Christophe Barraud predicts US enlargement will boost up after the election.His forecasts believe election results, Congress regulate, and financial affects.His technique makes use of financial knowledge, backtests, and poll-betting markets for exact predictions.

Thank you for signing up!

Get right of entry to your favourite subjects in a customized feed if you are at the move.

obtain the app

By means of clicking “Signal Up”, you settle for our Phrases of Provider and Privateness Coverage. You’ll opt-out at any time through visiting our Personal tastes web page or through clicking “unsubscribe” on the backside of the e-mail.

No person can are expecting the long run with simple task. However with regards to forecasting the financial system, Christophe Barraud has a startling observe document.Bloomberg has ranked the manager economist and strategist at Marketplace Securities Monaco the highest US forecaster yearly apart from as soon as since 2012. Within the quarterly standings, Barraud clinched the highest spot once more for the 3rd quarter of 2024.At this time, he has his points of interest set on the USA election, with its excessive stakes and wide variety of monetary chances. It is a tight race with two very other applicants who would produce other coverage results. In all probability the query that is even larger than who the following president might be is how a lot energy they are going to wield; regardless of how small or grand they appear, insurance policies are onerous to go and not using a majority in Congress.Barraud expects US enlargement to boost up as soon as the effects are in, and irrespective of who will get elected, he mentioned in an interview. It is because uncertainty has spooked enlargement as firms halted giant choices round capex and hiring. Moreover, a lot of opposed occasions, together with union moves and climate prerequisites like hurricanes, put a damper on issues.Total, he says US GDP enlargement will run more potent than consensus forecasts. Because of this 2024’s anticipated price of two.6% would are available in at 2.7%, and 2025’s consensus of one.8% could be nearer to two.1%.However enlargement can range relying on how Washington is sliced and diced subsequent yr. Here is how.

