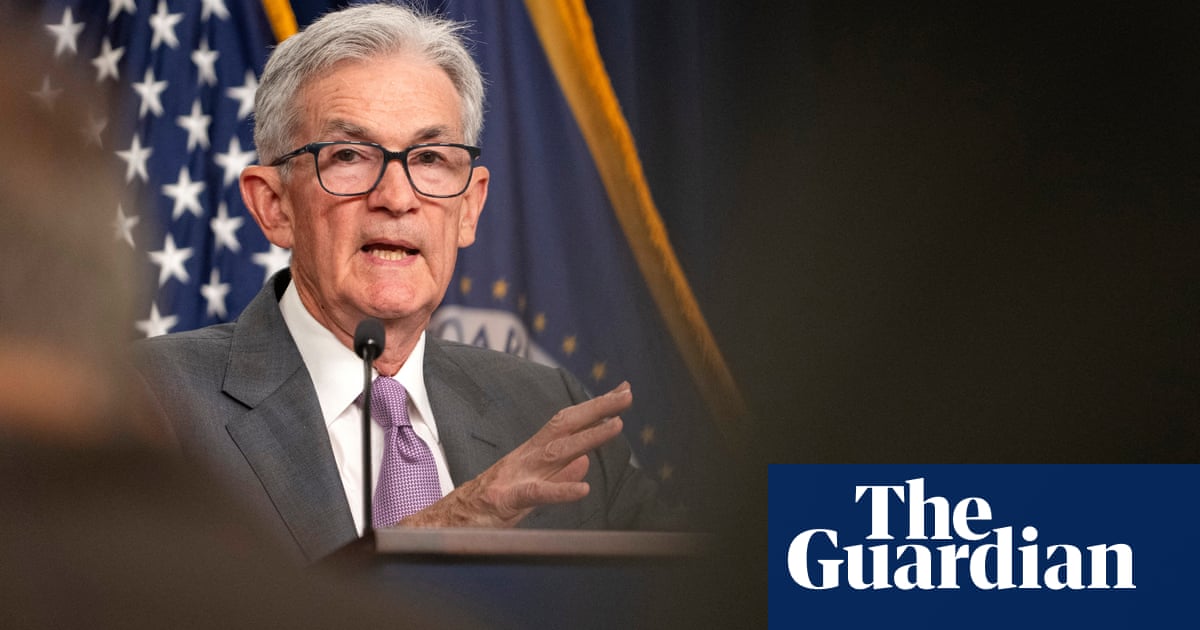

“The time has come” for america Federal Reserve to chop rates of interest, its chairman declared, hailing growth within the struggle to convey down inflation from its easiest degree in a technology.With worth expansion now on a “sustainable” trail again to standard ranges, Jerome Powell signaled that the central financial institution used to be able to start out decreasing charges from subsequent month.The USA hard work marketplace – which unexpectedly recovered from the wear inflicted all over the early months of the Covid-19 disaster, including thousands and thousands of jobs – now faces better “drawback dangers”, he said. Unemployment ticked up closing month.However Powell expressed self belief that there used to be “just right explanation why” to consider inflation may just retreat additional with out harmful the sector’s biggest economic system – if the Fed now acts.“The time has come for coverage to regulate,” Powell informed an annual symposium for central bankers at Jackson Hollow in Wyoming on Friday. “The path of commute is obvious, and the timing and tempo of fee cuts depends on incoming information, the evolving outlook, and the stability of dangers.”Two years in the past, when inflation used to be hovering all over the pandemic, policymakers on the Fed scrambled to chill america economic system through elevating charges to a two-decade top. Now worth expansion is falling again – it rose at an annual fee of two.9% in July, having light from a height of 9.1% in June 2022 – they’re getting ready to chop charges, however have not begun to take action.Officers hope to lead america to a so-called “comfortable touchdown”, wherein inflation is normalized, and recession have shyed away from. The Fed’s goal of inflation is two%.The central financial institution’s subsequent rate-setting assembly is because of happen in September, when it’s extensively anticipated to chop charges for the primary time since Covid-19 took dangle 4 years in the past.By contrast to Powell’s feedback, the governor of the Financial institution of England, Andrew Bailey, warned the United Kingdom economic system nonetheless confronted dangers from top inflation that can require rates of interest to stay upper for longer.“It’s too early to claim victory,” he informed the Jackson Hollow summit on Friday. “We want to be wary since the activity isn’t finished – we aren’t but again to focus on on a sustained foundation.”The United Kingdom central financial institution lower rates of interest for the primary time because the Covid pandemic previous this month, with a quarter-point aid in borrowing prices to five%. The Ecu Central Financial institution additionally lower rates of interest in June, however has since held its primary coverage charges unchanged.UK inflation rose above the Financial institution’s 2% goal in July, hitting 2.2%. The Financial institution has warned UK inflation may just height at about 2.75%, prior to falling again underneath goal inside of two years’ time.On the other hand, Bailey warned there have been dangers of “everlasting” inflationary pressures amid structural adjustments within the jobs marketplace. The pound rose through about 1% in opposition to america greenback on global forex markets to about $1.32 after the feedback through each central