Hedera value in decline in spite of the looming institutional pursuits.

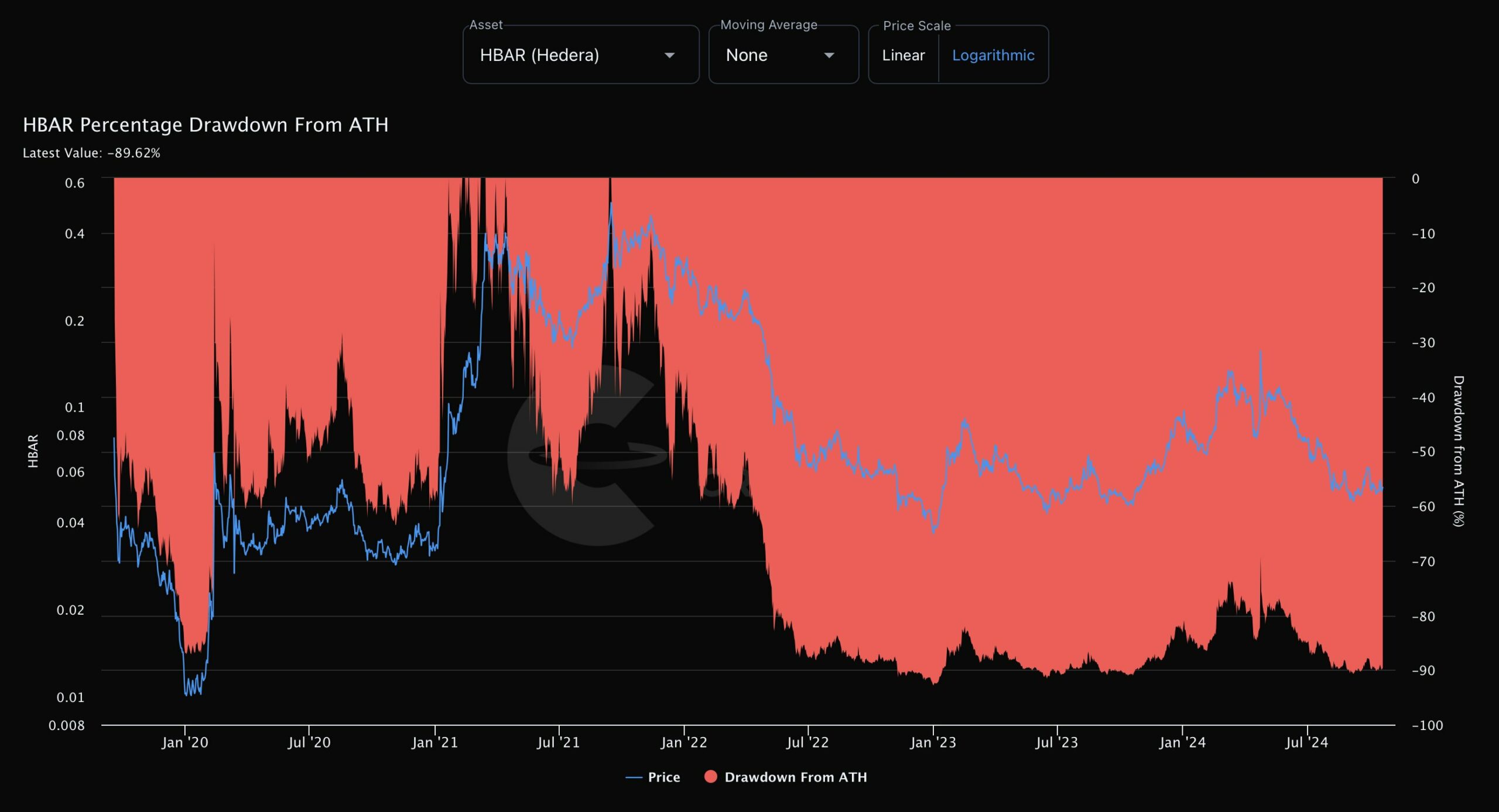