Similar tales

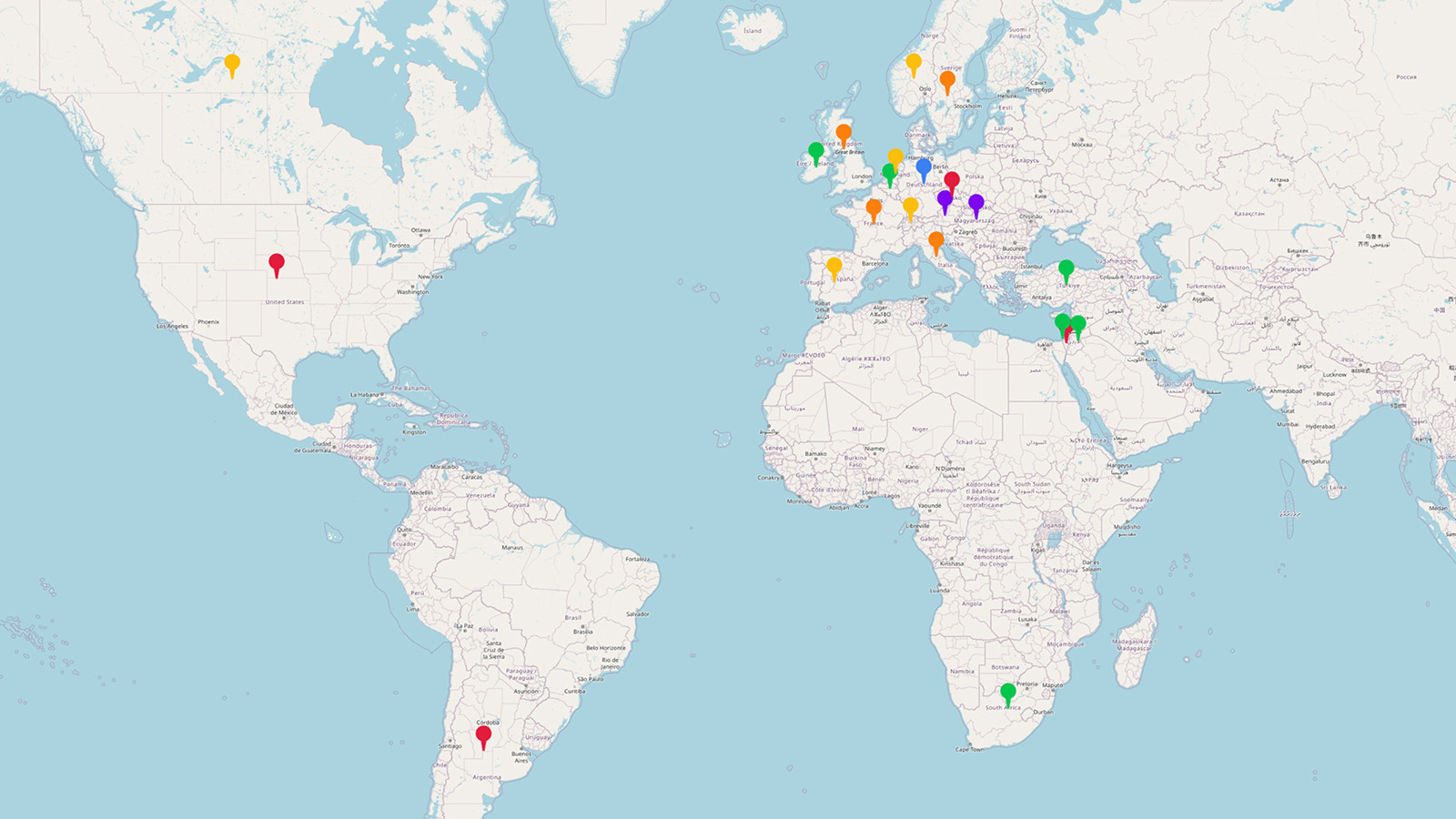

Barraud’s election forecasts — and his in all probability outcomeIn situation one, the place Vice President Kamala Harris wins with a divided Congress, now not a lot at the financial entrance is more likely to trade. Due to this fact, be expecting the established order, he mentioned.In situation two, former president Donald Trump wins, however with a divided Congress. This could restrict his talent to chop taxes for companies and families. Due to this fact, he’ll most likely focal point his efforts on international coverage, which means the whole lot related to business restrictions and price lists may well be carried out faster than anticipated, Barraud mentioned. The result would harm international enlargement. Within the quick time period, it might be impartial on US GDP. Then again, over the longer term, as nations retaliate, this might backfire and gradual the USA financial system.The 3rd situation is a Trump win with a Republican sweep, which Barraud believes is the in all probability end result. He expects Republicans to take the Senate; it is the Space which may be a toss-up.If Trump does acquire a majority, it might allow him to put into effect tax cuts for companies and families. It might also motive him to focal point extra on home moderately than international coverage. Within the quick time period, it might have a good have an effect on on US financial enlargement, making a GDP spice up in 2025 between 2.1% and a pair of.3%, he mentioned.Then again, there is a larger downside: Barraud’s heavy-weight shoppers, which come with giant banks, hedge finances, and pension finances, are increasingly more asking him concerning the trajectory of the ballooning US deficit. On the heart of that worry is how giant the deficit can get if Trump is elected and implements tax cuts leading to US earnings shortfalls and the way it might have an effect on the 10-year.For that, he has a couple of modeled projections. Relating to a Trump win, he expects an preliminary surprise bounce at the 10-year yield to no less than 4.5% in accordance with the place yields are nowadays, close to 4.23%. If he does not get a majority in Congress, then long term, the yield may just transfer an extra 15 foundation issues to 4.35%, once more in accordance with the place yields are nowadays. If there is a Republican sweep, then it might be adopted through a gentle transfer as much as 5% as traders search the next possibility top class. This could be particularly the case if he cuts immigration in a wholesome hard work marketplace, inflicting additional inflation.The ten-year yield final traded at 5% a yr in the past and in 2007 ahead of then. If Harris wins with a dividend Congress, yields may just drop farther from the place they’re, he mentioned. It is because the marketplace has already priced in a Republican win. So at first, it might proper down, he added.However what makes Barraud so certain about his predictions, even if his observe document is taken under consideration? His secret sauce is not in his private opinion or high-level point of view. When requested “why” one thing is predicted to shift, he laughs and says it is the style’s output.Like a quant dealer, Barraud’s calculations are constructed on a three-step technique that comes to amassing the most recent and largest financial, monetary, and satellite tv for pc knowledge, figuring out key indicators in accordance with backtests, after which merging enter from further fashions to problem the projections, disclose dangers, and tighten output. This time, election forecasting contains tracking more than one poll-betting markets with the best possible quantity of customers to gauge election results.