Nvidia (NASDAQ:NVDA) profits are simply across the nook and the Side road seems to be getting able for what has develop into a virtually conventional regimen – any other beat-and-raise readout from the AI large.

Analysts are already predicting a robust appearing, with Susquehanna’s Christopher Rolland, probably the most best 1% of Side road inventory mavens, being the newest to enroll in the refrain.

That mentioned, Rolland does upload a word of warning to the complaints. “We nonetheless be expecting higher effects/steering as tests round AI stay forged, even though we word near-term dangers round a possible GB200 prolong,” mentioned the 5-star analyst.

What Rolland is relating to is the design fault in Nvidia’s newest AI chip, the Blackwell GB200, which has brought about a prolong in its shipments.

However, for its Information Heart phase, which now instructions greater than 85% of the full earnings haul, AI call for “remains to be helped by means of increasing hyperscale capex plans and remark from gamers like Tesla suggesting sustained massive GPU purchases.”

Additionally, call for is anticipated to get an extra spice up from Endeavor/Shopper Web (which closing quarter represented over 50% of DC earnings) and from Sovereign AI. At the provide aspect, Nvidia has reaffirmed that Hopper GPU availability is making improvements to, supported by means of experiences of shorter lead occasions and worth discounts. Sure remarks from provide chain companions like Supermicro additionally signifies favorable prerequisites for the availability and insist of Nvidia’s GPUs.

In relation to the Blackwell prolong, Rolland says traders “deserve some clarification and reassurances round re-spin/renewed timetable.” If the delays are by means of up to 3 months, Rolland expects GB200 revenues might be driven into 2025, which is able to distinction with Jensen Huang’s earlier observation that the corporate is anticipating “so much” of Blackwell earnings this 12 months.

In the end, as “architectural hurdles, together with liquid cooling, will take time to qualify by means of consumers,” Rolland used to be already getting ready for a “slower ramp” of the GB200. Within the intervening time, given making improvements to provide and availability, Hopper GPUs (H100/H200) will have to pick out up the slack.

“In brief,” Rolland summed up, “we predict any other sturdy record however word increased expectancies into the print, with the narrative across the Blackwell ramp vital to force additional upside within the inventory.”

All advised, Rolland continues to view Nvidia as having “probably the most greatest alternative units forward and at an inexpensive a couple of,” reaffirming his Sure (i.e., Purchase) ranking at the stocks with a $160 value goal, implying a 27% upside within the coming months. (To observe Rolland’s monitor report, click on right here)

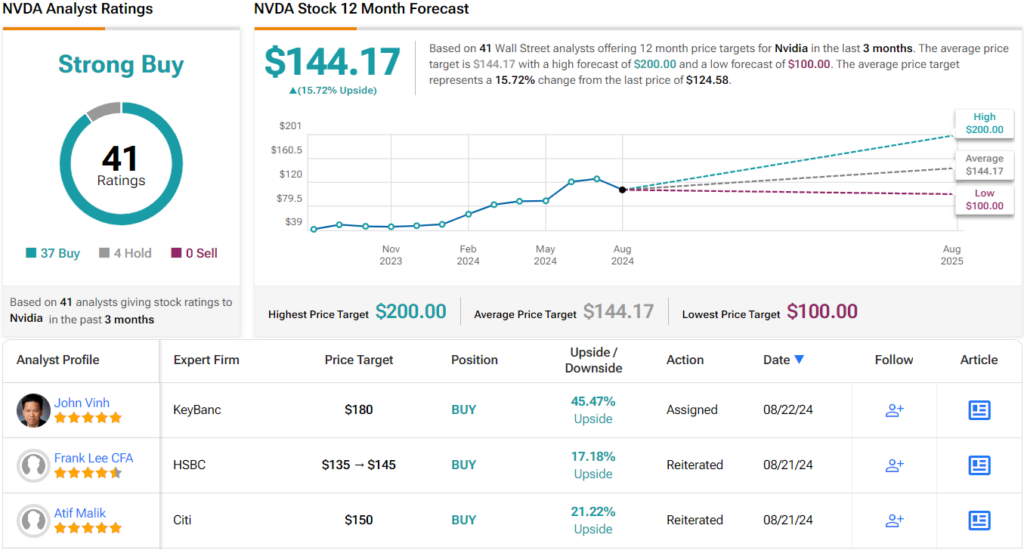

Rolland’s take chimes neatly with many of the different inventory prognosticators on Wall Side road. According to a mixture of 37 Buys towards 4 Holds, the inventory claims a Robust Purchase consensus ranking. The typical value goal stands at $144.17, providing one-year upside of ~16%. (See Nvidia inventory forecast)

To search out just right concepts for shares buying and selling at horny valuations, consult with TipRanks’ Best possible Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The evaluations expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions most effective. It is important to to do your individual research sooner than making any funding.