It’s no secret Nvidia (NASDAQ:NVDA) laws over the AI chip panorama and the large strides the semiconductor massive has taken during the last couple of years have cemented its place among the sector’s greatest firms.

With the AI alternative nonetheless at play, Citi’s Atif Malik, an analyst ranked in eleventh spot among the hundreds of Wall Boulevard inventory professionals, has been outlining the primary subjects on buyers’ minds at the moment.

Gross margin developments stay a significant speaking level. For the reason that AI supercycle kicked off halfway via ultimate yr, GMs were on an upward trajectory, attaining a prime of 78.9% within the April quarter. Then again, within the July quarter, the margin dropped to 75.7%. Malik sees the determine losing additional, hitting a low 70’s or ~72% trough within the January quarter, even if as soon as the Blackwell GPU platform totally ramps, the analyst expects long-term gross margins to “stabilize within the mid-70s%.”

Nvidia has cornered the marketplace for AI chips however the prospect of competition catching up is any other subject being mentioned among the investor base. In this factor, whilst Malik notes the significance of efficiency metrics, the analyst believes information middle operators prioritize TCO (general value of possession) and ROI (go back on funding), either one of which rely on throughput, a space the place Nvidia excels.

“As NVDA runs quite a lot of programs together with AI, the information middle operators depend on NVDA to have the {hardware} to run more than one programs reasonably than purchasing accelerators which might be restricted of their use instances,” Malik additional defined.

Relating to ROI, Nvidia has underscored the benefits its merchandise be offering to shopper web firms in main fields like social media, e-commerce, and seek. However with generative AI riding disruptive industry fashions, Malik advises buyers to be affected person as those alternatives totally expand.

That stance, alternatively, will repay sooner or later. “Whilst we’re bullish on any other robust +40% Y/Y cloud information middle capex expansion subsequent yr, we predict the inventory to most probably stay vary sure via CES January sooner than Blackwell pushed Y/Y gross sales and gross margin inflection within the Apr-Q,” Malik summed up. “Essentially, we consider AI adoption stays in third/4th innings as endeavor AI call for takes to the air subsequent with AI brokers.”

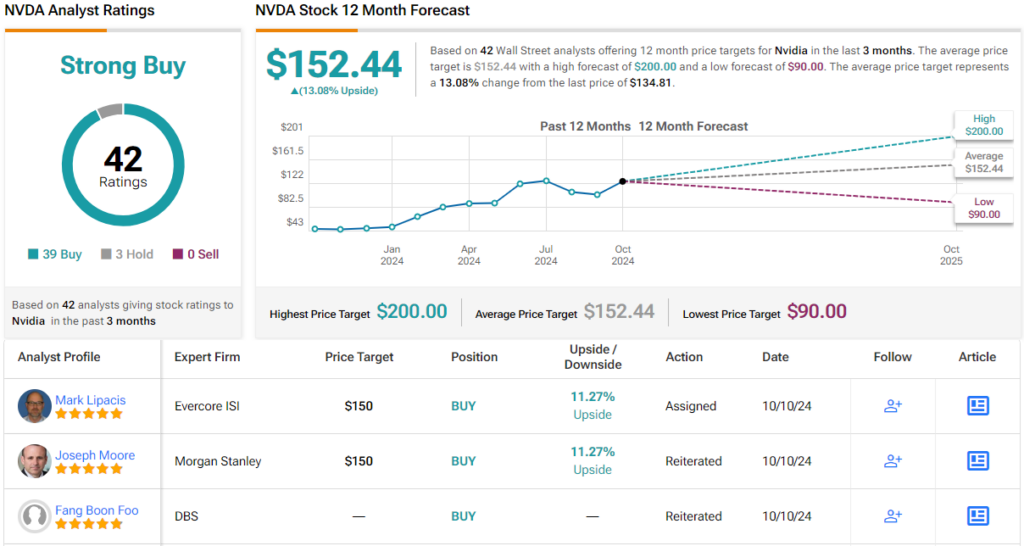

To this finish, Malik charges NVDA stocks a Purchase whilst his $150 value goal implies stocks will climb 17.5% upper over the approaching months. (To observe Malik’s observe document, click on right here)

Taking a look on the broader analyst consensus, except 3 holdouts, all 38 different analysts protecting Nvidia are bullish, leading to a Sturdy Purchase consensus. With a median value goal of $152.44, analysts be expecting the inventory to business at a 13% top rate in a yr. (See Nvidia inventory forecast)

To search out excellent concepts for shares buying and selling at sexy valuations, seek advice from TipRanks’ Best possible Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The critiques expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions most effective. It is important to to do your individual research sooner than making any funding.