Tesla (NASDAQ:TSLA) noticed its stocks decline this week after Wall Side road reacted negatively to the EV massive’s newest supply numbers. In Q3, Tesla delivered 462,890 automobiles, lacking the consensus estimate of 463,897 gadgets.

On the other hand, whilst traders voiced their displeasure, Canaccord analyst George Gianarikas has no qualms concerning the readout.

“Sure, deliveries had been a smidge gentle relative our expectancies,” Gianarikas says, however is going directly to make the case that the actual tale at the back of the supply effects used to be “affirmation that the corporate is outperforming its fellow Western OEMs in a large manner.”

Gianarikas elaborated additional, noting that, in fresh weeks, studies of provide chain disruptions around the auto business had been prevalent. Tesla, alternatively, turns out to have sidestepped this development and returned to year-over-year expansion.

Tesla’s Q3 supply determine represents a ~4.3% build up over the 443,956 automobiles delivered within the earlier quarter and a ~6.4% upward thrust from the 435,059 automobiles delivered right through the similar duration closing yr.

The development is basically right down to a robust appearing in China, with Gianarikas considering the tendencies exhibited within the area level to what’s coming subsequent. “There,” Gianarikas says, “EVs and hybrids are crushing the standard auto marketplace — and maximum Western OEMs are bleeding.”

In Gianarikas’ view, the principle factor going through maximum Western OEMs is that they’re simply no longer in a position to compete successfully in those segments. The information helps this take as gross sales of ICE car gross sales in China have considerably declined, whilst EVs, specifically hybrids, are seeing considerable expansion.

Tesla, alternatively, is managing to carry its flooring on this extremely aggressive marketplace because of it having a “compelling” EV – one thing different producers recently lack.

Subsequent within the Tesla diary is the much-talked-about “We, Robotic” match on October 10. Various marketplace watchers – Gianarikas integrated – are skeptical in regards to the near-term availability of its robotaxi. As such, heading into the development, expectancies are reasonably muted, despite the fact that Gianarikas thinks there’ll be sufficient fireworks to stay traders glad. “We do however be expecting some ‘wow’ moments in LA,” he mentioned. “Get in a position, subsequent week is showtime.”

In the meantime, Gianarikas issued a Purchase score on Tesla stocks despite the fact that his $254 value goal suggests a modest 6% upside from present ranges. (To look at Gianarikas’ monitor file, click on right here)

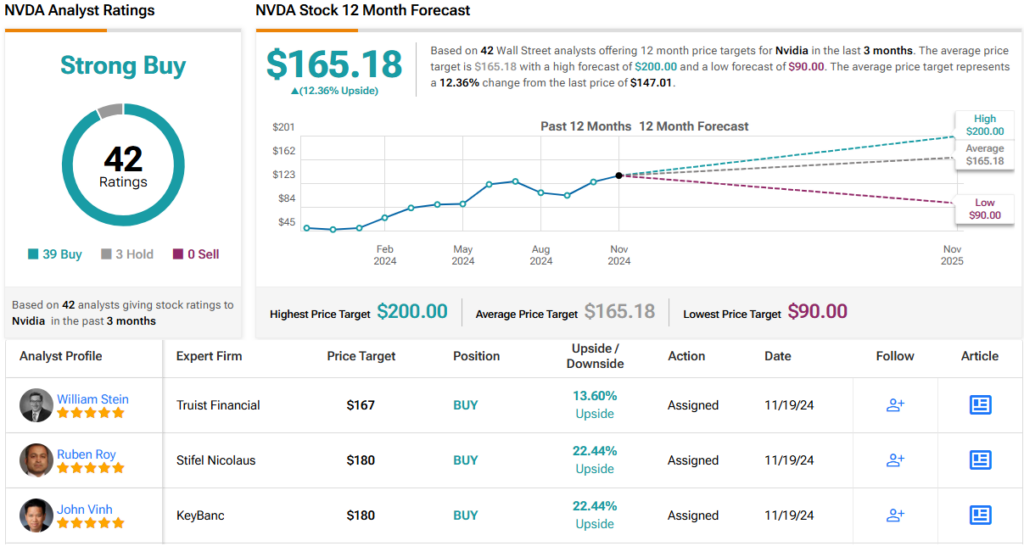

11 different analysts additionally assume TSLA inventory is a Purchase presently, however they’re pitted in opposition to 16 Holds and seven Sells, making the consensus view right here a Hang. Over the following yr, stocks are anticipated to put up a decline of 12%, taking into account the common value goal recently stands at $210.91. (See Tesla inventory forecast)

To search out just right concepts for shares buying and selling at horny valuations, seek advice from TipRanks’ Highest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The critiques expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions simplest. You will need to to do your personal research prior to making any funding.