Within the monetary international, 10 years is the blink of a watch. Want evidence? Take a better take a look at the desk beneath:Company2014 Marketplace Cap (billions)2024 Marketplace Cap (billions)IBM$182$178Nvidia$10$2,965In August 2014, IBM’s marketplace cap was once 18 occasions higher than that of Nvidia (NASDAQ: NVDA). However oh, how the tables have became. Nowadays, Nvidia has a marketplace cap of just about $3 trillion — about 17 occasions that of IBM. Listed below are two who can pull it off.

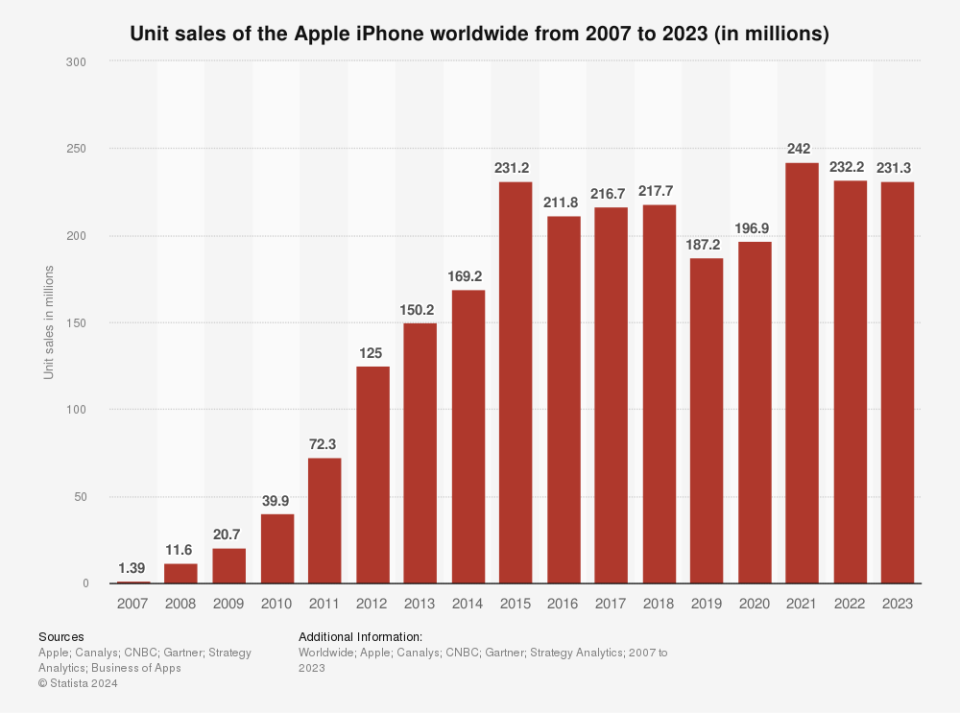

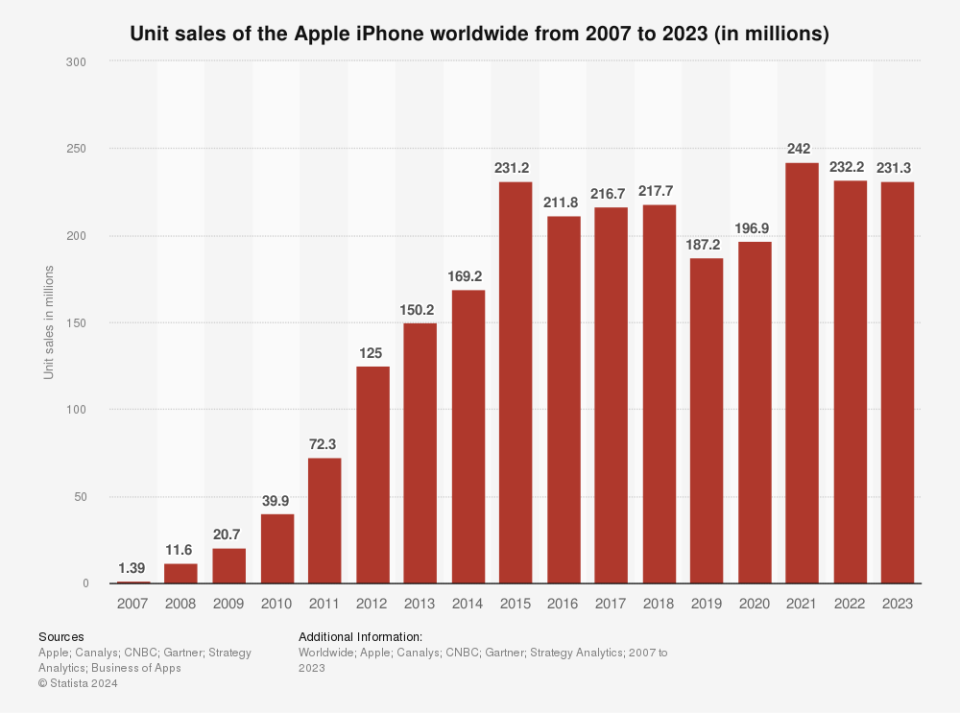

Symbol supply: Getty Photographs.MicrosoftIf the corporate is to overcome Apple within the subsequent decade, it’ll desire a a lot higher marketplace proportion. Even assuming that the marketplace cap of Apple stays strong, which means the corporate will have to succeed in a marketplace price of $ 3.4 trillion to seize Apple. This is a very tall order, and there are lots of firms that may do it. Microsoft (NASDAQ: MSFT) is considered one of them. First, Microsoft already has a marketplace capitalization of $ 3.1 trillion as of this writing. As not too long ago as June, Microsoft had a bigger marketplace proportion than Apple. As well as, Microsoft has a aggressive benefit that are supposed to, ultimately, assist the corporate’s marketplace proportion sluggish Apple. First, Microsoft has a different trade. The corporate has its fingers in cloud computing, gaming, advertising and marketing, {hardware}, tool, social media, and synthetic intelligence (AI). In brief, Microsoft has some ways to win. Apple, alternatively, has already benefited from its awesome {hardware} functions. And whilst Apple’s AI and AI services and products would possibly spice up the corporate’s earnings, the selling of the iPhone may just pose a significant problem for Apple over the following decade. NvidiaI’m skeptical about Nvidia at the moment. Its sky-high volatility makes it at risk of a unfavourable correction if the corporate’s gross sales display indicators of slowing. That stated, this newsletter describes what is going to occur within the subsequent 10 years. And if that’s the case, I believe Nvidia has a bonus over Apple. That is as a result of Nvidia’s core trade — making graphics processing gadgets (GPUs) that can energy AI machines for the following decade — goes to take a very long time. Gross sales of Apple’s signature tool – the iPhone – grew once a year between 2007 and 2015, however had been flat since then.

