might honor all of U.S. Metal’s collective bargaining agreements and has presented new commitments to the union past its current settlement. It has additionally stated the deal would not steered layoffs or plant closures and pledged to keep U.S. Metal’s title, logo and headquarters within the deal.NIPPON STEEL HIRES FORMER TRUMP OFFICIAL MIKE POMPEO TO ADVISE ON US STEEL ACQUISITION

U.S. Metal has stated its maintain Nippon Metal would toughen the American metal trade and get advantages employees in addition to provide chains. (Justin Merriman/Bloomberg by the use of Getty Pictures / Getty Pictures)Nippon Metal, which is based totally in Japan however isn’t a state-owned endeavor, has labored with U.S. Metal as a way to assuage the worries concerning the merger raised by means of politicians and hard work teams. The corporate up to now stated it might honor all of U.S. Metal’s collective bargaining agreements and has presented new commitments to the union past its current settlement. It has additionally stated the deal would not steered layoffs or plant closures and pledged to keep U.S. Metal’s title, logo and headquarters within the deal.NIPPON STEEL HIRES FORMER TRUMP OFFICIAL MIKE POMPEO TO ADVISE ON US STEEL ACQUISITION  90-eight p.c of U.S. Metal shareholders voted decisively in want of the merger with Nippon Metal. (Justin Merriman/Bloomberg by the use of Getty Pictures / Getty Pictures)U.S. Metal didn’t instantly reply to a request for remark. The corporate up to now instructed FOX Trade, “We stay dedicated to the transaction with Nippon Metal, which is the most productive deal for our staff, shareholders, communities and shoppers.”The partnership with Nippon Metal, a long-standing investor in the US from our shut best friend Japan, will toughen the American metal trade, American jobs and American provide chains and improve the U.S. metal trade’s competitiveness and resilience in opposition to China,” U.S. Metal’s earlier remark defined.When U.S. Metal shareholders voted at the deal in April, it was once licensed with 98% of the vote in want a number of the stocks voted, which made up about 71% of the corporate’s remarkable inventory.GET FOX BUSINESS ON THE GO BY CLICKING HERENippon Metal not too long ago driven again the anticipated ultimate date for the deal from September to December according to a Justice Division antitrust probe, regardless that the corporate stated it nonetheless expects the merger to continue.Reuters contributed to this file.

90-eight p.c of U.S. Metal shareholders voted decisively in want of the merger with Nippon Metal. (Justin Merriman/Bloomberg by the use of Getty Pictures / Getty Pictures)U.S. Metal didn’t instantly reply to a request for remark. The corporate up to now instructed FOX Trade, “We stay dedicated to the transaction with Nippon Metal, which is the most productive deal for our staff, shareholders, communities and shoppers.”The partnership with Nippon Metal, a long-standing investor in the US from our shut best friend Japan, will toughen the American metal trade, American jobs and American provide chains and improve the U.S. metal trade’s competitiveness and resilience in opposition to China,” U.S. Metal’s earlier remark defined.When U.S. Metal shareholders voted at the deal in April, it was once licensed with 98% of the vote in want a number of the stocks voted, which made up about 71% of the corporate’s remarkable inventory.GET FOX BUSINESS ON THE GO BY CLICKING HERENippon Metal not too long ago driven again the anticipated ultimate date for the deal from September to December according to a Justice Division antitrust probe, regardless that the corporate stated it nonetheless expects the merger to continue.Reuters contributed to this file.

Trump and Biden oppose Nippon-US Metal merger: What’s VP Kamala Harris’ place?