Chinese language shares are reasonable and may have the benefit of a more potent client.

With its financial system floundering, the Chinese language executive just lately introduced various measures to assist in giving it a boost. They come with lowering banks’ required reserve ratios, reducing key rates of interest, and lowering the desired downpayment proportion on 2d houses.

As well as, China will permit establishments, together with agents, finances, and insurance coverage firms, to make use of financing from the central financial institution to buy shares. There may be a plan to let firms and big shareholders use executive financing to shop for again their stocks.

By contrast backdrop, let us take a look at 3 Chinese language firms that industry within the U.S. that would have the benefit of this stimulus plan.

Baidu

Baidu (BIDU 2.54%) is a Chinese language era conglomerate this is maximum comparable to Alphabet within the U.S. It’s best identified for its seek engine, however like Alphabet, it additionally owns cloud computing and robotaxi companies. The corporate additionally owns stakes in publicly traded Chinese language commute corporate Go back and forth.com and video subscription provider iQIYI.

With the slow Chinese language financial system and extending pageant for commercials, Baidu has noticed its inventory combat this 12 months, down about 20%. In the second one quarter, its total earnings was once flattish, whilst its on-line advert earnings fell 2%. One house of energy was once its cloud industry, which noticed earnings upward push 14%.

Along with the have an effect on of the vulnerable macro setting and aggressive panorama, the corporate may be within the technique of looking to become its seek enjoy in the course of the integration of generative AI, which it says will supply extra correct and direct solutions. In August, about 18% of seek effects content material was once created by way of generative AI, up from 11% in mid-Might.

On the other hand, the corporate has stated this modification is lately resulting in fewer advert impressions, which is hurting earnings within the close to time period. Long term, although, the corporate thinks that is the correct technique and it’ll additionally discover different monetization fashions, equivalent to transferring from a cost-per-click type to a cost-per-sale type.

Whilst Baidu is coping with near-term inside and exterior headwinds, an progressed Chinese language financial system and client may move far towards serving to to reinforce its seek advert industry.

Alibaba

Wile Baidu resembles Alphabet, Alibaba (BABA 2.15%) is very similar to Amazon within the U.S., with massive e-commerce, logistics, and cloud computing companies.

Whilst Alibaba’s inventory has carried out neatly this 12 months, up greater than 20%, it is nonetheless down greater than 40% over the last 5 years. It too has struggled with greater pageant and a vulnerable Chinese language financial system. In Q2, its e-commerce earnings fell -1%, despite the fact that the corporate is making strides attracting extra shoppers, as its orders grew by way of double-digits and its gross products price (GMV) rose by way of top unmarried digits. Now that its Taobao and Tmall companies have stabilized, it’ll glance to extend monetization at the platforms.

And very similar to Baidu, its cloud computing unit has just lately been a standout. Whilst its Q2 earnings most effective rose 6% final quarter, the section’s adjusted EBITA (revenue prior to pastime, taxes, and amortization) soared 155% because it we could lower-margin shoppers roll off. The corporate additionally simply presented over 100 AI fashions to assist additional push enlargement.

Whilst Alibaba has been making strides in its turnaround efforts, an development within the vulnerable Chinese language financial system may move far in serving to with the ones efforts.

Symbol supply: Getty Photographs.

JD.com

Very similar to Alibaba, JD.com (JD 5.03%) operates an e-commerce and logistics industry in China. JD, on the other hand, sells extra direct pieces, so its margin profile is way not up to Alibaba’s. Just about part its general earnings comes from the sale of electronics and residential home equipment.

JD.com’s inventory is up just about 15% at the 12 months, however up lower than 10% over the last 5 years.

It too has been feeling drive from a vulnerable Chinese language client and greater pageant. Closing quarter, its earnings rose simply 1.2%, with retail earnings expanding 1.5%. It has additionally been seeing energy in its smaller grocery retailer industry, however gross sales of electronics and residential home equipment fell 4.6%.

To assist attempt to reinforce its industry, the corporate has desirous about looking to reinforce its provide chain functions to provide probably the most aggressive costs whilst additionally operating to create a greater consumer enjoy. It stated this technique is appearing some indicators of operating, with cast consumer enlargement momentum in each higher-tier and lower-tier markets.

Whilst JD.com has been making strides to reinforce its industry, given its ties to electronics and residential home equipment gross sales, it can be the most important beneficiary of the 3 to an progressed Chinese language client.

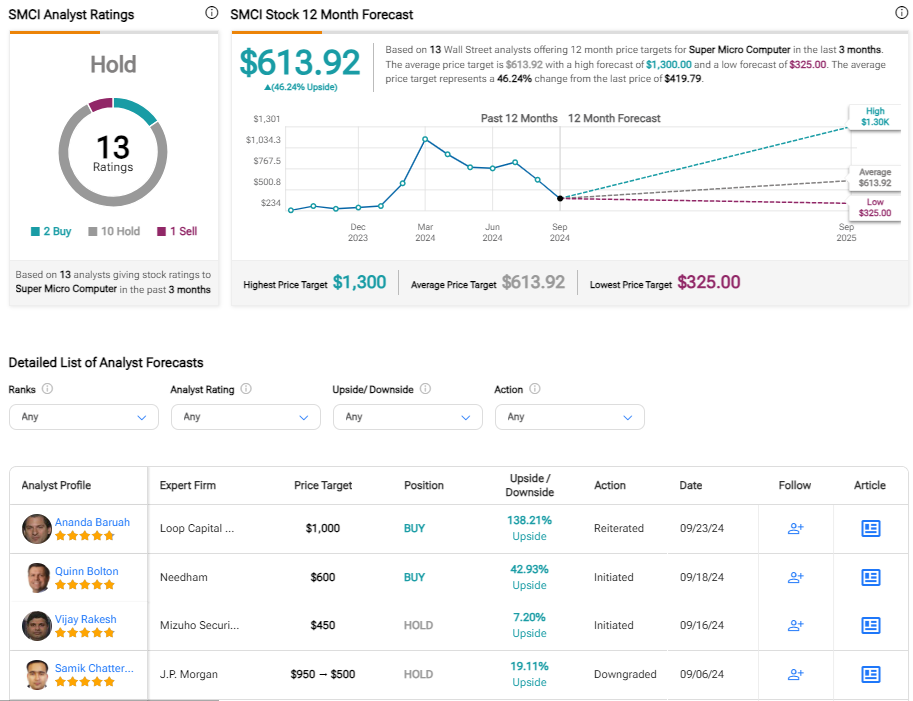

3 reasonable shares

Baidu, Alibaba, and JD.com are all very reasonable in comparison to their U.S. opposite numbers, with all 3 buying and selling at underneath 10 occasions on a ahead price-to-earnings (P/E) foundation in line with subsequent 12 months’s analyst estimates.

BABA PE Ratio (Ahead 1y) information by way of YCharts.

All 3 additionally raise a excellent quantity of internet money on their steadiness sheets and generate cast loose money float. Given this and their valuations, now can be a excellent time so as to add some publicity to those Chinese language shares, with the federal government taking a look to present the rustic’s financial system a spice up.

John Mackey, former CEO of Entire Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has positions in Alibaba Crew and Alphabet. The Motley Idiot has positions in and recommends Alphabet, Amazon, Baidu, and JD.com. The Motley Idiot recommends Alibaba Crew and iQIYI. The Motley Idiot has a disclosure coverage.