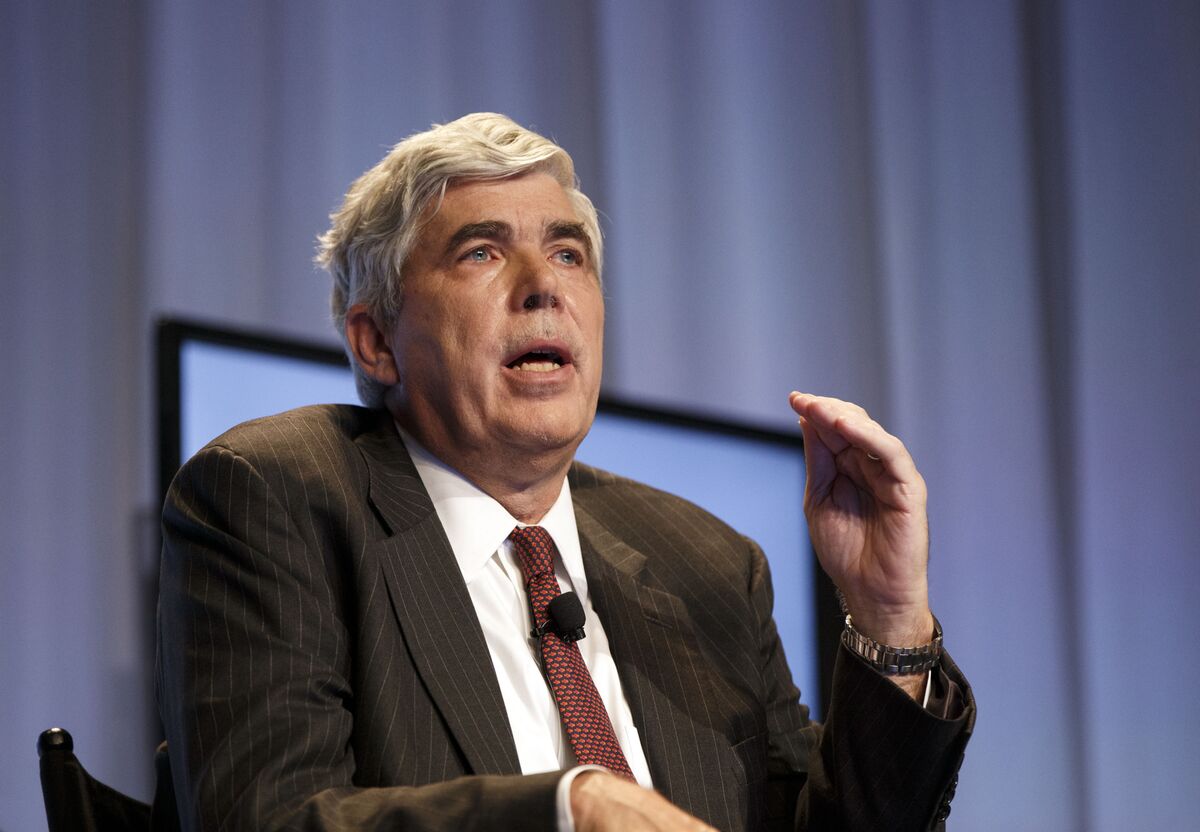

Ken Leech, the longtime Western Asset Control leader funding officer, left that position amid probes from the Justice Division and Securities and Trade Fee into whether or not some shoppers have been liked over others in allocating positive aspects and losses from derivatives trades.Leech, who manages probably the most biggest bond methods in the United States, will take a right away go away of absence after receiving a Wells realize from the SEC, the corporate stated in a submitting Wednesday. Federal prosecutors in New York are carrying out a felony probe into the follow referred to as “cherry-picking,” the place successful trades are credited to liked accounts, in step with other people conversant in the topic.

Western Asset’s Ken Leech Takes Depart of Absence Amid SEC Probe