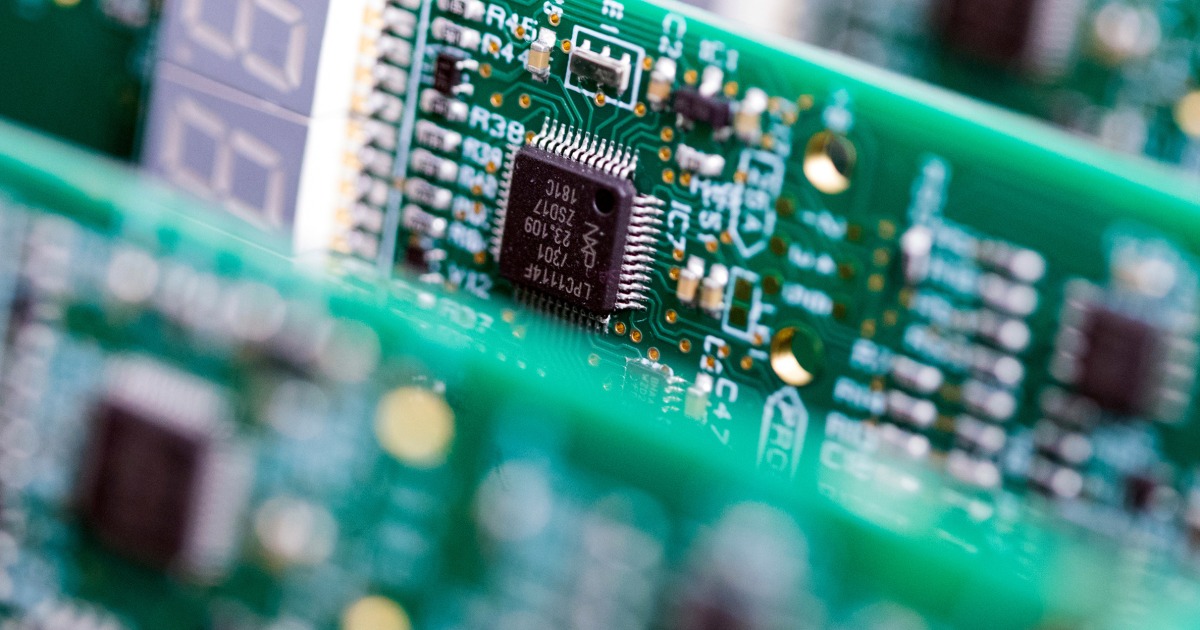

In a sprawling manufacturing unit in japanese Shanghai, the place marshy plains have lengthy since been transformed into commercial parks, China’s maximum complex chipmaker has been exhausting at paintings checking out the boundaries of U.S. authority.Semiconductor Production Global Company, or SMIC, is production chips with options not up to one-15,000th of the thickness of a sheet of paper. The chips pack in combination sufficient computing energy to create developments like synthetic intelligence and 5G networks.It’s a feat that has been accomplished by way of only some corporations globally — and one who has landed SMIC in the course of a the most important geopolitical contention. U.S. officers say such complex chip era is central now not simply to business companies but additionally to navy superiority. They’ve been combating to stay it out of Chinese language palms, by way of barring China from purchasing each the arena’s maximum state-of-the-art chips and the equipment to cause them to.Whether or not China can advance and outrace the USA technologically now hinges on SMIC, a partially state-backed corporate that’s the sole maker of complex chips within the nation and has grow to be its de facto nationwide semiconductor champion. SMIC pumps out thousands and thousands of chips a month for different corporations that design them, akin to Huawei, the Chinese language era company underneath U.S. sanctions, in addition to American companies like Qualcomm.To this point, SMIC hasn’t been ready to provide chips as complex as the ones of opponents akin to Taiwan Semiconductor Production Corporate in Taiwan, or others in South Korea and the USA. However it’s racing ahead with a brand new A.I. chip for Huawei referred to as the Ascend 910C, which is predicted to be launched this 12 months.Huawei’s chip isn’t as speedy or subtle because the coveted processors from Nvidia, the U.S. chip large, which the White Space has banned on the market in China. SMIC too can perhaps make just a small fraction of what Chinese language companies wish to purchase, professionals stated.However the chip would nonetheless be a boon for China’s A.I. ambitions. Nvidia’s parts are the name of the game sauce in A.I. computing clusters that may teach chatbots, unencumber new medications and lend a hand design hypersonic missiles. If Huawei, with SMIC’s lend a hand, could make extra A.I. chips within the coming years, that might blunt the have an effect on of American era restrictions — and possibly someday minimize into Nvidia’s lead.SMIC didn’t reply to requests for remark. Huawei and the U.S. Division of Trade, which oversees era controls, declined to remark.In an interview in June, Gina M. Raimondo, the trade secretary, stated that the USA led the arena in A.I., and that tech restrictions had been serving to to take care of that lead. “Now we have secure, to a big extent, our maximum subtle era from attending to China,” she stated.Liu Pengyu, a spokesman for the Chinese language Embassy in the USA, stated China adversarial “politicizing and weaponizing industry, medical and technological problems.” He added, “Sanctions and repression is not going to deter the advance of China and Chinese language enterprises.”Beijing has invested greater than $150 billion within the chip trade, together with a $47 billion funding fund introduced in Would possibly, serving to to gas a surprising manufacturing unit growth. SMIC by myself operates greater than a dozen chip production amenities, referred to as fabs, round China, and is making plans or developing a minimum of 10 extra, consistent with Paul Triolo, a tech professional at Albright Stonebridge