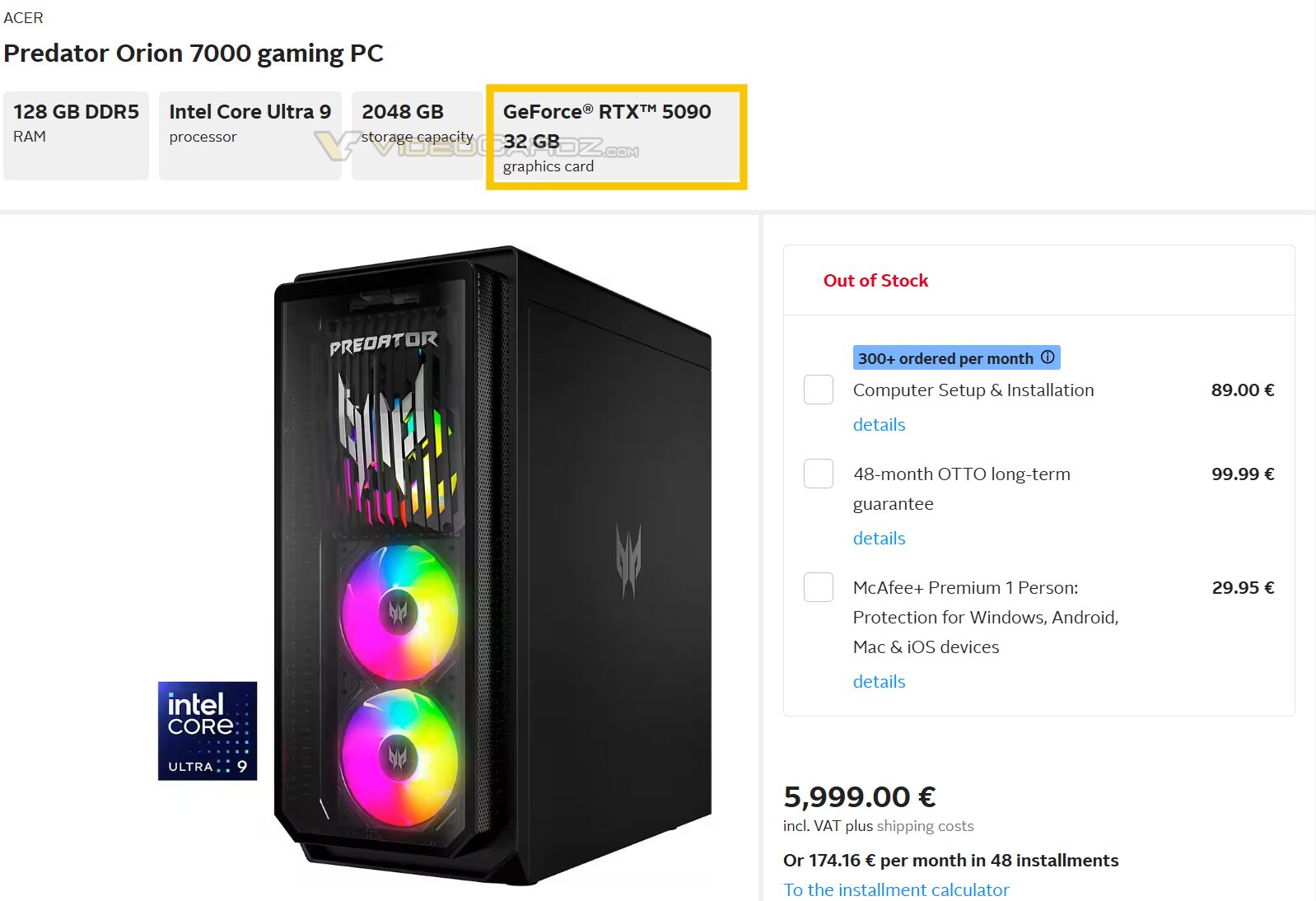

By means of Saqib Iqbal AhmedNEW YORK (Reuters) – Nvidia’s large inventory rally remains to be exerting an oversized affect over the S&P 500 index , reinforcing considerations that broader markets might be harm if the chipmaking massive’s fortunes flip.This yr’s 140% surge in stocks of Nvidia, whose chips are observed because the gold same old in synthetic intelligence packages, has accounted for roughly 1 / 4 of the S&P 500’s 17% acquire.Nvidia confirmed its robust grasp over Wall Side road on Wednesday, when the inventory’s 8.2% rally helped force the S&P 500 to its largest intraday upswing in just about two years. The index reversed a 1.6% loss to finish the day up 1.1%.Nvidia jumped after CEO Jensen Huang flagged sturdy call for for the corporate’s chips, boosting its marketplace price through greater than $200 billion and accounting for 44% of the S&P 500’s surge that day, information from Nomura confirmed.Nvidia’s rally “were given the entire marketplace transferring,” mentioned Chris Murphy, co-head of spinoff technique at Susquehanna Monetary Team.The S&P 500 has struggled to make headway this yr on Nvidia’s down days, eking out good points simplest 13% of the time when the chipmaker’s stocks have closed weaker, a Reuters research confirmed.This yr, the index has did not upward thrust greater than 1% on any day when Nvidia’s stocks ended decrease. In 2020, there have been 13 such cases.For lots of traders, the new strikes revived worries over a small cohort of shares dictating the marketplace’s course.Microsoft, Apple and Nvidia have a mixed weighting of just about 20% within the S&P 500, regardless that stocks of the primary two have won a ways much less this yr than Nvidia’s.Whilst fresh energy in non-tech sectors has stirred hopes of a broadening rally, a sustained sell-off in any of the tech megacaps may nonetheless badly harm broader markets, analysts mentioned.”If Nvidia is vulnerable as a result of call for for his or her product is going down then that is going to tank the entire marketplace,” mentioned Susquehanna’s Murphy.OPTIONS BOOSTTraders are preserving an in depth eye on Nvidia’s choices, that have performed a significant position in boosting fresh strikes.Nvidia just lately accounted for roughly 22% of the entire quantity of person inventory choices traded day-to-day, up from round 5% in the beginning of the yr, making it essentially the most actively traded inventory within the choices marketplace on maximum days, Industry Alert information confirmed.Nvidia’s good points are amplified when investors rush into upside name choices. When purchasing of those choices surges, marketplace makers who promote those contracts are at the hook to shop for and ship extra Nvidia stocks on the agreed worth, leaving them “brief gamma,” in choices parlance.Tale continuesThe further purchases to hide possibility carry the inventory even upper.”You do see the marketplace prepared to shop for upside calls when it is operating,” mentioned Chris Weston, head of analysis at on-line dealer Pepperstone. “When it is sizzling, those flows completely make a distinction.”Nvidia isn’t the primary inventory to have one of these robust sway over the remainder of the marketplace.Tesla, any other favourite of nonprofessional investors, displayed equivalent traits a couple of years in the past when the choices marketplace amplified the electrical automobile maker’s inventory swings, Nomura strategist Charlie McElligott mentioned.However AI turns out to have stirred the creativeness of traders much more than EVs.”The mania that’s the precise paradigm shift which AI represents around the company panorama, is solely making it a magnitudes-larger theme,” he mentioned. “Tesla was once by no means with regards to that.””AI is solely its personal animal,” McElligott mentioned.(Reporting through Saqib Iqbal Ahmed; Enhancing through Ira Iosebashvili and Richard Chang)

Nvidia’s inventory marketplace dominance fuels large swings within the S&P 500