Symbol supply: Getty Photographs.MicrosoftIf the corporate is to overcome Apple within the subsequent decade, it’ll desire a a lot higher marketplace proportion. Even assuming that the marketplace cap of Apple stays strong, which means the corporate will have to succeed in a marketplace price of $ 3.4 trillion to seize Apple. This is a very tall order, and there are lots of firms that may do it. Microsoft (NASDAQ: MSFT) is considered one of them. First, Microsoft already has a marketplace capitalization of $ 3.1 trillion as of this writing. As not too long ago as June, Microsoft had a bigger marketplace proportion than Apple. As well as, Microsoft has a aggressive benefit that are supposed to, ultimately, assist the corporate’s marketplace proportion sluggish Apple. First, Microsoft has a different trade. The corporate has its fingers in cloud computing, gaming, advertising and marketing, {hardware}, tool, social media, and synthetic intelligence (AI). In brief, Microsoft has some ways to win. Apple, alternatively, has already benefited from its awesome {hardware} functions. And whilst Apple’s AI and AI services and products would possibly spice up the corporate’s earnings, the selling of the iPhone may just pose a significant problem for Apple over the following decade. NvidiaI’m skeptical about Nvidia at the moment. Its sky-high volatility makes it at risk of a unfavourable correction if the corporate’s gross sales display indicators of slowing. That stated, this newsletter describes what is going to occur within the subsequent 10 years. And if that’s the case, I believe Nvidia has a bonus over Apple. That is as a result of Nvidia’s core trade — making graphics processing gadgets (GPUs) that can energy AI machines for the following decade — goes to take a very long time. Gross sales of Apple’s signature tool – the iPhone – grew once a year between 2007 and 2015, however had been flat since then.