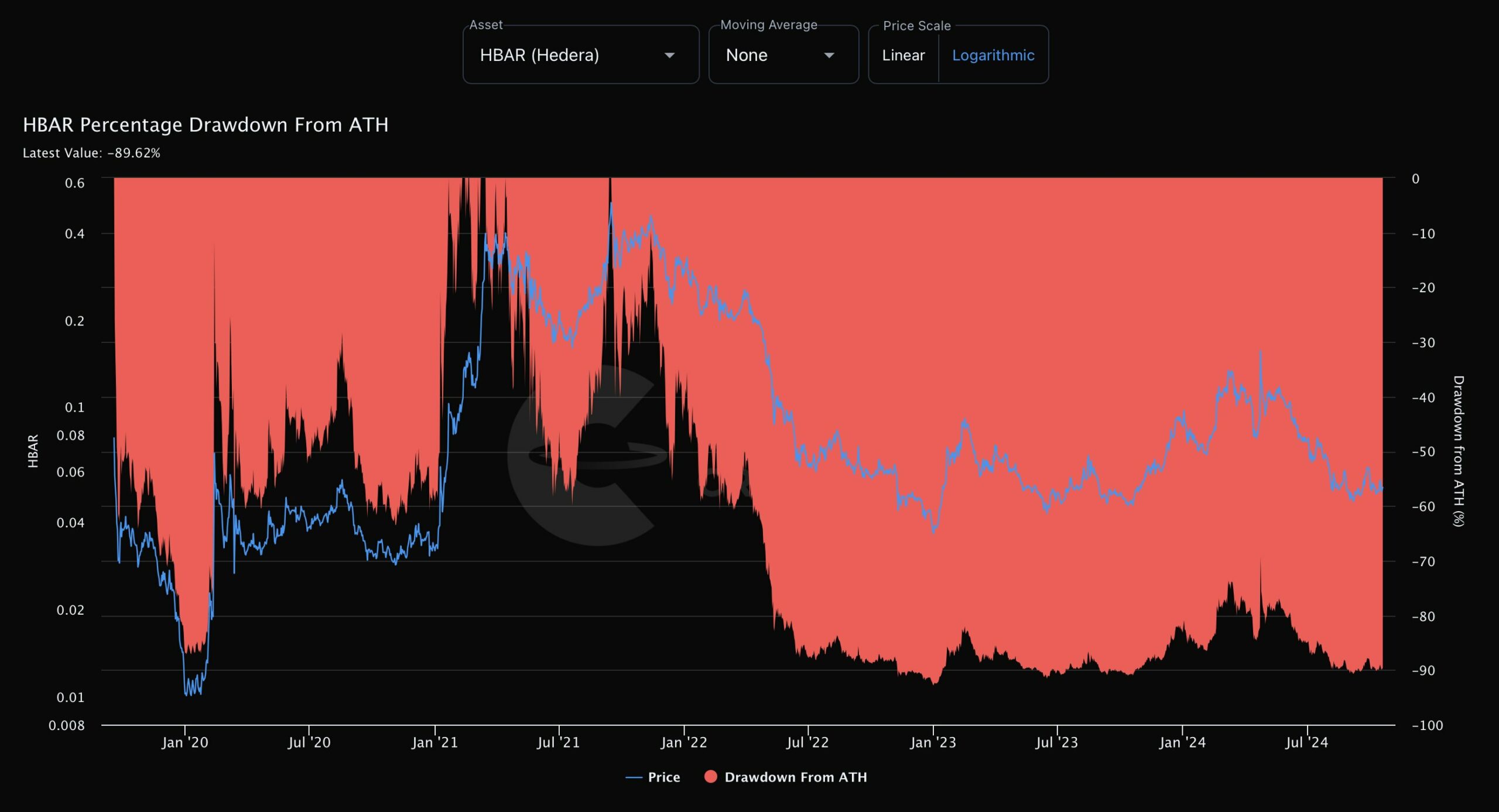

HBAR, as of press time, used to be 90% under its all-time top.

