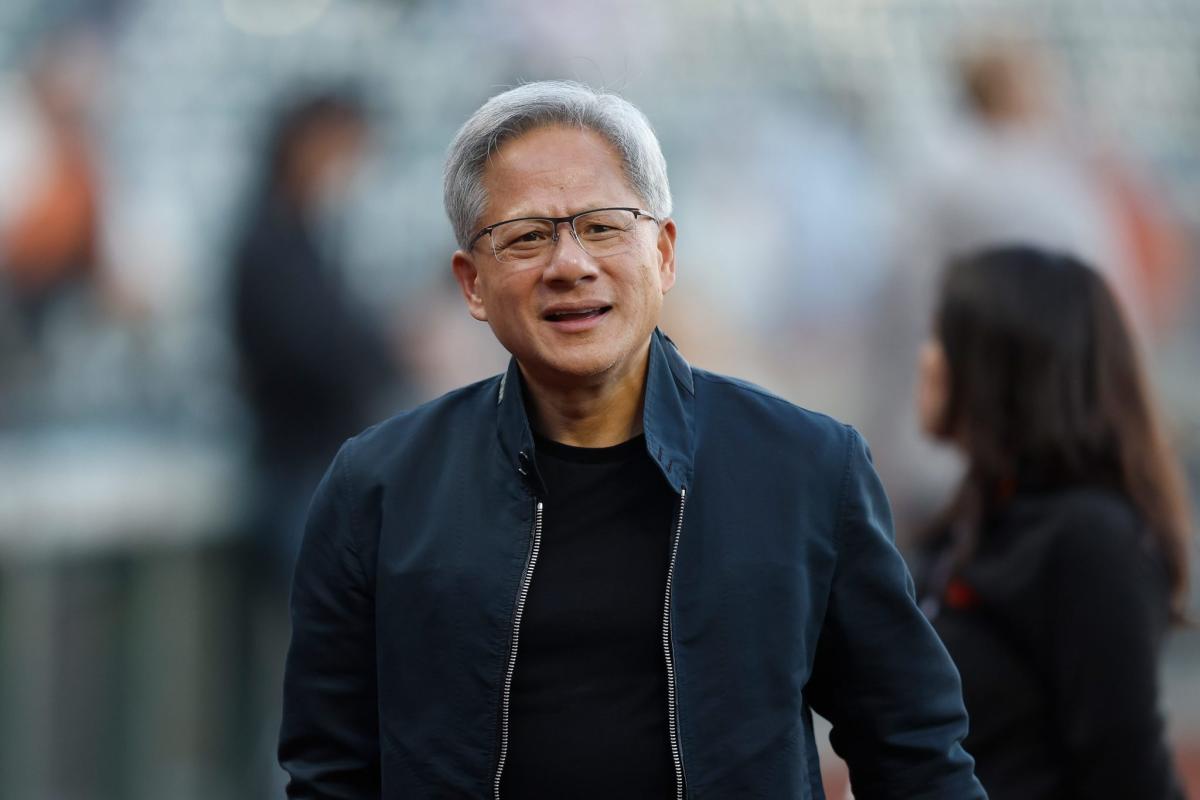

The brutal selloff in AI-chip inventory Nvidia provides traders a ravishing access level, Goldman Sachs argued on Monday.Founder and CEO Jensen Huang has observed his corporate lose 17% of its marketplace cap since issuing muted third-quarter steering that sparked issues its speedy revenue expansion might not be sustainable. Just a handful of businesses are these days fueling its booming AI chip industry, with simply 4 consumers constituting just about part of all Nvidia’s income.Talking with Yahoo Finance at the sidelines of a tech convention hosted by means of his financial institution, Goldman Sachs semiconductor analyst Toshiya Hari remained assured gross sales will select up as consumers out of doors of the 3 cloud hyperscalers—Amazon, Microsoft, and Google—begin to spend money on their very own AI compute clusters.“Call for for sped up computing remains to be in point of fact sturdy,” he mentioned on Monday, reaffirming his “purchase” advice at the inventory and arguing the inventory was once oversold. “You might be seeing a broadening within the call for portfolio into undertaking, even into sovereign states.”In line with Hari’s estimates for Nvidia’s 2025 income, Nvidia’s price-to-earnings more than one is within the low 20s because of the pointy pullback during the last couple of weeks. Through comparability, Tesla trades at 77 instances subsequent yr’s consensus revenue estimates, in line with Yahoo Finance.Customized silicon the most recent pattern amongst chip-starved Nvidia customersNvidia has pushed this yr’s positive factors within the S&P 500 index, however in recent times it has develop into a sufferer of its personal luck.A mix of manufacturing bottlenecks and a loss of significant festival way consumers are ready to be allotted provide of Nvidia’s Hopper AI coaching chips. The ones which are ready to in fact get their arms in this prized useful resource are paying in the course of the nostril, inflicting benefit margins at Nvidia to balloon.Unsatisfied with the loss of selection, tech corporations—together with Amazon and Tesla—are creating their very own customized silicon fairly than relying totally on Nvidia. Those proprietary chips may also be fabricated at specialised foundries like Taiwan Semiconductor Production Co. (TSMC), bypassing Nvidia totally.Hari said limitations are shedding with regards to the make-or-buy query, however argued the risk is overblown. one, Nvidia H100s command a 90% percentage of the AI chip marketplace as opposed to opponents like AMD’s MI300 sequence, so nobody comes just about its era. The ones consumers which are within the means of creating customized silicon are essentially all in favour of fixing compute duties distinctive to their companies, Hari defined.Tale continuesWhile those would constitute misplaced gross sales that might have another way long gone to Nvidia, the proprietary chips would no longer be suited to competing with Nvidia at once at the open marketplace.Hari cited Google for example, announcing the corporate is operating by itself AI chips to lend a hand enhance Google Seek. Through comparability, the crowd’s hyperscaler, Google Cloud Platform, confirmed no indicators of a reduced urge for food for Huang’s chips.“They’re nonetheless purchasing a boatload of Nvidia GPUs, and you’ll make the similar case for Amazon,” the Goldman Sachs analyst mentioned. “Inside service provider silicon, Nvidia is the go-to. Or even as opposed to customized silicon, they’ve were given the threshold with regards to tempo of innovation.”Goldman bearish on Intel, urging chipmaker to after all hit its guidanceAt the similar time, Hari remained bearish on Intel, arguing CEO Pat Gelsinger has an uphill fight.Now not handiest is Intel is shedding the race with Nvidia, AMD, and Qualcomm at the product aspect, however its foundry industry has no transparent trail to surpassing TSMC with regards to manufacturing era.Firms having a look to outsource fabrication in their chips would no longer chance swapping out the Taiwanese large for the inferior era of Intel, argued Hari.He charges Intel a “promote,” however introduced some recommendation to Gelsinger on how you can a minimum of put a ground underneath the inventory within the close to time period:“For starters it will lend a hand for the corporate to begin hitting what they information to,” he mentioned. “They’ve upset the marketplace rather ceaselessly, and that’s by no means just right for a inventory payment.”Neither Nvidia nor Intel may instantly be reached by means of Fortune for remark.This tale was once at the start featured on Fortune.com

Nvidia is a cut price now that AI goes past the hyperscalers, says Goldman Sachs