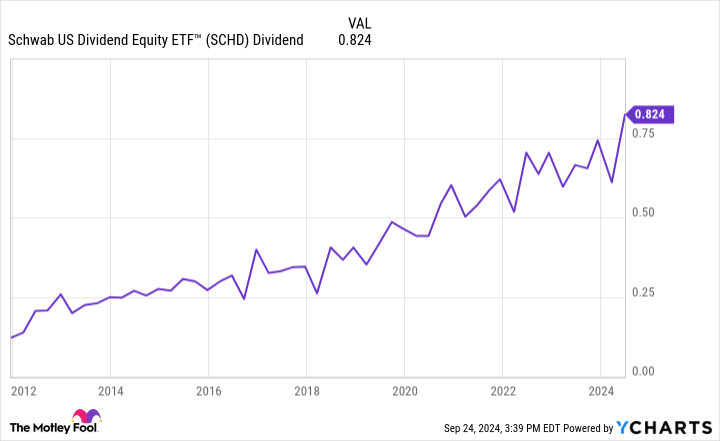

Purchasing dividend shares is a wonderful technique to make passive source of revenue. Then again, with such a lot of corporations paying dividends, it may be exhausting to grasp the place to start out. The Schwab U.S. Dividend Fairness ETF (NYSEMKT: SCHD) makes it clean. The exchange-traded fund (ETF) means that you can put money into 100 of the highest dividend shares thru one easy-to-buy bundle. And it fees an ultra-low expense ratio, which shall we traders stay extra of the dividend source of revenue those shares produce with out giving an excessive amount of again in charges.A who is who of dividend stocksThe Schwab U.S. Dividend Fairness ETF goals to trace the Dow Jones U.S. Dividend 100 Index. That index measures the efficiency of higher-yielding dividend shares with a document of consistency and robust monetary metrics in comparison to their friends. Those options permit the firms to frequently building up their above-average payouts. That is transparent from having a look at a few the fund’s best holdings. House Depot (NYSE: HD) lately sits on the best of the listing with a 4.3% allocation. The house development retail large has a dividend yield above 2% at Friday’s costs, very easily increased than the S&P 500 (not up to 1.5%). House Depot has a very good document of paying dividends. It has greater its payout for 15 directly years, together with by means of 7.7% in February. The corporate backs its payout up with a powerful monetary profile. It generated just about $11 billion in internet coins from running actions within the first part of this yr, simply masking its more or less $4.5 billion dividend outlay. With its coins waft, steadiness sheet, and long-term basics sturdy, House Depot should not have any bother proceeding to pay dividends. Verizon (NYSE: VZ) is the fund’s second-largest protecting, at 4.25% of its belongings. The telecom titan lately gives a dividend yield above 6%. It not too long ago delivered its 18th consecutive annual dividend building up, the longest present streak within the U.S. telecom sector. Verizon produces a variety of coins ($16.6 billion of money waft from operations within the first part of this yr), which coated its capital expenditures ($8.1 billion) and dividend bills ($5.6 billion) with room to spare. Verizon makes use of its extra unfastened coins to improve its already forged steadiness sheet, which is giving it the monetary fortitude to shop for Frontier Communications in a $20 billion all-cash deal to pressure long run enlargement. A excessive yield for an extremely low priceHome Depot and Verizon are two of the 100 dividend shares held by means of the fund. Maximum of its holdings be offering excessive dividend yields. On account of that, the fund itself has a excessive yield. Over the last yr, the fund’s yield is 3.3% in keeping with its distribution bills. The ones bills ebb and waft every quarter in keeping with the dividend bills gained by means of the fund. Then again, they have got trended increased over time:

Need to Gather Passive Source of revenue? This Prime-Yielding ETF Provides You 100 Best Dividend Shares for 1 Low Worth.

:max_bytes(150000):strip_icc()/GettyImages-2205510812-bf9459d0ca3b4227b1b897b43a268752.jpg)