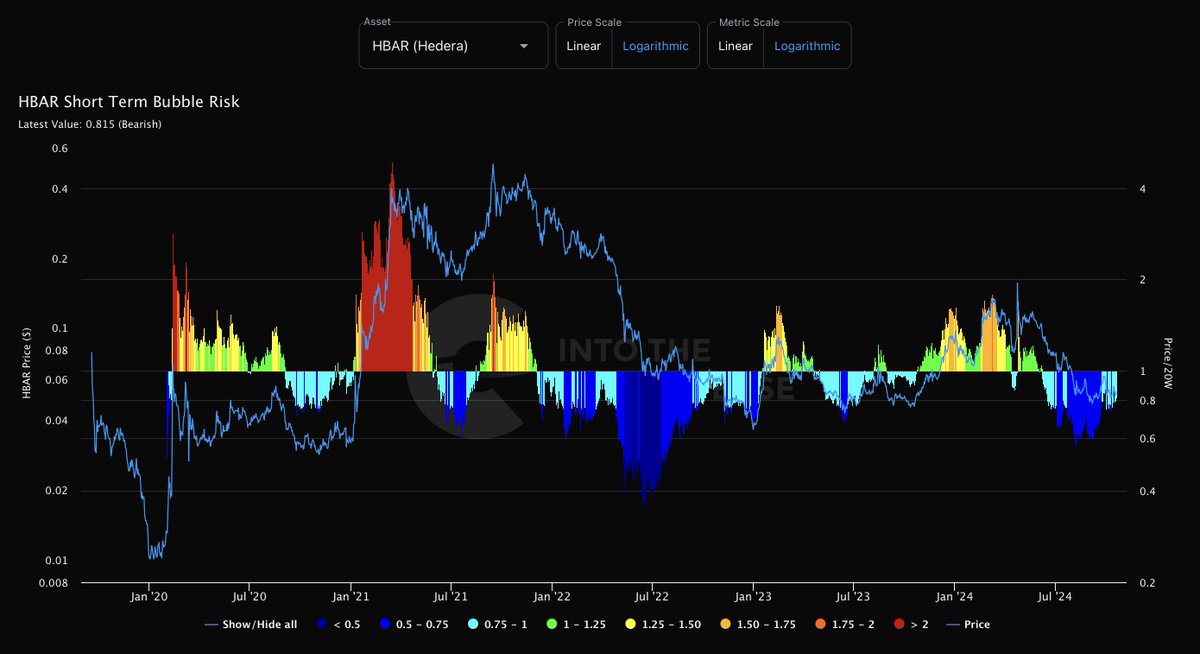

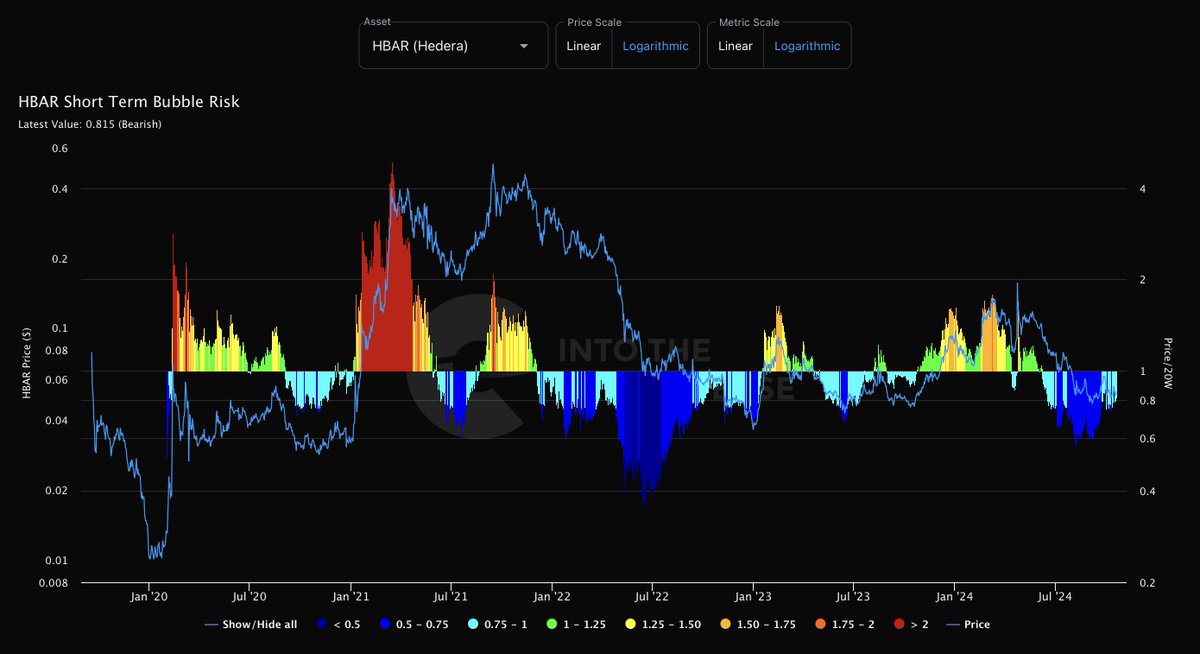

Hedera’s [HBAR] temporary bubble chance has became bearish. This shift raises questions on the way forward for value of the HBAR token. Just lately, Hedera has attracted extra consideration from crypto fanatics.

Within the coming months and years, institutional traders are anticipated to pour vital finances into HBAR, doubtlessly main to a cost surge.

Particularly, Morocco lately introduced a 2030 virtual technique powered by way of Hedera, aiming to make use of the community around the nation. Moreover, america HBAR Agree with has received institutional get right of entry to with the release of Canary Agree with.

Supply: IntoTheCryptoverse

Supply: IntoTheCryptoverse

Regardless of this, HBAR these days faces temporary bubble chance and struggles with its token value, even supposing adoption and real-life programs are rising.