bankers.In fresh months, critics of the Fed have accused the central financial institution of sitting on its palms and derailing america economic system, amid unease over its path. An abruptly susceptible jobs document for July, which got here an afternoon after the Fed once more selected to carry charges secure, sparked a fleeting world sell-off.There was an “unmistakable” cooling in stipulations within the labour marketplace, Powell noticed at Jackson Hollow on Friday, noting how activity advent had slowed, vacancies fallen and salary good points moderated. “We don’t search or welcome additional cooling in hard work marketplace stipulations.”skip previous publication promotionSign as much as Trade TodayGet set for the operating day – we’re going to level you to all of the trade information and research you want each morningPrivacy Realize: Newsletters would possibly comprise information about charities, on-line commercials, and content material funded through outdoor events. For more info see our Privateness Coverage. We use Google reCaptcha to offer protection to our web site and the Google Privateness Coverage and Phrases of Provider follow.after publication promotionThe Fed would “do the whole lot we will be able to” to reinforce the hard work marketplace because it cuts charges, he stated. “With a suitable dialing again of coverage restraint, there may be just right explanation why to assume that the economic system gets again to two% inflation whilst keeping up a robust hard work marketplace.”Shares rose as he spoke. The benchmark S&P 500 larger 0.8% and the technology-focused Nasdaq Composite won 1%.On Wall Boulevard, analysts and economists have spent months making an attempt to expect how briefly, and what sort of, the Fed will finally end up slicing charges.The Fed has “waited a long way too lengthy”, consistent with Ian Shepherdson, leader economist at Pantheon Macroeconomics, who described the shift within the central financial institution’s tone since its June assembly – when it additionally held charges – as “startling”.“These days’s speech is welcome, however it might had been significantly better for the economic system if the Fed had put slightly much less weight on a couple of disappointing inflation prints and had eased in June,” stated Shepherdson. “March would had been even higher, however policymakers had been so made up our minds to not be stuck out through surprising inflation once more that they have got waited till the danger has grow to be vanishingly small.”All through his speech on Friday, Powell harked again to 2021, when he – and lots of economists – argued that inflation used to be a “transitory” outcome of provide and insist fluctuations prompted through the pandemic, restrictions and lockdowns.“The great send Transitory used to be a crowded one, with maximum mainstream analysts and advanced-economy central bankers on board,” he recalled. Central banks together with the Fed have confronted grievance for his or her early research of inflation’s surge.

‘Time has come’ for US Federal Reserve to chop rates of interest, says Powell

![Pixel 6 vs. Pixel 9: Is now the time to improve? [Video] Pixel 6 vs. Pixel 9: Is now the time to improve? [Video]](https://9to5google.com/wp-content/uploads/sites/4/2024/11/Pixle-6-and-Pixel-9-cameras-2.jpg?quality=82&strip=all&w=1600)