who tracks the trade.SMIC, which has just about 19,000 staff, spent $4.5 billion on capital expenditures within the first part of this 12 months, greater than it earned in earnings, consistent with its monetary filings. Amongst contract chipmakers, it lags most effective TSMC in Taiwan and Samsung in South Korea in gross sales. It shipped just about 4 million wafers within the first part of the 12 months, every of which can also be cut up into masses or hundreds of chips.U.S. export controls have “compelled China and Chinese language corporations to recuperate around the board,” Mr. Triolo stated. Whilst those corporations face primary hurdles, “they have got already made vital development to get the place they’re now, and you’ll be able to’t truly underestimate their talent to doggedly pursue overcoming the opposite hindrances.”SMIC was once based in japanese Shanghai in 2000 by way of Richard Chang, a Taiwanese American who labored for many years on the U.S. chipmaker Texas Tools and changed into referred to as the daddy of Chinese language semiconductors. SMIC was once instantly seen as China’s resolution to TSMC, which is the arena’s greatest maker of state-of-the-art chips.To courtroom out of the country engineers, SMIC created a housing construction with a global college and opened church buildings close to its factories. The corporate employed from TSMC’s analysis and construction workforce, together with Liang Mong-song, SMIC’s present co-chief govt.SMIC constructed new fabs at a breakneck tempo, turning into the arena’s third-biggest chip foundry — the time period for a industry that makes chips on behalf of different corporations — inside 4 years of its founding. It presented affordable costs to companies like Qualcomm, Broadcom and Texas Tools. In 2004, it indexed on inventory exchanges in New York and Hong Kong.SMIC’s ties with the Chinese language executive have grown nearer over the years. Its greatest shareholders — China Knowledge and Verbal exchange Era Crew, Datang Holdings and China Built-in Circuit Business Funding Fund — are all state-owned. Through 2015, round part of SMIC’s board seats had been managed by way of folks with shut ties to the state.Executive beef up didn’t ensure good fortune. After a spate of overbuilding, SMIC was once compelled to dump a number of amenities. In 2019, it delisted from the New York Inventory Trade, checklist in Shanghai the following 12 months.Through then, China’s chip trade had attracted U.S. consideration as a countrywide safety factor. In 2019, the Trump management persuaded the Netherlands to dam a sale by way of the Dutch company ASML to SMIC of its maximum complex chipmaking gadget over considerations that it could assist China militarily.In 2020, the White Space slapped industry restrictions on SMIC after the newsletter of a record detailing its hyperlinks to a significant Chinese language protection conglomerate and military-affiliated universities. SMIC denied connections to the army. The Biden management later tightened the limitations.However the regulations have allowed for workarounds. Firms have persevered promoting much less complex apparatus to SMIC’s new factories by way of acquiring particular licenses and routing gross sales thru non-U.S. subsidiaries and staff.Given those loopholes, some stated it was once no thriller that SMIC had stepped forward.