HBAR value motion and BTC valuation

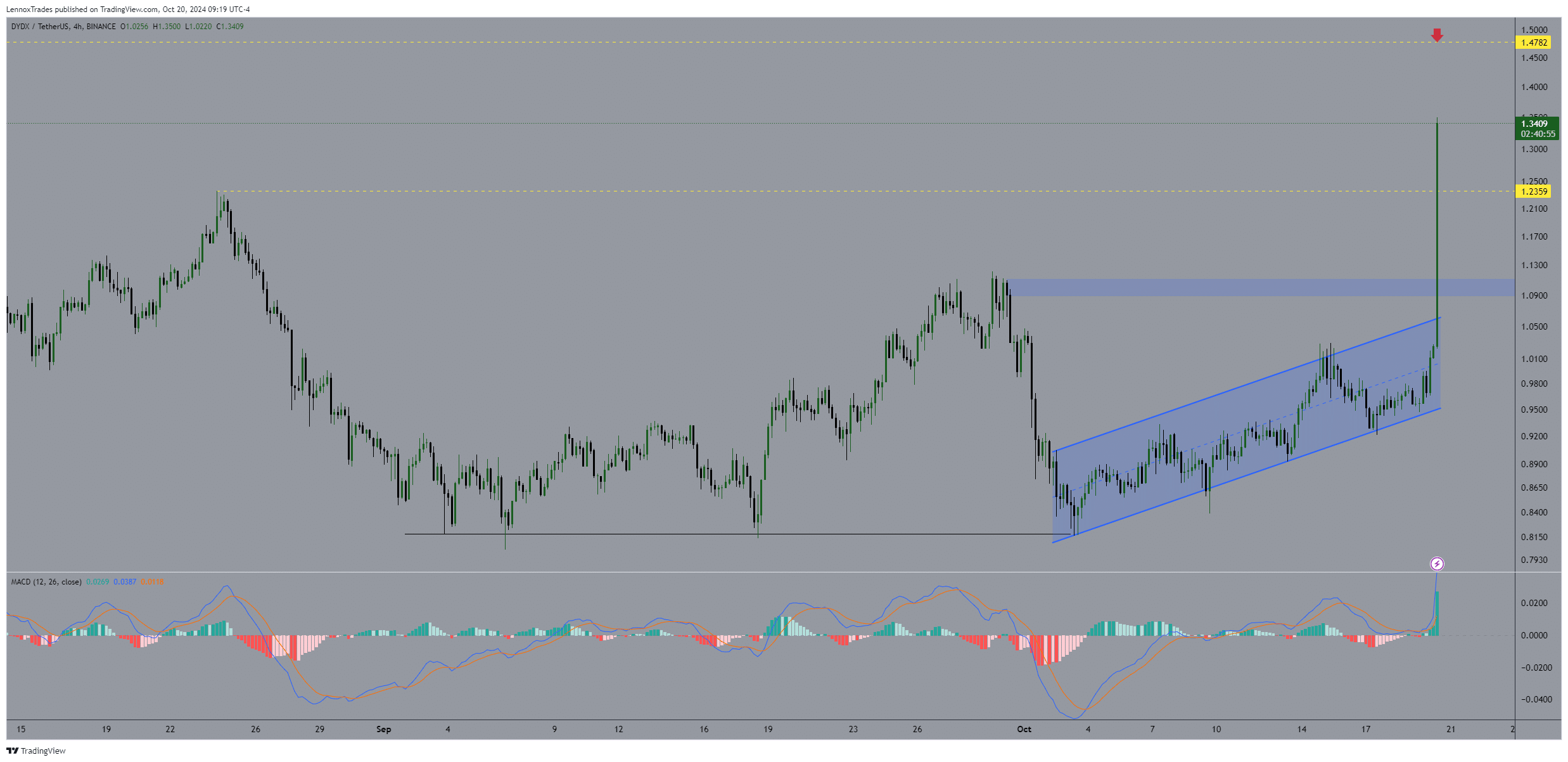

The day-to-day chart for HBAR unearths a bearish development, showed by way of the temporary bubble chance indicator.

Whilst the long-term outlook stays constructive, a value of $0.036 serves because the invalidation level for bullish eventualities because the ascending trendline used to be invalidated first.

Lately, the bullish outlook isn’t transparent, because the upward motion resembles a diagonal trend. HBAR must opposite its present value trajectory which ceaselessly declining.

An important smash above $0.064 is very important to signify a possible comeback for the bulls. Looking at patterns over a couple of timeframes displays {that a} double backside has shaped, suggesting that the present bearish development would possibly not remaining lengthy.