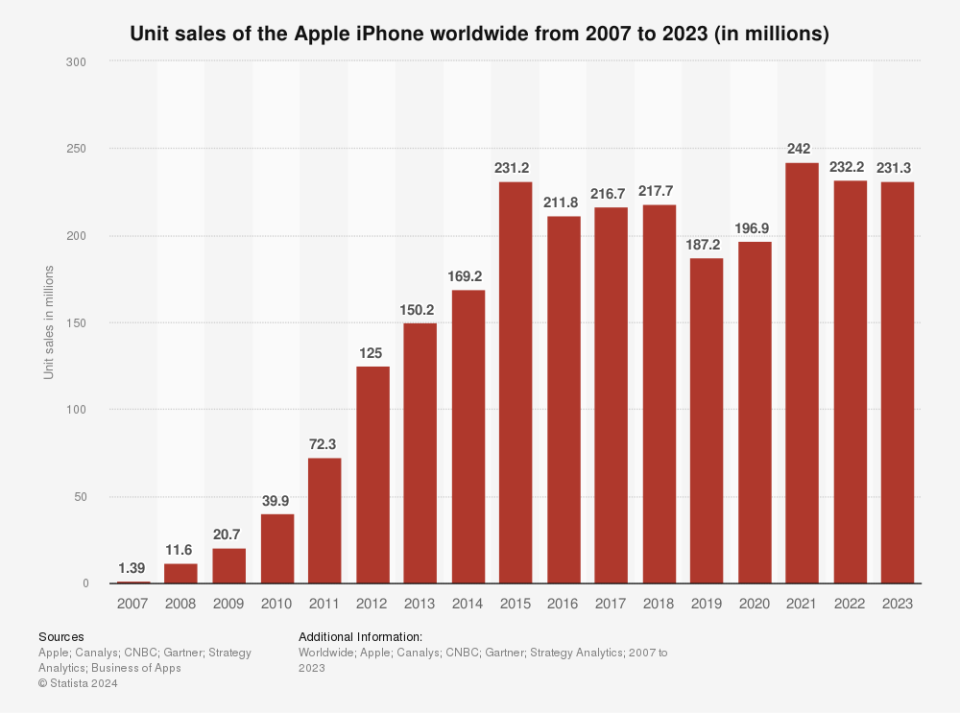

Symbol supply: Statista.Nvidia, alternatively, continues to be rising. During the last two years, the corporate has tripled its earnings as GPUs have offered like scorching desserts. That expansion won’t decelerate in the following couple of years. Many mavens be expecting that Nvidia’s gross sales will double to $160 billion by means of 2026. The object continues After all, there could also be some issues at the highway when competition take one of the marketplace proportion from Nvidia within the scorching marketplace of AI chips. However despite the fact that Nvidia’s gross sales expansion is slowing down, it may well simply shut the $500 billion marketplace hole between it and Apple over the following decade. Must you make investments $1,000 in Microsoft at the moment? Ahead of you get started purchasing Microsoft inventory, believe this: The Motley Idiot Inventory Advisory Team simply recognized what it believes are the ten highest shares buyers should buy at the moment… and Microsoft wasn’t considered one of them. The ten shares that have been reduce may just result in monster returns within the coming years. Assume again to when Nvidia made this record on April 15, 2005… for those who invested $1,000 throughout the beneficial length, you would have $758,227!* gives buyers an easy-to-follow technique for luck, together with a portfolio-building information, common updates from mavens, and choices two new ones each and every month. The Inventory Guide provider has quadrupled the go back of the S&P 500 since 2002 *.See 10 shares »*Inventory Guide returns as of August 22, 2024Jake Lerch holds positions in Global Trade Machines and Nvidia. The Motley Idiot has positions and recommends Apple, Microsoft, and Nvidia. The Motley Idiot recommends International Buying and selling Techniques and recommends the next choices: a January 2026 $395 name on Microsoft and a January 2026 $405 name on Microsoft. The Motley Idiot has a disclosure coverage.Prediction: Two Shares That Will Be Price Extra Than Apple 10 Years From Now was once at the beginning revealed by means of The Motley Idiot.

Symbol supply: Statista.Nvidia, alternatively, continues to be rising. During the last two years, the corporate has tripled its earnings as GPUs have offered like scorching desserts. That expansion won’t decelerate in the following couple of years. Many mavens be expecting that Nvidia’s gross sales will double to $160 billion by means of 2026. The object continues After all, there could also be some issues at the highway when competition take one of the marketplace proportion from Nvidia within the scorching marketplace of AI chips. However despite the fact that Nvidia’s gross sales expansion is slowing down, it may well simply shut the $500 billion marketplace hole between it and Apple over the following decade. Must you make investments $1,000 in Microsoft at the moment? Ahead of you get started purchasing Microsoft inventory, believe this: The Motley Idiot Inventory Advisory Team simply recognized what it believes are the ten highest shares buyers should buy at the moment… and Microsoft wasn’t considered one of them. The ten shares that have been reduce may just result in monster returns within the coming years. Assume again to when Nvidia made this record on April 15, 2005… for those who invested $1,000 throughout the beneficial length, you would have $758,227!* gives buyers an easy-to-follow technique for luck, together with a portfolio-building information, common updates from mavens, and choices two new ones each and every month. The Inventory Guide provider has quadrupled the go back of the S&P 500 since 2002 *.See 10 shares »*Inventory Guide returns as of August 22, 2024Jake Lerch holds positions in Global Trade Machines and Nvidia. The Motley Idiot has positions and recommends Apple, Microsoft, and Nvidia. The Motley Idiot recommends International Buying and selling Techniques and recommends the next choices: a January 2026 $395 name on Microsoft and a January 2026 $405 name on Microsoft. The Motley Idiot has a disclosure coverage.Prediction: Two Shares That Will Be Price Extra Than Apple 10 Years From Now was once at the beginning revealed by means of The Motley Idiot.