So the contract talks between aerospace corporate Boeing Co. (BA) and its placing machinists don’t seem to be going neatly. They’re going so now not neatly, in truth, that Boeing has withdrawn its newest contract be offering and walked clear of negotiations in the intervening time. That information has BA inventory buying and selling down 3%.

Boeing’s newest be offering featured a 30% pay carry for placing machinists to be delivered over the path of 4 years. However that supply is now formally off the desk. The union printed that it had “surveyed its individuals” after stated be offering was once won, and “…it was once rejected overwhelmingly.”

Boeing therefore attempted to take the ethical prime flooring, stating “…the union didn’t critically believe our proposals…..” Additional, Boeing famous, “…the union made non-negotiable calls for some distance in way over what may also be permitted if we’re to stay aggressive as a trade.”

Boeing’s Efforts to Carry Money

In the meantime, Boeing nonetheless unearths itself in a money crunch, and issues are about to worsen. A record from Bloomberg detailed an excellent chance that S&P World Scores was once ready to drop Boeing’s credit standing to “junk” standing because it continues to grapple with the strike.

There may be some hope. Boeing has reportedly won a number of proposals from banks, together with JPMorgan Chase (JPM) and Financial institution of The us (BAC), who’ve introduced probabilities for quite a lot of fundraising actions. Commonplace inventory gross sales, obligatory convertible bonds, and most popular fairness have all been complicated as choices, in step with a record from Reuters. One of the vital assets, the record famous, advised Boeing goal for round $10 billion within the fundraising.

Is Boeing Inventory a Purchase?

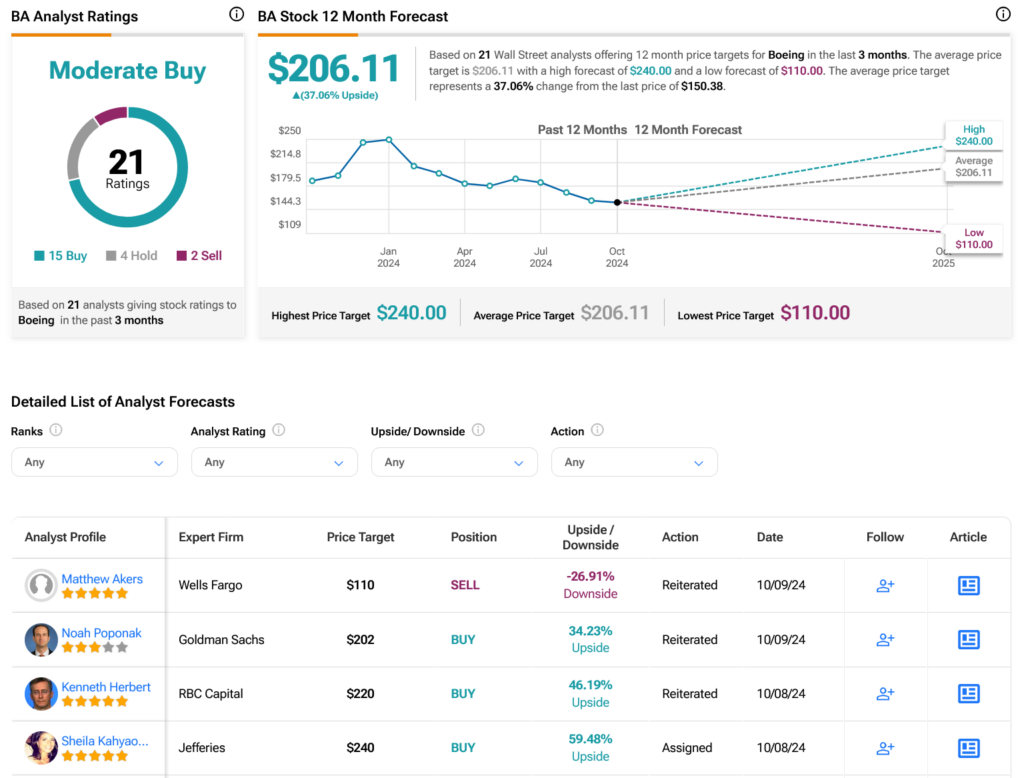

Turning to Wall Side road, analysts have a Average Purchase consensus ranking on BA inventory in line with 15 Buys, 4 Holds and two Sells assigned previously 3 months, as indicated through the graphic under. After a 22.27% loss in its proportion value over the last yr, the common BA value goal of $206.11 according to proportion implies 37.06% upside possible.

See extra BA analyst scores

Disclosure