Supply: TradingView

Supply: TradingView

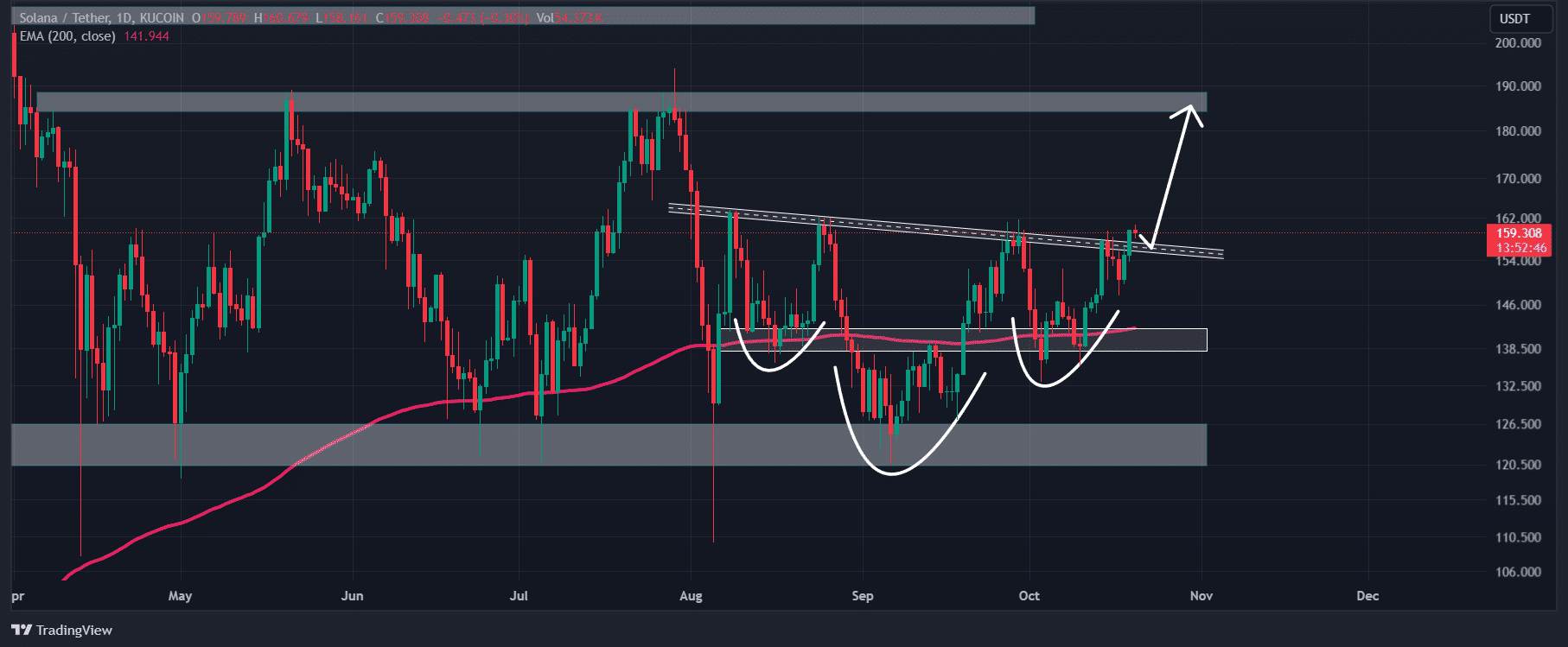

Additionally, HBAR is experiencing weak spot towards Bitcoin, indicating that the bearish development would possibly persist sooner than any bullish restoration. Its BTC valuation is on the lowest ranges since 2020, including to issues about HBAR’s quick long term.

