Lucid Crew (NASDAQ:LCID) delivered what traders concern maximum: percentage dilution. That used to be the cruel fact shareholders confronted on Thursday.

Lucid stocks cratered ~18% after the corporate introduced that it’s issuing 262.4 million commonplace stocks, in conjunction with a personal placement of 374.7 million stocks to Ayar 3rd Funding Corporate, an associate of the Saudi Public Funding Fund (PIF). The Saudis are already Lucid’s majority stockholder and can deal with an possession stake of round 59%.

The overall stocks introduced, together with each the private and non-private placement, constitute 28% of the former remarkable percentage rely. In response to a percentage value of about $3, the fairness providing will generate gross proceeds of roughly $1.9 billion.

On the identical time, the posh EV maker additionally introduced a initial information for Q3, calling for income of $199-200 million vs. the Boulevard at $196 million. The corporate additionally expects an working loss within the vary between $765 million to $790 million, falling shy of consensus at (752) million.

Traders may well be bemoaning the dilution however Stifel analyst Stephen Gengaro notes that the providing will considerably bolster LCID’s liquidity and also will pass towards serving to the corporate reach its targets, akin to the power to release the Gravity SUV and fund the improvement of the Atlas next-gen pressure unit.

“Whilst we didn’t imagine LCID had to elevate capital presently, we anticipated further capital can be wanted over the following three hundred and sixty five days,” the analyst additional mentioned. “The fairness elevate plus the roughly $5.16 billion of overall liquidity as of 9/30/24 definitely creates an extended runway for LCID and must bolster investor self assurance in its liquidity and that the Saudi PIF fund will proceed to improve Lucid’s capital wishes.”

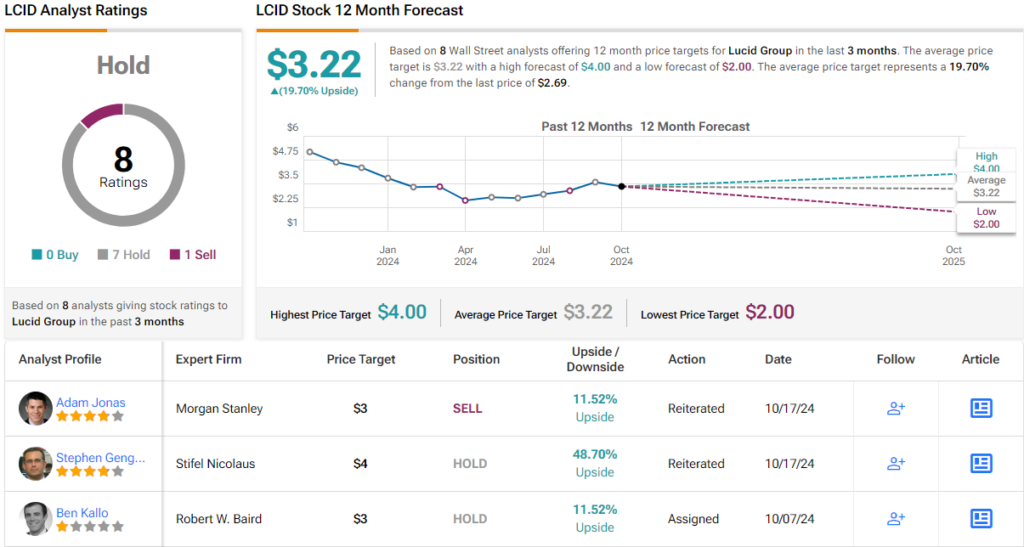

Base line, there’s no alternate to Gengaro’s stance, who reiterates a Dangle (i.e., Impartial) ranking at the LCID even supposing that would possibly as neatly be a Purchase bearing in mind his $4 value goal components in 12-month returns of ~49%. (To look at Gengaro’s monitor file, click on right here)

Among his colleagues, 6 different analysts sign up for Gengaro at the fence whilst the addition of one Promote does no longer regulate the Dangle consensus ranking. The common value goal recently stands at $3.22, suggesting the stocks will climb ~20% over the following 12 months. (See Lucid inventory forecast)

To seek out just right concepts for shares buying and selling at sexy valuations, discuss with TipRanks’ Perfect Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The evaluations expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions simplest. It is important to to do your individual research ahead of making any funding.