“The fence has gotten upper, however we’ve made up our minds to depart open the entrance, facet and again gate,” stated Jimmy Goodrich, a senior adviser for era research to the RAND Company.These days, North American consumers account for approximately a 6th of SMIC’s earnings. The corporate’s boxy silver manufacturing unit in japanese Shanghai the place it makes complex chips for Huawei sits in a compound attached to different factories that promote chips that cross into merchandise bought round the USA, and purchase equipment from American corporations.In line with Chinese language customs knowledge, China’s imports of chipmaking apparatus within the first seven months of this 12 months surged 53 p.c from the similar duration in 2023.Officers in search of harder limits on SMIC have confronted pushback from those that say that might injury the USA economically, since SMIC additionally works with American corporations.When Congress attempted in 2022 to go a legislation barring the Pentagon from purchasing merchandise containing SMIC chips, automakers, guns corporations and others complained, announcing the parts had been woven thru their provide chains, folks aware of the discussions stated.The legislation, which sooner or later handed, was once modified to present protection providers 5 extra years to chop their ties with Chinese language chipmakers that had navy connections.“U.S. corporations would say, correctly, when you attempted to place SMIC into chapter 11 the next day, there could be collateral injury for U.S. corporations,” stated Chris Miller, the creator of “Chip Battle,” a historical past of the trade.Necessity breeds innovationIn August 2023, as Ms. Raimondo visited China on a diplomatic commute, Huawei launched a telephone with a SMIC chip that exceeded the era limits up to now set by way of U.S. restrictions. The timing was once seen as a slap within the face to the USA.Analysts and U.S. chip executives concluded that SMIC had repurposed much less complex apparatus to make a extra complex chip.Each TSMC and Intel, the U.S. chip large, attempted the similar approach previously. However the technique can lead to many inaccurate chips, and Intel discovered it wasn’t commercially viable, semiconductor professionals stated.In reaction, U.S. officers had been drafting even tighter regulations that will goal some SMIC factories. They’ve additionally driven Dutch and Eastern officers to prevent supplying SMIC’s maximum complex fabs. This month, the Netherlands issued new regulations that introduced its export controls consistent with U.S. laws.The restricted get right of entry to to complex apparatus has unquestionably held SMIC again, and a few professionals argue that, as competition like TSMC and Intel innovate, and as the USA and its allies ramp up their era controls, China shall be left additional at the back of. The restrictions already seem to have slowed the rollout of a few of Huawei’s new merchandise.Galen Zeng, a senior analysis supervisor at IDC, a marketplace intelligence company, estimated that SMIC would perhaps lag different global chip giants by way of 3 to 5 years even though China evolved substitutes quickly for important chipmaking apparatus.Nonetheless, Dylan Patel, the manager analyst at SemiAnalysis, a analysis company, estimated that SMIC may just make 1.2 million A.I. chips for Huawei subsequent 12 months, double this 12 months — a long way fewer than what China wishes or what American chip designers make, however indicating an upward trajectory.In an electronics marketplace in Shenzhen in April, John Wu, a Huawei dealer, stated Huawei’s A.I. chips had restricted availability. However he expressed self assurance that Chinese language companies would proceed to increase, and that festival would in the end harm the USA.He described the U.S. restrictions the usage of a Chinese language expression — like “lifting a rock most effective to drop it on one’s personal ft,” he stated.

The Chinese language Chipmaker on the Center of the U.S.-China Tech Battle