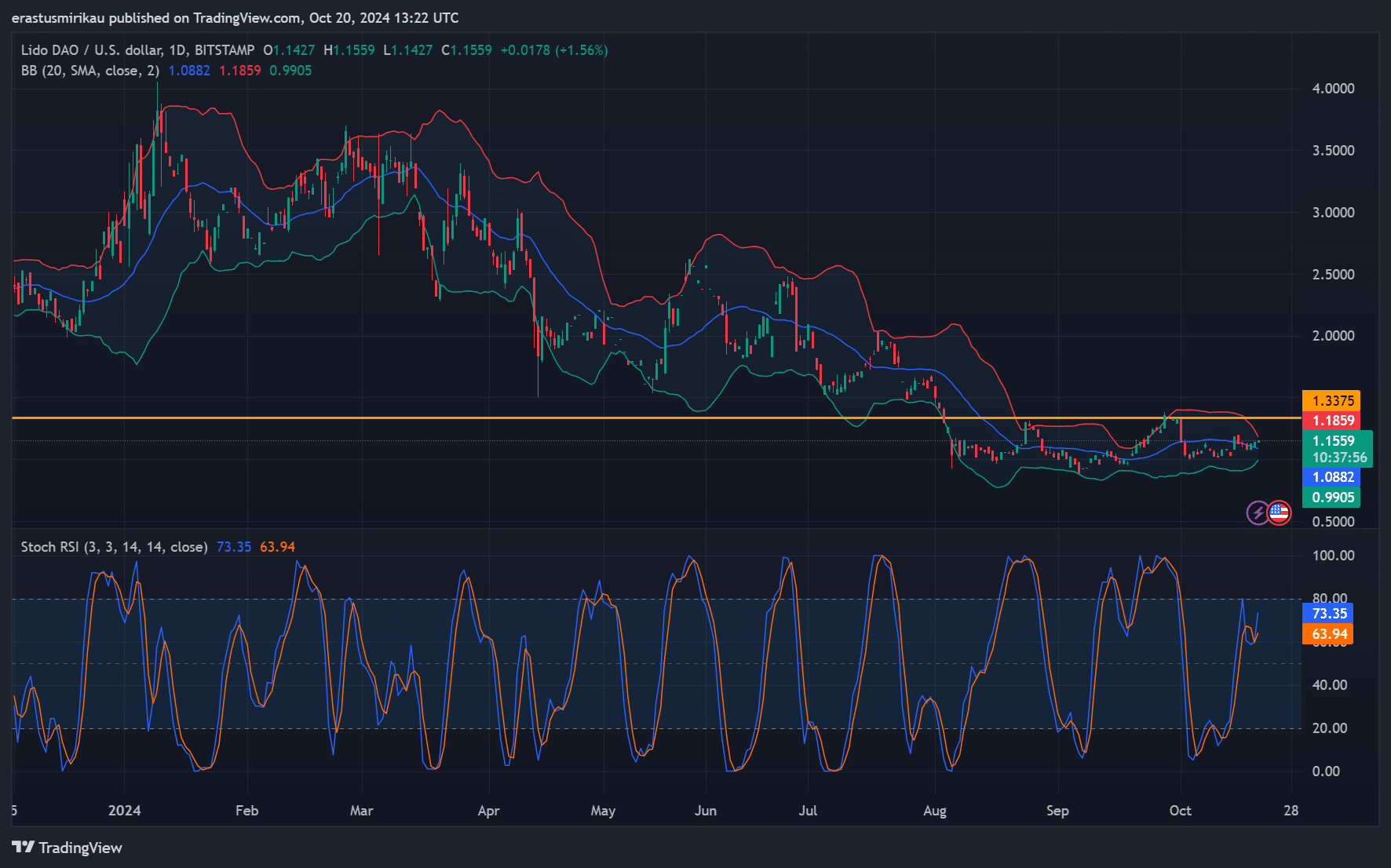

Proportion drawdown

Moreover, Hedera’s value used to be 90% under its all-time top at press time, reinforcing the bearish outlook for HBAR. Traditionally, when the share drawdown from an all-time top reaches 90%, it regularly precedes next positive factors.

Thus, in spite of the present decline in value, Hedera stays a mission to observe carefully. The platform’s genuine use circumstances would possibly sooner or later enhance and support its token value.

Is your portfolio inexperienced? Take a look at the HBAR Benefit Calculator

Whilst Hedera faces temporary demanding situations, its long-term attainable stays promising. Institutional hobby and real-world programs of HBAR may force long term expansion.

Buyers will have to observe key value ranges and marketplace traits as HBAR navigates this vital duration. By means of keeping track of marketplace traits and institutional actions, traders can higher perceive the way forward for Hedera and its attainable to transport upper.

Subsequent: Cardano: Social buzz equals positive factors? How ADA stands to learn